FAQ on GSTR 3B

- 24 Jul 25

- 11 mins

FAQ on GSTR 3B

- What Is Form GSTR-3B?

- What Is the Last Date to File Form GSTR-3B?

- Who Should File Form GSTR-3B?

- Where Should You File Form GSTR-3B?

- Will the GST System Save My Confirmed Data if I Exit Without Completing the Form?

- Is It Mandatory to Pay the GST Liability Mentioned in GSTR-3B?

- What Happens if I Pay GST Liability Later than Due Date?

- Can I Modify the Submitted Form GSTR-3B?

- Where Can I Declare the Details of Outward/Exempt/Nil-rated/Non-GST inward supplies?

- How to Show the Inward Supplies Taxable Under Reverse Charge Mechanism?

- How Can I Claim Back the RCM Amount Paid?

- If I Do Not Have Any Transaction in a Specific Tax Period, Do I Need to File Form GSTR-3B?

- Do I Need to Fill in the Details of Inward Taxable Supply?

- Where Do I Declare the Outward Taxable Supplies in GSTR-3B?

- Will the Utilised Cash or ITC functionality be available for releasing return-related liabilities?

- What Is Table 6.1 in Form GSTR-3B?

- For SEZ Supplies, Do I Need to Pay IGST and Then Claim a Refund?

- Can I File GSTR-3B and Not Pay the Tax?

- Why Is GSTR-3B Significant?

- Can I File GSTR-3B for the Month of November if My GSTR-3B for October Is Pending?

- Can I Pay the Tax Without Filing Form GSTR-3B?

- What Should I Do If GSTR-2A and GSTR-3B Do Not Match?

- Is There an Easy and Quick Way to File a Nil Return for GSTR-3B?

- Which Form Will Be the Replacement of GSTR-3B?

- Do I Need to Make Invoice Level Entries of Details in GSTR-3B?

- What to Do If I See Values As Zero Even After Proceeding After the Status is Submitted?

- Where Should I Declare Inward Supplies Liable to Reverse Charge in GSTR-3B?

- Can I Utilise ITC on RCM Supplies to Reduce Tax Liabilities?

- Where in GSTR-3B Can I See the Final Tax Liability?

- Which Taxpayers Do Not Need to File GSTR-3B?

- Can I Claim ITC on Capital Goods in GSTR-3B?

- What Is Common ITC?

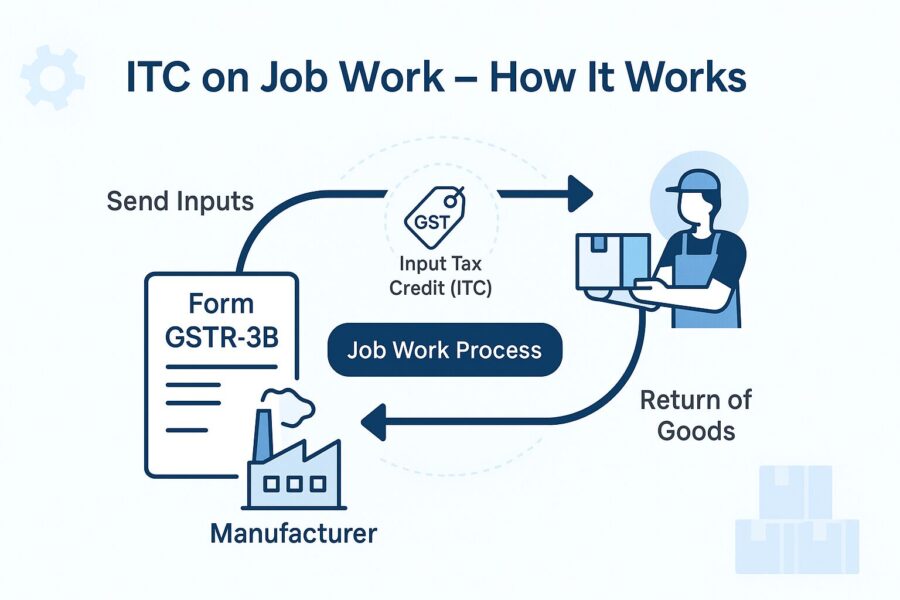

- How Does ITC Apply to Job Works?

- What Is Table 3.1 (b) in Form GSTR-3B?

- Which Tables Are Auto-drafted from Form GSTR-2B to Form GSTR-3B?

- Which Tables of Form GSTR-3B Are Auto-populated from Form GSTR-1/1A?

- Is Invoice Matching Applicable in GSTR-3B?

Key Takeaways

- GSTR-3B is a monthly or quarterly self-declared summary return of inward and outward supplies.

- The due date is the 20th of the following month for monthly filers and the 22nd/24th for quarterly filers.

- Late filing attracts 18% interest and penalties, even if no transactions occurred.

- Form GSTR-3B cannot be revised once filed; adjustments must be made in subsequent returns.

- Reverse charge liabilities and eligible ITC must be properly declared in Tables 3 and 4.

Form GSTR-3B entails the details of inward and outward supplies during a tax period. Filing this return is mandatory for all registered taxpayers under the Indian GST framework. Explore some of the FAQs on GSTR-3B to avoid delayed payments and return filing which attract penalties, interest and late fees.

What Is Form GSTR-3B?

Form GSTR-3B summarises inward and outward supplies for a particular tax period. Taxpayers use this form to declare, adjust or discharge GST liabilities using ITC (Input Tax Credit). This is a self-declared summary GST return that is submitted monthly or quarterly for those under the QRMP scheme.

Taxpayers are required to disclose key details such as total regular sales (GST supplies) or outward intra-state supplies, input tax credit claimed and the net tax liability. Ensure you do not submit partially complete Form GSTR-3B.

What Is the Last Date to File Form GSTR-3B?

For taxpayers filing monthly, Form GSTR-3B must be submitted by the 20th of the month following the relevant tax period. The due date of GSTR-3B for quarterly filers is either the 22nd or 24th of the month after the end of the respective quarter or applicable period (of the earlier tax period or previous period), as notified by the government.

Notably, you do not file taxes for the current return period; you file it after the end of the tax period for the previous return period or previous tax period.

Who Should File Form GSTR-3B?

All taxpayers including registered, normal and casual taxpayers need to file this form every month.

Where Should You File Form GSTR-3B?

You can file Form GSTR-3B on the unified GST portal after you log in using valid credentials under the ‘Returns Dashboard’ option.

Will the GST System Save My Confirmed Data if I Exit Without Completing the Form?

You need to ‘Save’ the details of an incomplete form to save the changes that you make.

Is It Mandatory to Pay the GST Liability Mentioned in GSTR-3B?

It is compulsory to pay the mentioned GST liability in Form GSTR-3B. If you do not pay, you might attract late fees, penalties and interest.

What Happens if I Pay GST Liability Later than Due Date?

If you do not pay GST liability within the due date, you will attract an 18% penalty on the liability per annum. To avoid paying additional penalties, ensure you pay your GST liabilities within the last date.

Can I Modify the Submitted Form GSTR-3B?

You cannot modify a submitted Form GSTR-3B. However, if you need adjustments or rectifications, you can consider the same in the following tax period.

Where Can I Declare the Details of Outward/Exempt/Nil-rated/Non-GST inward supplies?

You need to specify details of the above-mentioned supplies in Table 3.1(c) and Table 3.1(e) of the form.

How to Show the Inward Supplies Taxable Under Reverse Charge Mechanism?

You can mention inward supplies under the reverse charge mechanism in Table 3.1(d) of the form. Further, you need to create an invoice to release the tax liability against that invoice.

How Can I Claim Back the RCM Amount Paid?

You cannot claim the tax paid as a refund. However, you can claim the input tax credit in Table 4 of the form.

If I Do Not Have Any Transaction in a Specific Tax Period, Do I Need to File Form GSTR-3B?

In case you do not have any transactions, you need to declare ‘Nil Returns’ for the concerned tax period.

Do I Need to Fill in the Details of Inward Taxable Supply?

You do not have to declare all inward supplies. However, you need to mention details of ineligible and eligible ITC in Table 4 of the form.

Where Do I Declare the Outward Taxable Supplies in GSTR-3B?

You can declare outward taxable supplies in Table 3.1(a) of Form GSTR-3B. This will exclude zero-rated and nil-rated supplies, which you need to mention separately in Table 3.1(b) and (c).

Will the Utilised Cash or ITC functionality be available for releasing return-related liabilities?

The details of the form are provided in a consolidated manner wherein taxes need to be paid based on Table 6 of the form after the taxpayer submits returns.

What Is Table 6.1 in Form GSTR-3B?

Table 6.1 of the form deals with payment of tax. In this table, taxpayers need to declare the final amount of tax payable for a specific tax period. This further includes liabilities set off using ITC and cash.

For SEZ Supplies, Do I Need to Pay IGST and Then Claim a Refund?

As SEZ (Special Economic Zone) supplies are export and zero-rated supplies, you can pay IGST and then avail ITC claims or you can simply avoid not paying. In the latter case, you will not be eligible for ITC.

Can I File GSTR-3B and Not Pay the Tax?

If you file GSTR-3B, you need to pay the taxes outstanding. However, you do not need to pay taxes if you do not have any transactions during the tax period or you had only purchases and no sales during a specific tax period.

Why Is GSTR-3B Significant?

The primary objective of filing the return is to enable taxpayers to declare and settle their GST dues for a specific tax period. Timely submission of GSTR-3B is crucial for businesses to ensure they can avail input tax credit without any disruption.

Can I File GSTR-3B for the Month of November if My GSTR-3B for October Is Pending?

You have to file the pending GSTR-3B first before you can file your GSTR-3B for November. Once you have filed the pending return, you can proceed to file the following returns.

Can I Pay the Tax Without Filing Form GSTR-3B?

You cannot pay the tax without filing the form. Even if you can generate a challan, for tax compliance, experts advise you to pay the tax and file the returns within the due dates.

What Should I Do If GSTR-2A and GSTR-3B Do Not Match?

If there is a mismatch in GSTR-2A and GSTR-3B, you need to speak to the supplier regarding ITC claims. Based on clarifications, you can raise ITC claims to reduce your tax burden.

Is There an Easy and Quick Way to File a Nil Return for GSTR-3B?

The easiest way to file a Nil Return is by sending an SMS from your registered mobile number using an OTP. This is available as per Rule 67A of the CGST Rules, 2017 (Central Goods and Services Tax Rules).

Which Form Will Be the Replacement of GSTR-3B?

Under the New GST Return System, Form GST RET - 1 will replace Form GSTR-3B. Businesses with turnover of less than ₹5 Crore will have options to choose from GST RET - 2 and GST RET -3.

Do I Need to Make Invoice Level Entries of Details in GSTR-3B?

You need to fill in the aggregate values solely while filing GSTR-3B. Notably, Form GSTR-3B is for regular taxpayers or normal taxpayers and not composition taxable persons.

What to Do If I See Values As Zero Even After Proceeding After the Status is Submitted?

You need to save the details before you proceed to avoid errors. This error usually happens when you make a payment without saving the details.

Where Should I Declare Inward Supplies Liable to Reverse Charge in GSTR-3B?

You need to declare inward supplies under the reverse charge mechanism in Table 3 of the form. It includes eligible and ineligible ITC - supplies, which has been declared in Table 4 of the form.

Can I Utilise ITC on RCM Supplies to Reduce Tax Liabilities?

You cannot utilise ITC under RCM to reduce your tax burden. This is because you receive ITC in the electronic cash ledger.

Where in GSTR-3B Can I See the Final Tax Liability?

You can find the total amount of tax payable in Table 6 of the form. Navigate to the table to find the total amount of tax payable.

Which Taxpayers Do Not Need to File GSTR-3B?

Non-resident Taxable Persons, Input Service Distributors (ISD), suppliers of online information and database access or retrieval services (OIDAR) and composition dealers need not file this form.

Can I Claim ITC on Capital Goods in GSTR-3B?

GSTR-3B allows you to claim ITC on capital goods used for business purposes. Ensure you do not claim ITC on capital goods used for personal or non-business purposes.

What Is Common ITC?

Common ITC refers to such input tax credits used for both business and non-business purposes. You can claim it proportionately in GSTR-3B, based on the amount you used for business purposes.

How Does ITC Apply to Job Works?

The principal manufacturer can consider genuine input tax credit claims on the purchase of goods that he/she sends to job works. If you are a principal manufacturer, you can claim ITC for payment of taxes.

What Is Table 3.1 (b) in Form GSTR-3B?

Table 3.1(b) of the form mentions IGST paid on deemed exports, exports and SEZ supplies. This value needs to be equal to or greater than the value mentioned in Tables 6A, 6B, and 6C of Form GSTR-1.

Which Tables Are Auto-drafted from Form GSTR-2B to Form GSTR-3B?

Tables 3.1(d), 4(A)(1), (3), (4), (5) and 4(B)(2) are auto-populated values or auto-drafted details in GSTR-3B returns calendar from GSTR-2B.

Which Tables of Form GSTR-3B Are Auto-populated from Form GSTR-1/1A?

Details in Table 3.1 (a), (b), (c) and (e) relating to outward supplies, along with Table 3.2 covering inter-state supplies to unregistered persons, composition dealers and UIN holders, are auto-populated in Form GSTR-3B based on the data furnished in Form GSTR-1/1A.

Is Invoice Matching Applicable in GSTR-3B?

Invoice matching is not carried out in GSTR-3B, as it is a self-declared summary return filed by the taxpayer. Matching in form is essential to proceed further with business compliances and ensure effective vendor management, vendor payment and vendor delight as a complete supply chain solution.

By

By