GST on Bikes

- 22 Aug 24

- 10 mins

GST on Bikes

Key Takeaway

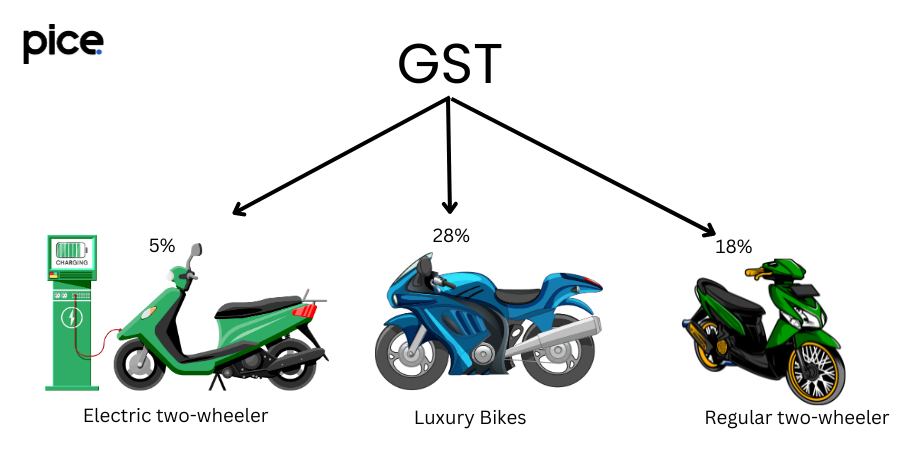

- The GST on motorcycles varies based on engine capacity, with regular bikes generally taxed at 18% and luxury bikes at 28%.

- Electric motorcycles benefit from a significantly lower GST rate of 5%, promoting their adoption as eco-friendly transportation.

- The Harmonized System of Nomenclature (HSN) Code is essential for determining the appropriate GST rate for different types of motorcycles.

- Motorcycle insurance policies are subject to an 18% GST, impacting the overall cost of bike ownership.

- The implementation of GST has simplified the tax structure, benefitting both manufacturers and consumers by reducing tax cascading and enhancing market transparency.

The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the manufacture, sale, and consumption of goods and services in India. Introduced in July 2017, GST replaced various state and central taxes, simplifying the tax structure.

GST Percentage and HSN Classification for Motorcycles

The Harmonized System of Nomenclature (HSN) is a particular categorization scheme that governs GST on motorbikes. To facilitate international commerce, the classification of items is standardized by this widely accepted code system. The HSN Code is essential for figuring out the appropriate tax rate for motorbikes. Regular motorcycles that have an engine displacement of less than 350 cc are normally charged 18% GST, however bikes with larger displacements may be charged 28%. The purpose of this larger tax framework, which includes these rates, is to standardize and streamline tax compliance for both bike makers and buyers.

Manufacturers may claim credit for input tax paid under the GST input tax credit (ITC) method, which helps lower the final consumer's total cost burden. By avoiding the cascading impact of taxes, this strategy makes sure that taxes are only paid on the value added at each level of the supply chain. This reduces the effective tax on motorcycles, which is advantageous to both bike makers and consumers of two-wheelers.

In order to maintain compliance, companies must know the relevant HSN Code and the corresponding GST rate, and consumers must be aware of the tax consequences of their transactions. The pricing, buying choices, and general market dynamics of the Indian vehicle industry—particularly the two-wheeler sector—have been profoundly affected by the uniformity brought about by the Goods and Services Tax.

Bike Rate after GST

The current GST rates for motorcycles are structured to account for various factors, including engine capacity and the type of bike. Regular bikes, which form a significant portion of the two-wheeler industry, generally attract an 18% GST rate if their engine capacity is below 350 cc. However, bikes with larger engines face a higher GST rate of 28%, reflecting the government's strategy to impose higher taxes on luxury items.

The GST rate for electric bikes is set at 5%, significantly lower than that for regular bikes. This reduced rate is part of a broader initiative to promote electric vehicles (EVs) and reduce the environmental impact of transportation. The lower tax rate makes electric bikes more affordable, encouraging more consumers to opt for these environmentally friendly alternatives. This shift is crucial for reducing fuel prices and emissions, aligning with global sustainability goals.

In addition to the GST rates, state-specific taxes and additional charges can also affect the final bike price. Buyers need to be aware of these additional costs when making a bike purchase, as they can vary significantly between states. The overall tax burden, therefore, includes the base GST rate, state-specific taxes, and any additional taxes imposed by local authorities.

For bike manufacturers and dealers, understanding these tax structures and rates is essential for pricing their products competitively and ensuring compliance with business regulations. The clarity brought by the standardized GST rates has streamlined business operations and improved transparency in the two-wheeler market.

GST Rates Applicable to Motorcycles

The present motorbike GST rates are set up to take a number of variables into consideration, such as the bike's type and engine capacity. The two-wheeler sector is mostly composed of regular motorcycles, which are subject to an 18% GST rate if their engine size is less than 350 cc. But motorcycles with bigger engines have to pay a higher GST rate of 28%, which is in line with the government's plan to tax luxury goods more heavily.

Compared to standard motorcycles, electric bikes have a much cheaper GST charge of 5%. This discounted pricing is a component of a larger campaign to encourage electric cars (EVs) and lessen the effect of transportation on the environment. Electric bikes are more inexpensive because to the decreased tax rate, which encourages more customers to choose these greener options. This change is essential to meet global sustainability targets by lowering fuel costs and emissions.

💡If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

The final bike price may also be impacted by extra fees and state-specific taxes in addition to the GST rates. When purchasing a bike, buyers should be aware of these extra expenses since they might differ greatly across states. Therefore, the basic GST rate, state-specific taxes, and any extra levies levied by local authorities are all included in the total tax burden.

It is crucial for bike dealers and manufacturers to comprehend these tax rates and structures in order to set competitive prices for their goods and guarantee that they adhere to company laws. The two-wheeler market has been more transparent and company operations have become more efficient as a result of the standardization of GST rates.

GST Rates for Electric Motorcycles

The need for environmentally friendly modes of transportation has led to a dramatic change in the two-wheeler market, with the introduction of electric motorbikes. Compared to ordinary motorbikes, electric motorcycles are subject to a GST charge of 5%. This reduced tax rate is intended to promote the use of electric vehicles (EVs), in line with the government's more general objectives regarding sustainability and the environment.

Electric bikes are seen to be a vital first step in lowering fuel costs and lowering reliance on fossil fuels. Electric bikes are now more inexpensive because to the lower GST rate, which encourages further consumer adoption. This action is anticipated to spur market expansion for electric vehicles, supporting producers of electric two-wheelers.

The GST rate on electric bikes not only lowers the cost of these vehicles but also shows the government's support for renewable energy sources. The government hopes to create a better environment by lowering pollutants and carbon emissions via the provision of incentives for the purchase of electric bikes.

The reduced GST rate on electric motorcycles provides a financial incentive for consumers of two-wheelers to choose these greener options. It is anticipated that the move to electric two-wheelers would change the dynamics of the industry and inspire additional automakers to make investments in electric vehicle technology.

All things considered, the advantageous GST rates for electric bikes are a calculated step toward facilitating the shift to environmentally and economically beneficial forms of mobility.

GST on Motorcycle Insurance Policies

Motorcycle insurance policies are also subject to GST, which impacts the overall cost of bike ownership. The GST rate on insurance premiums is set at 18%, consistent with other financial services. This rate applies to all types of bike insurance policies, including third-party liability and comprehensive coverage.

For two-wheeler buyers, understanding the GST on insurance policies is crucial for budgeting the total cost of bike ownership. The 18% GST on insurance premiums adds to the overall expenses, making it essential for consumers to factor this in when purchasing a bike.

Insurance companies must ensure compliance with GST regulations, accurately calculating and collecting GST on the premiums paid by policyholders. This compliance is crucial for maintaining transparency and avoiding legal complications.

The input tax credit mechanism also applies to insurance policies, allowing insurers to claim credit for the GST paid on inputs. This system helps reduce the effective tax burden on insurers, enabling them to offer competitive premium rates to customers.

For the two-wheeler industry, the GST on insurance policies is a key factor influencing the cost of bike ownership. Ensuring clarity and transparency in the application of GST on insurance premiums helps consumers make informed decisions, contributing to a more efficient and compliant marketplace.

The Effect of GST on Motorcycles

The implementation of GST has had a profound impact on the motorcycle industry, transforming the tax structure and influencing various aspects of the market. By replacing multiple state and central taxes with a single tax regime, GST has simplified the tax landscape, making it easier for businesses to comply with tax regulations.

One of the significant impacts of GST on motorcycles is the standardization of tax rates. The uniform GST rates for regular bikes, electric bikes, and bike insurance have brought clarity and predictability to the market. This standardization has reduced the complexity of the tax system, benefiting both manufacturers and consumers.

For bike manufacturers, the input tax credit (ITC) mechanism under GST has been a game-changer. ITC allows manufacturers to claim credit for the GST paid on inputs, reducing the overall tax burden and improving cash flow. This system has helped manufacturers maintain competitive pricing and support the growth of the two-wheeler sector.

Consumers have also benefited from the simplified tax structure, with more transparent pricing and reduced tax cascading. The lower GST rate on electric bikes has made them more affordable, promoting the adoption of sustainable transportation solutions. This shift is expected to drive significant changes in the market dynamics, encouraging more investment in electric vehicle technologies.

However, the implementation of GST has also posed challenges, particularly in terms of compliance and administrative burdens. Businesses need to stay updated with the latest GST regulations and ensure accurate tax calculations to avoid penalties.

Overall, the effect of GST on motorcycles has been transformative, bringing both opportunities and challenges. By simplifying the tax structure and promoting sustainable transportation, GST has set the stage for a more efficient and dynamic two-wheeler industry in India.

By

By