All About Invoice Reference Number Under GST

- 13 Oct 25

- 7 mins

All About Invoice Reference Number Under GST

Key Takeaways

- The Invoice Reference Number (IRN) in GST is a 64-character unique code generated for every e-invoice to ensure authenticity and compliance.

- IRN under GST is created using a hash algorithm that secures supplier GSTIN, invoice number, financial year, and document type.

- It helps prevent tax evasion, avoid duplicate entries, and supports transparent GST compliance through e-invoicing.

- IRN generation is mandatory for GST invoices, debit notes, and credit notes, integrating closely with the e-way bill system.

- Businesses can generate IRNs via the GST portal, Excel offline tool, or API integration with GST Suvidha Providers.

IRN is a unique number that you find in every e-invoice generated in India. This unique number offers an identity to every e-invoice and helps to streamline tax management, reduce scams and tax evasions, maintain transparency, and boost operational efficiency.

It plays a crucial role in the overall e-invoicing system, ensuring better control over business compliances and reducing duplicate entries.

GST-registered individuals need to upload all these B2B business invoices on the government portal. Once they verify these invoice details, they store them in appropriate places to make them handily available to other portals from the GST network, including the e-way bill system for transportation tracking.

Further in this blog, we are going to learn more about IRN, its structure, and uses. We will also know about the importance of Invoice Reference Number under GST and how and when they are generated.

What is the Invoice Reference Number?

The IRN is a unique identification number consisting of 64 characters that you will find in every GST e-invoice. Every time you create, or your shopkeeper creates an e-invoice, the IRP or Invoice Registration Portal assigns them a new IRN. The IRP offers a unique IRN to every invoice raiser with a GSTIN for a financial year in the entire GST System.

The sole purpose of IRN in a GST invoice is to provide authenticity to an original e-invoice. It acts as a lever for tax officers to check the genuineness of a transaction. Moreover, it is highly used to match input and output tax credits issued by taxpayers, check their genuineness, and identify scams. This also supports direct tax compliance and enhances the invoicing process across sectors.

What is the Hash Algorithm in IRN under GST

A Hash generation algorithm is a function that helps to convert an alphanumeric message with special characters or a string into a series of numbers. This helps to hide the original message from certain people by converting it into a numeric code. The GSTN mainly uses this algorithm to standardise the e-invoicing system and increase privacy. It ensures each IRN carries a digital signature component that validates its authenticity.

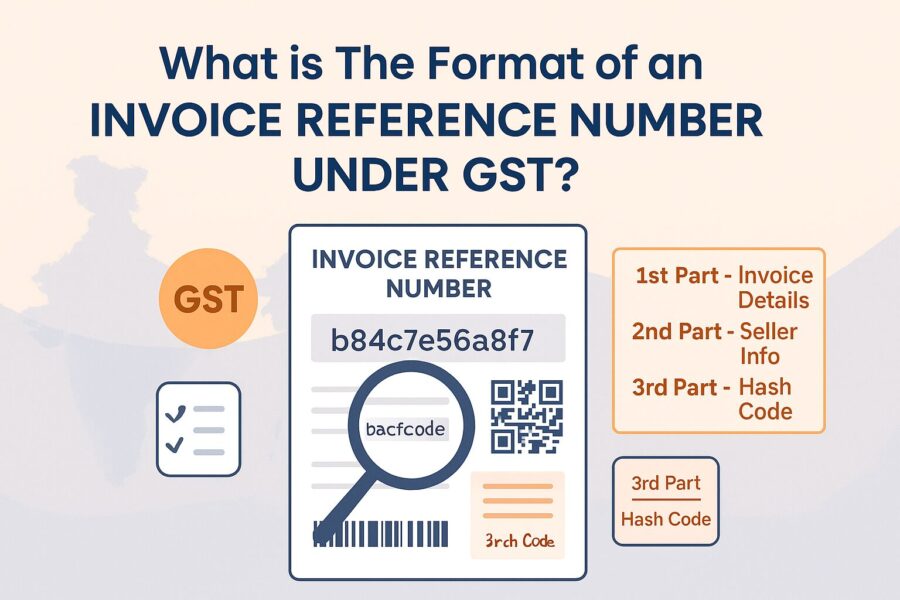

What is The Format of an Invoice Reference Number Under GST?

An IRN is a 64-character-long alphanumeric message or a string. These strings turn into a unique IRN with the help of a hash algorithm. Here is an in-depth explanation of the structure of IRN:

- The first section consists of a hash representing the supplier’s GSTN.

- The second part of an IRN includes the hash of the invoice number.

- The third part of your IRN incorporates a hash that represents the financial year.

- The fourth part of your IRN is a hash that represents your document type.

The IRN format reflects key invoice details that support various GST checks and GST compliance.

What Parameters Help Generate an Invoice Reference Number Under GST?

The GSTN uses algorithms to convert messages or strings into a numeric code. This algorithm goes through three main parameters before converting into an Invoice Reference Number under GST. Here are the three of them:

- Supplier’s GSTIN Number

- Other Relevant documents related to the supplier

- It must have a mention of the financial year in ‘YYYY-YY’ format (i.e., for example, 2024-25)

It is not always a mandatory step. Another alternative that most taxpayers use is it help generate the IRN outside the portal and upload it along with other invoices. The IRN also links closely with the e-way bill portal, especially when businesses need to transport goods across states.

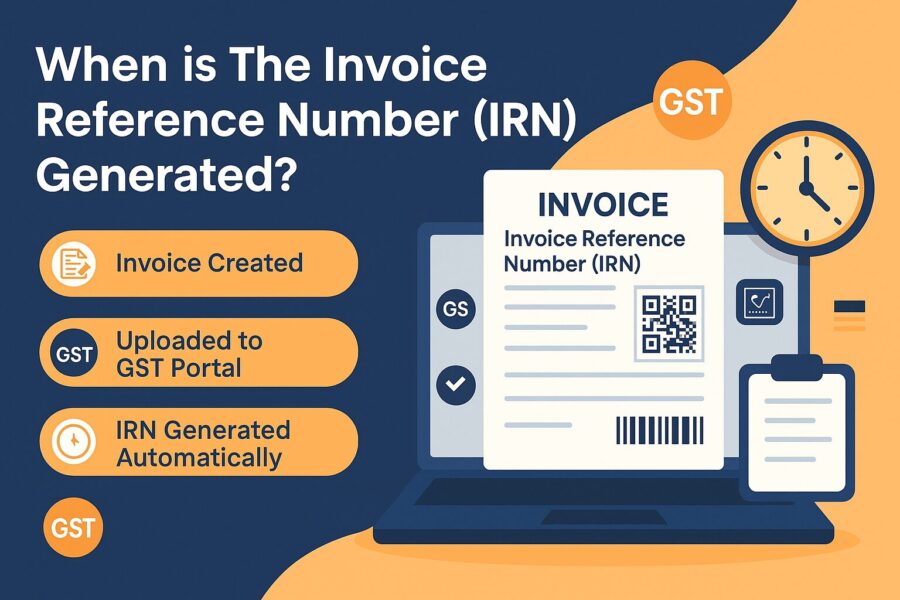

When is The Invoice Reference Number (IRN) Generated?

It is mandatory to generate an IRN number for a GST invoice when a seller issues an invoice, credit note, or debit note to their customers. However, looking at the problems frequent sellers are facing in issuing a new IRN, on 1st October 2020, they allowed taxpayers with an annual turnover of over ₹500 crores to get a 30-day grace period for creating an IRN.

However, you must know that you do not generate an IRN at the instant you issue an invoice. You are basically uploading an invoice that you have already generated using billing or accounting software. Generating a unique IRN will help you with tax compliance with your GST laws and help generate e-invoices.

People will continue to prepare e-invoices using software to generate invoices through the Central Registry or the GST System. However, you need to follow some preset standards and parameters. This ensures improved financial operations and real-time tax validation.

A taxpayer can choose either of the options below to generate their IRN:

- Using the MS Excel Offline tool

- Directly visiting the GST Portal or a GST Suvidha Provider through API integration

Regardless of which option you choose among them, in both cases, the IRP will have a de-duplication test where your IRN is checked against data present in the Central Registry of the GST System to ensure that your IRN is unique.

Conclusion

The IRN is a unique set of numbers you will find in every GST e-invoice that a supplier develops to make a sale. This unique number differentiates each invoice from the others, thus helping to find duplicate entries. It further assists in preventing tax evasion and boosts transparency.

Your Invoice Reference Number under GST also enhances the process of claiming input tax credit by matching suppliers’ IRN numbers. The IRN generation is a thorough and complex process, including a thorough verification process.

This system helps to ensure all GST invoices are legitimate, helping businesses grow their credibility and trust in the market. It plays a vital role in ensuring seamless GST compliance, integrating with the e-way bill, and managing Types of Invoices raised in the course of financial operations.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

What is an Invoice Reference Number (IRN) in GST?

How is the IRN generated for GST invoices?

When is it mandatory to generate an IRN under GST?

Why is IRN important in GST compliance?

How can businesses generate an IRN under GST?

Uploading invoices on the GST portal

Using the Excel offline tool provided by GSTN

Integrating APIs via a GST Suvidha Provider (GSP)

In each case, the Invoice Registration Portal (IRP) validates details and issues a unique IRN, ensuring every GST e-invoice remains authentic and traceable.

By

By