GST Export Invoice Format in India: Everything You Need to Know

- 8 Aug 24

- 13 mins

GST Export Invoice Format in India: Everything You Need to Know

Key Takeaway

- GST's Role: GST ensures tax compliance, offers zero-rated supply benefits, and supports input tax credit refunds for competitive advantage.

- GST for Small Businesses: A GST-compliant export invoice format helps small businesses with legal compliance, tax benefits, and efficient exporting.

- Essential Documents: Export invoices need shipping bills, bills of lading, packing lists, and necessary certifications.

- Bond/LUT vs. IGST: Use bond/LUT for better cash flow by avoiding IGST upfront; choose IGST for quick refunds.

- Technology in Exporting: Technology streamlines export invoice management, reduces errors, and ensures compliance, boosting efficiency.

In today's global market, knowing and applying the correct procedures for export invoicing under the Goods and Services Tax (GST) in India is crucial for businesses aiming to expand their horizons beyond domestic borders.

This comprehensive guide gives detailed insights into the GST export invoice format, offering key insights and actionable strategies to streamline your export processes.

Meaning of an Export Invoice

An export invoice is not just a document; it's a gateway that facilitates the smooth transition of goods across international borders, adhering to legal and tax obligations.

Under GST, it holds specific significance, encapsulating all necessary details to comply with tax regulations and ensuring that businesses can claim their input tax credits effectively.

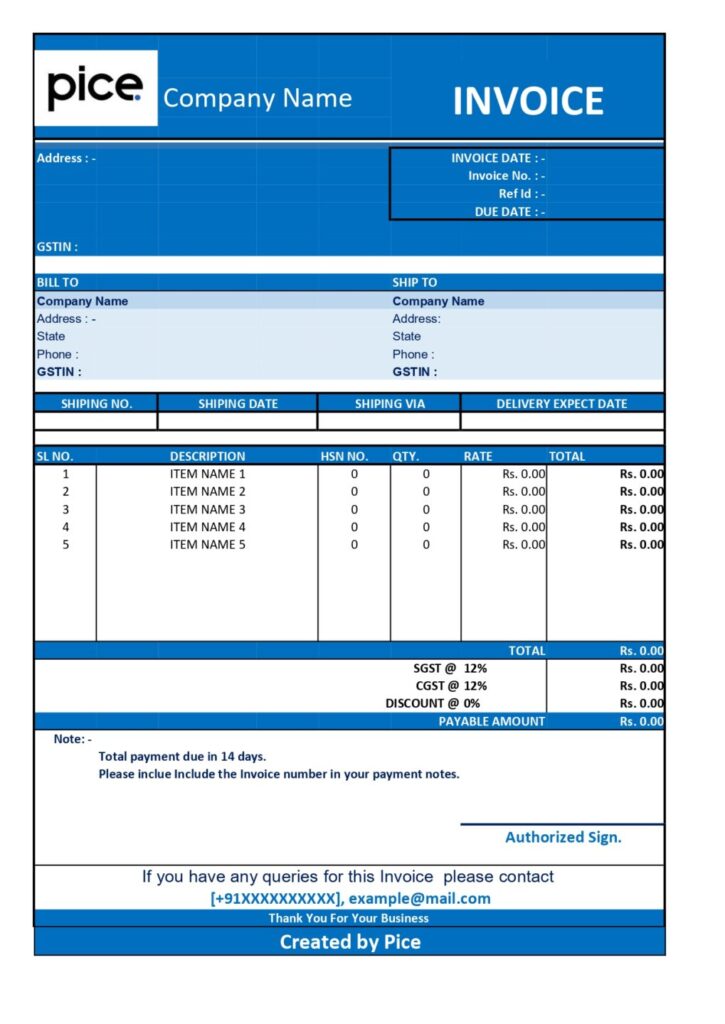

Contents of an Export Invoice Format Under GST

The structure of an export invoice under GST is meticulously designed to encompass all vital information, from the description of goods to the tax rates applicable. It's paramount for ensuring transparency and compliance with the GST framework, thereby substantiating the importance of raising such an invoice.

Below is a detailed exploration of the essential components that must be included in an export invoice under GST to ensure it meets legal requirements and facilitates smooth international transactions.

- Exporter and Buyer Details

- Exporter's Name and Address: The full name and address of the exporting entity registered under GST.

- Buyer's Name and Address: The name and shipping address of the foreign buyer receiving the goods.

- Invoice Details

- Invoice Number: A unique number for identifying the invoice.

- Date of Invoice: The date when the invoice is generated.

- Date of Removal: The date when goods are dispatched or removed for export.

- GST and Other Identification Numbers

- GSTIN: The GST Identification Number of the exporter.

- PAN: The Permanent Account Number of the exporter.

- IEC: Importer Exporter Code, mandatory for exports from India.

- Buyer and Consignee Details (if different)

Details of the actual buyer and the consignee, if they are not the same entity, including their addresses and country of establishment.

- Product Details

- Description of Goods: A clear description of the goods being exported.

- HSN/SAC Code: The Harmonized System of Nomenclature Code, or Service Accounting Code, is a systematic classification of goods and services.

- Quantity: The quantity of goods being exported, along with the unit of measurement.

- Value: The total value of the goods, as agreed upon with the buyer.

- Taxable Value and Tax Rates

Taxable Value: The value of goods that are taxable under GST.

Rate of Tax: The GST rate applicable to the goods being exported. For exports, GST is often levied at a rate of 0% under LUT/Bond or with payment of IGST.

- Additional Charges

Any additional charges or fees, such as packing, insurance, and freight, should be mentioned separately.

- Shipping Details

- Port of Discharge: The port where goods will be unloaded.

- Place of Supply: The place of supply in the context of GST.

- Destination Country: The country to which the goods are being exported.

- Payment Terms

The terms of payment agreed upon between the exporter and the buyer include the currency of the transaction, payment method, and payment due dates.

- Declaration and Signature

A declaration stating that the bill contains true and accurate additional details, accompanied by the signature of the exporter or a person authorized by the exporter.

Documentation for Export Invoices

Accompanying documents play a pivotal role, providing a comprehensive overview and proof of transaction. This segment will elucidate the documents involved in the export invoice process, reinforcing the legal and financial integrity of international trade activities.

- Export Invoice: Details the product or service being exported, including quantity, price, and terms of sale. It must comply with GST requirements and include the GSTIN (if applicable), a statement of GST being zero-rated, and other mandatory details as per the GST law.

- Shipping Bill/Bill of Export: Required for customs clearance, it includes details about the goods being exported, the freight and insurance charges, and the exporter's and buyer's details.

- Packing List: Complements the export invoice by providing detailed information on the packaging of the exported goods, including weights, dimensions, and package marks.

- Letter of Undertaking (LUT): Required for exporters opting to export without the payment of IGST, enabling them to claim refunds on input tax credits.

- Proof of Origin: Certificates or declarations proving the origin of the goods are necessary for preferential access under free trade agreements.

- Bill of Lading or Airway Bill: Acts as a contract of carriage and a receipt for the goods shipped.

- Insurance Certificate: Provides proof of insurance coverage for the goods being exported.

- Regulatory Documents: Depending on the product and destination, specific permits, certifications, and inspections reports related to health, safety, and environmental standards may be required.

Indian Laws on Export Invoice

Navigating through the Indian laws regarding export invoices reveals the country's commitment to standardizing trade practices and promoting ease of doing business. This section will explore the legal framework governing export invoices under GST, such as.

- GST Compliance: Export invoices must include essential details like exporter's and buyer's information, product descriptions, HSN codes, quantities, and values as per GST rules.

- Unique Invoice Number: Must feature a unique, sequential invoice number.

- Currency and Value: Clearly state the total value and currency, considering the exchange rate.

- Taxation: Indicate zero-rated supply status, with options for bond/LUT exports without IGST or with IGST for later refund.

- Declaration: Include a declaration of compliance with GST laws and the accuracy of invoice details.

GST export invoices in India benefit from a 0% tax rate, offering exporters options for bond/LUT or IGST payments, with mandatory HSN code listings and digital submissions through the GST portal for swift refund processing within 60 days.

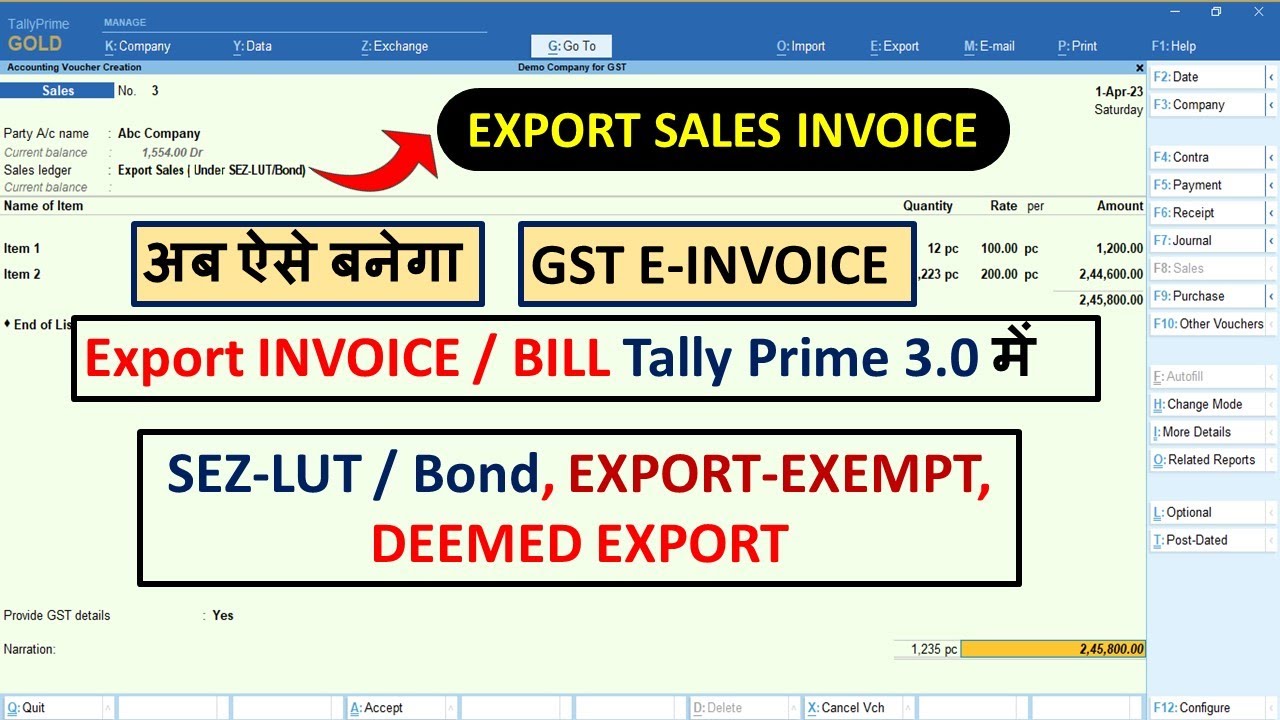

Types of Export in GST Invoice Form

Understanding the different types of exports recognized under GST—such as exports under bond or LUT and exports with payment of IGST—is crucial for businesses to ensure compliance and optimize tax benefits.

| Type of Export | Description | GST Implication |

|---|---|---|

| Export Under Bond or LUT | Goods and services exported without IGST, using a bond or LUT. | No IGST is paid; the input tax credit is refundable. |

| Export With Payment of IGST | Goods and services are exported with an IGST payment. | IGST paid at export is refundable. |

| SEZ With IGST | Supplies to SEZ with IGST are treated like exports. | IGST paid; refundable by the exporter. |

| SEZ Without Payment of IGST | Supplies to SEZ without IGST, under bond or LUT. | No IGST is paid; the input tax credit is refundable. |

| Deemed Exports | Specified supplies within India are treated as exports. | No IGST if under bond/LUT; if paid, refundable. |

Creating Export Invoices

Creating efficient and compliant export invoices involves several key steps that can streamline operations and ensure adherence to GST regulations

Generate Export Invoices

- Automated Software: Utilize automated invoicing software that can generate export invoices quickly, ensuring accuracy and compliance with GST requirements.

- Real-time Data Integration: Implement systems that integrate real-time data from sales, inventory, and shipping for accurate and up-to-date bill creation.

Customizable GST Formats

- Template Customization: Use invoicing platforms that offer customizable GST invoice templates, allowing businesses to include all necessary details as per GST norms.

- Adaptable to Changes: Ensure the invoicing system can easily adapt to changes in GST laws and regulations, maintaining compliance without extensive manual adjustments.

Streamlining Export Operations

- Centralized Documentation: Centralize all export-related documentation within a single platform for easy access, management, and tracking.

- Digital Tracking Systems: Adopt digital tracking systems for shipments and inventory, providing visibility and control over the export process.

- Collaboration Tools: Implement collaboration tools that allow seamless communication and document sharing among teams, partners, and customers, enhancing efficiency and reducing delays.

How to prepare an export invoice under GST?

A step-by-step guide on creating a GST-compliant export invoice format will equip businesses with the knowledge to prepare accurate and timely documents for their international transactions.

Step 1: Gather the Necessary Information

Collect all relevant details, such as the exporter's GSTIN, buyer's details, product descriptions, HSN/SAC codes, and the terms of sale.

Step 2: Choose the Type of Export

Determine whether the export will be under a bond or LUT without payment of IGST or with payment of IGST.

Step 3: Invoice Preparation

Use a GST-compliant invoicing software or template to create the bill. Ensure it has all the mandatory fields required for an export invoice under GST.

Step 4: Include Exporter and Buyer Details

Fill in the exporter’s name, address, GSTIN, and the buyer’s name and address. Include the country of destination.

Step 5: Insert Invoice Details

Add the invoice number (unique for each invoice), date of invoice, and date of supply.

Step 6: Product Details

Clearly list each product or service, including descriptions, quantities, unit prices, total value, HSN/SAC codes, and the taxable value.

Step 7: Tax Calculation

Specify the tax rate applied (if any) and calculate the IGST amount if the export is with payment of IGST. For exports under bond/LUT, indicate that IGST is not applicable.

Step 8: Additional Charges

Itemize any additional charges, such as freight, insurance, and packing costs, separately.

Step 9: Declare Shipping and Billing Details

Mention the port of loading, destination port, and terms of delivery (Incoterms).

Step 10: Signature and Declaration

Include a declaration that the information provided is true and accurate. Sign the bill from the authorized signatory.

Step 11: Attach Supporting Documents

Prepare and attach any required supporting documents, such as a copy of the bond or LUT (if applicable), packing list, and shipping documents.

Step 12: Review and Send

Double-check the bill for accuracy and completeness. Send the original bill to the buyer and keep a copy for your records.

Download GST Export Invoice Format

- Download in PDF Format: Download Now

- Download in Excel Format: Download Now

Benefits for Small Businesses

The adoption of a GST-compliant export invoice format is especially beneficial for small businesses for several critical reasons mentioned below, offering them a competitive edge in the global market by ensuring compliance and facilitating smoother trade operations.

- Legal Compliance: Ensures adherence to GST regulations, avoiding penalties.

- Tax Refunds: Facilitates the claim of IGST refunds on exports or input tax credits, improving cash flow.

- Global Standards: Meets international trade standards, enhancing credibility with overseas buyers.

- Efficient Processing: Simplifies customs clearance, reducing delays in shipping and receiving goods.

- Record-Keeping: Aids in accurate record-keeping for financial reporting and audit purposes.

- Market Expansion: Supports expansion into international markets by ensuring tax and documentation requirements are met.

- Financial Management: Helps manage finances better by providing clear records of export transactions and associated taxes.

Consideration in issuing an Export Invoice

Issuing an export bill correctly is imperative. This segment outlines considerations for issuing an export bill, including the choice between exporting under bond/LUT or with payment of IGST.

General Considerations for All Export Invoices

- Compliance with GST Rules: Ensure the bill adheres to GST requirements, including format and mandatory fields.

- Accurate Details: Provide precise information about the exporter, buyer, shipment, and product details.

- Harmonized System of Nomenclature (HSN) Codes: Include the correct HSN/SAC codes for goods or services being exported.

- Currency and Payment Terms: Specify the currency of transaction and agreed payment terms.

- Declaration: Include a declaration stating the goods are intended for export.

Specific Considerations Based on the Type of Export

Export under Bond/Letter of Undertaking

- Bond or LUT Details: Mention the bond or LUT under which goods are being exported, indicating that IGST is not paid.

- Eligibility Documentation: Keep records proving eligibility for export under bond/LUT, as per GST guidelines.

- Refund Claims: Prepare to claim refunds on input tax credits used in the production of exported goods.

Export with IGST

- IGST Payment: Clearly show the IGST amount charged on the export bill and ensure timely payment of the same.

- Refund Process: Understand the process for claiming a refund of the IGST paid on exported goods, including necessary documentation and timelines.

SEZ with IGST

- Specify SEZ Details: Indicate that the goods or services are supplied to an SEZ unit or developer with IGST payment.

- Proof of Supply: Maintain proof of supply to SEZ for claiming IGST refunds, including endorsements from SEZ authorities.

- IGST Refund Mechanism: Familiarize yourself with the procedure for claiming a refund of IGST paid on supplies to SEZ.

Conclusion

The adoption of the GST export bill format is a significant step towards simplifying the export process, ensuring compliance, and fostering global trade. This guide has covered the essentials, from understanding the export invoice's meaning to leveraging technology for operational efficiency.

💡For seamless GST payments and managing your export bills efficiently, consider using the PICE application. Get started with PICE today and streamline your GST payments and export invoicing process. Click here to sign up and take the first step towards hassle-free GST management.

FAQs

What is the significance of GST on export invoices?

How can small businesses benefit from a GST-compliant export invoice format?

Small businesses can benefit from a GST-compliant export invoice format by ensuring their transactions are recognized for tax benefits, such as zero-rated GST on exports and eligibility for input tax credit refunds. This compliance enhances their credibility with global partners and tax authorities, streamlines their export documentation process, and supports the accurate and timely filing of tax returns, ultimately improving cash flow through faster tax refund processes.