How to File GSTR 9C on the GST Portal?

- 14 Oct 24

- 12 mins

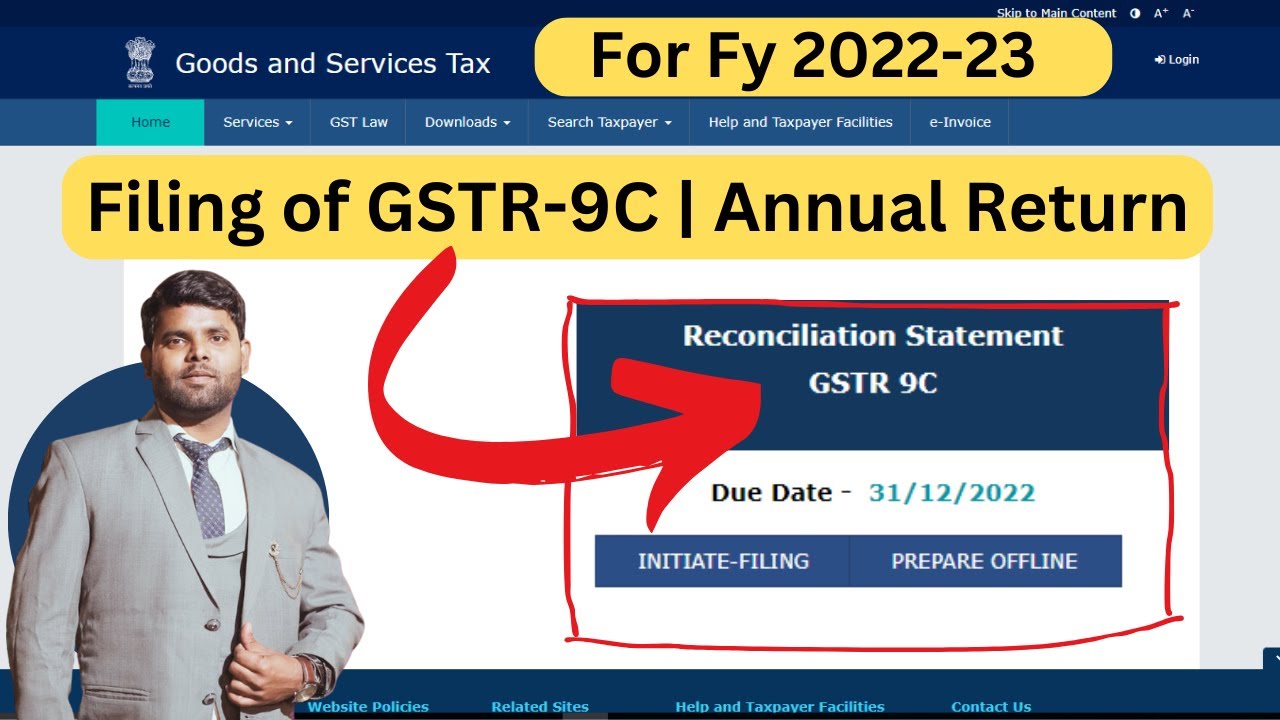

How to File GSTR 9C on the GST Portal?

- What Is GSTR-9C and Why Should You File it?

- Pre-requisites to Prepare and File GSTR-9C

- Reconciliation Statement and Certification for GSTR-9C

- Preparing Form GSTR-9C Tables for Using the GSTR 9 C Offline Utility

- Steps to Generate Form GSTR-9C JSON File Using the Offline Utility

- How to Upload the GSTR-9C JSON file on the GST Portal?

- Steps to File the Form GSTR-9C on the GSTN Portal

- Conclusion

Key Takeaways

- GSTR-9C reconciles GSTR-9 data with audited financial statements, ensuring accuracy in turnover reporting.

- Mandatory for businesses with turnover above ₹5 crore, GSTR-9C must be certified by a Chartered Accountant.

- Timely filing avoids penalties and ensures smooth compliance under GST regulations.

- Filing involves online and offline steps, including generating and uploading a JSON file.

- Proper reconciliation ensures transparency in tax liabilities and ITC claims, supporting long-term financial compliance.

For companies whose taxable turnover exceeds ₹5 crores, filing GSTR-9C is an essential legal obligation. In order to verify that the information submitted in GSTR-9 corresponds to the taxpayer's audited finances, this form serves as a reconciliation statement. The GSTR-9C provides transparency and clarity for business compliance by highlighting any differences between the declared and audited data.

It is created and approved by a Chartered Accountant or Cost Accountant for the taxable person. Both offline and online processes are included in the method. In addition to satisfying legal requirements, timely submission of GSTR-9C forms aids in the maintenance of correct records in a financial period. This protects companies from fines and penalties payable and guarantees uninterrupted functioning under the GST system.

What Is GSTR-9C and Why Should You File it?

GSTR-9C is an audit form introduced on September 13, 2018. Taxpayers with an annual turnover above ₹5 crore must file it annually. A Chartered Accountant (CA) must certify the form. It reconciles the supply turnover filed in GSTR-9 with the taxpayer’s audited annual financial statements.

The form includes the taxpayer’s gross and annual turnover from their accounting books. These figures are then reconciled with all GST returns for the financial year. Any differences and their reasons must be clearly stated. GSTR 9C is required for each GSTIN.

After certification from a Cost Accountant, you then file it on the GST portal or at a facilitation centre. Additional documents, like audited accounts and GSTR-9 forms, may also be required. Lastly, taxpayers must note that they need to file GSTR-9C by December 31 following the audited financial year.

Pre-requisites to Prepare and File GSTR-9C

To file the GSTR-9C form, the following conditions must be met:

- The registered person or regular taxpayer must have a valid GSTIN under GST.

- Valid login credentials (Username and password) for the applicable taxpayer are required.

- The taxpayer should have filed Form GSTR-9 (Annual Return) for the relevant financial year.

- The business must have an annual aggregate turnover exceeding ₹5 crores.

On the GST Portal, GSTR-9C tile gets enabled only after filing the Form GSTR-9 of that financial year. For the GSTR 9 C offline filing process, the taxpayer needs a laptop or desktop. The tool used must be compatible with Windows 7 or above and Microsoft Excel 2010 or above. The process involves downloading the form from the GST portal, filling it out using the offline utility and then uploading the completed form back to the portal.

Reconciliation Statement and Certification for GSTR-9C

The GSTR-9C is a reconciliation statement comparing the taxable turnover/annual return Form GSTR-9 filed with the taxpayer's audited financial statements. The form is divided into several key parts:

Part 1: Basic Entry Details - This section gathers essential information like the financial year, GSTIN, legal name and trade name of the taxpayer. It also asks whether the taxpayer is subject to an audit report under any Act.

Part 2: Reconciliation of Turnover Declared - Here the taxpayer reconciles the taxable turnover and unbilled revenue reported in the audited financial statement with the taxable turnover declared in GSTR-9. This ensures that the sales figures align across both records as per books of accounts.

Part 3: Reconciliation of Tax Paid - In this section, you need to detail the tax payment transactions at various tax rates (5%, 12%, 18%, etc.). It includes both normally paid taxes and those paid on a reverse charge basis.

Part 4: Reconciliation of ITC (Input Tax Credit) - This part reconciles the ITC claimed in the financial statements with the ITC reported in GSTR-9, helping to identify any discrepancies in the transitional credit claimed.

Part 5: GST Auditor’s Recommendations -The GST auditor wouldmake recommendations on any additional liability due to discrepancies found during reconciliation on turnover after adjustments declared. This includes details on taxes, interest, penalties, un-reconciled payment transactions and any outstanding demands or other amounts that need to be paid.

Preparing Form GSTR-9C Tables for Using the GSTR 9 C Offline Utility

The regular taxpayers will have to perform steps offline and on the GST portal. First, a GST auditor needs to fill in the details in Part A to prepare Form GSTR-9C tables as per books of accounts:

Pt II: Reconciliation of Gross Turnover

- Table 5: Reconciliation of gross turnover as declared in audited financial statements and Form GSTR-9C

- Table 6: Reasons for the un-reconciled difference in aggregate turnover or annual gross turnover

- Table 7: Reconciliation of annual turnover after adjustments

- Table 8: Reasons for un-reconciled difference in turnover and audited financial statement

Pt III: Reconciliation of Taxes Paid

- Table 9: Reconciliation of rate-wise liability and the amount payable

- Table 10: Reasons for un-reconciled payment of the taxable turnover

- Table 11: Additional amount payable but not yet paid or any outstanding demand on completed supplies without payment under reverse charge supplies

Pt IV: Reconciliation of Input Tax Credit (ITC)

- Table 12: Reconciliation of net ITC

- Table 13: Reasons for un-reconciled difference in ITC

- Table 14: Reconciliation of ITC, as declared in GSTR-9 with ITC, availed on expenses as per audited financial statements or books of accounts

- Table 15: Reasons for un-reconciled ITC

- Table 16: Tax payable on the un-reconciled difference in ITC

Pt V: Additional Liability Due to Non-Reconciliation of Input Tax Credit

- Access tab Pt V and fill in the basic details in the value and cash payment of tax columns.

- After updating all the Table-Wise details, click on the ‘Validate sheet’ button and correct any errors.

Steps to Generate Form GSTR-9C JSON File Using the Offline Utility

Here’s a step-by-step guide on how to generate the Form GSTR-9C JSON file using the offline utility:

Step 1: Log in to the GST portal and download the GSTR-9 form.

Step 2: Download the table-wise details of GSTR-9C, which was derived from Form GSTR-9.

Step 3: Get the GSTR-9C Offline Tool. For this, select 'Offline Tools' followed by 'GSTR-9C Offline Tool' from the 'Downloads' tab.

Step 4: Access the GSTR Offline Utility Worksheet and enter the relevant data as required.

Step 5: Generate the preview PDF file to view the draft version of Form GSTR-9C.

Once you go through the above-mentioned steps, the JSON file can be generated.

Form GSTR-9C should be self-certified by the normal taxpayer. He should verify the return and the taxable turnover adjustments, either through a DSC (Digital Signature Certificate) or by using an Aadhaar-based signature mechanism to complete successful filing.

How to Upload the GSTR-9C JSON file on the GST Portal?

Before you generate the JSON file, make sure:

- You have installed emSigner on your system.

- The PAN in the ‘PT V’ tab of your Worksheet matches the PAN registered with your DSC.

Otherwise, you won't be able to e-sign the JSON file.

- Go to the home tab and click ‘Generate JSON file to upload GSTR-9C details on GST portal’. Save the file when the ‘Save As’ dialogue box appears on the GSTR-9C tile. Ensure the HTML file names ‘wsweb’ and ‘GSTR_9C_Offline_Utility’ are in the same folder to generate the JSON file.

- When a pop-up message appears, click the ‘Allow blocked content’ of the ActiveX pop-up in IE.

- Click the ‘Initiate signing’ button.

- Click ‘Ok’ when the ‘Ready to sign’ pop-up appears.

- Click ‘Open Emsigner’. Select the Certificate and sign when the Emsigner popup appears.

- A success message will confirm the signing is complete. Click ‘OK’.

- Another popup will confirm the JSON file has been generated and saved. Click ‘OK’ to close it.

- You can now send this signed JSON file to the registered taxpayer for uploading.

Uploading the JSON File

- Log in to the GST portal using the GSTR-9C Offline Utility.

- Select “Annual Return Form GSTR-9” under the ‘Returns’ tab after logging in to find taxable turnover. Choose the correct financial year. Click ‘Search’. Once the page loads select “Prepare Offline”. Then click “Upload”.

- You can make edits in the GSTR-9C form before clicking “Proceed to File”. If changes are made, re-generate and re-upload the JSON file using the GSTR-9C offline utility.

If errors occur during upload, download the Error file Report. Correct the issues and upload the updated JSON file. Browse for the JSON file and click open. A confirmation message will appear once the upload is successful.

Steps to File the Form GSTR-9C on the GSTN Portal

Follow these detailed steps, to successfully file GSTR-9C on the GSTN portal:

Step 1: Begin with uploading the JSON file generated on the GST Portal. Then upload and proceed to add the necessary annual statements like Balance Sheet, Profit and Loss Statement etc. Confirmation of each paper is also essential before you can continue.

Step 2: Make sure all documents which you uploaded are in PDF format. The maximum size of each file should be 5 MB and you need to upload a maximum of two files per section. This is to make sure the documents fall within boundaries set by the portal as in what we have seen before.

Step 3: Save the document after you have uploaded each one. This will set its status to "Processed". Skipping clicking “SAVE” after each upload will result in an error message will appear when you attempt to click “PROCEED TO FILE.”

Step 4: The “PROCEED TO FILE” button will only become active after you have successfully uploaded the following essential documents:

- Generated JSON file

- Balance sheet in PDF format

- Profit and loss account in PDF format

Step 5: Before final submission, you can preview your GSTR-9C draft by clicking the “PREVIEW DRAFT GSTR-9C (PREVIEW)” button. This step allows you to carefully review all the details and make any necessary corrections.

Step 6: When you click the “PROCEED TO FILE” button, you will be directed to the verification page. Confirm the verification details, which will then enable the “FILE GSTR-9C” button. Clicking this button is the final step to officially file the form.

Step 7: After successful filing, you can easily track the status of your GSTR-9C form for reference. Go to the “Services” tab on the GST Portal, select “Returns” from the drop-down list, and click on “View Filed Returns.” This feature allows you to keep track of your form for any future reference.

Following these steps will ensure that your GSTR-9C is filed accurately and can be monitored efficiently. In case of an error file, follow these steps and avoid the penalty payable:

- Download Error Report: If there’s an error filed during the upload, download the error report.

- Make Corrections: Correct the issues in the JSON file.

- Re-upload Updated JSON: Upload the corrected JSON file.

- Download Processed JSON: Download the processed GSTR-9C JSON file from the GST Portal.

- Import to Offline Tool: Import the JSON file into the GSTR-9C Offline Tool.

- Make Edits: Add or edit data as needed.

- Upload Updated JSON: Upload the updated JSON file to the GST unified Portal.

Conclusion

Within the Indian finance ecosystem, GSTR-9C is both a mandatory requirement and a key statement for maintaining financial integrity during a specific financial period. Businesses verify the accuracy of their mandatory filings by carefully balancing the taxable turnover in the annual accounts with audited financial statements.

A registered person can access the detailed procedure through the GST website and offline services, which simplifies it. Maintaining GSTR-9C compliance promotes an accountable and transparent culture, in addition to helping to prevent penalties.

Long-term financial stability and business compliance depend on the taxable person's ability to comprehend and file GSTR-9C correctly, regardless of the size of your company.

💡If you want to streamline your payment and make GST payments, consider using the PICE App. Explore the PICE App today and take your business to new heights.