What is Form DRC 02 in GST?

- 11 Jul 25

- 6 mins

What is Form DRC 02 in GST?

Key Takeaways

- Demand and recovery under GST are initiated when tax authorities identify unpaid taxes or wrongful ITC claims.

- Form GST DRC-02 is a formal notice issued under Sections 73(1) or 74(1) of the CGST Act to notify taxpayers of outstanding dues.

- Taxpayers are given a fair opportunity to respond, pay dues, or provide evidence before any recovery actions are enforced.

- DRC-02 ensures transparency by mandating that the summary of unpaid tax is shared electronically with the taxpayer.

- Understanding the DRC-02 process is crucial for businesses to maintain compliance and avoid penalties under GST.

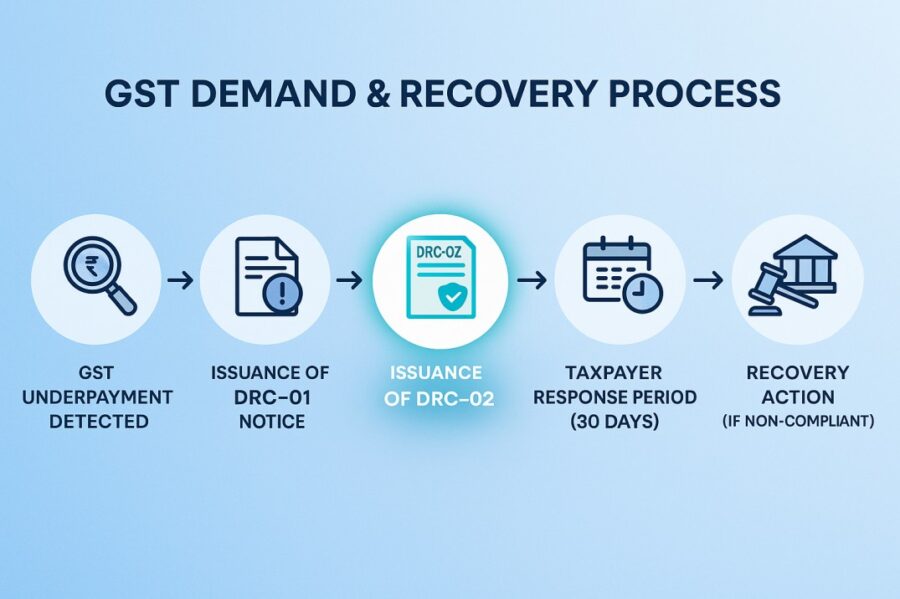

Demand and Recovery under GST is a process that the government can initiate to collect unpaid taxes. The tax authorities can recover unpaid tax if a taxpayer has paid an incorrect amount of GST or has wrongly claimed input tax credits. The demand and recovery process begins when the tax authorities identify an error or fraud and issue a fresh notice, such as DRC-01 and form DRC-02.

The tax authorities will allow taxpayers to respond or pay. If the taxpayer fails to respond or pay, tax authorities can recover the tax through bank attachments or the sale of property.

In this blog, we will focus on the demand and recovery process, while highlighting all the associated details that you need to know about DRC-02 in GST.

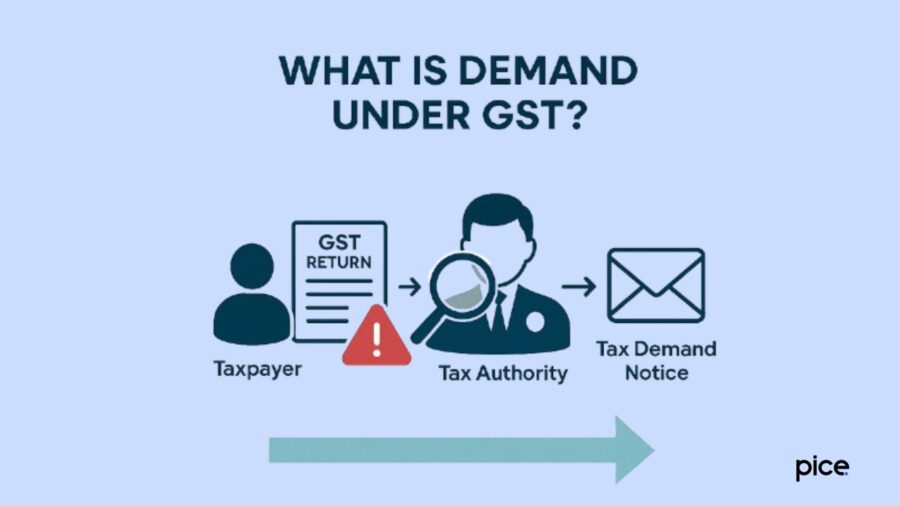

What Is Demand Under GST?

GST is mandatory to pay through self-assessment. There should not be any problem if an assessee ends up paying accurate tax on self-assessment. It is the sole responsibility of GST authorities to begin the demand and recovery procedure against the assessee in case of underpayment or improper use of input tax credit.

What is Recovery Under GST?

The Goods and Services Tax (GST) notice is a kind of notification that a tax authority sends to the taxpayer for collecting any unpaid taxes. When a taxpayer fails to pay required GST liabilities within the prescribed deadline, issuance of a notification takes place. The recovery notice states a deadline to the taxpayer, which is usually about 30 days from the issue of notice date. Within this date, the taxpayer’s duty is to pay the unpaid tax or interest.

On the other hand, a registered taxpayer is also penalised if he/she fails to file GST returns within the deadline prescribed in Form GSTR 3A. However, government officials look into this process and begin recovering tax under GST if the taxpayer fails to file the same, even after three months after issuance of order of the tax demand notice.

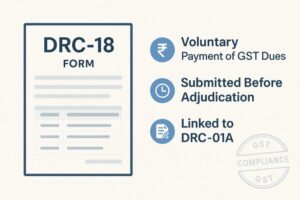

What is Form GST DRC-02?

Form GST DRC-02 is a notice that the tax authority issues under Section 73(1) or 74(1) of the CGST Act. As per the statement summary of DRC-02, if a tax officer issues a detailed statement of unpaid taxes for any period, he is eligible to issue a statement following Section 73(3) or Section 74(3) of the Act.

The required summary of the statement is further uploaded electronically in this form. Similar to DRC-01, the new form DRC-02 was also accepted from April 1, 2019, through Notification No. 16/2019 – Central Tax, dated 29th March, 2019.

What is the Purpose of the Issuance of Form GST DRC-02?

Issuance of Form GST DRC-02 is a method of communicating tax demand to a taxpayer in a formal manner when discrepancies exist under GST law. It is a show cause notice to inform the compulsory taxpayer about the tax, imposition of penalty and interest, which, as per the authorities, is unpaid/partly paid/availed wrongly.

Issued under Section 73(1) or 74(1) of the CGST Act when a proper officer conducts an initial assessment and finds out that there has been a short payment, non-payment or use of Input Tax Credit over the values, which may be adjusted. The authorised body provides the taxpayer a chance, namely the period of issuance of DRC–02, within which the taxpayer must pay the required outstanding amount, or defend his or her position supported by evidence.

The result of this procedure is that it makes sure fairness has been applied by first giving the taxpayer an opportunity to explain or rectify the situation before any enforcement action is taken. Therefore, form is paramount to ensure transparency, and by extension, due process in tax administration.

What is the Format of DRC-02 in GST?

The image below depicts the required format of DRC-02 in GST:

Conclusion

In summary, demand and recovery under GST help ensure tax compliance and fair payment by everyone. Taxpayers have an opportunity to remedy their unintended errors or state their position before the GST demand has a serious impact on taxpayers.

The demand and recovery represent a system of government revenue protection, while providing taxpayers with a reasonable time and notice before responding to the tax authority's recovery action.

Knowing DRC-02 in GST will ensure that businesses remain compliant with tax obligations. Ultimately, this framework supports smooth tax collection and an operational GST regime to sustain and benefit our economy.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By