How to Submit Form GST DRC-20

- 31 Aug 24

- 9 mins

How to Submit Form GST DRC-20

Key Takeaways

- Form GST DRC-20 allows taxpayers to request deferred payment or instalments for their GST dues, helping manage cash flow during financial constraints.

- Timely submission of Form GST DRC-20 is crucial to avoid penalties and ensure the approval of deferment or instalment requests.

- Accurate information and proper documentation are essential when filing Form GST DRC-20 to ensure smooth processing by the GST authorities.

- Taxpayers can view and manage their instalment schedules on the GST Portal, ensuring compliance with the approved payment plan.

- Regular monitoring of the GST Portal for updates, orders, and payment schedules is vital for maintaining compliance and avoiding issues with the GST authorities.

Form GST DRC-20 is an important tool for taxpayers who need to request the deferment of their GST dues or wish to pay in instalments. Understanding how to properly file this form is essential for maintaining compliance with GST regulations while managing financial obligations effectively.

Understanding Form DRC-20 under GST

Form GST DRC-20 is a formal application that allows taxpayers to request the deferment of their GST payments or to opt for payment in instalments. This form is particularly useful for businesses that may be facing temporary liquidity issues and need to spread their tax payments over a period of time. The form is submitted to the jurisdictional officer, who reviews the application and issues an order based on the details provided.

The application of taxpayer for deferred payment or payment in instalments can be critical in industries with fluctuating cash flows, such as food services or security guard services. Under the GST law, this form can be used by Input Service Distributors or OIDAR service providers as per the rules specified. Additionally, taxpayers must ensure that they are compliant with the necessary regulations under Input Service Distributors - Rule 6 and OIDAR Service Providers - Rule 6.

Timeline for Submitting Form GST DRC-20

Timely submission of Form GST DRC-20 is crucial for its approval. Typically, the form should be filed within the time for payment specified in the GST demand notice or before the due date of the GST dues. Failure to submit the form on time may lead to rejection of the request and could result in penalties or additional interest charges.

Taxpayers must be mindful of the time for payment and ensure that the form is submitted promptly, especially when dealing with monthly tax payment cycles or other time-sensitive tax obligations. The form should be submitted after the intimation of payment made or when the taxpayer realizes the need for deferment. Properly managing the timeline ensures that the taxpayer can avail of the benefits of deferred payment or instalments without any disruption.

How to File Form GST DRC-20?

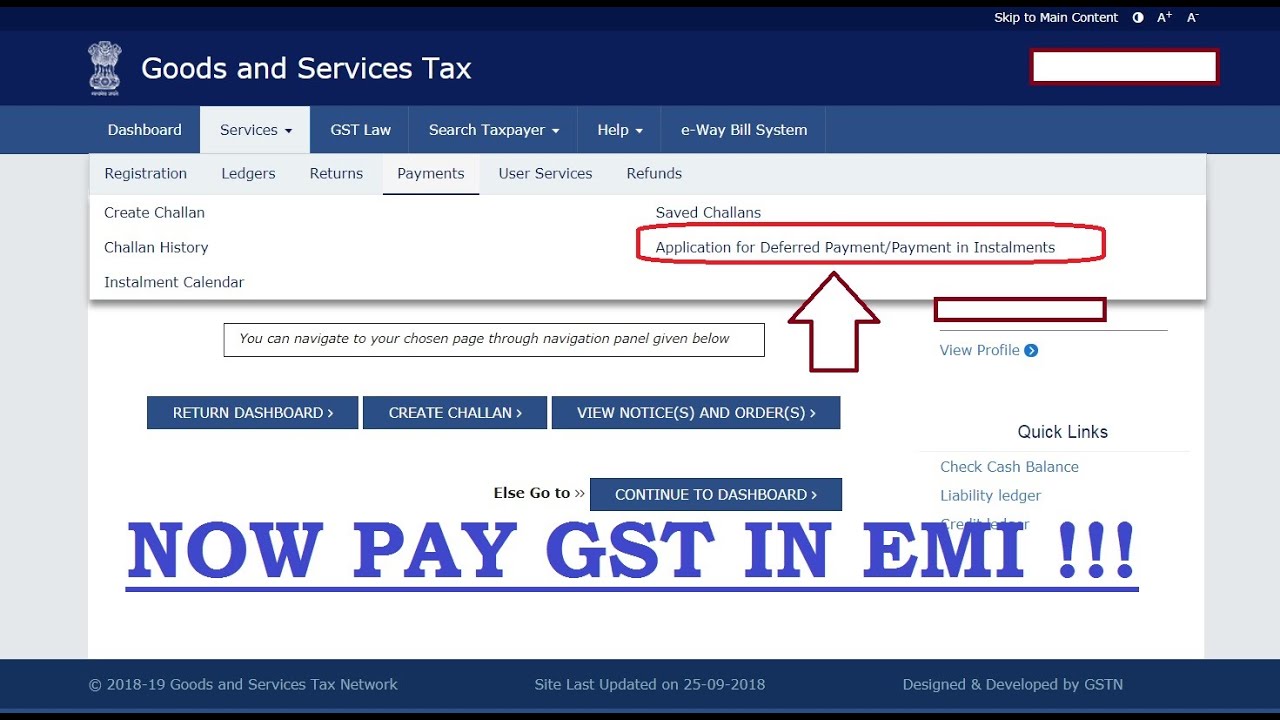

Filing Form GST DRC-20 involves several steps, beginning with logging into the GST Portal using valid login credentials. Once logged in, the taxpayer should navigate to the common portal features and select the appropriate application option. The taxpayer must then enter the relevant details of payment made or pending, using the payment box provided.

The filing process requires accurate information, including the specific amount for which deferment or instalments are being requested. The taxpayer should also indicate the proposed monthly instalments or deferred payment schedule, ensuring that all payment details are clear and precise. After filling in the application, it is advisable to preview the form using the PREVIEW button before submission to avoid any errors.

Once the application is ready, the taxpayer can proceed to the final step of filing the application by clicking the SUBMIT button. Upon submission, the taxpayer should generate a challan using the GENERATE CHALLAN button if any upfront payment is required. The success message on the portal confirms the submission.

Making Payments through Form GST DRC-20

Payment using Form GST DRC-20 can be done through the options provided within the GST Portal. After the form is successfully submitted, the jurisdictional officer will review the application and issue an order regarding the payment terms. The taxpayer can view this order on the GST Portal and must comply with the payment instructions provided.

💡 If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

The GST DRC-20 payment can be structured as monthly instalments, depending on the terms approved by the proper officer. Taxpayers must ensure that each instalment is paid on time to avoid penalties. The installment options and schedule will be visible on the GST Portal, and taxpayers can make payments accordingly.

It is important to regularly check the GST Portal for any updates or intimation of payment made, as well as to confirm that payments are successfully processed. Details of payment made, including payment in installments, will be recorded in the taxpayer’s dashboard.

Step-by-Step Application Process

Submitting an Application for Deferred Payment or Instalments

To apply for deferred payment or payment in instalments, the taxpayer needs to log in to the GST Portal and select the relevant application option. After providing the necessary details, such as the amount due and the proposed payment schedule, the taxpayer should carefully review the application before submission. The application process also includes calculating the payable amount using the CALCULATE button, followed by generating a challan if required.

Once the application is submitted, the taxpayer should keep an eye on any audit notifications, as audits may be triggered by the application. This is particularly relevant for businesses undergoing regular audits, such as food services or security guard services.

Accessing Your Filed Application

After submission, the taxpayer can access the filed application through the GST Portal by navigating to the dashboard. The filed application will be listed under the relevant section, and the taxpayer can view the details, including the status of the application and any additional requirements or documentation needed by the GST authorities.

The taxpayer should regularly check for any updates or messages related to the application, as SMS notifications or portal alerts may provide crucial information about the processing of the application.

Checking the Issued Order on Your Application

Once the jurisdictional officer reviews the application, an order will be issued outlining the payment terms and conditions. Taxpayers can view this order on the GST Portal under the order section. This order will detail the number of instalments, the due dates for each instalment, and any conditions attached to the deferred payment or instalment plan.

It is essential to comply with the order’s requirements to maintain good standing with the GST authorities. Non-compliance could result in penalties or the cancellation of the deferment agreement.

Viewing the Instalment Schedule

The instalment schedule for GST payments can be viewed on the GST Portal. This schedule, which will be based on the issued order, outlines the dates and amounts due for each instalment. Taxpayers should monitor this schedule regularly to ensure timely payments.

The instalment calendar will provide a detailed view of all upcoming payments, helping taxpayers manage their cash flow and avoid missing any payments. Regularly viewing and adhering to this schedule is crucial for the successful completion of the deferred payment plan.