How to get GSTIN number for Flipkart?

- 17 Oct 24

- 9 mins

How to get GSTIN number for Flipkart?

Key Takeaways

- Flipkart sellers need GST registration if their turnover exceeds ₹40 lakhs (goods) or ₹20 lakhs (services).

- GSTIN allows sellers to claim Input Tax Credit (ITC) and reduce tax liability.

- Having a GSTIN ensures compliance with India's tax laws and boosts business credibility.

- GST is applied based on the location of supply, affecting CGST/SGST or IGST.

- Regular GST return filing is mandatory to avoid penalties and maintain compliance.

For Flipkart sellers, GST registration is crucial to follow India's tax laws. GST is applied to every stage of the supply chain—from production to sales. To start, you need a GSTIN, which is essential for listing products on e-commerce platforms. Here you will learn how to get GSTIN number for Flipkart and other crucial details.

GST Registration for Flipkart Sellers

If you are selling goods or services on Flipkart and your annual turnover exceeds the GST threshold of ₹40 lakhs (for goods) or ₹20 lakhs (for services), GST registration is required. Flipkart Seller Hub helps online sellers to display and market their products. There is a commission that Flipkart takes from the seller whenever they do product listings on the platform.

This fee varies depending on some factors, like the type of product that is being offered in the market. Additionally, an 18% GST is applied to this commission.

GST registration is important for Flipkart sellers as it helps you meet the legal requirements of GST. It manages your tax responsibilities, builds trust among millions of buyers and opens up growth opportunities. Therefore, you must understand first how GST relates to a product of an e-commerce business before proceeding to the registration process.

Let us use a T-shirt as an example to see how GST is applied.

- Production Stage

To manufacture the T-shirt, raw materials are bought. For instance, let the cost of these raw materials be ₹100 and let there be a tax charge of 12%. The tax on these materials is ₹12.

- Manufacturing Stage

The manufacturer adds value to the raw materials, say ₹75, making the total value ₹175. GST of 12% on this added value would be ₹21. However, since the manufacturer has already paid ₹12 for the raw materials, they only need to pay an additional ₹9 (₹21 - ₹12). This illustrates why it is important to grasp how GST is implemented before registering.

- Wholesale Stage

When the wholesaler buys the T-shirt for ₹175, they might add ₹50 to it, bringing the total to ₹225. GST at 12% on this new value would be ₹27. The wholesaler only needs to pay the difference of ₹6 (₹27 - ₹21) because they get credit for the tax already paid by the manufacturer. This shows why wholesalers need to understand GST applications before registration.

- Retail Stage

Finally, if the retailer adds ₹25 to the T-shirt, the final price becomes ₹250. GST on this amount would be ₹30, but since the retailer has already paid ₹27 in previous stages, they only need to pay an additional ₹3 (₹30 - ₹27).

Knowing this process is essential for retailers before performing business registration under GST. For each product sold, a TDS of up to 1% will be deducted from the sale amount and paid to the government. However, GST-registered sellers can claim this amount back every month.

GSTIN Number for Flipkart Seller

To sell consumer products on Flipkart, you need a GSTIN (Goods and Services Tax Identification Number). This registration requirement is essential because you must collect and remit GST on your sales to the government. Selling on Flipkart opens up access to a broader market for buyers both in India and globally.

Significance of GSTIN for Flipkart Sellers

For Flipkart sellers, having a GSTIN is essential due to government rules for businesses that sell taxable goods and services. You need GST registration if your sales exceed the prescribed threshold limit. If you only sell exempted goods on Flipkart, you do not need to register for GST. However, if you sell other consumer products, GST registration is required.

Having a GSTIN comes with input tax credit benefits. This means you can reduce the GST you owe on sales by claiming credits for GST paid on purchases, which helps lower your tax bill and improves cash flow. In short, getting a GSTIN is important for Flipkart sellers to follow GST rules, avoid fines and take advantage of GST benefits.

Flipkart GST Registration Guidelines

The following mentions the guidelines for GST registration in different situations:

- Already Registered Under GST

If you have already done GST registration, you can continue as usual. However, if you were initially registered under the composition scheme, you must switch to the regular scheme.

- Selling Exempted Goods Only

If you only sell exempted goods, you do not need to get a GSTIN to register on online selling platforms. GST registration is not required for sellers of exempted goods.

- Business Operations Across Multiple States

If you sell in multiple states, you must register for GST in each state where you make supplies. This ensures you meet the inter-state sales GST registration regulations.

- Place of Supply Differing from Office Location

If the place where your goods are supplied is different from your main office, you need GST registration in the state where the supply takes place.

- Place of Supply Guidelines for Flipkart Sellers

The GST is a destination-based tax, one in which the tax is charged according to the location where the goods or services are being consumed. The place of supply is crucial because it defines the type of tax that you will have to charge. If the place of supply is in the same state of incorporation as the supplier, both the CGST and the SGST are levied. However, if the place of supply is in a different state from the supplier, IGST is levied on the supply of goods and services.

GST Return Procedures for Flipkart Sellers

GST registration streamlines the process of filing periodic returns, making it more convenient for e-commerce businesses to keep accurate records. For Flipkart sellers, GST return filing regularly, both monthly and annually, is essential.

- Monthly Returns

You need to file the returns by the 10th of each month. Moreover, fill out the GSTR-1 Form by providing the description of products and services supplied during the month.

- Mid-Month Activities

File the GSTR-2 form, between the 11th and 15th. This application form will include business details of purchased taxable goods and services.

- End-of-Month Procedures

By the 20th review and finalise the GSTR-3 form. Make any necessary payments by providing your bank account details.

- Annual Returns

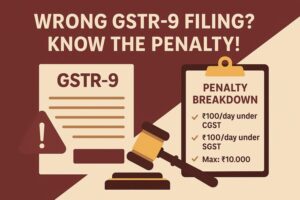

Submit the GSTR-9 form by December 31st for the financial year.

Filing of GST returns on time is crucial to avoid penalties and interest. Adherence to deadlines is important to prevent any legal consequences.

Advantages of Having GSTIN for Flipkart Sellers

The following are the advantages of having GSTIN for Flipkart sellers:

- Legitimacy and Compliance

Getting GST registration for the Flipkart store is beneficial to your business as it increases your business’s viability and proves that your business adheres to tax policies. It also ensures the company has trust with its customers as well as ensures compliance with tax regulations.

- Input Tax Credit (ITC)

GST registration has made it possible for business people to recover the Input Tax Credit on business purchases. This assists in the reduction of the GST amount that one owes to the government on sales by applying the same against the credits of the GST charged on the purchases thus easing the tax burden.

- Nationwide Selling

A GSTIN allows you to perform inter-state sales and intra-state sales in India without dealing with extra tax issues. It simplifies transactions and ensures business compliance with state-specific tax laws.

- Simplified Taxation

It is due to GST that the taxation process has become very easy as a number of taxes have been merged into one tax. This helps businesses to easily meet compliance with GST laws and also eliminates the cumbersome task of dealing with multiple taxes.

Conclusion

After you have learned how to get GSTIN number for Flipkart, you will find that securing this registration is a smart business strategy for e-commerce sellers. It not only increases your credibility and expands your market base but also helps you abide by tax laws.

While it may appear to be more beneficial to sell without the GST, the benefits that come with having the GSTIN tend to overpower any demerits associated with it.

💡If you want to streamline your payment and make GST payments, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By