How to File GSTR 6 on GST Portal: A Step-by-Step Guide

- 1 Aug 25

- 10 mins

How to File GSTR 6 on GST Portal: A Step-by-Step Guide

- What is GSTR-6?

- What is an Input Service Distributor (ISD)?

- Due Date and Eligibility to File GSTR-6

- Where to File GSTR 6?

- How to File GSTR 6 on the GST Portal?

- Revision of GSTR 6

- Pre-conditions for Filing of Form GSTR-6

- Modes of Signing Form GSTR-6

- Details of GSTR 6

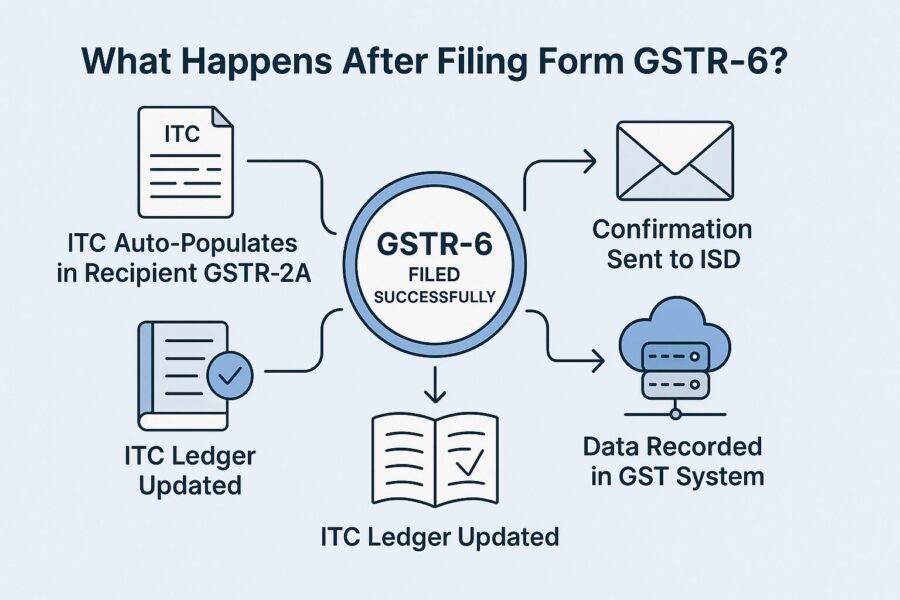

- What Happens After Filing Form GSTR-6?

- Late Fees for Delayed Filing of GSTR 6

- Conclusion

Key Takeaways

- GSTR-6 is a mandatory monthly return for Input Service Distributors (ISDs) to report and distribute Input Tax Credit (ITC).

- Only ISDs with a separate GST registration are eligible to file GSTR-6, and it must be filed even if there are no transactions.

- The due date for filing GSTR-6 is the 13th of the following month, with late fees applicable for delays including NIL returns.

- Filing involves reviewing auto-drafted invoices, accepting or rejecting them, and distributing ITC among eligible branches.

- Once filed, GSTR-6 updates ITC records for recipients and helps maintain GST compliance and transparency in tax credit flow.

GSTR 6 is a crucial monthly return that Input Service Distributors (ISDs) must file under the Goods and Services Tax (GST) framework. Filing GSTR 6 accurately ensures seamless credit distribution and compliance with GST regulations. It helps businesses meet their tax obligations effectively and avoid penalties due to errors or delays.

This article will provide you with a step-by-step guide on how to file GSTR 6 on the GST portal, highlighting all the associated details that you need to know.

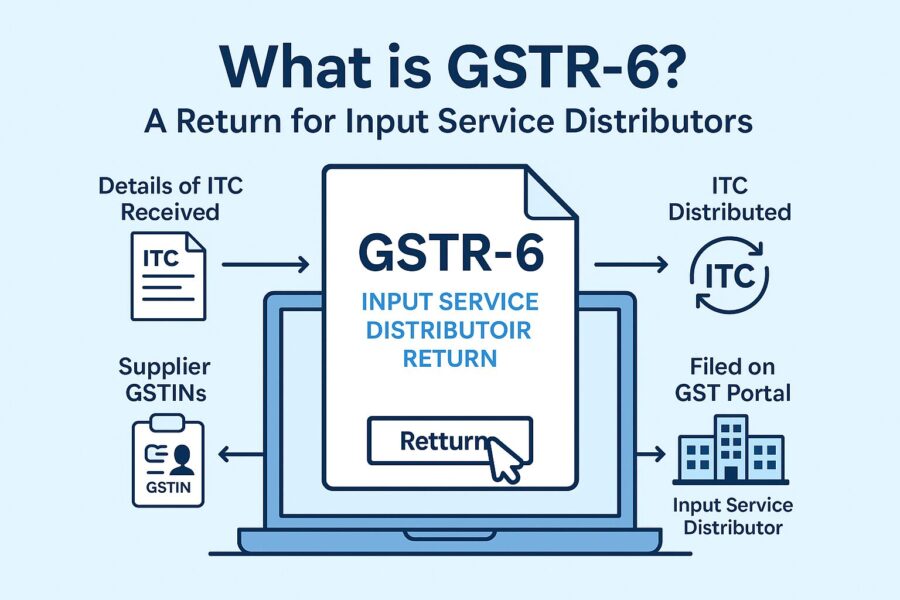

What is GSTR-6?

GSTR 6 is a monthly return that contains information on the input tax credit (ITC) received and distributed among the various branches of an organisation. Filing of GSTR 6 only needs to be done by ISDs.

What is an Input Service Distributor (ISD)?

An Input Service Distributor under GST refers to the office of a supplier that actively distributes ITC for common services to its various branches. The ISD allocates ITC proportionately to units that have different GST identification numbers but operate under the same Permanent Account Number (PAN).

1. Scope and Limitations

An ISD distributes credit only for input services, not for goods. Companies that operate through a central office and maintain multiple registered branches use this mechanism to allocate credit efficiently.

2. Registration and Compliance

To act as an ISD, an entity must obtain a separate GST registration, regardless of any turnover threshold. The ISD issues invoices and files monthly returns using Form GSTR-6 to ensure compliance.

3. Credit Distribution

The ISD distributes ITC to its units based on each unit’s proportionate turnover, ensuring fair and transparent allocation.

4. Reverse Charge Mechanism

The ISD cannot accept invoices raised under the reverse charge mechanism. If it needs to deal with reverse charge supplies, it must register separately under GST to handle such transactions.

Due Date and Eligibility to File GSTR-6

Only and all ISDs are responsible for filing GSTR 6. It has to be filed regardless of whether there are any transactions to report, including in the case of a nil return. The due date for filing GSTR 6 every month is the 13th of the next month. For instance, for the period May 2025, the due date for filing will be 13th June 2025.

Where to File GSTR 6?

To file GSTR 6, a taxpayer will need to download a GSTR 6 form from the ‘Returns Dashboard’ of the GST portal. They just need to go to the GST portal and select options in this sequence: Services> Returns> Returns Dashboard.

How to File GSTR 6 on the GST Portal?

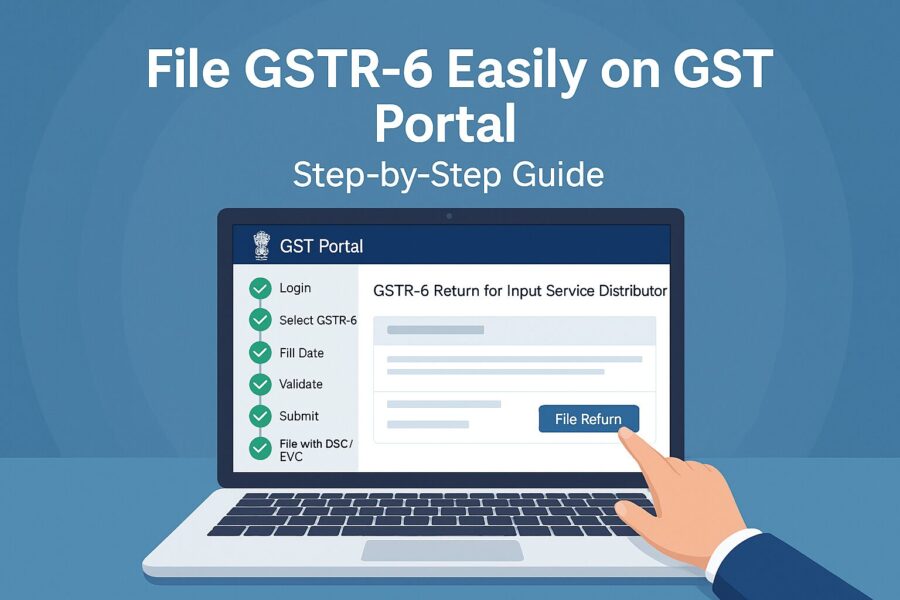

To file GSTR 6 on the GST portal, one needs to follow these steps:

1. Log in to the GST Portal using your credentials.

2. Click on the ‘Return Dashboard’ from the main menu.

3. Choose the month and year from the drop-down list and then click on ‘Search’.

4. On your screen, there will appear two options: ‘Return for input service distributor GSTR-6’ and ‘Details for auto-drafted supplies GSTR 6A’. Among these select the first option and click ‘Prepare Online’.

5. Then you will need to scroll down to the page and click on ‘Generate GSTR-6 Summary’. After this, wait until the system auto-fills your return.

6. Click on ‘3 – Input Tax Credit Received for Distribution’.

Review the list of GSTINs from vendors. Click on each GSTIN to check invoice details. You can take five actions while you are checking the invoice details:

1. Modify: Click the 'Edit' icon, update invoice details if they are not correct and click ‘Save’.

2. Accept: Select the correct invoices that match your record and then click ‘Accept’ from the checkbox on the side.

3. Reject: Select incorrect invoices if all the information it contains is wrong and click ‘Reject’.

4. Keep Pending: If you are unsure, select invoices and click ‘Pending’.

5. Add Missing Invoice: If any invoice is missing, click ‘Add Missing Invoice Details’, fill in the details, and click ‘Save’.

Note that you can change these actions anytime before submission of the final return.

7. Click on ‘6B: Debit/Credit Notes Received’.

Follow the same steps as above to accept, reject, modify, mark pending or add missing notes in this tile.

8. Next, go to ‘5, 8 – Distribution of Input Tax Credit (ISD Invoices & Credit Notes)’. Click ‘Add Document’ and enter the details listed below, and click ‘Save’.

● ITC eligibility (eligible/ineligible)

● Unit type (registered/unregistered)

● GSTIN of the recipient

● ISD document type (Invoice/Credit Note)

● Invoice/Credit Note numbers and dates

● Tax amount

1. Now for ‘4: Total ITC Available and Eligible/Ineligible ITC Distributed’, click on ‘Calculate ITC’ to see the total, eligible, and ineligible ITC amounts.

2. Lastly, preview your return and submit it. After submission, the status in the ‘Return Dashboard’ changes to ‘Filed’.

Revision of GSTR 6

A taxpayer can not revise their GSTR 6 after filing for a month because there is still no provision in the system to do so. The only way the mistake can be corrected is that they correct it while filling out GSTR 6 for the next month.

Pre-conditions for Filing of Form GSTR-6

There are a total of five prerequisites that should be fulfilled before filing GSTR 6. They are as follows:

1. GSTIN of ISD: This is a unique identification number given to every ISD.

2. Period of Return: Specify the month for which you are filing the return.

3. Input Tax Credit (ITC) Received and Distributed: Details regarding the received credits and their distribution.

4. Debit/Credit Notes Details: Details regarding the issued debit and credit notes.

5. Legal and Trade Name: Registered name as per the GST registration.

Modes of Signing Form GSTR-6

While filing GSTR 6 on the GST portal, you can do it in two ways online. These are as follows:

Digital Signature Certificate (DSC)

A Digital Signature Certificate (DSC) serves as the electronic version of a physical or paper certificate. Users can present it electronically to prove their identity and sign documents digitally. In India, authorised Certifying Authorities issue DSCs. The GST Portal accepts only PAN-based Class II and III DSCs.

Electronic Verification Code (EVC)

The Electronic Verification Code (EVC) verifies the user's identity by generating an OTP on the GST Portal. The system sends this OTP to the mobile number of the authorised signatory provided in Part A of the Registration Application.

Details of GSTR 6

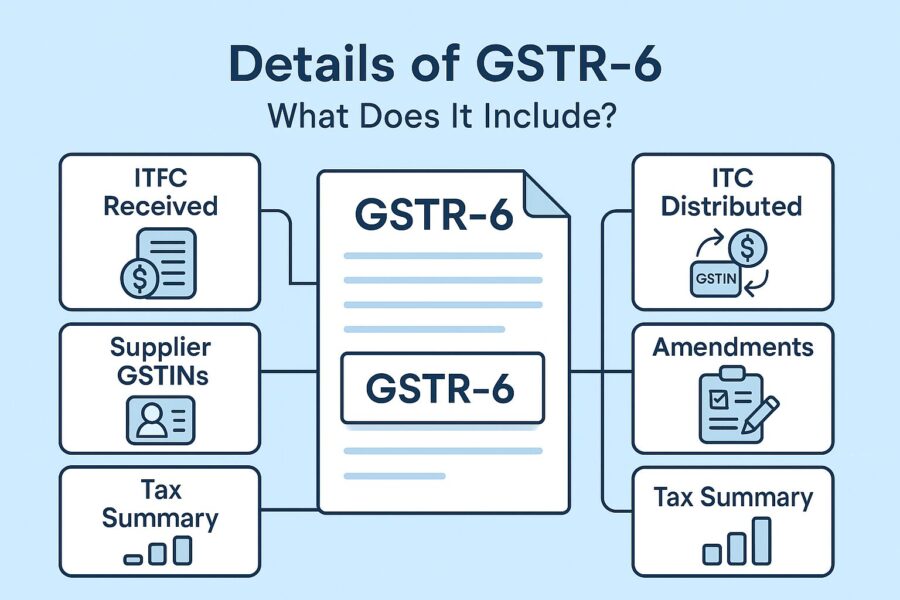

Below are the details which you need to fill out for filing GSTR 6:

1. GSTIN: Enter the GSTIN of the dealer for whom you are filing the return.

2. Name of the Registered Person: The system will automatically populate the taxpayer’s name.

3. Input Tax Credit Received for Distribution: The system will auto-fill this section with invoice-wise details of all inputs received for ITC distribution.

4. Total ITC/Eligible ITC/Ineligible ITC to Be Distributed for the Tax Period: Enter the total ITC of the Input Service Distributor, clearly separating it into total, eligible and ineligible ITC.

5. Distribution of Input Tax Credit Reported in Table 4: Report the entire ITC distribution by ISD in this table. Dealers receiving the credit will use the details in this table to claim ITC.

6. Amendments in Information Furnished in Earlier Returns in Table No. 3: Use this section to correct any errors in the invoice details of inward supplies submitted in earlier returns. Remember, you can only rectify the mistakes made in the previous month of filing.

7. Input Tax Credit Mismatches and Reclaims to Be Distributed in the Tax Period: This table will record any changes to the total ITC due to mismatches or reclaims after rectification.

8. Distribution of Input Tax Credit Reported in Tables 6 and 7 (Plus/Minus): Make necessary adjustments to the credit amount distributed to dealers based on entries in Tables 6 or 7.

9. Redistribution of ITC Distributed to a Wrong Recipient (Plus/Minus): Enter corrections for any ITC distributed to the wrong dealer in previous returns.

10. Late Fees (if any): Enter any late fees the dealer has paid in this section.

11. Refund Claimed from Electronic Cash Ledger: Provide details of any refunds you intend to claim from the electronic cash ledger.

What Happens After Filing Form GSTR-6?

After you fill out the GSTR 6 form, here’s what takes place next:

● The system generates an Authorised Reference Number after your filing is complete.

● For confirmation of the same, an email and an SMS are sent to the registered e-mail ID and mobile number of the applicant.

● In case you made any changes in your form while filing it, the details are auto-filled in the GSTR-1 form GSTR 5 form of the counterparty supplier.

Late Fees for Delayed Filing of GSTR 6

Under GST law, a late fee is levied when there is a delay in filing GST returns. It serves as a penalty for not meeting the prescribed return filing deadlines. The government has set a fixed late fee for each day of delay, currently reduced to ₹50 per day in the case of form GSTR-6. However, this reduction does not apply to cases where a NIL return is submitted.

Conclusion

Understanding how to file GSTR 6 on the GST portal is essential to maintain transparency and ensure the correct allocation of input tax credit. By following the correct procedure and timelines, businesses can streamline their GST compliance and reduce the risk of mismatches in returns.

This act of timely and accurate filing of GSTR 6 not only upholds regulatory requirements but also contributes to efficient tax administration within an organisation.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By