Supply of Goods and Services under GST: Components, Classification and More

- 4 Nov 24

- 10 mins

Supply of Goods and Services under GST: Components, Classification and More

Key Takeaways

- GST is a destination-oriented tax applied to each stage of value addition, with tax obligations arising at the time of supply.

- Supply in GST includes a wide range of transactions like sales, leases, and imports, and follows specific criteria to be considered taxable.

- The components of supply—place, time, and value—determine the tax type, due dates, and amount for each transaction.

- GST categories include taxable and non-taxable supplies, with subtypes such as zero-rated, nil-rated, exempt, and non-GST supplies.

- Composite supplies involve bundled goods/services with a principal item, while mixed supplies are combinations taxed based on the highest rate in the bundle.

Goods and Services Tax (GST) is a destination-oriented multi-stage tax that is levied on every value addition. Be it a supply of services or goods, GST applies to each transaction. The obligation to pay tax arises at the time of supply. The applicability of GST depends on the determination of whether the transaction qualifies to be a supply.

Though the GST Council has exempted certain goods, services, and suppliers from GST provisions, a clear concept of which type of supplies are chargeable is important for vendors. To empower you with a clear vision of the supply of goods and services under GST, this comprehensive overview denotes the definition, classification, components and more about supply in GST.

Interested in knowing more about the significance of supply in GST? Then scroll down!

Concept Prior to GST

Before the introduction of GST, the concept of supply was nonexistent. There was a variety of indirect taxes across multiple supply chain stages ensuring a complete supply chain solution. We have enlisted some erstwhile indirect taxes below. Have a look:

- Central Excise Duty: When goods were transferred from the manufacturing unit to warehouses, then Central Excise Duty was used to levy on them. Customers pay this tax to retailers or intermediaries.

- Service Tax: This indirect tax is paid to the provider after the consumption of services. Consumers often pay Service Taxes to cab drivers, travel agents, cable providers and more.

- VAT: A VAT or Value-added Tax refers to an indirect consumption tax on services and goods that is implied at each stage of the supply chain when the goods or services receive a value.

GST is a consolidated taxable provision of all these indirect taxes along with others. This amalgamation not only has eliminated the cascading effect of taxation but also allows every Indian state to follow the same rate of tax for a particular product or service.

💡 If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

What Is Supply in GST?

Simply put, supply is a taxable event in GST. Supply refers to various taxable events, such as manufacture, sale, purchase, rendering of service, entry into a territory of the state, transfer, barter, exchange, licence, disposal, lease, rental, import and export services for consideration etc. The scope and meaning of supply under GST can be defined by 6 parameters. In GST a supply should be:

- Of goods, services or both

- Made under consideration, in exchange for reward or cash

- Processed by a GST-registered person

- Of taxable products

- Made in the course or for furtherance of business

- Occurred in taxable territories

The concept of supply is a consolidation of these 6 parameters. There is an exception for supplies made in the course of business without consideration. Transactions involving the provision of goods or services without payment are generally not considered supply, except for specific cases. Importing services for payment, regardless of whether it is part of a business, also becomes supply.

Enlisted under Schedule I under the CGST Act, transactions between related persons, such as employer and employee, business partners etc, will be considered as supply even if they are made without any payment.

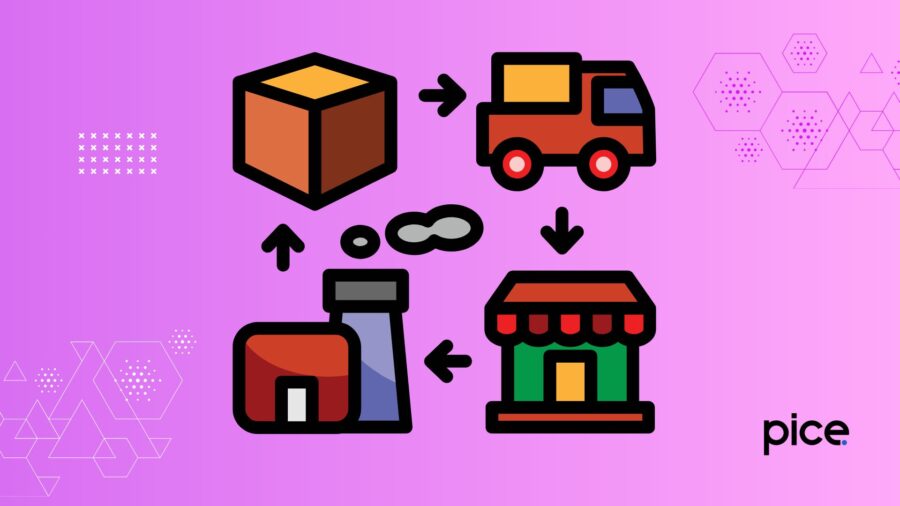

Components of Supply

The supply of goods and services under GST holds 3 components: time, value and place. These 3 components estimate the tax owned in a transaction. Here’s all the details:

- Supply Place: The place of supply specifies whether it is an intra-state, inter-state supply or external trade. The determination of place signifies the type of GST applicable to it.

- Supply Time: Supply time allows vendors to check when the associated tax and GST returns are due.

- Value of Supply: The value of supply determines the amount of tax that is required to be paid for this supply.

Categories and Types of Supply

GST-oriented supplies have 2 categories: taxable supplies and non-taxable supplies. These categories are classified further. Take a look:

Taxable Supplies: Taxable supplies refer to goods and services that are taxable under Goods and Services Tax. These supplies allow registered taxpayers to receive refunds on tax paid. In other words, they can optimise ITC or Input Tax Credits on the tax paid during purchase.

There are 3 types of taxable supplies. These are:

- Regular Taxable Supplies: When GST-registered taxpayers supply a product or service within India attracting a GST rate of more than 0%, then the supply is termed regular taxable supplies.

- Zero-rated Supplies: Every time a taxable person exports goods to a Special Economic Zone (SEZ) unit, or makes deemed exports, the GST applicable to the goods or services becomes 0, even if they would normally be subject to a GST rate higher than 0% when sold within India. These supplies stand as zero-rated supplies.

- Nil-rated Supplies: When supplied goods or services attract 0% GST by default, the supplies become nil-rated.

Non-taxable Supplies: A non-taxable supply refers to goods, services, or both that are not subject to taxation under GST.

Non-taxable supplies have 2 types:

- Exempt Supplies: As the name implies, the transmission of exempted goods is called exempt supplies. Exempted goods or services do not attract GST, even if they fall under the scope of GST. However, a registered taxpayer is not eligible to claim an Input Tax Credit for inputs used in the production of such supplies.

- Non-GST Supplies: This specifies all the supplies that are not within the purview of GST.

Please note: Certain supplies are not considered as a taxable supply under GST. Here’s a list:

- Supply of goods from a non-taxable territory to another without entering India

- Supply of warehoused goods to buyers prior to passing clearance for home consumption

- Goods supply for high sea sales

Schedule II of the CGST Act speaks of several activities that are termed as the supply of goods or services in GST. Take a look:

Activities Defined as the Supply of Goods in GST

- Any type of title transfer in goods

- Title transfer of goods under a contract denoting that the goods will become your property in future once you clear the payment

- Transfer or disposal of goods that are part of the business assets, under the direction of the owner

- Supply of goods from an unincorporated organisation to a member in exchange for cash

Activities Defined as the Supply of Services in GST

- Transfer of ownership or share in goods without transferring the title

- Lease or rental of a building for business use

- Leasing or occupancy licence or land tenancy

- Any process or treatment applied to someone else's goods

- When business owners permit personal use of business assets

- Rental of immovable property

- Construction of a building, including a complex or building intended for sale

- Temporary transfer of business assets or permission to use intellectual property rights

- Development of IT services

- Transfer of the privilege to use any goods for any purpose

Supplies Involving Multiple Goods and/or Services

All supplies of goods and/or services under GST serve as either entirely goods or entirely services based on the main item or service provided as per Schedule II of the GST law. This also applies in situations where the supply includes both goods and services.

Although supply of goods and services are separate, they can also be provided as a package or a collection using one of the following supply methods:

- Composite Supplies:

A composite supply refers to a supply that includes 2 or more goods/services that are typically sold together in the course of business. One of these goods/services is principal supply. This means that the items serve as a combination and cannot be separately supplied.

For example, a car seller sells a brand-new car along with its registration and insurance. This is a composite supply. Here, the car serves as a principal supply and all other things are secondary supply.

- Mixed Supplies:

Mixed supplies, a comparatively new term, means a combination of 2 or more goods and services bundled together for a single price. The tax rate in mixed supplies relies on the item which has the maximum rate of tax. All gift combos and festive gift boxes fall under mixed supplies.

Conclusion

With this, the discussion about the supply of goods and services under GST has come to an end. Under the GST regime, the estimation of taxes revolves around the supply of goods or services or both. Therefore, supply stands as the pivotal factor. It determines the tax implications of all transactions, whether commercial or otherwise.

By

By