DRC 18 in GST: Full Form, Definition and Format

- 16 Jul 25

- 5 mins

DRC 18 in GST: Full Form, Definition and Format

Key Takeaways

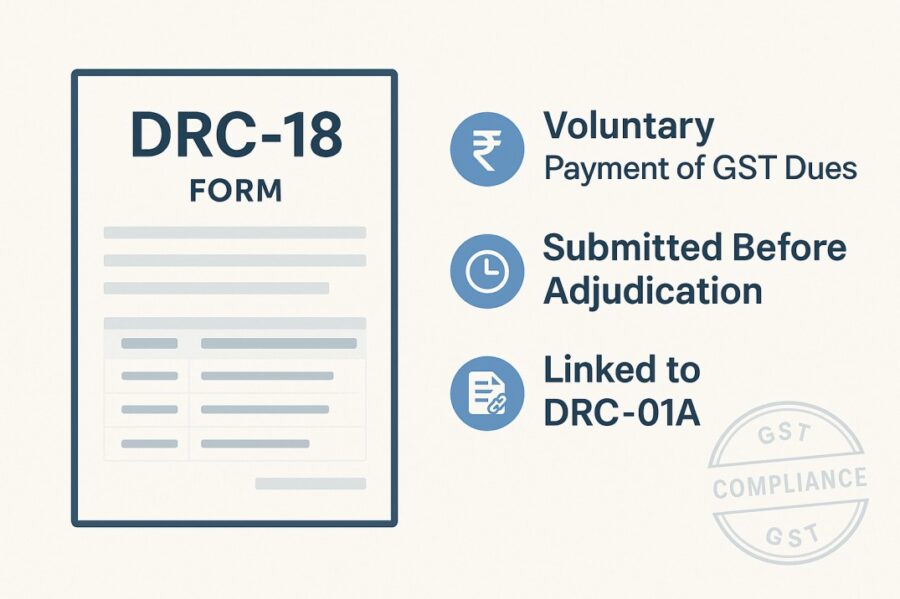

- DRC-18 is a tax recovery certificate issued when a taxpayer fails to pay GST dues despite prior notices.

- It empowers district collectors or authorized officers to recover outstanding GST like overdue land revenue.

- Form DRC-18 marks the final step in the GST demand and recovery process after earlier forms like DRC-01 and DRC-03.

- Timely taxpayer response to GST notices is crucial, as failure to comply can lead to legal recovery proceedings.

- Understanding DRC forms ensures better GST compliance and helps taxpayers avoid coercive enforcement actions.

When tax authorities discover differences between the amount of tax paid and the amount that should have been paid, they notify taxable individuals using a variety of official notice or demand forms under the Indian GST framework. These notifications are classified into various kinds of notifications, each of which focusses on a particular recovery scenario.

As the first official notification to the taxpayer of the unpaid tax, applicable interest, or penalties, Form DRC-01 is especially important. DRC-03 is another crucial form that enables the taxpayer to comply and make voluntary payments prior to the start of any legal action.

The definition, format, and importance of Form DRC-18 in GST, as well as its role in the overall demand response mechanism for GST compliance, will be the main topics of this article.

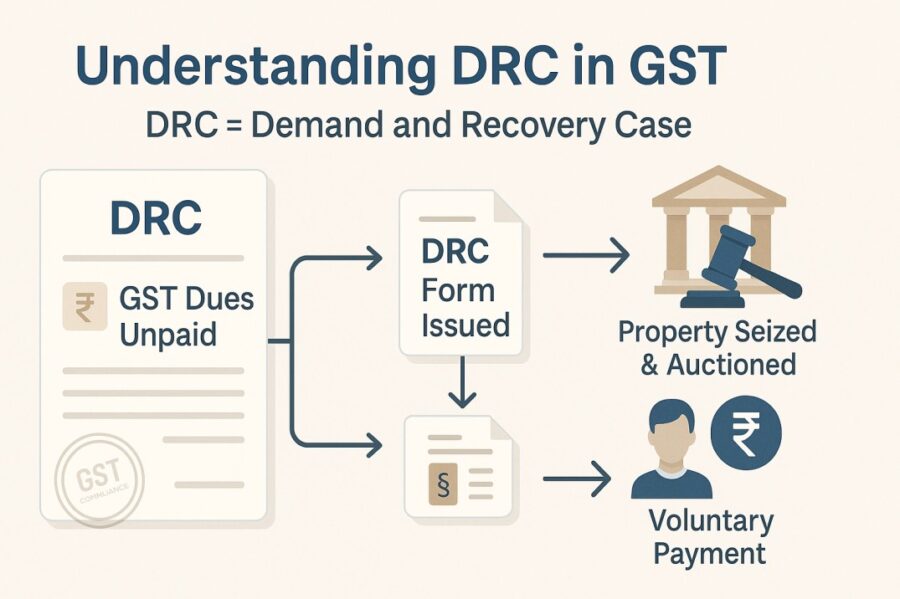

What is DRC in the GST Framework in India?

The full form of DRC in GST is a "Demand or Recovery Certificate" issued by the tax authorities of India. After issuance of a DRC notice, persons liable for tax need to act promptly. If the authority does not get any response, taxpayers may face further penalties. In some cases, they may get involved in legal entanglements.

From DRC–01 to DRC-28, there is a wide range of DRC forms that the Indian government issues to make the taxation process seamless. The taxpayer is expected to provide a demand response if a tax demand is made and they do not react appropriately

Definition of DRC 18 in GST

If a tax payable person in our country fails to pay amount they owe, the proper officer has the right to issue a certificate in Form DRC-18. This certificate is then dispatched to the collector of the district or any other authorised officer where the person either resides, owns property, or runs a business.

Once the collector or authorised personnel receive the certificate, the proper officer starts tax recovery process. They treat outstanding amounts like overdue land revenue payments and take action accordingly.

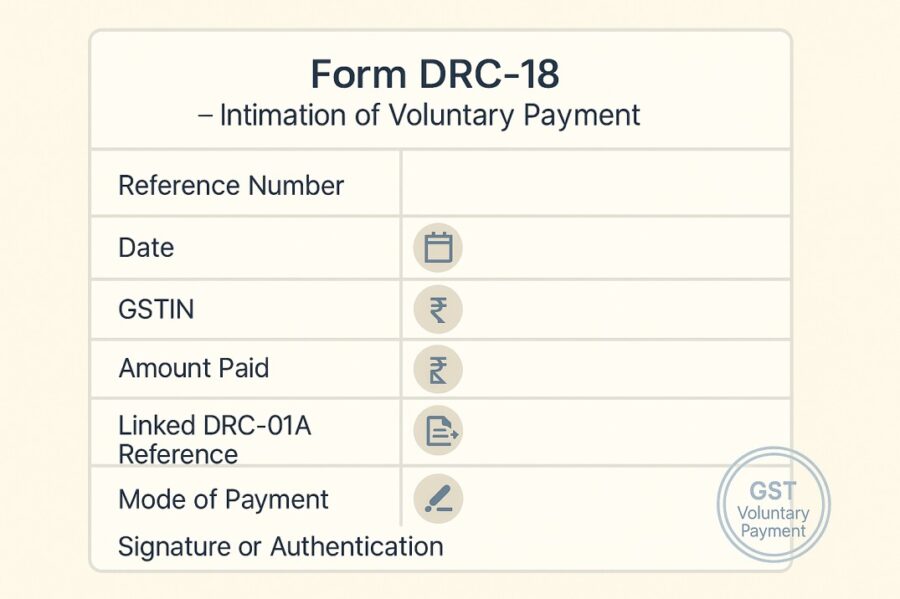

What is the Format of Form DRC 18 in GST?

Here is the screenshot of the format of Form DRC 18 under GST for your reference.

Conclusion

DRC-18 in GST acts as a robust recovery tool, allowing authorities to treat unpaid taxes like land revenue dues. It concludes the demand response cycle, following earlier notices. Taxpayers must understand the kinds of notifications, their time limits, and respond within the maximum time period.

Ignoring a notice of demand can trigger coercive action. Timely action helps avoid legal issues and ensures continued compliance with tax regulations.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By