How to Deal with Fake Invoices Under GST?

- 29 Oct 24

- 7 mins

How to Deal with Fake Invoices Under GST?

Key Takeaways

- Genuine GST invoices are essential; fake ones lead to tax evasion and fraud penalties.

- Watch for red flags like multiple GSTINs under one PAN or mismatched transaction data.

- Investigate thoroughly by verifying business premises and transaction records.

- Use tools like offence databases and ITC blocking to manage high-risk profiles.

- Severe penalties, including imprisonment, await those involved in fake invoicing.

A fraudulent business owner might often issue fake GST invoices to their buyers. The purpose of these invoices is to evade taxes payable to the government. However, these activities are unlawful and adversely affect the government's revenue collection for social welfare.

Learn how to prevent using fake GST invoices in this detailed guide.

What Is a GST Invoice?

A supplier issues a GST invoice mentioning the transactions of goods and services provided to the recipient or purchaser. On the flip side, a fake GST invoice is a deceptive document that represents transactions for evading taxes. It is often used to fraudulently claim benefits under GST. Fake invoices often include transactions of goods and services that were not actual supplies or receivables.

Understanding Fake Invoices and Their Impact

Fake invoices reflect fake purchases and supplies of goods and services. These invoices help suppliers claim Input Tax Credit (ITC) leading to financial losses for the government. It additionally renders an unfair benefit for the perpetrators. Fake invoices, thus, pose threats to the effectiveness and integrity of the GST rules for businesses.

Taking Precautionary Measures to Deal with Fake Invoices Under GST

Precautionary measures need to be taken to identify suspicious entities and detect fraudulent GST transactions. The following are the key risk profiling elements to prevent GST fraud:

- You need to scrutinise and verify registered taxpayers based on risk profiling to detect fake invoices.

- Ensure you focus on sectors that have a history of being prone to tax evasion.

- You can maintain a database of offenders to prevent their re-entry.

- Consider the following risk indicators associated with fraudulent persons:

- Holding multiple GST registrations under the same PAN in the GST portal

- Sharing common mobile numbers, email addresses, addresses, authorised signatories or promoters

- Permitting individuals with cancelled GST registration or rejected registration to re-apply

- Considering live registration under the same PAN with CGST laws when it is restricted under the SGST laws

Identifying Fake Invoices Under GST and How to Deal with Them?

Here is how you can identify and investigate fake GST invoices:

- Identification

To detect fraud and verify a genuine tax invoice, look for the following key details:

- Multiple GSTIN registrations for one PAN or address

- GSTIN includes incomplete or incorrect address

- Taxpayers deal with sensitive commodities

- Multiple GSTINs contain common email addresses, mobile numbers, addresses, authorised signatories or promoters

- A mismatch between the volume of goods transacted and declared premises

- E-way bills generated and transaction details in GST returns differ

- PAN involved in a fake invoice or other fraudulent transactions in GSTR-1A or GSTR-2A

- Unusual utilisation of input tax credit (ITC) above 95%

- Investigation

Investigation helps determine if the transactions in invoices are actual (genuine invoices). Here are the ways to investigate:

- Searching declared premises to prove inadequate manufacturing facilities

- Checking the electricity and water consumption with the declared quantity of goods manufactured

- A lack of space or facilities to manage traded goods

- Suppliers of incorrect invoices having no premises to deal with goods

- Non-existence of required inputs, input services or valid clearance, licence and permissions

- A lack of necessary agreements between entities

- If no e-way bill is found

- Fake vehicle numbers mentioned on e-way bills and invoice data

- Compare details provided to agencies like the Income Tax and Registrar of Companies

- Verifying details of vehicles with records with the Regional Transport Office (RTO)

What Needs to Be Done after the Detection of a Fake Invoice Under GST?

After a show cause notice is issued or penal actions are undertaken, you can follow the steps below to prevent fraudulent activities further:

- Creation of an Offence Database in the GST Application

The office database reflects the GSTIN of the entities with fake GST invoicing or helps identify invoice fraud. It can automatically detect the identity of the buyers associated with these entities and send alerts to the officers for additional verifications.

- Handling Re-registration Differently

If the registration has been cancelled, then the re-registration process needs to be managed differently. These applications need to raise alerts for officers for verification before re-registration. Officers need to undertake physical verification for these applications.

- Identifying Entities that Availed ITC Based on Fake Invoices

It is essential to recover the ITC that fraudulent businesses claim, as it leads to financial losses for the government. Further, there needs to be a sample-based transaction analysis to detect fraud for the businesses that deal in fake invoicing instead of issuing a correct invoice or legitimate invoice.

- Provisional Attachment of Property and Bank Accounts

In such a scenario, Section 83 of the CGST Act, 2017 allows the provision for provisional attachment of property and bank accounts in Rule 159 of the CGST Rules, 2019. This needs to be carried out to prevent additional fraudulent transactions.

- Criminal Involvement of Directors

If Directors are found involved in criminal offences of GST evasion, Section 89 of the CGST Act, 2017, along with Section 83 permits attachment of bank accounts and properties of directors.

- Blocking ITC of the Entities and Their Beneficiaries

It is essential to block the input tax credit of the persons creating fake invoice fraud or fake GST invoice scams to prevent them from taking undue benefits. In addition, ITC needs to be blocked for their beneficiaries under the GST authorities’ jurisdictions.

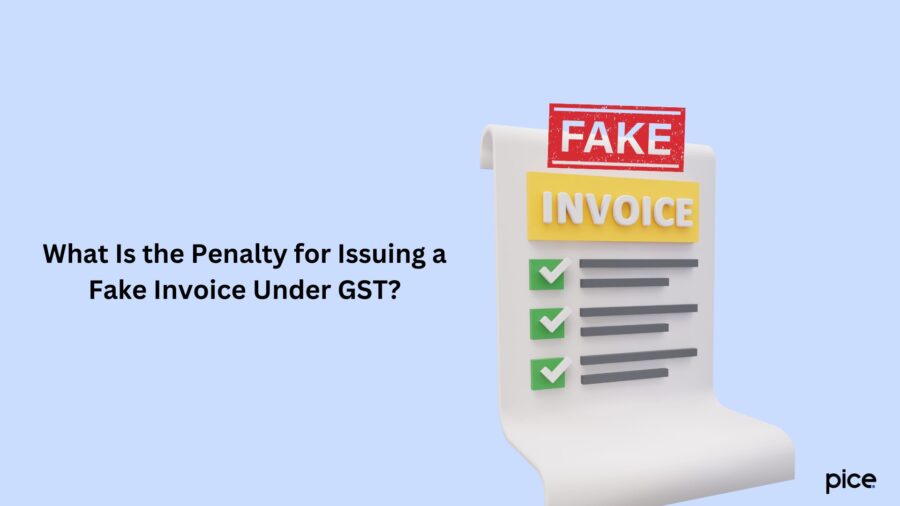

What Is the Penalty for Issuing a Fake Invoice Under GST?

The penalty for fake GST invoice generation applies to both the person issuing and the person using the benefits. Here are the penalties that apply:

| Amount of tax evaded or utilised input tax credits (ITC) | Penalty |

| If the taxpayer used or obtained an ITC worth more than 竄ケ5 crore using false invoices | Imprisonment up to 5 years plus fine |

| Exceeds 竄ケ2 crore but does not exceed 竄ケ5 crore | Imprisonment of up to 3 years plus fine |

| Exceeds 竄ケ1 crore but does not exceed 竄ケ5 crore | Imprisonment up to 3 years plus fine |

| Commit or raise the commission of any of the offences mentioned above | Imprisonment up to 6 months or a fine or bot |

Conclusion

Fake GST invoices can be identified by several means. Based on investigations, if the suppliers and purchasers are found guilty of the offence, penalties apply for both entities. To avoid such penalties, ensure you adhere to the GST rules and prevent issuing fake invoices for tax evasion.

💡If you want to streamline your payment and make GST payments, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By