Is GST Direct or Indirect Tax? Meaning, Features & Facts

- 14 Nov 25

- 14 mins

Is GST Direct or Indirect Tax? Meaning, Features & Facts

Key Takeaways

- GST is an indirect, multi-stage tax levied on the supply of goods and services across India.

- It replaced multiple indirect taxes like VAT, excise duty, and service tax, creating a unified tax structure.

- GST is destination-based, meaning the tax revenue goes to the state where the goods or services are consumed.

- Input Tax Credit (ITC) eliminates the cascading effect of taxes, making goods and services more affordable.

- Digital systems like e-invoicing and e-way bills ensure transparency, reduce tax evasion, and simplify compliance.

The Government of India levies both direct and indirect taxes. Direct taxes include the taxes imposed on a person’s regular income, profits or revenue.

The Income Tax Act governs such collections, including income tax, Capital Gains Tax, and corporate tax. The Central Board of Direct Taxes (CBDT) handles the duty of collecting direct taxes.

Now, the question arises: Is GST a direct or indirect tax?

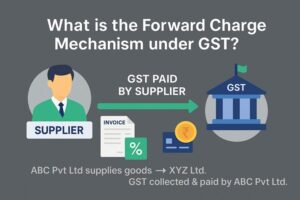

The Goods and Services Tax is classified as an indirect tax. Typically, it is the manufacturers and suppliers who handle these payments, collecting the tax beforehand from their customers.

Since its rollout, the GST Council has overseen the system and the GST collections have soared to an impressive ₹20.2 trillion in FY24, marking a significant achievement for this new taxation initiative by the government.

To gather more valuable insights on GST, continue reading.

What is GST?

GST is an indirect taxation method backed by the Goods and Services Tax Act, which was passed in the Rajya Sabha Parliament on 29th March, 2017. The new rule came into existence from 1st July, 2017 and it replaced several earlier taxes, such as VAT, service tax, excise duty, customs duty, etc.

As a result, the GST gave rise to a simple, unified tax framework that also influences financial planning strategies.

To grasp the concept of GST in detail, you must learn about its features which are shared below:

Multi-Stage

A taxable item under the GST structure goes through numerous change-of-hands fulfilling a supply chain. It covers the entire journey of a product/ service from its manufacturer to the end consumer.

Usually, the following stages are present:

- Purchasing raw materials/ supplies

- Manufacturing of the product

- Storing of the goods

- Selling the products to wholesalers

- Selling the same commodities to retailers

- Selling them to the end consumers

Witnessing these stages, you may be wondering: Is GST a direct or indirect tax? The answer is yes. It is an indirect tax and also multi-stage, as the tax is imposed on each transaction before it reaches the next recipient.

Value Addition

The scope of GST is largely affected by precise value addition. Let us understand with an example. Suppose a biscuit manufacturer purchases raw materials like sugar, flour, etc. from a seller to start the production. They will be liable to pay a 5% GST on these purchases.

However, when the manufacturer sells the end product, i.e., the packaged biscuits, they will charge an 18% GST (applicable for all bakery goods). Here, you can see the GST rate adding up due to visible value additions.

Destination-Based

Suppose a pharmaceutical company based out of Karnataka is selling its medicine to a final consumer in Tamil Nadu. In this case, as the GST is determined based on the place of supply (location of consumption), the whole tax amount will go to Tamil Nadu and not Karnataka.

Objectives of GST in India

The main purpose of GST was to eliminate the complications of multiple indirect taxes. For instance, while enforcing the GST Act, the Government aimed to:

Realise the Vision of ‘One Nation, One Tax’

Before the introduction of GST, India's indirect tax system was a mess, with different taxes imposed by both central and state governments. This created a lot of inconsistencies and made things complicated.

So, the goal of GST was to bring all these various taxes together under one roof, establishing a consistent tax structure across the country.

Eliminate the Cascading Effect of Taxes

The old tax system often led to an inefficient ‘tax on tax’ situation, where products were taxed at every stage of production and distribution, ultimately driving up prices for consumers. GST sought to put an end to this cascading effect by allowing for a smooth input tax credit (ITC) throughout the supply chain.

This meant that tax was only applied to the value added at each step, lowering the overall tax burden and making goods and services more affordable.

Tackle Tax Evasion

GST was carefully designed and is currently administered by 33 active members who are empowered to take decisive action against tax evasion. The digital aspect of GST filing, along with its invoice matching system, has made it tough for businesses to conceal transactions or understate sales.

The thorough chain of input tax credit also encourages compliance, as companies can only claim credit for taxes paid on legitimate purchases. These factors boost transparency and accountability, leading to improved tax collection and enhanced trust among law enforcement authorities, tax officials and businesses alike.

Ensure Fair Pricing and Boost Consumption

By eliminating the cascading effect of taxes and improving supply chain efficiency, GST aims to reduce the overall cost of goods and services. This reduction in costs translates into more competitive pricing in the market.

Lower prices, in turn, are anticipated to stimulate demand and increase consumption, thereby boosting economic activity and contributing to the nation's GDP growth.

Note: If you are a taxpayer with a yearly turnover exceeding ₹20 Lakhs, then you have to register your business under GST. This threshold is even lower (₹10 lakhs) for special category states in India. Proper GST registration ensures seamless compliance and supports your overall investment profile.

Benefits of Implementing GST Regulations

The GST in India, while aiming for specific objectives, has yielded several tangible benefits that contribute to the nation's economic landscape. All the associated benefits are the great results that come from achieving collective goals and as the new tax system develops.

Simplified Tax Compliance

The ease in business tax compliance is one of the major advantages. GST has eliminated much of the complications in the process of filing tax and taxation burden by collapsing a range of existing indirect taxes levied by the central and state governments.

The companies are no longer required to run through various tax jurisdictions or to comply with different state-specific regulations. Thus, the process of compliance has resulted in an impressive average monthly tax collection of ₹1.84 Lakh Crores as of June 2025

Well Co-ordinated Supply Chain Management

Since there has been a seamless movement of Input Tax Credit (ITC) by GST, it has resulted in minimal production cost and has created more competitiveness. Businesses can credit the taxes paid on the inputs throughout the whole supply chain which came with the removal of the cascading effect.

It not only reduces the total cost of goods and services but also enhances the competitiveness of Indian goods in the international markets, increasing the exports and also the industrial project, 'Make in India'. This indirectly boosts investor confidence in India’s securities market.

100% Technology-Driven Process

The digital backbone of GST, including online filing and invoice matching, has brought about greater transparency and formalisation of the economy. The comprehensive digital trail makes it significantly harder for businesses to evade taxes, leading to a broader tax base and increased government revenue.

This formalisation also encourages more businesses, especially smaller enterprises, to register and operate within the organised sector, contributing to a more centralised and accountable economic system. This also complements broader taxation efforts like Corporation Tax and wealth tax reforms.

How to Calculate GST?

The total GST amount is computed as the sum of GST chargeable on reverse charge, output supplies and inward supplies. All concerned taxpayers must determine this total themselves each month. Considering you are a monthly taxpayer, you must furnish this amount every month.

Determining the appropriate tax amount will allow you to avoid the 18% interest that the Government imposes when an actual payment falls short of the pending payment.

Here you can take a look at the GST formula:

GST amount = (original selling price * applicable GST rate) / 100

Consequently, the net price = GST amount + original selling price

Let us take a quick example. Suppose Jahnvi is selling a birthday gift box from Gujarat and the commodity will reach Maharashtra. The price of the gift box is ₹5,500 and the GST rate levied on it is 18%.

In this case, the GST amount will be ₹(5,500 * 18) / 100 = ₹990. Simultaneously, the net price of the commodity will be ₹(5,500 + 990) = ₹6,490.

What are the Different Components of GST?

Getting an answer to the query - ‘Is GST a direct or indirect tax’, is just the tip of the iceberg. To understand its applicability, you must know that this taxation framework is further divided into four components:

State Goods and Services Tax (SGST)

SGST is the applicable tax on the sale of supplies within a state. It has replaced various taxes like VAT, state sales tax, entry tax, surcharges and cess.

Central Goods and Services Tax (CGST)

CGST is levied on both inter-state and intra-state transactions and it has successfully replaced many previous taxes like Service Tax, Central Excise Duty, customs duty, SAD, CST, etc.

Union Territory Goods and Services Tax (UTGST)

Like SGST, the taxes applicable on the sale of services or products in union territories are referred to as UTGST. These include places like Andaman and Nicobar, Dadra, Daman and Diu, etc.

Integrated Goods and Services Tax (IGST)

Like CGST, an intra-state transaction can attract IGST too. Normally, the integrated GST applies to supplies made towards Special Economic Zones (SEZs) or during registered dealer purchases where an unregistered supplier is involved.

Here you can take a look at some examples to understand the GST levy in a better way.

An electronics appliance seller in Punjab sells products worth ₹54,000 to a customer within the same state. In this transaction, an 18% GST is levied with 9% of CGST and 9% of SGST. Consequently, a total GST of ₹9,720 will be equally shared between the Central Government and the State Government.

Now, suppose the same seller sends goods worth ₹40,000 to another state, say Himachal Pradesh. In this situation, only CGST will apply at an 18% rate, and the Central Government will receive ₹(40,000 * 18) / 100 = ₹7,200.

For the ease of tax compliance, the government has turned the whole GST payment system online, improving transparency and easing the burden on taxpayers, both individuals and entities such as those filing corporate tax or Capital Gains Tax returns.

GST Rates in India

In India, multiple GST slab rates exist, such as:

- The 5% Slab

This bracket covers all the basic products and services. They include the packaged food products such as some spices, tea, coffee (other than instant coffee), baby food, some lifesaving medicines, domestic LPG, and economy-class air tickets.

- The 12% Slab

This is where processed food products, as well as other common consumer items, fall. It includes butter, ghee, cheese, mobile phones, fruit juices, pre-packaged coconut water and business class tickets are some common examples.

- The 18% Slab

There is a vast amount of goods and services under this GST slab rate. Hair oil, toothpaste soaps, ice cream, pasta, cornflakes, printers, hotel accommodation with tariffs over ₹7,500, and many IT and telecom services are common examples.

- The 28% Slab

This is the highest slab, primarily for luxury goods and ‘sin goods’. Examples include luxury cars, motorcycles, aerated drinks, instant coffee, dishwashers, air conditioners, and cigarettes (which also attract a cess).

Tax Laws Before GST

Earlier, both the state and the central governments levied multiple indirect taxes. The states primarily imposed Value Added Tax (VAT). However, every state had different rules and regulations.

Conversely, the Central Government taxed interstate transactions. Besides, some other indirect taxes like the entertainment tax, local tax and octroi were applied by both the state and the centre.

The table below shows the various taxes which were active in the pre-GST regime:

| Taxes That are Replaced by GST | Taxes That are Still Applied Now |

|---|---|

| Central Excise Duty | Basic Customs Duty |

| Duties of Excise | Tax applicable on diesel and petrol |

| Customs (additional duty) | Stamp duty on property |

| Additional duties of excise | Tax levied on alcohol and tobacco products |

| Cess | Electricity duty |

| Special additional duty of customs | Vehicle tax |

| State VAT | Property tax |

| Purchase tax | |

| Central Sales Tax | |

| Luxury tax | |

| Entry tax | |

| Entertainment tax | |

| Advertisement tax | |

| Tax on gambling, lotteries, and betting |

Note: A reduced 2% GST rate, facilitated by Form C, continues to apply to interstate transactions. This tax rate is applicable in very specific conditions and requires adherence to proper documentation.

What are the New Compliances Under GST?

The GST Act transformed the tax regime in India due to the introduction of multiple digital systems, besides e-filing of returns. These include:

- E-way Bills: A centralised mechanism of tracking of goods in transport, e-way bills have been phased in, beginning with the inter-state movement on April 1, 2018, and the intra-state movement on April 15, 2018.

E-invoicing streamlines data exchange, minimising errors and directly populating information into the GST portal and e-way bill system, thus simplifying GSTR-1 preparation and e-way bill creation.

- Electronic Invoicing (E-invoicing): Businesses began using the e-invoicing system in phases, starting October 1, 2020. From August 1, 2023, this system includes businesses with annual turnover exceeding ₹5 crore since the 2017-18 financial year.

This is done by uploading the B2B invoices to the GSTN portal, after which it is validated giving a special Invoice Reference Number, a digital signature and a QR code. Through e-invoicing, data transfers can be simplified and errors are fewer. Also, the data is directly entered into the GST portal and e-way bills system, making GSTR-1 easier to prepare and e-way bills easier to generate.

Conclusion

By the end of the blog, it is quite evident that you have got the answer to ‘Is GST a direct or indirect tax?'. Additionally, you know how the tax applies in several typical situations. However, staying on top of compliance can require professional assistance and tools, for which you may need to reach out to experts.

Always ensure that you also consider legal disclaimers before acting upon any tax-related advice. Proper adherence to tax laws not only helps with GST but also supports other areas like income tax, Capital Gains Tax, and corporate tax, forming a core part of your financial planning.

By

By