Reverse GST Calculation Formula in Excel: Step-by-step Guide

- 8 Apr 25

- 8 mins

Reverse GST Calculation Formula in Excel: Step-by-step Guide

- What is Reverse GST Calculation?

- The Reverse GST Calculation Formula Explained

- How to Use the Reverse GST Calculation Formula in Excel

- Download the spreadsheet and follow along with the tutorial on Reverse Sales Tax Calculator in Excel

- Reverse GST Calculation in India

- Common Mistakes in Reverse GST Calculation & Ways to Avoid Them

- Why is the Pice Reverse GST Calculator Your Best Choice?

- Conclusion

Key Takeaways

- Reverse GST calculation helps determine the base price from a GST-inclusive amount.

- Use the formula: GST-inclusive price ÷ (1 + GST rate/100) to find the original price.

- Excel simplifies reverse GST by automating price, tax, and base amount calculations.

- Common mistakes include using the forward formula and ignoring CGST/SGST breakdowns.

- The Pice Reverse GST Calculator ensures fast, accurate, and India-specific GST breakdowns.

If you are someone who wants to figure out the price of an item before the application of tax, it can be very helpful to know how to reverse calculate GST. By using a reverse GST calculation formula in Excel, one can easily calculate the original price by referring to the total GST-inclusive amount.

This facility allows businesses and business owners indulging in financial planning, to keep a check of their pricing, helping individuals confirm the price that is inclusive of tax.

This blog shall dive deeper into the application of the reverse GST calculation formula in Excel, and other associated details.

What is Reverse GST Calculation?

GST reverse calculation is also commonly known as GST element calculation. For beginners, it is important to understand what Reverse GST calculation means. It refers to the manual calculation of the GST tax component of a whole amount that results (inclusive of the tax amount).

Here is an example of a scenario where reverse GST calculation may be required. Say that you are informed of the price of a product/service, quoted as 'inclusive of GST’. This means that the price of the item/service already includes the tax value. In such a case, you would probably want to know the GST amount separately. So, you will be required to reverse-calculate the GST amount under this circumstance.

The applicable tax rate, in this case, is usually included in the bill, which is offered to the consumer at the retail store, the latter needing to submit the GST amount to the central government. Now, there may arise a scenario where the buyer/recipient shall be required to pay the tax amount under the ‘reverse charge mechanism’.

The vendors may have raised the respective invoices without the applicable tax rate, tagged as 'tax is payable under RCM by the recipient'. It is also necessary in the case of accurate input Tax Credit (ITC) claiming, tax filing, and invoicing.

These purchasers should first figure out the GST/self-invoice, and deposit it with the government, in case the vendor is not registered under the GST law. This is again, where the knowledge of reverse GST calculation comes into play!

The Reverse GST Calculation Formula Explained

This section discusses the formulas that can be applied for the reverse calculation of GST.

Find the price excluding GST first by using this formula:

(GST inclusive price)/(1+(GST rate/100)) = GST exclusive price

The next and final step would be to find the GST amount, by using the GST reverse calculation formula below:

GST Inclusive Price − GST Exclusive Price = GST Amount

The formulas shall help break down the gross amount into its components, specifying the basic amount and the GST value.

How to Use the Reverse GST Calculation Formula in Excel

Here is a simple guide of the steps to use the reverse GST calculation formula in Excel:

Step 1: Apply the Formula to reverse calculate GST. For instance, if the total amount is ₹118 with an applied 18% GST, you must type in =118 / 1.18' in Excel. This will help you find the original cost price, which is ₹100.

Step 2: Next, you have to extract the GST amount by finding out the base price. So, calculate the GST amount by subtracting the base price from the entire amount. For instance, ₹118 (post-cost price) - ₹100 (base price) = ₹18.

Step 3: Finally, you have to implement the same in Excel. Feel free to set up the Excel sheet with separate columns for the total price, base price, GST rate, and GST cost. This shall make the process automatic as well as easy.

The above-mentioned steps show exactly how the reverse calculations help with keeping track of prices, and following tax rules in the process.

Download the spreadsheet and follow along with the tutorial on Reverse Sales Tax Calculator in Excel

Reverse GST Calculation in India

To properly understand the concept of reverse GST calculation, let us take an example. The gross amount that shall be paid, inclusive of GST, is Rs.1,300. The applicable GST rate is 12%. Consider an interstate transaction in this scenario. So, here’s what the accurate calculation shall look like:

● Gross Value: Rs.1,300

● GST: 12%

● Divisor: 1.12 (since 1 + 0.12)

● Base Value or Actual Price: Rs.1,160.71 (Rs.1,300 / 1.12)

● Total GST Amount (IGST/Integrated tax): Rs.139.29 (Rs.1,300 - Rs.1,160.71)

India, in particular, has four GST slabs. The slabs include 5%, 12%, 18%, as well as 28%. The reverse GST calculation formula can be applied to practical scenarios in India, like in the case of:

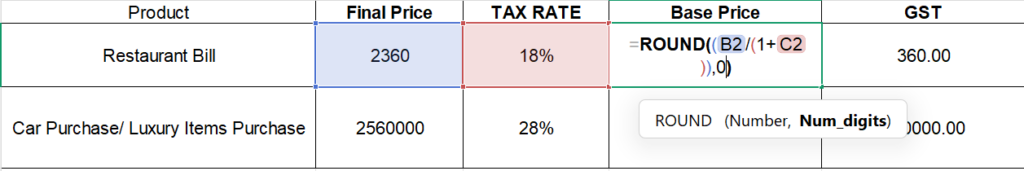

Example 1: Restaurant Bill

● Total Bill: ₹2,360 (including 18% GST).

● Base Price = ₹2,360 / 1.18 = ₹2,000

● GST = ₹360

Example 2: Car Purchase/ Luxury Items Purchase

● Final Price: ₹25,60,000 (including 28% GST)

● Base Price = ₹25,60,000 / 1.28 = ₹20,00,000

● GST = ₹5,60,000

Common Mistakes in Reverse GST Calculation & Ways to Avoid Them

Following are some common mistakes made during reverse GST calculation:

● Composite Tax Rates Are Ignored: Certain items mention the combined CGST + SGST value. It is crucial to check for the breakdown.

● Forward Formula Usage: The Forward formula is, “Base Price × (1 + Rate) = Forward GST.” However, the Reverse formula is different, as mentioned before.

● Errors with Rounding Off: Excel sheets round off decimals. However, it is important to note that GST laws require the exact values.

A simple way to avoid such common reverse GST calculation mistakes is through the use of the Pice Reverse GST calculator.

Why is the Pice Reverse GST Calculator Your Best Choice?

With the Pice Reverse GST calculator, you can access instant results for the values you input. It is automatic and accurate at the same time. So, there is a much-reduced scope for any manual mistake. On top of that, you get access to India-specific rate chart support. Plus, with free access to Excel templates, make reverse GST calculation much easier for your team! Try it now and get precise results in seconds!

Conclusion

By thoroughly understanding the reverse GST calculation formula in Excel, you can simplify your tax calculations while saving time on the other hand. By referring to the formula, that is, ((Total Amount*GST Rate)/100) + Total Amount, easily calculate the original value of an item, before GST application.

It shall, especially, be useful while dealing with invoices/receipts that only portray the total amount of the product/service (including GST). Thus, streamline your financial calculations by accurately implementing the reverse GST calculation formula in Excel.

Also, do you want to take precautions against possible human errors? To be extra confident and land upon accurate calculations, refer to the Pice Reverse GST Calculator readily available online!

FAQs

What is Reverse GST Calculation and when is it needed?

It’s commonly needed when the price quoted includes GST, and you want to identify how much of it is tax. This is crucial for accurate tax filing, invoicing, and input tax credit claims. It’s also helpful when dealing with unregistered vendors or reverse charge scenarios. Businesses use it to maintain transparency and control over their pricing.

How can I calculate Reverse GST using Excel?

=Total Price / (1 + GST Rate/100).To get the GST amount, subtract the base price from the total price.

Create columns for GST rate, total price, base price, and GST amount to automate the process.

For example, for ₹118 at 18% GST:

=118/1.18 gives ₹100 (base price), and ₹18 is the GST.Excel formulas help avoid manual errors and save time.

What GST rates are commonly used in India?

Each rate applies to different categories of goods and services.

For example, essential items fall under 5%, while luxury cars or high-end goods often attract 28%. It’s important to know the correct rate for accurate reverse calculations.

Invoices may also reflect CGST and SGST (or IGST for interstate sales).

What are common errors in Reverse GST Calculation and how to avoid them?

Ignoring combined GST rates (CGST + SGST) may result in incorrect base price extraction. Rounding errors in Excel can slightly skew tax values—avoid auto-rounding. Also, failing to update the tax rate can lead to miscalculations.

Using tools like the Pice Reverse GST Calculator helps reduce such risks.

Why should businesses use tools like the Pice Reverse GST Calculator?

Pice offers automatic, real-time results tailored to India’s GST structure.

It supports all major GST rates, prevents common missteps, and speeds up billing processes. The calculator is especially useful for bulk invoice processing or internal audits. Plus, you can download Excel templates to standardize your workflow.

By

By