How to Change GST User ID and Password Without Email?

- 14 Feb 25

- 7 mins

How to Change GST User ID and Password Without Email?

Key Takeaways

- Recover GST User ID—Use ‘Forgot Username’ on the GST portal and verify via OTP.

- Reset Password—Click ‘Forgot Password,’ verify OTP, and set a new one.

- Update Contact Details— Use ‘Amendment of GST Registration’ to change email or mobile number.

- Consultant’s Contact Info—If registered with their details, approach a GST officer to update.

- Security Tip—Regularly update credentials and keep passwords confidential.

The Goods and Services Tax (GST) system in India is crucial to ensure a smooth taxation process and effectively managing your GST account. It is however important to change your password and user name in the GST online portal for privacy and security reasons.

This helps ensure that no other unauthorized individuals can access your financial information without your consent. By logging into the GST Common portal, you can change the GST login credentials with ease, check bank account details and file returns within the due date.

Continue reading this blog to learn about how to change GST user ID and password without email.

How to Recover User ID?

Recovering a User ID from the GST portal is a simple and easy task. Here is a detailed step-by-step process you must follow to recover your user ID:

1. Go to the official website of the GST unified portal.

2. Navigate and choose the ‘Existing User Login’ option located on the homepage.

3. Click on the ‘Forgot Username’ from the respective login page of the GST portal.

4. You will be redirected to a new webpage. Provide the provisional ID sent to you through SMS or e-mail. Additionally, provide the Captcha correctly.

5. Click on the 'Generate OTP' button and you will receive an OTP on your registered mobile number.

6. Provide the OTP and select the ‘Continue' button to proceed further.

7. Provide answers to security questions from a list of three sets during the time of registration. Make sure to attempt them correctly and then click on the Submit button.

Completing the above steps, you will receive the username on your registered mail address, and you will receive your registration certificate soon.

How to Reset a New Password?

Registering in the GST portal allows you to conduct several direct tax compliance-related activities. For this, opening an account on the GST portal is mandatory. Individuals with a GST account can also set passwords to protect their information.

If you have forgotten your password in the GST portal, it is possible to reset a new one. Here are the steps to follow for changing your old password and set a new one:

1. Visit the official GST portal and you will locate a 'Forgot Password' button on the home page. Click on that button to reset your password and choose a new one.

2. Provide your username and captcha on the respective fields of GST registration. Once done, click on the 'Proceed' icon to continue.

3. You will receive a One Time Password on your registered contact number. Provide the OTP for verifying your identity.

4. Once OTP is verified, set a new password for your GST portal account

5. Re-enter the set GST password in the blank provided, verify it and soon you will receive a confirmation message. Make sure to keep the new password in mind but do not write it anywhere to ensure the safety and security of your account

6. Upon completing the verification process, your password in the GST portal is set and from now on you can continue accessing your account with the new password

By following the above-mentioned GST registration steps, managing your username and password on the GST portal becomes easier and hassle-free.

How to Change if Accountant/Consultant Used His Mobile Number and Email ID?

By now, you must have a clear understanding that both an email address and a mobile number play an important role. While you proceed toward the registration process in the GST portal, an email ID and contact number will be necessary.

The CA/CMA or other practitioners might provide their email ID and mobile number. For this, the OTP is sent to their contact number. Changing the consultant will thereby let you face difficulty in retrieving your user ID and password.

In this scenario, you can approach the proper officer to change your mobile number and email ID but it will be quite time-consuming. Thus, be careful with this matter beforehand.

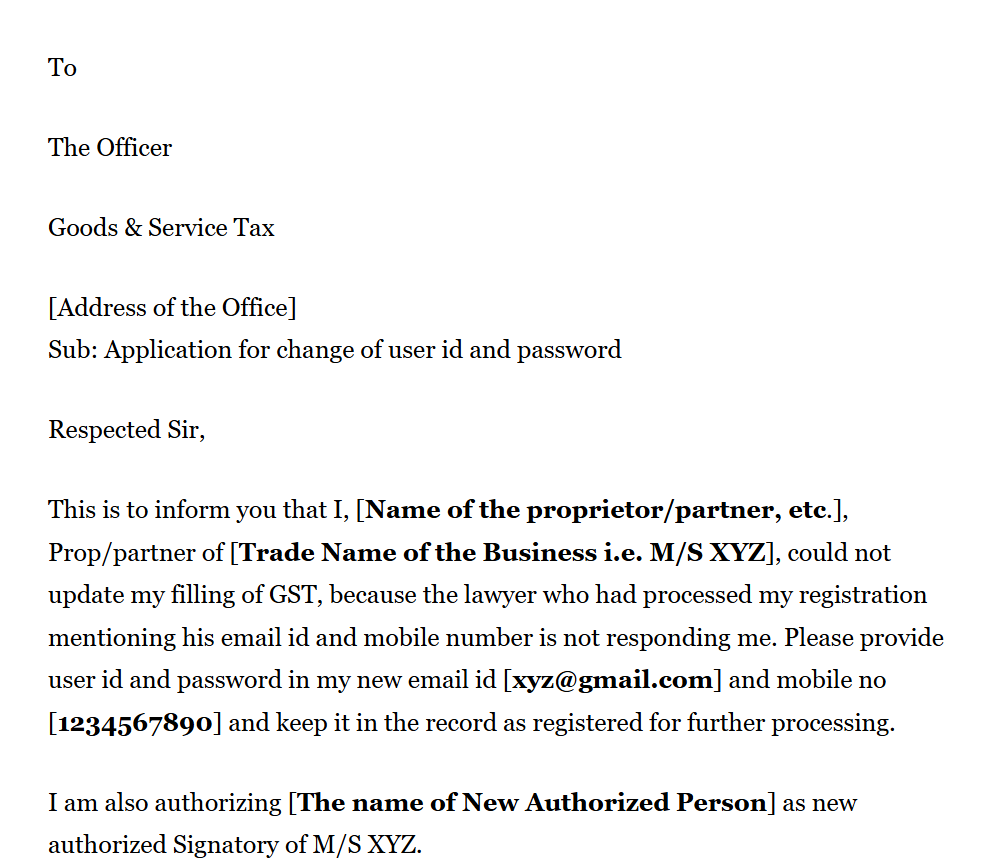

The Form of Application Letter to the Concerned Officer

Here is the format to follow while writing an application letter to the concerned officer:

How to Change Your Existing Email ID and Mobile Number?

For changing your existing email ID and mobile number, here are the detailed steps to follow:

1. Log in to the respective official GST portal and click on the 'Service' button.

2. Click on 'Amendment of GST Registration' (registration non-core fields) located under the Registration section.

3. Proceed towards changing the email address and phone number of the proprietor.

4. An OTP will be sent to your registered mobile address. Provide the number and continue saving that respective section.

5. Soon after this, proceed towards submitting the amendment to the GST registrar.

6. EVC will be further sent to your email address and mobile number.

Following these steps, you can successfully change your contact number and existing email ID.

Conclusion

To conclude, making changes in your username and password on the GST portal is vital for further protecting your business from cyber threats. By following the detailed steps above in the GST portal, updating your login credentials becomes easier and hassle-free. Taking this simple initiative can help you further in maintaining the integrity of financial data and ensure compliance with tax regulations.

If you are looking for solutions on how to change your GST user ID and password without email, the GST portal provides alternative methods, such as using your registered mobile number. However, make sure to choose a strong password and keep it confidential. Through regular review and updating of your GST account settings, you can safeguard your business and carry out business operations smoothly.

💡If you want to streamline your payment and make GST payments via credit card, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By