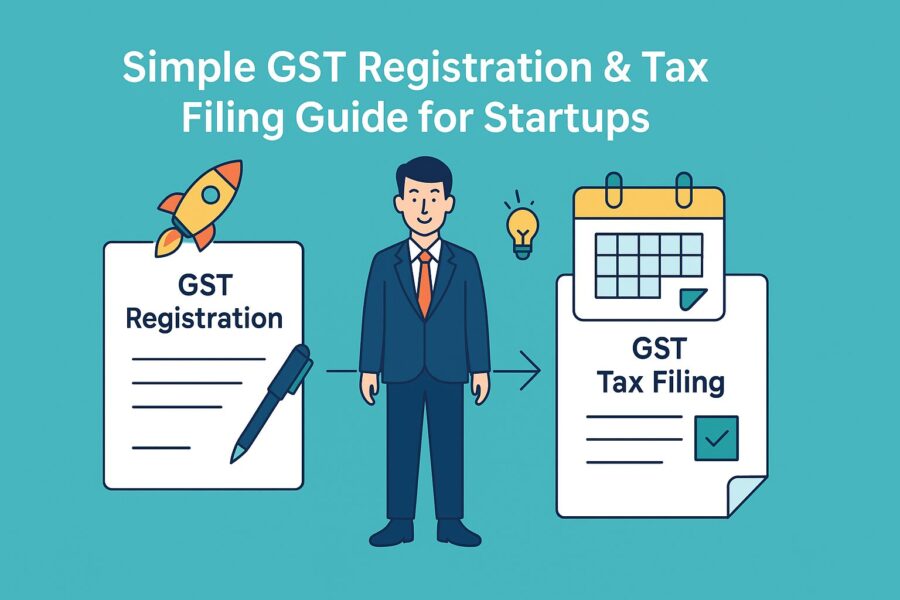

A Complete Guide on GST Registration Process for Startups

- 7 Oct 25

- 12 mins

A Complete Guide on GST Registration Process for Startups

- Simple GST Registration Procedure and a Guide to Filing Tax Returns for Start-ups

- Online Simpler Procedure Under GST in India

- Is GST Registration Important for Small Businesses?

- How Does GST Help Start-ups & Small Businesses?

- Impact of GST on Small Businesses and Start-ups

- Offences & Penalties Under GST for Evading Any New GST Rules

- Conclusion

Key Takeaways

- GST registration is mandatory for start-ups with annual turnover above ₹40 lakh (₹20 lakh in special category states).

- Online GST registration simplifies compliance, allowing start-ups to register, pay taxes, and file returns digitally.

- GST benefits for start-ups include input tax credit (ITC), reduced compliance costs, and ease of doing business.

- Under the GST composition scheme, small businesses with turnover up to ₹1.5 crore can pay tax at lower rates.

- GST for start-ups removes multiple state-wise registrations, streamlines logistics, and promotes nationwide expansion.

India has emerged as the world’s 3rd-largest startup ecosystem, with over 1.57 lakh startups recognised by the Department for Promotion of Industry and Internal Trade (DPIIT) as of December 31, 2024.

To support this growing business landscape, the Indian Government introduced the Goods and Services Tax (GST), which allows small businesses to bypass the complex central and state taxation obligations. Following this, a multitude of indirect taxes are replaced by a simplified, unified tax system in India.

This blog shall discuss the GST registration process for start-ups, the minimum turnover required, new rules applicable, benefits and much more.

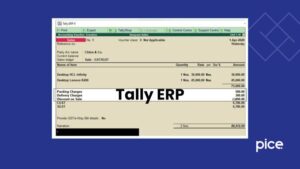

Simple GST Registration Procedure and a Guide to Filing Tax Returns for Start-ups

GST registration as well as filing returns under GST in India are online processes that are not just simple but also quick. Keep the necessary documents in handy to complete the process in a matter of minutes.

Start-ups that are struggling with capital, wield chances to gain immense financial benefits owing to the implementation of GST in India. As a much higher threshold is offered for GST registration for start-ups, the following and beyond have brought relief to small businesses:

- Tax credits on purchases

- Ease of processes, etc.

Online Simpler Procedure Under GST in India

The GST registration process in the online mode has made the tax compliance procedure much easier to navigate and significantly more efficient. This is especially relevant in the case of start-ups, as it allows them to focus more on business growth-related activities.

Here is how the online GST registration process has helped start-ups:

- Under the GST Act, start-ups can register, pay taxes and file returns online. This eliminates the extra hassle faced in completing the above-mentioned tasks in the offline mode, dealing with several tax authorities and obliging by payment requirements.

- GST for small enterprises allows start-ups to claim ITC (input tax credit) against their purchases. This reduces their overall tax burden and boosts cash flow.

- GST has also removed the need for several registrations, as start-ups shall operate across states with one single GST registration number, making it simpler for the entities to grow their business and reach more people.

As per the proceedings of the recent GST Council meeting, smaller taxpayers have been extended some relief as the associated late fees for filing GSTR-1/GSTR-3B have been waived.

Is GST Registration Important for Small Businesses?

A GST composition scheme has been introduced for small businesses in India, under the GST Act. The scheme allows for a lower tax value for businesses which have a turnover of up to ₹1.5 crore per year.

Registration under GST is mandatory for small businesses, given that one is a supplier of goods and has an annual turnover above ₹40 lakh. In States like Meghalaya, Arunachal Pradesh, Mizoram, Manipur, Nagaland, Sikkim, Puducherry, Telangana, Uttarakhand and Tripura, the associated turnover limit for small business GST registration for suppliers of goods, is set to a limit of ₹20 lakh.

Businesses that have a turnover of over ₹20 lakh are mandatorily required to register for GST, in the service sectors of India. The turnover limit for small business GST registration, as providers of services, is set to ₹10 lakh for Mizoram, Manipur, Tripura and Nagaland.

How Does GST Help Start-ups & Small Businesses?

Start-ups in India which are a part of the service industry had to collect/pay service tax to the government, prior to the GST regime. The non-utilization of VAT which was paid on the various purchases made against business requirements, was deemed as one of the main points of concern. No provision is extended for the claiming of credit of state VAT against the liability of service tax.

Now, start-ups can set off the tax paid on various purchases, which may include office supplies and other types of goods; given that the tax is paid on the sales under GST in India.

Pre-GST Example of VAT

A start-up shall purchase office supplies worth ₹50,000 by paying 5% VAT on them. It extends service to a different company for ₹80,000 upon which the 15% service tax is applied.

Here’s an overview of tax calculation, listing the amounts to be paid by the small business/start-up, at the time when adjustment of VAT/service tax was not allowed:

| Service tax as paid on the services extended (80,000x15%) | 12,000 |

| VAT paid during the purchase of office supplies (50,000x5%) | 2,500 |

| Total indirect tax | 14,500 |

Post-GST Example of Tax Credit on Purchases

Say, a start-up purchases office supplies for ₹50,000 at 12% GST, and provides service to a different company for ₹80,000, at 18% GST.

Here is a breakdown of the credit of the taxes they have paid on said purchases, which they can enjoy post-introduction of GST in India:

| GST on the services provided (80,000x18%) | 14,400 |

| Less: GST paid during the purchase of office supplies (50,000x12%) | 6,000 |

| Net GST that is to be paid | 8,400 |

Note: You can calculate the GST inclusive/exclusive rates for the goods you purchase, with the help of a GST calculator online.

Impact of GST on Small Businesses and Start-ups

Trace the impact of GST on start-ups and small businesses by going through the points below:

1. Ease with Logistics for Start-ups & Small Businesses

The act of moving goods from the origin stage to consumption falls under logistics. Prior to the GST regime being introduced in India, the industry struggled to keep up with multiple, complex tax obligations, several warehouses, delayed movement of goods, etc. All such concerns have been addressed by the GST Act.

· The Requirement to Maintain Multiple Warehouses Eliminated

GST for small businesses and start-ups has eliminated the requirement to maintain several warehouses across the states, as no inter-state tax is applicable on goods’ movement. This has allowed the logistics players to optimise spaces and storage, cut down on inventory and have enhanced control over maintenance costs. This simultaneously allows for the enhancement of warehouse management efforts.

· Elimination of Tolls, Check Posts and Border Inspections

GST for start-ups and small businesses has eliminated the tolls, check posts as well as the need for inspections having to be carried out at borders which otherwise, cause delay/corruption in the context of inter-state goods’ movement.

In turn, this has minimised transportation time as well as logistics costs. At the same time, it has boosted operational efficiency and contributed to customer satisfaction. GST numbers for businesses which are carried out online have promoted the unrestricted movement of goods through states without negatively weighing barriers.

2. Tax Burden for Manufacturing Start-ups

As per the excise laws previously in place, the manufacturing businesses which have a turnover of above ₹1.50 crore, are required to pay excise duty. However, under the GST Act, the turnover limit has been brought down to ₹20 lakh.

This has increased the tax burden for several manufacturing start-ups and this change has presented challenges for certain start-ups. As a result, they have had to adjust to this new tax regime to maintain compliance with the GST regulations.

3. Reduction in Compliance Cost for Businesses

A major benefit associated with the introduction of GST in regard to small businesses is the simplification of taxes that has resulted. This is due to the merging of different taxes previously being levied, into one singular payment obligation. It has reduced businesses’ ambiguities and complexities, especially for start-ups and small-scale enterprises, which are necessitated to deal with various tax rates/regulations through states/sectors.

The reduction in compliance costs has been a major advantage for start-up businesses as well as entrepreneurs. They are now able to focus their attention on more of their core growth strategies, innovation and beyond to make the business flourish.

Start-ups/small businesses are not required to navigate a multitude of tax departments, to streamline the tax return filing process and claiming of ITC. This has resulted in the minimisation of the risk of tax evasion/corruption. It has also promoted accountability and transparency within the Indian tax collection system.

4. Ease of Doing Business with a Single Registration Requirement

Another advantage associated with the GST system is the streamlined procedure for registration. Start-ups shall easily register under a single authority, not having to repeatedly register across borders, multiple times. This makes operations for start-ups much easier, as they can operate country-wide with a single registration number and the corresponding tax return.

A single registration requirement minimises lengthy paperwork or duplication, compliance-related costs, and other complexities. It lets a start-up expand its customer base within the common market.

5. Hurdles Faced by Start-ups

There is a boosted working capital requirement, given that start-ups must pay GST upfront, on the various inputs while also claiming ITC (input tax credit) later. In addition, increased compliance costs may result, with the requirement to file monthly returns as well as maintaining accurate records of transactions, arise.

Start-ups, especially small/medium scale enterprises, may experience a lack of clarity as well as awareness about the GST procedures/ provisions.

Offences & Penalties Under GST for Evading Any New GST Rules

Refer to the table below to discover the amount of penalty applicable to a specific type of offence:

| Offence Type | Penalty Amount |

| ·Penalty applicable for not registering under GST· Penalty applicable for committing fraud· Penalty applicable for not filing GST returns· Penalty applicable for not issuing invoices | Penalty at 10% of the tax pending/₹10,000 (the higher amount is applicable) |

| Penalty applicable for delay in the filing of GST returns | A late fee of ₹100 per day is applicable under the CGST Act; ₹100 is applicable under the SGST Act.Therefore, a total penalty of ₹200 per day shall apply, up to a maximum of ₹5,000. |

| Penalty applicable for choosing composition scheme even if the business does not qualify for it | In the case of fraud (as per Section 74), a 100% penalty of the pending tax amount/₹10,000 shall apply (whichever is higher) If it is not a case of fraud, a 10% penalty of the tax pending/₹10,000 shall apply (whichever is higher) |

| GST rate penalty applicable for wrongful charging of a higher GST rate | The penalty of 10% of the tax pending/₹10,000, shall apply (whichever is higher) (Note: this is relevant only in case the additional GST levied is not submitted to the government) |

| Penalty applicable for the wrongful charging of a lower GST rate Penalty applicable for the filing of GST returns incorrectly | Interest at 18% p.a. shall apply to the GST shortfall |

| Penalty applicable for inaccurate invoicing | Penalty of ₹25,000 shall apply |

| Penalty applicable for the inaccurate type of GST charged (say, IGST in place of CGST/SGST) | Penalty shall be charged in this scenario. Businesses are required to make accurate GST payments. At the same time, they must get a refund of the incorrect GST amount paid before. |

Conclusion

The GST registration process for start-ups is a crucial yet simple step towards ensuring compliance with GST regulations and company growth. We hope you now have an enhanced understanding of the requirements, as start-ups, to hassle-freely register for GST in India.

Thus, claim input tax credits and issue valid invoices, while also expanding your business operations and maintaining transparency.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By