Financial Credit Note Under GST

- 9 Sep 24

- 7 mins

Financial Credit Note Under GST

Key Takeaways

- A financial credit note is issued by suppliers to adjust taxable supply values due to reasons like discounts, product returns, or discrepancies in invoicing.

- Credit notes help correct overcharges or damaged goods and must include key details like the supplier's GSTIN, taxable amount, and tax rate.

- Credit notes must be reported in GST returns to adjust tax liabilities, ensuring transparent tax filings.

- There is no specific format for a credit note under GST, but essential information like a unique serial code and signature is required.

- Financial credit notes must be retained for 72 months after filing the annual return to ensure compliance and prevent duplicate claims.

All GST-registered individuals have to issue tax invoices. If any situations occur during the business that cause a reduction in the taxable supply value, the supplier can initiate a credit memo or credit note issuance. Here, we have discussed the typical intricacies of a financial credit note under GST.

What Is a Financial Credit Note?

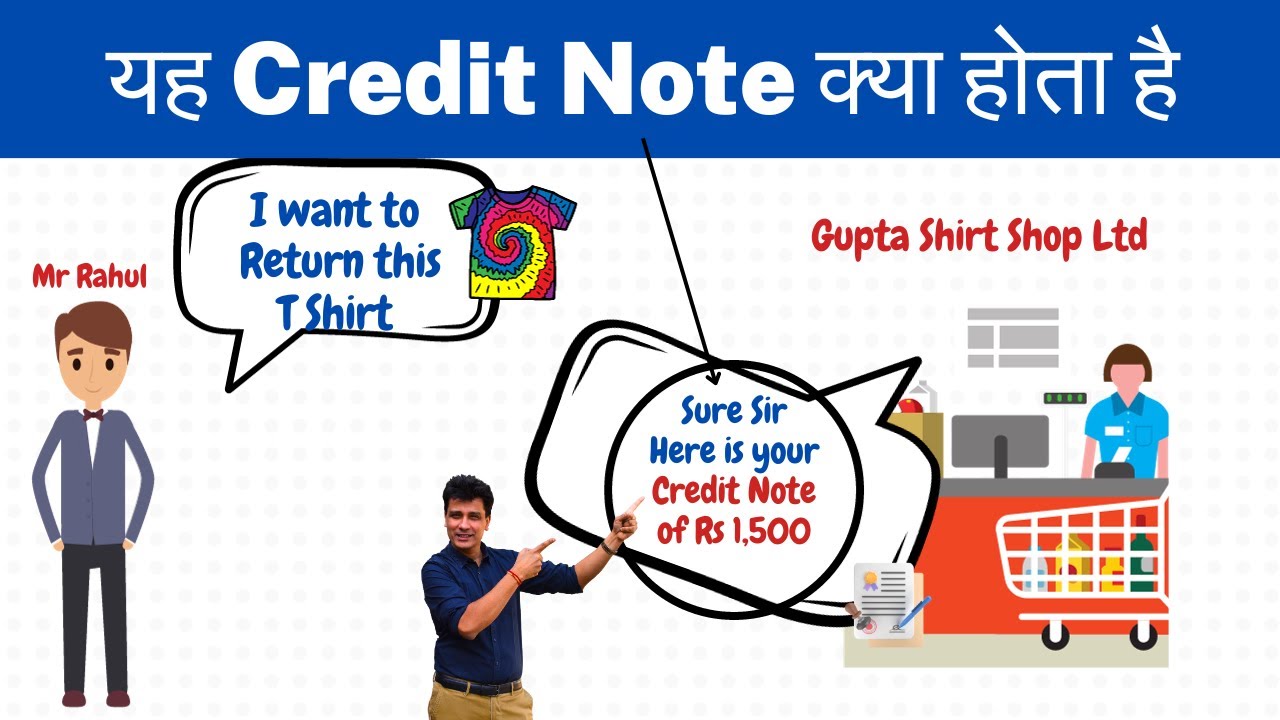

A financial credit note is very common and is issued by all types of businesses. Suppliers, who particularly wish to credit the accounts of their customers for different reasons, issue this document. The cause of permitting a credit can be a discount, damage while shipping, cost distinction, etc.

When to Issue a Financial Credit Note?

As per the GST statute, individual credit notes can be issued during the following instances:

- The tax levied in the tax invoice includes additional charges other than the applicable tax for the delivered supplies

- In cases where the services or goods involved are discovered to be insufficient

- Taxable value seems to exceed the estimated taxable sum which was previously supposed to be imposed

- In situations when the customer returns any goods or wants refunds for services

Key Details of Credit Notes

There is no prescribed credit note format as per the GST Act. However, the concerned supplier has to ensure the credit note matches the following data:

- Business name, location of supply supply type and GSTIN of the supplier

- Category of the document (it can either be a debit note or a credit note)

- The date on which the document is being issued

- A unique 16-character serial code. The issuer can prefer to keep this serial number as numeric, alphabetic or alphanumeric (including special characters is also allowed)

- The rate of tax and GST value of the supply along with the taxable amount credited to the customer

- Signature of the authorised supplier or his relevant representative's signature

Following the nuances of credit notes is essential for filing a valid tax refund.

💡 If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

Impact of Financial Credit Notes on GST Returns

The necessity to file financial credit notes has helped streamline the regular tax return filing process. For any business, now it is important to generate debit/ credit notes to maintain transparency on both ends. The credit-debit notes relevant to GST norms must be duly reported while filing quarterly/ monthly returns.

The issue of credit note proves to be useful for both sellers and customers. If you are unsure about the advantages of the issuance of credit note, here we have listed a few of them:

- Credit notes help rectify discrepancies in billing

- It provides formal documentation for returned supplies

- Suppliers can successfully maintain account reconciliation

- Vendors issue credit notes to easily settle disputes surrounding product quality or overpricing

- Easy adjustments to GST liability with credit notes become possible

Overall, these documents assist business persons in resolving disputes that may arise while filing returns. Maintaining proper GST credit notes is highly advised for uninterrupted business operations.

Procedure for Issuing a Tax Credit Note

We suggest you go through the below-mentioned example to understand the process of issuing a financial credit note:

Stage 1: Supplier A sells taxable B2C supplies to one of their clients, accompanied by original invoices.

Stage 2: The client identified quality discrepancies in the end product and initiated a return to supplier A with a corresponding debit note.

Stage 3: Supplier A acknowledges receipt of the debit note and will subsequently issue a credit note to document the returned commodities.

No set time limit has been stipulated for the issuance of a debit or credit note. Both debit and credit notes issued during a given month must be declared in the corresponding GST return.

Nevertheless, the GST portal mentions a particular time limit within which these documents can be declared by tax professionals for a particular financial year. A supplier can declare them on earlier of the below-mentioned dates:

- 30th September of the year following the tax period during which the concerned supply was made

- Actual date of filing the yearly return pertaining to the concerned period

The Bottom Line

To ensure direct tax compliance, any financial credit note under GST must be retained for a minimum of 72 months following the filing of the corresponding annual return. It allows a registered person to claim a reduction in tax liabilities legally. In addition, it aids authorities in readily identifying instances of claim duplication by individuals who attempt to unlawfully reduce their output GST liability.