Deemed Supply Under GST

- 20 Nov 24

- 9 mins

Deemed Supply Under GST

- What Is a Deemed Supply?

- GST Input Tax Credit Refund

- Steps to Claim the GST Input Tax Credit Refund

- Documents Required for ITC Refund

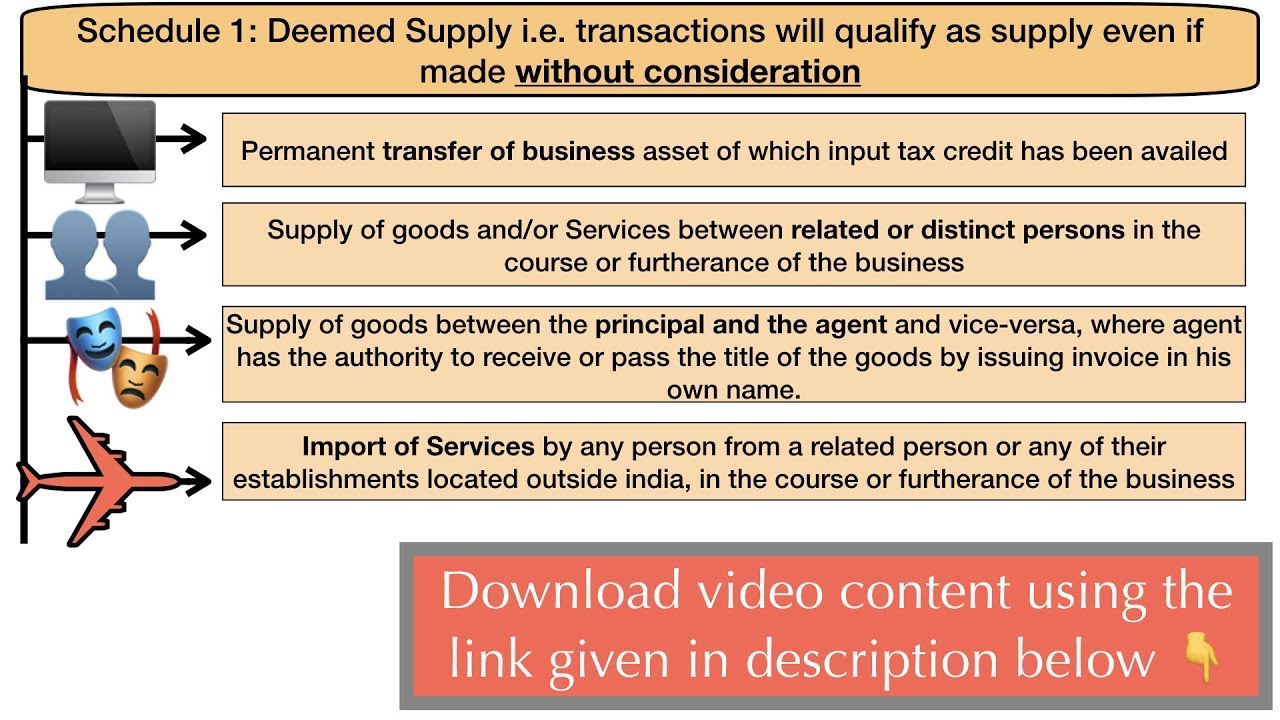

- Which Activities Are Considered as Deemed Supply?

- Who Is a Related Person Under GST?

- What Is the Taxability of Supply Made Between Related Persons?

- Valuation of Transactions Between Related Persons

- Supply of Goods via Agent

- Taxable Person Importing Services From a Related Person

- Permanent Transfer of Business Assets Where ITC Has Been Availed on Such Assets

- Conclusion

Key Takeaways

- Deemed Supply: Transactions without or with minimal consideration, like barter or related-party services, are taxable under GST.

- ITC Refunds: Refunds apply to inverted tax structures and SEZ supplies, but not for exempt or nil-rated outputs.

- Related Persons: Supplies without consideration between related or distinct persons are taxable under Schedule 1, with exemptions for gifts under ₹50,000.

- Valuation Rules: Related-party supplies are valued using open market value or comparable goods/services.

- Asset Transfers: Permanent transfer of ITC-availed assets is taxable, excluding personal use or temporary transfers.

Deemed supply under GST refers to a type of supply where goods or services are provided with little or no consideration in return. This concept was introduced in order to ensure that the current taxation regime covers all taxable services, including those that may fall outside the tax ambit.

Whether it involves the supply of goods between related persons or the donation of business assets, these supplies have implications in terms of ITC claims and tax liabilities.

In this blog, we will discuss deemed supply under GST, the process of ITC refund, valuation and taxability of supplies and many more.

What Is a Deemed Supply?

Deemed supply is a type of supply under Goods and Services Tax in which there is either no consideration or inadequate consideration for the supply of services and goods. This type of supply is also known as barter supplies.

Let us understand this with the help of an example. Suppose Mr.XYZ is a Chartered Accountant offering Income Tax services, and his friend, also a Chartered Accountant, specialises in GST services. He asks his friend to file his GST returns without any payment, and in return, he agrees to handle his Income Tax matters for free. This exchange of services without consideration under Schedule 1 would be subject to GST as 'Deemed Supply'.

GST Input Tax Credit Refund

Here are some of the cases where taxpayers can claim the refund of input tax credit:

- The business runs on a structure of inverted tax.

- Supply of services or goods to Special Economic Zone (SEZ) units without timely payment of tax.

Here are some of the cases where taxpayers cannot claim the refund of input tax credit:

- If you export goods that are subject to excise duty, the accumulated input tax credit that you did not use will not be eligible for a GST refund.

- If an inverted tax structure prevails in a business, the output will be nil-rated or will be exempt from GST.

Steps to Claim the GST Input Tax Credit Refund

To claim the GST Input Tax Credit refund, fill up the details of outward supplies invoices or sales invoices on the GST portal. Then, sign back into the portal to provide turnover details of inverted-rated supplies or zero-rate. The system will automatically generate the net ITC details, which you can edit. Provide bank account information, upload necessary documents, and the system will generate your ARN.

Documents Required for ITC Refund

You need certain documents for a refund of ITC. You need to file GSTR-1 and GSTR-3B for the specific tax periods, EGM details, shipping bill, FRC/BRC from a bank if you are claiming a GST refund for the export of services, and filing Form RFD-01.

Which Activities Are Considered as Deemed Supply?

Take a look at the following to understand if the activity amounts to supply under CGST ACt, Section 7.

- When goods or services supplied are settled by other goods or services from another registered person, it is considered deemed supply.

- When a principal supplies goods to an agent, and the agent supplies those goods on behalf of the principal without vendor payment, it is also considered a deemed supply.

- If an agent receives goods on behalf of the principal without any payment, it will be treated as a deemed supply.

- Importation of services from a related person or an establishment outside India for business purposes or regular business operations is treated as a deemed supply.

Who Is a Related Person Under GST?

As per Section 2(84) of the GST Act, a person can be related under GST only if he falls under any of the following types:

- An employer and an employee

- Director/officer of one business who is also the director/officer of another business

- A shareholder holding 25% of another company’s shares, directly or indirectly.

The legal persons can be HUF, individuals, companies, local authorities, body of person or entities working outside India.

What Is the Taxability of Supply Made Between Related Persons?

Any transaction that involves the supply of goods or services between related persons with consideration at arm's length falls under the provisions of the scope of supply. On the other hand, supplies between distinct persons without consideration come under Schedule 1 of the GST Act. However, we can consider these transactions as'supply' if meant for the furtherance of business.

Additionally, if a business entity makes an activity of import of service from imports business or related person residing outside India for the due course of business, it will be a ‘supply.’

One exemption is a gift by the employer to an employee and the cost of gifts is less than ₹50,000 will not be a supply.

Valuation of Transactions Between Related Persons

The value of supply between related persons, except for the supply of goods via agent, can be determined as follows:

- In case supply is between two related entities, relationships between two entities influence the prices of supply.

- If you can not determine open market value, then you need to consider the value of goods of quality and kind.

- For instance, a private limited company ABC Ltd. without consideration supplies management technical services to a company where it has controlling rights, i.e., CBA Ltd. The supply of technical services for the benefit of a group will be a supply.

Supply of Goods via Agent

The meaning of agent is a person who has been employed to understake any type of act for another, in order to represent another in third person dealings.

GST is applicable if a principal makes a supply to the agent, which the agent will supply on the principal’s behalf. If the agent makes the supply to the principal when the agent receives the supplies on the principal's behalf, GST is applicable.

Extension of loan service supply to the recipient by the DCA, who is not an agent, will be an independent supply on a principal-to Principal basis. However, the activity of extension of credit to the recipient by the DCA will not be a separate supply.

Taxable Person Importing Services From a Related Person

Import of service would be a supply when the taxable person makes from an establishment or related person outside India.

For instance, ABC Inc., a US-based company, is established by A Ltd. and B Ltd., both based in India. If B Ltd. imports business support services from ABC Inc. without any consideration, the import will be treated as supply.

Another example is, SHC Ltd. a business in India and holds 50% shares of TC Ltd., a company in the USA. The business auxiliary services that TC Ltd. provides to SHC Ltd. is a supply.

Permanent Transfer of Business Assets Where ITC Has Been Availed on Such Assets

It will be a supply in cases of permanent transfer, sale of business assets, or donation of assets where there has been a condition of availment of input tax credit. It will be a supply even if no valuable consideration is received. Goods and Services Tax applies to the sale or disposal of business assets without consideration only. It does not apply to the sale of personal assets or personal consumption of business assets.

Goods that you send on job work or goods that you send for certification or testing will not be a supply as there is no case of permanent transfer.

Conclusion

Deemed supply under GST broadens the tax base by including transactions that you do not ordinarily consider as supplies. It treats certain activities like supply through agents, conditional transfer of business assets, etc. as taxable supplies.

For businesses, understanding the rules governing these supplies is crucial for ITC benefits and maintaining business compliance.

💡If you want to streamline your payment and make GST payments, consider using the PICE App. Explore the PICE App today and take your business to new heights