How to View GSTR 9 Excel Format on GST Portal?

- 21 Feb 25

- 6 mins

How to View GSTR 9 Excel Format on GST Portal?

Key Takeaways

- Preview GSTR-9 Draft on the GST portal before final submission.

- Verify details to prevent errors and avoid penalties.

- Follow step-by-step process to download the Excel format.

- Draft includes six sections covering sales, tax payments, and more.

- Seek expert help for accurate and hassle-free filing.

All registered taxpayers can preview the GSTR-9 Excel format on the official GST portal before making the final submission. Individuals can easily acquire the GSTR-9 draft to tally its information before filing returns.

This blog will give you a clear understanding of how to view the GSTR-9 draft and explain why it is important to do so for a smooth filing experience.

What Is Draft GSTR-9?

The GSTR-9 draft file can be found on the official GST website. It is crucial to maintain the preciseness and rules of filing the GSTR-9 document. Taxpayers utilise this Excel interface as a checkpoint that allows them to verify all the inputs before making a final submission.

As a regular taxpayer, you can download the GSTR-9 in Excel and meticulously verify the particulars to ensure correctness. It is an important step to restrict instances of discrepancies or errors in the final filing activity.

Importance of Reviewing GSTR-9 Before Filing of Returns

The GST Council has mandated all relevant taxpayers to file the GSTR-9 form within a predetermined time frame. Additionally, if any discrepancy is noticed, there can be potential penalties as well.

Sometimes, a tax officer can scrutinise these submissions too particularly if there is a complication arising from wrong inputs or any incomplete details. Thus, to be at the safer end, consider downloading and checking the GST 9 Excel format and adhering to the income tax regulations before submitting your form.

How to View the GSTR-9 Draft in Excel?

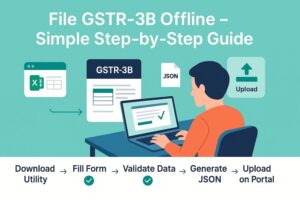

As you have now already understood what a GSTR-9 draft is, these are a few mandatory steps to follow to view the GST 9 form in Excel format:

Step 1: Access the GST Portal

Open the official GST website and securely log in to your account by entering the correct username and password. These are the foremost steps to start the GST 9 filing procedure.

Step 2: Navigate to the Dashboard

After the login has been successful, you can see the dashboard on your device screen. Here, select the ‘Annual Return’ option from the navigational tabs to get an idea about the various filing options.

Step 3: Select the Relevant Financial Year

Select the fiscal year 2024-25 to begin your filing process with the right financial year cycle.

Step 4: Initiate GSTR-9 Online Preparation

Choose the ‘Prepare Online’ option under the ‘Annual Return GSTR-9’ tile to start preparing your yearly returns without any hassle.

Step 5: Handle Nil Return Filing Option

Proceed to the next window and check against either 'Yes' or 'No'. These checkboxes are for Nil Return Filing. After you have made the appropriate selection, click on 'Next'.

Step 6: Preview Draft GSTR-9 in Excel

Locate the tab named 'Preview Draft GSTR 9 – Excel' and click on it to see the detailed Excel format. You can see this option in the footer section of your screen.

Step 7: Download the Draft Excel File

Click on ‘Preview Draft GSTR 9 – Excel’ to activate the Excel file. Once activated, click on it to access the file.

What Is the Format of Draft GSTR-9 Excel?

The draft GSTR-9 format in Excel comes with 6 sections, which include information related to sales or supplies. Take a look at the following breakdown of this format:

- In the first section, you will find the basic details of a taxpayer.

- Here, in the 2nd section, goes the details of the supplies made to and from the business throughout the entire fiscal year.

- Next comes the 3rd section including all the input tax credit details which has already been declared in the returns filed during the particular year.

- Details of the tax payment will be displayed in the 4th section. Note that this has to align with the details already declared in the returns filed in that year.

- The 5th section includes previous year transaction details which are already declared in returns from April to September of the current fiscal year.

- In the last section, you will find the details related to late fees, demands and refunds, HSN summary, deemed supplies, etc.

Conclusion

Realising the significance of reviewing GST 9 Excel format is crucial to ensure flawless submission of income tax returns. You can use this blog as a comprehensive guide and follow the steps mentioned upon opening the GST portal.

However, the procedure can seem tough to first-time learners. Therefore, to ensure 100% accuracy in return submissions, you can get help from GST experts.

💡If you want to streamline your payment and make GST payments via credit card, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By