DRC 20 in GST: Everything You Need to Know

- 17 Jul 25

- 10 mins

DRC 20 in GST: Everything You Need to Know

Key Takeaways

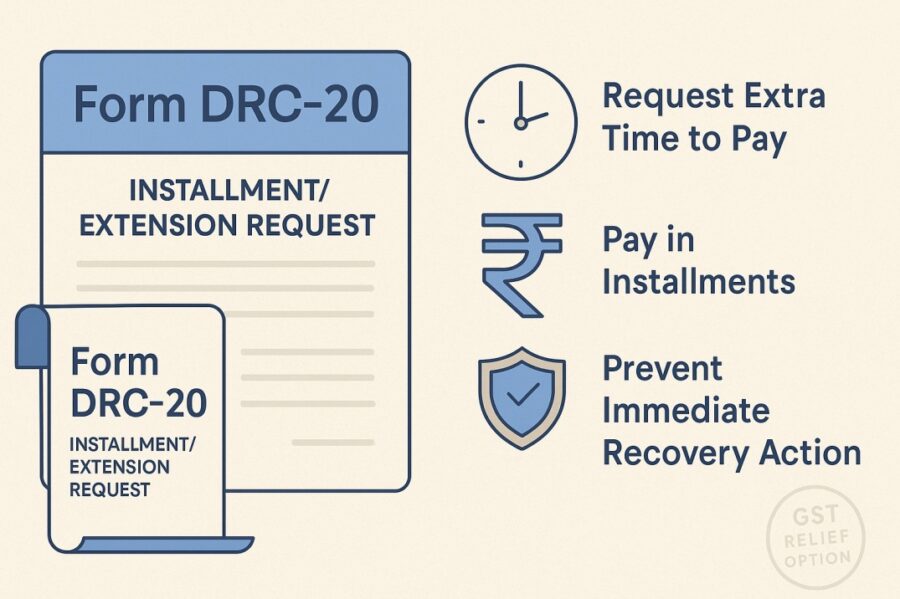

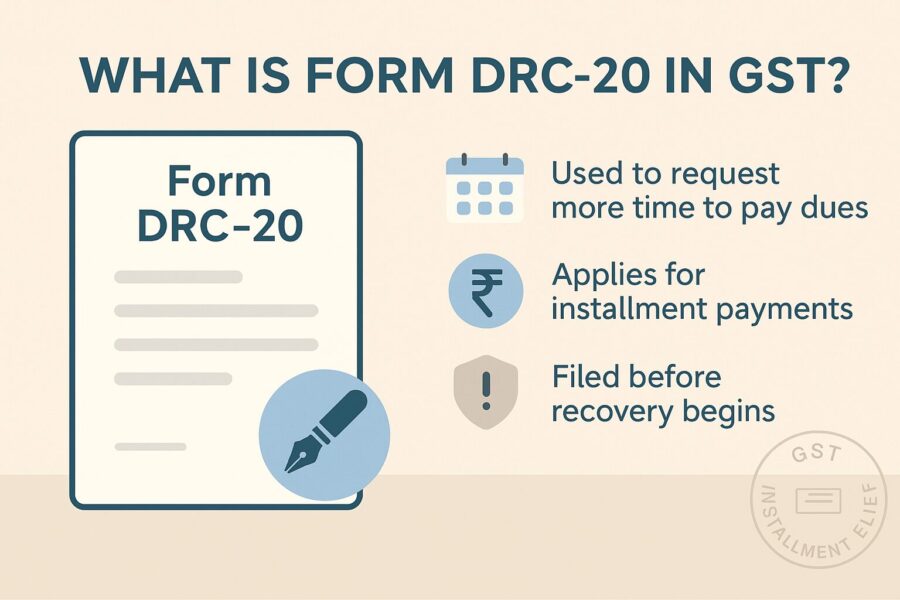

- Form GST DRC-20 allows deferment or installment-based payment of pending GST demand.

- A maximum of 24 monthly installments is permitted, with 18% annual interest.

- The form must be filed before a Recovery ID is generated.

- Amounts below ₹25,000 are ineligible for deferment.

- File and track the application directly through the GST portal with proper documentation.

The Form GST DRC-20 application is filed by the registered taxpayer. It is specifically done for the deferment of GST payments (a lump sum demand amount) that is outstanding against them. The taxpayer can file to make the application for payment of the outstanding demand/ GST demand in monthly instalments.

In this blog, we shall discuss the uses of the Form DRC-20 in GST, its conditions, and the steps to fill out the form.

What is Form DRC-20 under GST?

Here is what the application of the taxpayer can request from the Commissioner/proper officer upon filing the form GST DRC-20, as per payment terms:

● To extend the timeline for associated with the default in payment of outstanding dues;

● Allow the concerned taxpayer to complete payment in instalments

The highest number of monthly instalments, according to payment terms, however, is limited to 24. Note that according to Section 50 of the CGST Act, the deferred payments/payment in instalments shall attract an interest rate of 18%.

This Form GST DRC-20 comes in handy for a taxpayer when there is demand pending for recovery, but they are unable to make the full payment at once. In such a case, the taxpayer shall use the form to defer the payment. They can also request to make the payment in instalments.

Timeline for Submitting Form GST DRC-20

The Form GST DRC-20 can be filed by the taxpayer on the GST portal at any time, given that it’s prior to generating a recovery ID. This allows the taxpayers to proceed with the recovery process seamlessly.

In particular, the Form DRC-20 in GST shall be filed if the demand amount is pending for recovery against the taxpayer under the GST Act. In case the taxpayer is unable to make the complete tax payment in one go, they can apply for a deferred payment plan or send in an application for payment in installments.

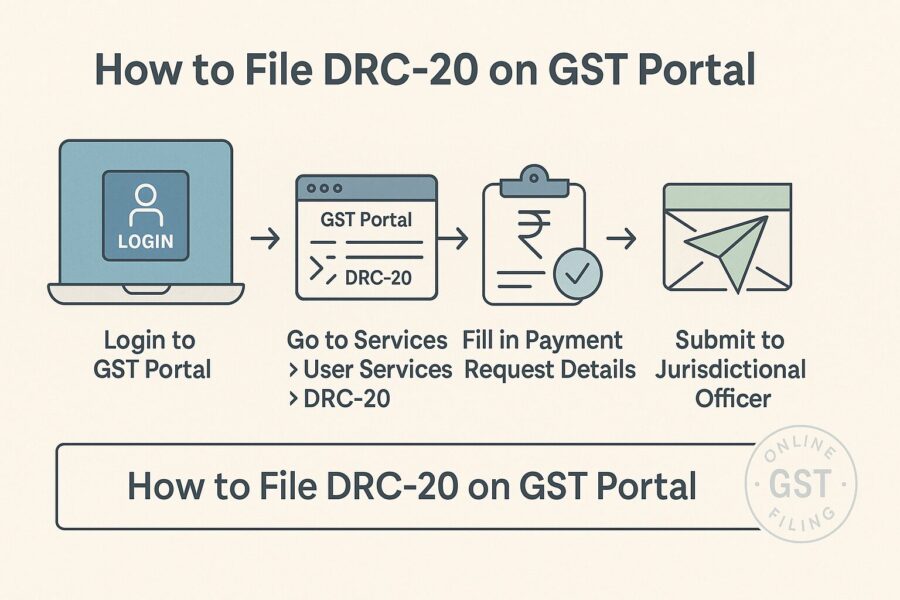

How to File Form GST DRC-20?

Before initiating the filing process, decide whether you are applying for deferred payment or payment in instalments. Here is a step-by-step application process for filing GST DRC-20:

Step 1: To initiate filing Form GST DRC-20, start by logging in to the GST portal.

Step 2: Go to the 'Dashboard'. Follow up by then going to the 'Services' section; click on 'User services'; and finally 'My application'.

Note: You may also navigate to the 'Dashboard', then go to the 'Services' section. Next, go to 'Payments' and lastly, 'Application for Monthly Instalments or Deferred Payments'.

Step 3: The 'My Applications' page shall pop up. Choose the application form type as 'Application for Deferred Payment or Payment in Instalments' by clicking on the drop-down list.

Step 4: Choose ‘New Application’.

Step 5: A fresh application page will open up, where you will be required to provide the necessary information.

Here are the details you will be required to provide:

● Demand ID - Choose the ‘Demand ID’ by clicking on the drop-down option. The demand information that is outstanding against your chosen Demand ID shall be populated alongside the details related to the tax period.

Note: In case the demand amount is lower than ₹25,000, an error message shall show up. It will state that a deferment facility is not available for any amount less than ₹25,000. In case your formal application for deferment has already been filed against the chosen Demand ID, an error text shall pop up. It will be noted that the application has already been filed. In case the 'Recovery ID' for the chosen Demand ID is pre-generated, an error text shall show up. It will be stated that the Recovery ID has already been generated and that you shall not be able to apply for deferment.

● Specify the Type of Payment – You may opt for ‘monthly instalments’, and you will be presented with an option to input the number of months. Proceed to click the ‘Calculate button’. You can opt for ‘Split into equal instalments’ and the outstanding amount shall be divided up into your preferred number of months (a maximum of 24 months). Finally, you can opt for ‘Deferred payment’ and settle on the preferred due date of payment.

● Upload the Necessary Documents: Type in a brief passage describing the document you want to upload as the ‘supporting document’. Proceed to click on ‘Choose File’ and complete the uploading process.

● Provide Reasons: You may type in the necessary information. However, this is not a mandatory step.

● The Verification Process: Choose the authorised signatory. Proceed to tick off the declaration checkbox and type in the place. The 'Designation' or 'Status' sections shall get auto-populated. Click on the 'Preview' button before submission, after you've uploaded all the information.

Step 6: Make sure to minutely go through the preview of your application form, checking every detail in the process. Finally, you can click on the ‘Submit’ tab to continue.

Step 7: You can file your application either with EVC or DSC, on the ‘submit application’ page.

A provision acknowledgement page shall pop open, and you will receive an SMS as well as an email with the intimation regarding the successful filing of your application. You will also receive your ARN. You may 'claim on download' in order to download the acknowledgement document.

It is also important to note that the regular checking of the GST Portal is crucial for possible updates or the intimation of payment made, to make sure that they are completed successfully.

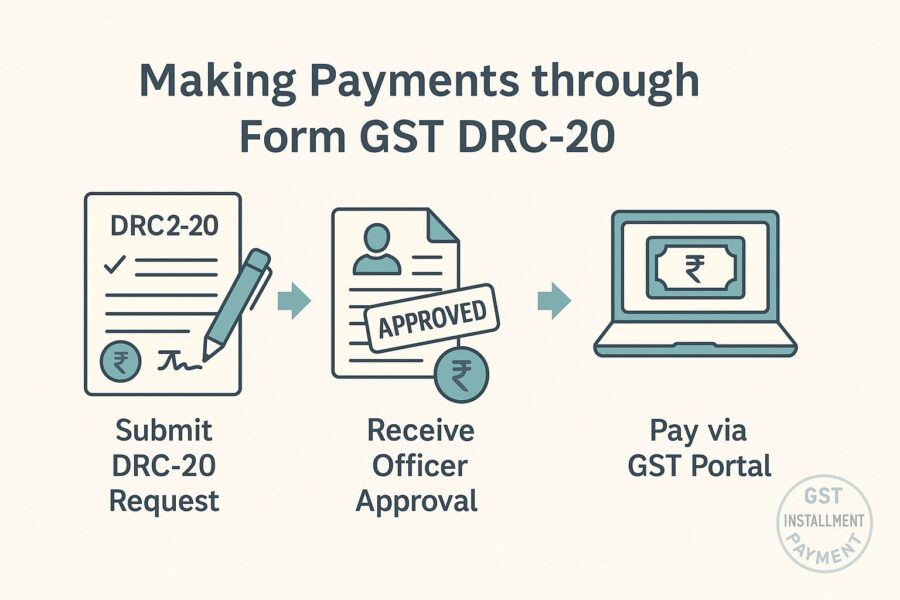

Making Payments through Form GST DRC-20

This taxpayer uses the Form GST DRC-20 when the demand amount is pending for recovery, and they are unable to make the entire payment at once. In such a case, the taxpayer shall use this form as a tool to defer the payment or simply make the payment in more manageable amounts in instalments. This allows the taxpayer to conveniently make payments through Form GST DRC-20.

Submitting an Application for Deferred Payment or Instalments

Follow the step-by-step guide to filing GST DRC-20 provided above to submit an application for deferred payment or payment in installments.

Accessing Your Filed Application

Here are the steps you can follow to access your filed application form:

Step 1: Go to the ‘Case Details’ page of your specific application. Choose the ‘APPLICATIONS’ tab, in case it is not already selected by default in payment. You will find the option to access the acknowledgement document and your filed application on this page. You will also be able to view the supporting documents in PDF mode. Select ‘BACK’ in order to go back to the ‘My Applications’ page.

Step 2: Choose the documents under the column that reads "Action" in order to download. Post-downloading, you can easily view them.

Step 3: Choose the ‘BACK’ option to go back to the ‘My Applications’ page.

Checking the Issued Order on Your Application

Here are the steps you can follow to check the issued order on your application form:

Step 1: Go to the relevant 'Case Details' and click on the tab that reads 'ORDERS'. Locate the option to access the issued order, alongside attached documents, in the PDF mode.

You can click on ‘BACK’ to go back to the ‘My Applications’ section.

Step 2: Click on the hyperlink that reads ‘View’ under the "Action" column. This will let you download and access the issued Order.

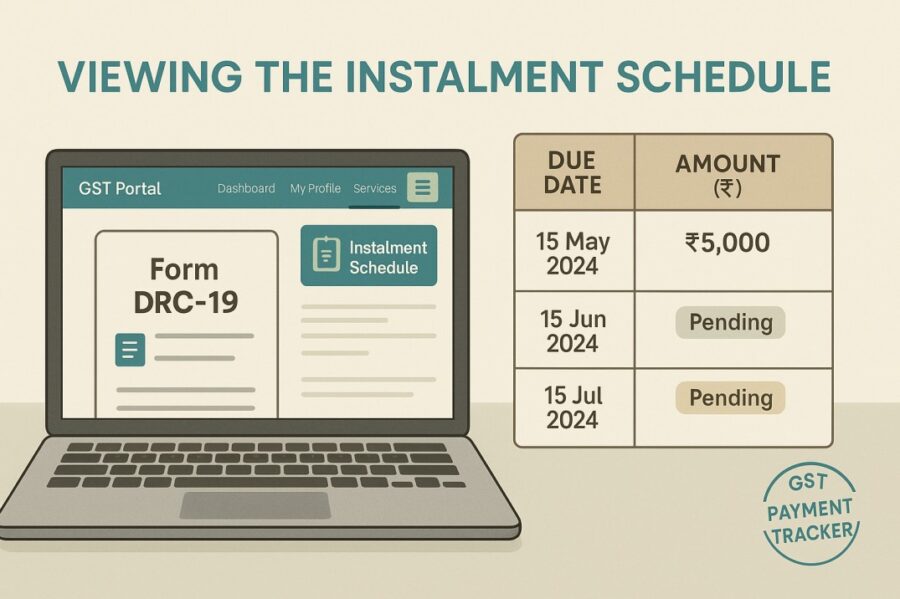

Viewing the Instalment Schedule

The instalment schedule lists the instalment details alongside the status of payments after the application of taxpayer goes through. So, the details of the payment made shall be viewed here. Here are the steps to view the instalment schedule:

Step 1: Visit the URL, www.gst.gov. You will be directed to the GST Home page.

Step 2: Provide your credentials to log in to the GST portal.

Step 3: On accessing the ‘Dashboard’ page, click on ‘Services’, then on ‘Payments’ and finally, ‘Instalment Calendar’.

Step 4: Once the Instalment Calendar search page opens up, type in the Demand ID.

Step 5: Click on the ‘Submit’ button to continue.

Step 6: You may select the major head hyperlink in order to view the minor head information.

Step 7: Access the details and click on the ‘Close’ button when done.

Conclusion

Overall, the Form GST DRC-20 allows the taxpayer to request the Commissioner for an extension of the time for payment of the pending amount or for the payment to be completed in instalments. A maximum number of monthly instalments is limited to 24. According to Section 50 of the CGST Act, the deferred payments shall attract an interest at 18%.

The DRC 20 in GST allows the taxpayer genuinely facing difficulties with cash flow and in complying with their tax obligations, by extending a form of relief to them via payment timeline extension/instalment facility.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By