How to Add HSN Code in GST Portal: Step-by-Step Guide

- 29 Sep 25

- 9 mins

How to Add HSN Code in GST Portal: Step-by-Step Guide

Key Takeaways

- HSN code in GST ensures correct classification of goods and services, helping businesses maintain compliance and accurate tax reporting.

- Businesses with turnover above ₹5 crores must add 6-digit HSN codes, while smaller businesses can use 4-digit codes for GST compliance.

- Adding HSN code on GST portal involves updating details in the ‘HSN/SAC’ tab under taxpayer profile with correct description and tax rate.

- Correct HSN codes help avoid GST penalties, reduce invoicing errors, and enable faster GST return filing and refunds.

- Businesses must regularly update HSN codes on GST portal whenever new products or services are introduced for smooth GST return filing.

HSN or the Harmonised System of Nomenclature, is a widely accepted set-up for categorising traded goods. Initially introduced by the World Customs Organisation (WCO) for international trade, it now acts as the standard for denoting and classifying products.

Businesses should be aware of the specific HSN codes to streamline their daily operations and ensure compliance with GST. Additionally, by learning how to add HSN code on the GST portal, business owners can ensure they are not breaching regulatory requirements more efficiently.

Why is HSN Important?

HSN codes are a crucial component when it comes to worldwide trade and taxation structure. This nomenclature ensures uniformity in segregating goods and streamlining procedures, such as, customs clearance, invoicing, and overall taxation.

For business, precise HSN designation secures precise and timely contribution of government taxes, reduces errors in invoicing, and maintains compliance with regulations.

Why is Adding an HSN Code in the GST Portal Important?

Uploading the corresponding HSN codes against supplies made is crucial owing to the following reasons:

- Timely HSN Code Verification Process Maintains Tax Compliance

HSN codes are the key while segmenting services and goods for taxation. They simplify tax rate calculation by accurately addressing the type of supplies a businessperson deals with.

- Correct HSN Codes Help Avoid GST Legal Issues

To comply with GST regulations, a registered taxpayer needs to add the correct HSN codes across their returns. Otherwise, subsequent failures can cause unnecessary delays in GST filing as well as incur risk of penalties.

- Appropriate HSN Utilisation Enables Faster Processing of Returns

Proper implementation of HSN codes facilitates quick processing of GST returns as companies can effortlessly claim refunds through spotless paperwork.

Who Needs to Add HSN Code on Their GST Profile in 2025?

According to the latest GST regulations, the following business entities should mandatorily update the correct HSN codes of their supplies:

| Annual Turnover Threshold | HSN Code Guidelines |

|---|---|

| Less than ₹5 Crores (for B2C supplies) | Optional or four-digit HSN code |

| Less than ₹5 Crores (for B2B supplies) | Optional or four-digit HSN code |

| Above ₹5 Crores (for all types of supplies) | Should have six-digit HSN code |

Besides the above-mentioned businesses, the following entities also need to mention the applicable HSN codes at the time of filing returns:

- Non-resident taxpayers

- Casual taxable persons

- Those registered under the Reverse Charge Mechanism

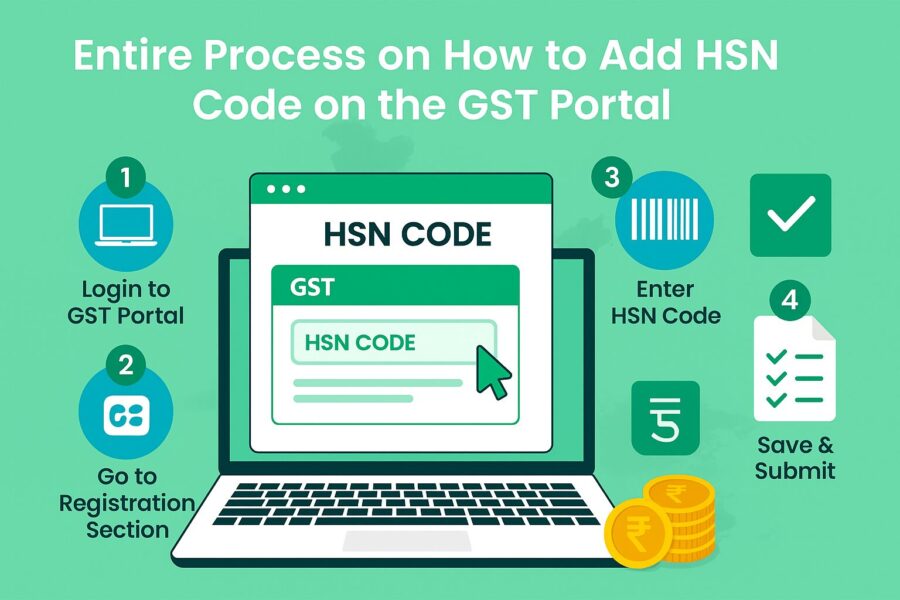

Entire Process on How to Add HSN Code on the GST Portal

Here is a simple process on how to declare HSN details for uniform classification of supplies on the GST portal:

Step 1: Open the Official GST Website

To start the procedure, open the official GST portal and log into your account. For a successful login, you must enter the valid credentials, i.e., your GSTIN followed by the account password.

Step 2: Go to the 'Profile' Tab

After the login is done, you must visit ‘Services’ from the navigational bar. Next, you have to click on ‘Taxpayer Profile’.

Step 3: Select the Option - ‘HSN/ SAC’

Under the ‘Goods and Services’ tab, you have to click on ‘HSN/ SAC’ to mention the relevant product or service code.

Step 4: Add or Edit an Already Added HSN Code

Click on the option marked as ‘Add HSN’ to enter a fresh HSN code. Here, you will be prompted to enter a six-digit code that represents the supply (goods or services) that you are selling to the customers.

After entering the correct HSN, you must provide a brief description of the supply related to that code.

Finally, you have to mention if the specific product/ service is taxable. If yes, then you must choose the applicable tax rates (it can be 5%, 12%, 18% or 28%).

Step 5: Save the Changes Made

Once all the necessary details are mentioned, do not forget to click on the ‘Save’ button. After this, the system will automatically check the validity of the inputs. After a successful verification, the accurate records of HSN codes will be present in your GST account.

Step 6: Verify the HSN Code

After you click on ‘Save’, please double-check whether you have added the HSN code correctly. To do this, you can revisit the ‘HSN/ SAC’ tab where you can verify if all the inputs made are correct.

HSN Code List for GST in India

The published HSN code chart under the GST law divides taxable and non-taxable goods into separate headings. This well-documented table allows businesses to precisely calculate the GST amount on their supplies and maintain tax compliance. The specifics of the HSN code list are given here:

| Section | HSN Code Range | Commodities | Applicable GST Rates (%) |

|---|---|---|---|

| I | 0101 - 0511 | Animal products and live animals | 0%, 5%, 12%, 18% |

| II | 0601 - 1404 | Vegetable products | 0%, 5%, 12%, 18% |

| III | 1501 - 1522 | Fats or oils from both vegetable and animal sources | 5%, 12%, 18% |

| IV | 1601 - 2403 | Prepared foodstuffs like spirits, beverages, and tobacco | 0%, 5%, 12%, 18%, 28% |

| V | 2501 - 2715 | Mineral products | 5%, 12%, 18% |

| VI | 2801 - 3825 | Chemicals and allied industries | 0%, 5%, 12%, 18%, 28% |

| VII | 3901- 4017 | Rubbers, plastics and articles made out of them | 12%, 18% |

| VIII | 4101 - 4304 | Leather, skins, fur skins, raw hides | 5%, 12%, 18% |

| IX | 4401 - 4601 | Wood and things made out of wood; cork and things made out of cork | 12%, 18% |

| X | 4701 - 4923 | Paper, paperboard and similar items | 12% - 18% |

| XI | 5001 - 6310 | Textile and related products | 0%, 5%, 12%, 18% |

| XII | 6401 - 6702 | Umbrellas, footwear, headgear | 12%, 18% |

| XIII | 6801 - 7020 | Glassware and ceramic items | 12%, 18% |

| XIV | 7101 - 7118 | Jewellery, stones, and other precious metals | 0%, 3%, 5%, 12%, 18% |

| XV | 7201 - 8311 | Base metals and articles thereof | 5%, 12%, 18% |

| XVI | 8401 - 8548 | Machinery and mechanical appliances | 5%, 12%, 18% |

| XVII | 8601 - 8716 | Vessels, aircraft and passenger vehicles | 12%, 18%, 28% |

| XVIII | 9001 - 9209 | Photographic, optical and medical equipment | 12%, 18% |

| XIX | 9301 - 9306 | Arms and ammunition | 12% |

| XX | 9401 - 9617 | Miscellaneous manufactured products | 12%, 18% |

| XXI | 9701 - 9706 | Antiques and works of art | 12% |

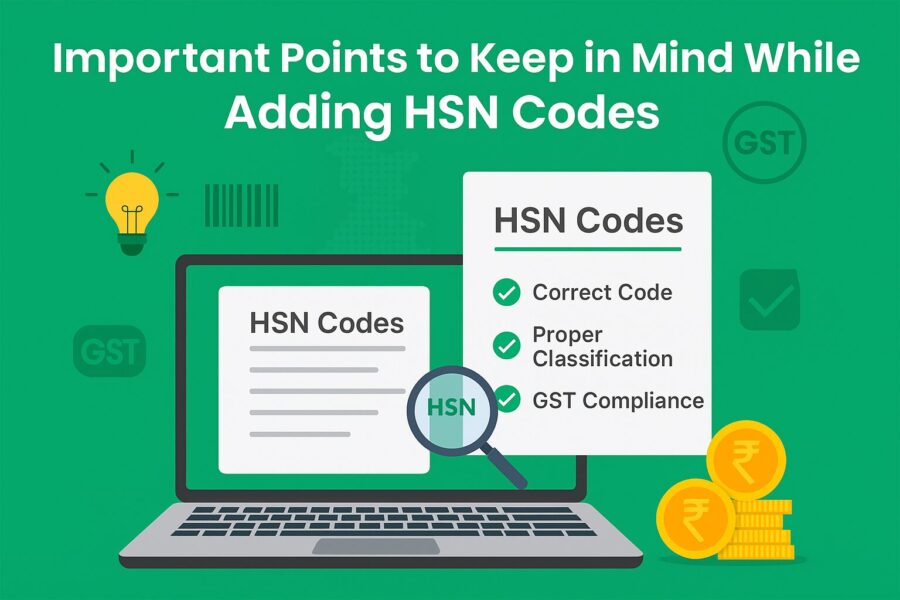

Important Points to Keep in Mind While Adding HSN Codes

Kindly note the points provided below before filling out the HSN code details in your GST profile:

- Number of Digits

Based on the annual turnover of your business, you may be required to mention either a 6-digit or a 4-digit HSN code. For instance, companies where the turnover is more than ₹5 Crores, they have to enter 6-digit HSN codes. Otherwise, a 4-digit HSN code will be appropriate.

- Correct HSN Codes

It is essential to specify precise HSN codes against the sold products. Conversely, if you enter the wrong HSN code, it can cause errors while filing GST returns or addressing taxation disputes.

- Frequency of HSN Code Update

Whenever you introduce new services or products to your business, the list of HSN codes must be updated accordingly. As a responsible taxpayer, you must strive to keep this list updated and aligned with your daily business operations.

- GST Return Filing

HSN code particulars are crucial at the time of reporting a business’ GST returns via Form GSTR-1 or GSTR-3B. So, you must make sure that the HSN codes are correctly placed to avoid mistakes in the return forms.

Conclusion

Understanding how to add HSN codes on the GST portal and correctly declaring them is crucial to complying with the GST rules. In the long run, this will ensure flawless tax assessment, reduce the chances of errors and facilitate smoother transactions.

Additionally, adhering to the HSN guidelines will empower businesses to explore options like loans, which are sometimes necessary to support financial needs and drive growth.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

Why is adding an HSN code important in GST?

Who needs to add HSN codes on the GST portal?

How can I add or edit HSN code in my GST profile?

Log in with GSTIN and password.

Go to Services > Taxpayer Profile > HSN/SAC.

Click Add HSN, enter the 4 or 6-digit code, product description, and applicable tax rate.

Save and verify details.

The system validates inputs and updates your profile accordingly.

By

By