GST Offline Tool Not Working: Easy Fix Guide

- 4 Nov 25

- 9 mins

GST Offline Tool Not Working: Easy Fix Guide

Key Takeaways

- Fix GST Offline Tool errors easily by updating your OS to Windows 7 or higher and ensuring compatible browser versions.

- Download the latest GST New Return Offline Tool from the official GST portal to file returns without internet issues.

- Ensure system compatibility — install Excel 2007+, WinZip/WinRAR, and supported browsers like Chrome 49+ or Firefox 45+.

- Use GST Offline Tools for filing GSTR-1, GSTR-3B, and GSTR-4 efficiently, even without an internet connection.

- Resolve GST Offline Tool problems quickly by checking updates, reinstalling the tool, or using GST billing software alternatives.

The GST offline tool is a popular tool used by GST-registered taxpayers to perform tasks such as filing GST returns (e.g., GSTR-1, GSTR-3B, and GSTR-4), calculating tax liability and more, without the need for an internet connection.

However, users often face situations where the GST offline tool is not working properly. This can happen due to reasons like using an outdated operating system (below Windows 7), missing important updates or system compatibility issues.

The good news is, most of these problems can be fixed easily with a few simple steps. Moving forward in this blog, we are going to learn how to fix the GST offline tool and make it work, along with other valuable information.

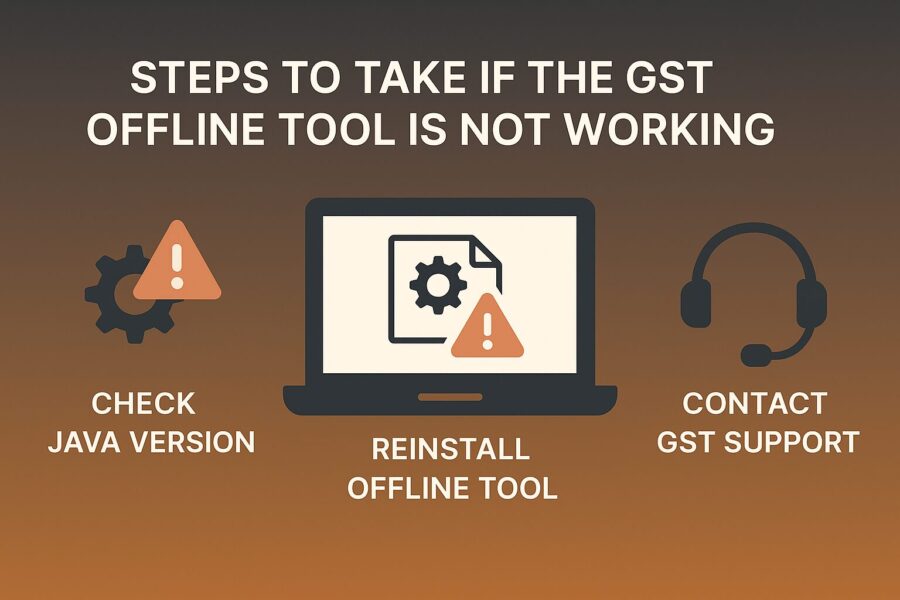

Steps to Take if the GST Offline Tool Is Not Working

Sometimes, after downloading the GST offline tool, you may run into certain issues. Errors like “GST offline tool not working”, “Windows 10 not opening after installation” or a blank screen are common.

If you are wondering how to fix the GST offline tool, a few simple steps are usually all it takes to get it up and running again.

At first, you can simply try to refresh your device. Later on, just make sure your computer meets the following requirements:

- Make sure your OS (Operating System) is at least Windows 7 or higher versions. The GST offline tools are incompatible with Linux or Mac operating systems.

- You must download and install one of the browsers, such as Google Chrome or Bing, on your computer before using these tools.

- If you have Google Chrome as your browser, make sure it is version 49+.

- A Firefox OS should have version 45 or above.

- Your system must have Microsoft Excel 2007 or a newer version to run GST offline tools.

- You will have to uncompress your files using WinZip or WinRAR in order to extract the download utility.

- If you still face issues, you can also check GST Billing Software, Billing Software for Mac, Free Billing Software for PC and POS Billing Software.

Steps to Download and Install the GST New Return Offline Tool

Taxpayers use GST offline tools to conduct various GST-related tasks more simply. However, to do that, you must first download and install the new return offline tools.

Here's what you need to do:

Step 1: Visit the official GST Portal from your browser and go to the 'Downloads' Section.

Step 2: Click on 'Offline Tools'. You will see a list of options. Among those options, click on 'GST New Return Offline Tool (Beta)'.

Step 3: In the next interface, click on the download link available on the right-hand side of your screen.

Step 4: A notification for confirmation will pop up on your screen. Click on 'Proceed'. A Zip folder will download to your system.

Step 5: Go to your File Explorer and from the 'Downloads' section, click on the zipped folder.

Step 6: You will see one of the files with a title named “GSTNewReturnsOffline_beta.exe”. This is the offline tool. Double-click on it to open it.

Step 7: A message will pop up on your screen to install the tool. From the browse option, choose where you want to install the tool and click on 'Next'.

Step 8: Now, click on 'Install' to start the installation process.

Step 9: Once the installation process is over, click on 'Finish'.

Step 10: Now, your tool is ready for use. Double-click on it to open the tool.

Note: The offline tool has new updates over time. Make sure to use the latest version of the tool.

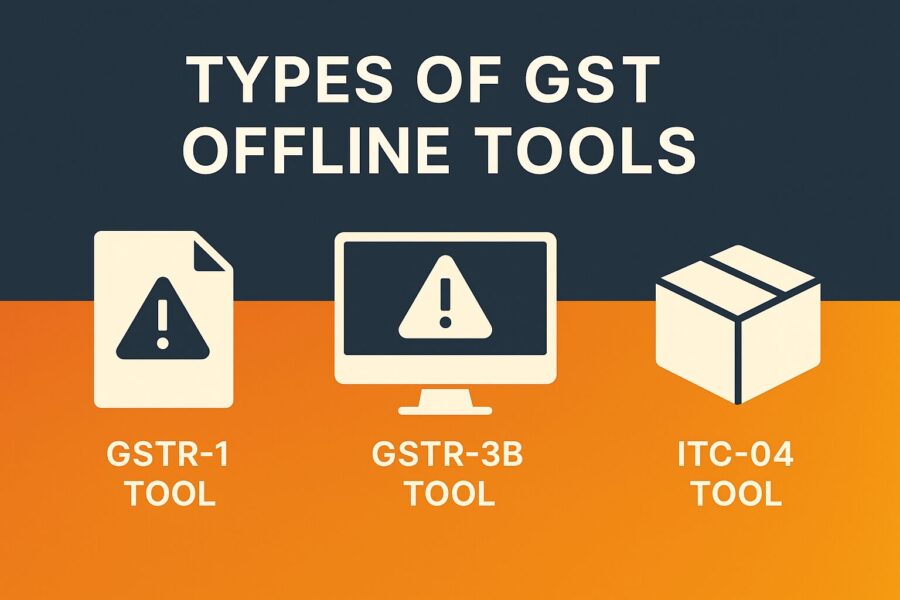

Types of GST Offline Tools

There are basically 2 main types of GST offline tools: 'Excel GST offline billing tool' and 'GST New Return Offline Tool'. Let’s know them in detail.

- Excel GST Offline Billing Tool

The Excel GST offline billing tool is a no-internet billing program based on Microsoft Excel. This tool facilitates taxpayers to make free invoices and file GST returns like GSTR-1 report, GSTR-3B, GSTR-4 and others with just a single click. This is a handy tool for many businesses in India that do not have a stable internet connection.

- GST New Return Offline Tool

This tool was introduced to the taxpayers for a limited period or on a trial basis. This helped with the taxpayer’s acquaintance with the new return forms established under GST. Currently, only 2 annexures (GST ANX-1 and GST ANX-2) are available.

List of GST Offline Tools and Steps to Use Them

When you open the 'Downloads' section on the GST Portal, you will find various kinds of GST offline tools. Let’s know about a few of these tools in detail.

- Tran 1 Offline Tool

This form allows businesses that still follow the previous taxation system or VAT system to convert their VAT liability into applicable SGST. Like any other tool, you can download this form from the GST Portal. However, you must convert your Form into JSON format and then upload it to the GST Portal.

- Tran-2 Offline Tool

Business owners with a GSTIN must file Tran-2 or Transition 2 when they do not have valid invoices for the tax they pay on inputs. This often happens when these business owners purchase their inputs from suppliers who do not have a GST registration.

- Offline Tool for ITC 01

GST-registered businesses or individuals submit the GST ITC-01 document when they seek to claim ITC (Input Tax Credit) under Section 18(1) of the GST Act. This tool acts as a declaration form for GST-registered taxpayers to claim ITC on inputs they hold in their warehouses as stocks, such as raw materials or finished goods.

- Offline Tool for ITC 04

GST taxpayers use the ITC 04 offline tool to assist manufacturers in developing ITC 04 declarations offline. This application also facilitates business owners to upload important data from a list of invoices to the GST system.

- Offline Utility Tool for GSTR-3B

If you are a registered GST taxpayer, you need to file a self-declaration online. This self-declaration form is the GSTR-3B return form. This is an important GST filing and all taxpayers with a valid GSTIN Number must file it separately.

Once they file this self-declaration paperwork, they can no longer edit or change it. Using this offline tool reduces the occurrence of mistakes that can happen when filing this return. However, before using this tool, make sure you have Windows 7 or a newer version of the OS for compatibility.

- Offline tool for GSTR-4

GSTR-4 is a return file that composition dealers have to file and submit once every quarter (a quarter is 3 months). The offline tool GSTR-4 is a trustworthy tool for return filing. Howevert requires Windows 7 OS or newer versions and WinZip or WinRAR-type file decompression software for its extraction and installation.

Conclusion

The GST offline tools offer great help to taxpayers in carrying out their tasks, such as tax calculation and filing GST returns. People can access these tools directly from the GST Portal from the 'Downloads' section.

However, you might sometimes face issues like the GST offline tool not working. In such cases, just follow a few simple steps and ensure your computer meets the minimum system requirements.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By