Step-by-Step Guide to Adding Multiple Businesses to One GSTIN

- 14 Aug 24

- 11 mins

Step-by-Step Guide to Adding Multiple Businesses to One GSTIN

Key Takeaways

- Single Legal Entity Registration: Multiple branches or business types can operate under one GSTIN if they are not separate legal entities.

- Separate Registrations for Verticals: Businesses can choose to register distinct verticals separately under the GST framework for better financial management.

- Centralized Compliance Benefits: Using one GSTIN across multiple branches simplifies compliance, reporting, and administration.

- Strategic Management of Input Tax Credits: Centralized GST registration allows for efficient management and utilization of input tax credits across all branches or verticals.

- Consult Professional Guidance: Always consult with a tax professional to ensure compliance and optimize GST management strategies across multiple business operations.

The Goods and Services Tax (GST) system in India allows single business entities or businesses with multiple branches across different states to streamline their tax compliance through a centralized or single GST registration, eliminating the need for a separate GST registration procedure.

This approach can simplify the tax filing process, reduce administrative burdens, and ensure a hassle-free registration process and uniform compliance across all branches.

This guide explores the essentials of GST registration process for multiple branches, including benefits, simple registration procedures, and key considerations.

Can You Add Multiple Business Entities Under the Same GST Number?

Adding multiple business entities under a single GST number is legally permissible but comes with its own set of regulations and compliance requirements. This segment elucidates the legal framework and practical considerations.

Legal Feasibility

- Single Legal Entity: Under the GST law, a GST number, or GSTIN (GST Identification Number), is assigned to a single legal entity. If you own multiple business ventures, they can be registered under a single GST number only if they are not distinct legal entities. This means that different branches or divisions of the same company can operate under one GST number, but separate companies must have separate GST registrations.

- Different Business Verticals: If a single legal entity operates different business verticals, they can opt for separate GST registration for businesses with each vertical if they wish. This is often done for accounting or operational reasons, such as different tax liabilities or compliance requirements in different industry sectors.

Practical Considerations

- Operational Ease: Having a single GST number for multiple branches or divisions of the same business can simplify operations for maximum efficiency. It centralizes tax filing and compliance, making it easier to manage from an administrative standpoint.

- Tax Compliance: When multiple businesses operate under one GST number, all transactions are consolidated under a single return. This can simplify tax filing but may complicate the tracking of transactions, especially if the businesses are diverse.

- Audit and Legal Implications: With multiple businesses under one GST number, any compliance issue in one area could potentially impact the entire entity. It’s crucial to maintain rigorous accounting practices to separate the transactions of different branches or business types.

Is separate registration required for multiple business branches in various states?

No, separate GST registration for multiple business branches in various states is not mandatory, according to the Authority for Advance Ruling (AAR). The AAR has clarified that a single entity can use one GST registration across different states if it maintains centralized billing or accounting systems that can adequately address and comply with tax liabilities under GST law.

This decision helps simplify the administrative process for businesses operating in multiple states, reducing the need for multiple registrations and filings.

How to Register Multiple Types Under One GST Number?

In the Indian GST (Goods and Services Tax) regime, registering multiple types of businesses under a single GST number is possible if these businesses are structured as different verticals under the same legal entity. This setup can offer significant advantages in simplifying administrative and compliance processes.

Here's a detailed guide on how to register multiple business types under one GST number.

- GST Registration for Multiple Business Verticals: The GST framework allows a single legal entity operating multiple business verticals to obtain separate GST registrations for each vertical if it chooses. This is particularly useful if the operations are distinct enough to warrant separate tax treatments.

- Business Vertical: As per GST law, a "business vertical" is a distinguishable component of an enterprise that engages in supplying individual goods or services or a group of related goods or services which is subject to risks and returns that are different from those of other business verticals.

Advantages of Registering Multiple Business Types Under One GST Number

- Simplified Operations: Central management of GST compliance might be simpler under a single registration, depending on the business's internal organization.

- Consolidated Tax Filing: Streamlines the process of tax filing by reducing the number of returns that need to be filed.

- Unified Credit Utilization: Allows for easier management and utilization of input tax credits across different business verticals.

Steps to Register Multiple Business Types Under One GST Number

Step 1: Determine Eligibility

Ensure that all the business types you intend to register are legally part of the same entity and meet the criteria for being considered distinct business verticals.

Step 2: Document Preparation

Gather all necessary documents required for the GST registration process. Typically, this includes:

- PAN of the entity

- Identity and address proofs of the owner(s)

- Business registration or incorporation certificate

- Proof of business address

- Bank account statement

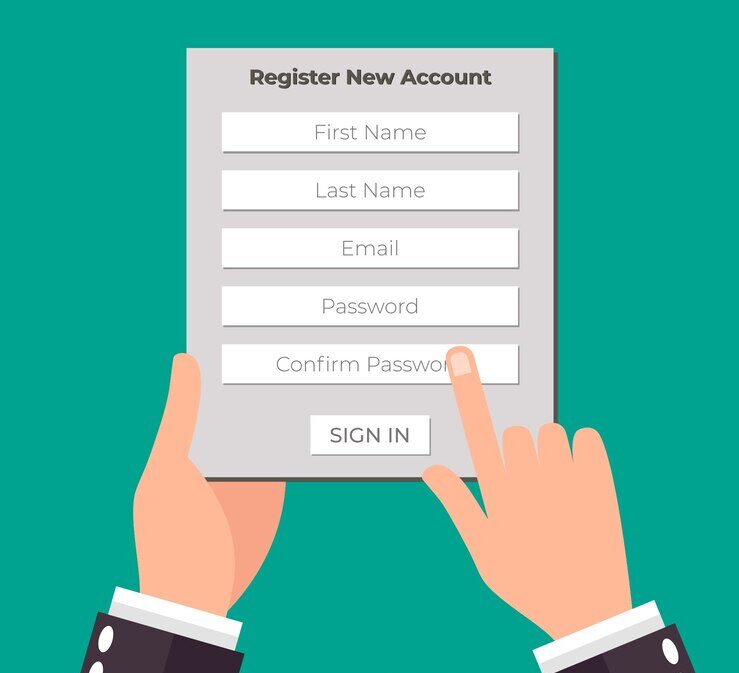

Step 3: Registration Process

You can choose to either register each vertical separately or manage them under one GST registration, depending on operational and compliance considerations. Here’s how to manage them under one voluntary GST registration procedure:

- Log in to the GST Portal: Navigate to the official GST portal.

- Modify Registration Details: If you already have a GSTIN, you can add additional business verticals by amending your existing GST registration. This is done through the 'Amendment of Registration Non-CCore Fields' section.

- Specify Business Verticals: Clearly specify each business vertical during the amendment process. Provide details such as the nature of business activities and the address of each vertical.

Step 4: Compliance and Verification

- Review and Submit: Ensure all details are correct and submit the application. The GST officer might conduct physical verification or request additional information.

- Receive Acknowledgement: Once verified and approved, you will receive an acknowledgement, and your GST registration will be updated to include all business verticals under one number.

- Maintaining Compliance for Multiple Business Types

- Accurate Record-Keeping: Maintain separate accounts for each business vertical to ensure precise tracking of revenues, expenses, and GST liabilities.

- Regular Filings: File GST returns as required, noting the consolidated transactions of all verticals. Ensure accurate reporting to avoid penalties.

- Manage Input Tax Credits: Properly allocate input tax credits among verticals to maximize tax efficiency.

Scenarios Where Multiple Businesses Can Be Added to One GSTIN

Managing multiple business operations under a single GST Identification Number (GSTIN) is permissible under certain conditions. This can simplify administrative tasks and compliance obligations, especially for entities operating several business units that do not constitute separate legal entities.

Here are key scenarios where multiple businesses can be added to one GSTIN, ensuring compliance and streamlined operations.

Legal Entity Structure

Single Legal Entity with Multiple Business Units: If multiple business units or divisions operate under the umbrella of a single legal entity, they can all be registered under one GSTIN. These units may engage in different kinds of business activities but must not be separately incorporated.

Examples:

- A manufacturing company that also runs a transport division.

- A corporate entity with different product lines, such as electronics, clothing, and accessories.

- Business Verticals

Distinct Business Verticals: The GST law allows a single legal entity to obtain separate GST registrations for distinct business verticals if it chooses; however, it is also permissible to operate multiple verticals under a single GSTIN if they do not opt for separate registrations.

Examples:

- A company that manufactures both clothing and footwear may choose to manage these as distinct verticals under one GSTIN if they do not require separate financial treatment.

- A food processing company that also engages in direct retail sales of its products.

- Geographical Considerations

Multiple Branches in various Locations: If the law does not require these branches to have separate GST registrations, a business may operate branches in various geographical locations under a single GSTIN. This is often the case with service-oriented businesses where physical goods are not being transferred across state lines.

Examples:

- A consulting firm with offices in multiple cities but centrally billed and managed under the same firm name.

- A chain of restaurants operating under the same brand name across one state.

- Sector-Specific Scenarios

Conglomerates and Conglomerate Subsidiaries: While each subsidiary typically requires its own GSTIN because they are separate legal entities, a conglomerate that directly manages several businesses can do so under one GSTIN if those businesses are not incorporated separately.

Examples:

- A business entity that operates both a bookstore and a café within the same premises.

- A company that manages a chain of educational institutions and stationary stores under one management.

- Operational Efficiency

Centralized Accounting and Administration: Entities that choose to operate multiple businesses under one GSTIN often do so to leverage centralized accounting, unified tax filing, and administrative efficiency.

Examples:

- A corporation that centralizes its accounting for multiple product lines to streamline operations and reduce overhead.

- A business that manages several small boutique shops under one management system.

- Compliance and Regulatory Strategy

Strategic Tax Planning and Compliance: Operating multiple businesses under one GSTIN may be part of a strategic approach to compliance and tax planning, particularly if the businesses are closely linked in their operations and supply chains.

Examples:

- A manufacturer that also operates its distribution network might keep these operations under one GSTIN to simplify the calculation of input tax credits and compliance reporting.

- A business entity that engages in both production and retail of goods, where supply chain interdependencies make unified GST compliance more practical.

Conclusion

Registering multiple branches under a single GSTIN can significantly ease the operational and compliance burden for businesses. However, it requires careful planning, meticulous documentation, and adherence to compliance requirements.

It’s often beneficial to consult with a tax professional to ensure that all procedures are correctly followed and that the business remains compliant with GST laws. This approach not only simplifies the tax handling processes but also helps in maintaining a cohesive financial strategy across multiple business locations.

If you want to pay GST dues with a credit card and experience the convenience and possibility of earning rewards on payments, then download PICE business payment app now.

By

By