What is the nature of supply in GST?

- 17 Feb 25

- 10 mins

What is the nature of supply in GST?

Key Takeaways

- Supply under GST includes the sale, transfer, barter, or lease of goods and services.

- Three key components: time, value, and place of supply.

- Types of supply: taxable (standard, zero-rated, reverse charge) and non-taxable (exempt, non-GST).

- Supply must be taxable, within a taxable area, and by a registered person.

- Proper classification ensures GST compliance and prevents penalties.

Supply under GST is the central concept of the tax system. It refers to buying, selling, exchanging, or otherwise dealing in goods or offering services. These transactions attract GST if done in the course of business. They involve supplying, including sale, leasing, or even providing products to others on a barter basis.

It covers tangible products, services, and circumstances in which payment is not always necessary. Supply is one of the fundamental pieces of knowledge that you have to acquire to determine when GST may apply.

Continue reading this blog to gain detailed insights about the nature of supply in GST, its components, and others.

What Does Supply Mean Under GST?

In the case of GST (Goods and Services Tax), supply means the act of selling, transferring, bartering, or leasing goods or services. It comprises all methods of sale and purchase done for consideration. Supply fronts GST since the tax is levied on it.

There is also the concept of the supply thought to be standard-rated, zero-rated, and exempt. It may also involve intrastate supplies (within the same state) or inter-state supplies (between two or more states).

Supply involves any sale of goods, offering services as well as exchange for goods or even giving gifts as well. The first condition where this situation applies is where the supply is made in the course of business in relation to Goods and Service Tax. Nevertheless, certain special cases of taxation are considered even without consideration.

Supply of Goods or Services

The transfer of goods and services during the process of transactions is considered a supply of goods. For instance, when you purchase a textbook from any retailer, you become the owner of the textbook. In other words, the ownership of the textbook gets transferred from the retailer to you.

On the other hand, the transfer of rights in goods without any transfer of title is considered a supply of service. For instance, if you are using transportation services, you have the right to use that service. Here the ownership remains still with the transportation company.

Supply Should be Taxable

Supply of goods and services can be subject to any taxable event or might be exempted. Supplies which are taxable fall under the category of goods and services that attract GST. Tax-exempt supplies are the supplies of goods and services that belong to a category as specified in the GST Act.

Supply Should be Made by a Taxable Person

A taxable person is identified as an individual registered under the GST or has the liability of registering a person who is registered voluntarily. Carrying out supply between two non-taxable individuals is not categorized as supply under GST by default.

If any individual supplies goods and services in different states or operates in several business verticals, then they must get registered separately for each state. Each of these entities that have undergone registration are taxable individuals.

Supply Should be Made Within a Taxable Territory

Taxable territory implies any particular place in India, excluding the state of Jammu and Kashmir.

Supply Should be Made in Exchange for Consideration

The consideration here means the bartering of goods and services or the payment made for supply in money. Any prepayment done towards a supply is also categorized as a consideration by the government.

As per the CGST Act, here is a list of activities categorized as supply even if it is made in exchange for consideration:

- Supply is carried out between two separate individuals for business-related purposes.

- When any business transfers or disposes of assets permanently for which you can avail input tax credits.

- Any supply of goods on behalf of the supplier of supply received by an agent on behalf of the customers.

- Importing services from any related individual or from his or her business operating outside India for carrying out any business-related purposes.

Supply should be made in the course of business or in the interest of growing a business.

GST is applicable only for carrying out business-related transactions. Hence, for any transaction to be categorized as supply under GST, it has to be made for business purposes. However, if supplies are made for meeting any personal purpose, they will not be categorized as supply under GST.

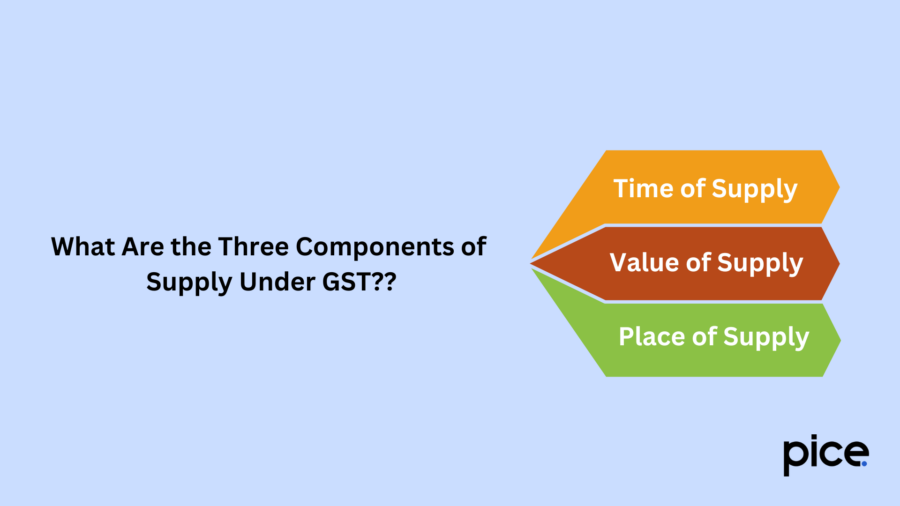

What Are the Three Components of Supply Under GST?

Here are the three main components of supply under GST that help in the calculation of GST liability on transactions:

- Time of Supply

The time of supply denotes the period when the goods and services get supplied, which in turn, indicates when the associated GST can be paid. For goods, the time of supply takes place earliest of the following scenarios:

a) The issuing date of an invoice

b) The date for removing the goods (if supply means movement)

c) The date of receiving payment by the supplier, if it takes place before issuance of the invoice

Whereas, for services, the time of supply takes place earliest following any of the below scenarios:

a) The issuing date of an invoice or receiving payment

b) If the issuance of invoice fails to take place within the defined period, the date of provision of the service

Most importantly, determination of the right time of supply is vital, as it creates an impact on the time of filing of GST returns and tax payments.

- Value of Supply

The value of supply is a prime determination of the taxable amount on which the calculation of GST takes place. It takes into consideration the following:

a) The price to pay for any goods and services

b) Any additional charges relating to supply that include transportation fees, costs of packaging and insurance

c) Any duties, taxes and cess, excluding the GST itself

d) Subsidies in direct link with prices, excluding those the government provides

Alongside this, the value of supply also does not consider any discounts if provided before or during the time of supply. Accurate determination of the value of supply is, however, crucial as it creates a direct impact on the GST amount to be paid.

- Place of Supply

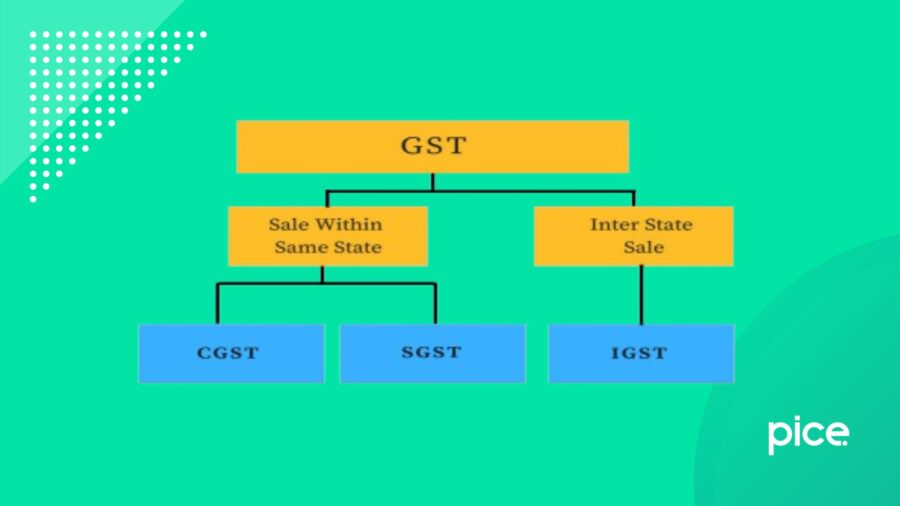

Determining the place of supply is crucial for determining if a transaction takes place interstate or intrastate, which further affects the kind of GST to be levied (IGST is applicable for interstate supplies while CGST and SGST are for intra-state supplies).

a) For goods, the place of supply is the location where delivery of goods takes place.

b) For services, the place of supply denotes the respective location of the service recipient. However, for transportation services, the place of supply is the location where the service takes place.

Correctly determining the place of supply ensures the accurate application of taxes and thereby helps prevent any disputes or errors in the filing of taxes.

Types of Supply Under GST

Supplies under GST are broadly classified into two main categories: taxable supplies and non-taxable supplies. Let’s explore each of the types of supply under GST in detail below:

- Taxable Supplies

Taxable supplies imply the supply of goods and services that are subjected to GST. Businesses with such supplies should be registered under GST and comply with the related obligations. Taxable supplies are further divided into:

a) Zero-rated supplies: These kinds of supplies are taxable, but the GST rates applicable are zero. This kind also takes into consideration the exports category.

b) Regular Taxable Supplies: This is one of the most common and convenient taxable supplies. It takes into consideration the transfer of goods and services for a consideration, with the application of a standard GST rate.

c) Reverse Charge Supplies: Under certain cases, other than the supplier, the recipient of supply is also eligible to pay GST. This kind of mechanism is applicable for carrying out specific transactions that include imports.

- Non-Taxable Supplies

The two main categories of supplies under non-taxable supplies are:

a) Exempt Supplies: Exempt supplies are categorized as those supplies excluded from GST services. However, businesses with exempt supplies might need to undergo a registration process if their rate of turnover exceeds the prescribed threshold.

Examples are newspapers, agricultural production, and other educational-related services.

b) Non-GST Supplies: These kinds of supplies are made completely outside the scope of GST. Examples are transactions in securities, the use of goods and services personally, and the sale of immovable property.

Other Important Categories

- Mixed Supply: A mixed supply refers to a combination of two or more goods or services provided together for a single price. Each item in the combination can be supplied independently and does not rely on the others.

- Composite Supply: A composite supply refers to a combination of two or more goods or services that are naturally bundled and provided together in the normal course of business, with one being the principal supply. This takes into consideration the principal supply with one or more ancillary supplies. The applicable rate of GST is determined by the rate of principal supply.

Conclusion

Supply under GST is a principle that defines when tax is charged and how it should be charged. It includes all sales, exchanges, or other dispositions of property. More importantly, GST makes taxation simple and does not allow a state to put unfair taxes on other commodities.

The rules of supply must be comprehended to avoid violations of the GST guidelines. This also aids in avoiding penalties and hence enables a smooth running of the business.

This way, it helps businesses understand what falls under supply to manage their taxes effectively. In a sale, barter, or lease, generally, supply is the key, which constitutes the GST. This makes it compulsory for any business to adhere to the guidelines.

💡If you want to streamline your payment and make GST payments via credit card, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

What is considered a supply under GST?

What are the key components of supply under GST?

Time of Supply: Determines when GST is payable.

Value of Supply: The transaction value, including additional costs.

Place of Supply: Determines whether IGST, CGST, or SGST applies.

By

By