List of Special Category States under GST in India

- 10 Apr 25

- 11 mins

List of Special Category States under GST in India

- What is Special Category Status?

- Which States are notified as Special Category States in India?

- What is the Threshold Limit for Special Categories States?

- What Benefits Does the Central Government Give to Special States Categories?

- How to Compute the Threshold Limit for GST Registration When a Person is Operating in Both Special Category State and Regular States?

- How GST Affects Special Category States

- Conclusion

Key Takeaways

- Special Category States receive unique tax and financial concessions under GST to address developmental challenges.

- States like Himachal Pradesh and Assam benefit from reduced GST thresholds and increased central funding.

- GST registration threshold for these states increased from ₹10 lakh to ₹20 lakh post-April 2019.

- These states receive 30% of the Centre’s gross budget, along with 90:10 central funding for centrally-sponsored schemes.

- GST’s impact includes promoting industrialization, infrastructure development, and reducing regional disparities in special category states.

Special Category States, which come under the GST regime in India, are those specific states and union territories (UTs) which enjoy certain extra provisions. Such a ‘special status’ grants them exemption from corporate tax, customs duty, income tax and excise duty, among other tax obligations.

Due to these special category states frequently facing economic and developmental challenges, they are offered specific benefits/concessions with a view to promoting their overall growth and evolution.

30% of the state’s gross budget goes towards special category states under GST. Certain criteria exist for states to be classified under special categories. For example, the category shall include hilly states or ones with rocky terrains, low income levels, and more. Such socio-economic reasons do, indeed, play an essential role in the classification procedure.

In this blog, we shall examine some examples and explore the special category status group under GST more deeply.

What is Special Category Status?

Some states and UTs in India, assume the special category status. This status makes them eligible for a range of fiscal as well as developmental benefits under Section 22 of the GST (Goods and Services Tax). This initiative was a recommendation by the National Development Council.

Here is a list of the key features characterising the special category states:

- Tax Concessions: In order to boost industrialization efforts and attract investments, the special category states under GST are given tax exemptions. With such exemptions available, they are able to lessen their tax burden under the Goods and Services Tax (GST) regime.

- Central Assistance: The Centre allows the special category states to enjoy preferential treatment, in the form of aids, grants, and methods of economic support to prompt social growth.

- Flexible Funding: Special category states experience certain issues which are peculiar to them, owing to alternative socio-economic conditions. The Center, thus, offers more flexibility in terms of fund utilization, in order to address such complicated situational drawbacks.

- Plan Assistance: A major portion of the central government funds kept aside for yearly plans, is offered in the form of assistance to further develop the education, construction, and healthcare fields, in the context of special category states.

- Low Per Capita Income: States that have a lower per capita income, tricky topography, and other types of socio-economic challenges disrupting their all-rounded growth, are considered to be a part of the special category status.

Let us site an example of a special category state which benefits from the extra provisions and why they deserve the considerable assistance. Himachal Pradesh is a state which gains from the GST incentives offered. This is because the state is characterised by complicated pathways and hilly terrains. Plus, they have lower income levels, compared to the stats reflecting the state of the rest of the regions in India.

So, Himachal Pradesh is offered concessions that aim to boost industrialisation, investment, and employment opportunities, ultimately fostering all-rounded economic and infrastructural development.

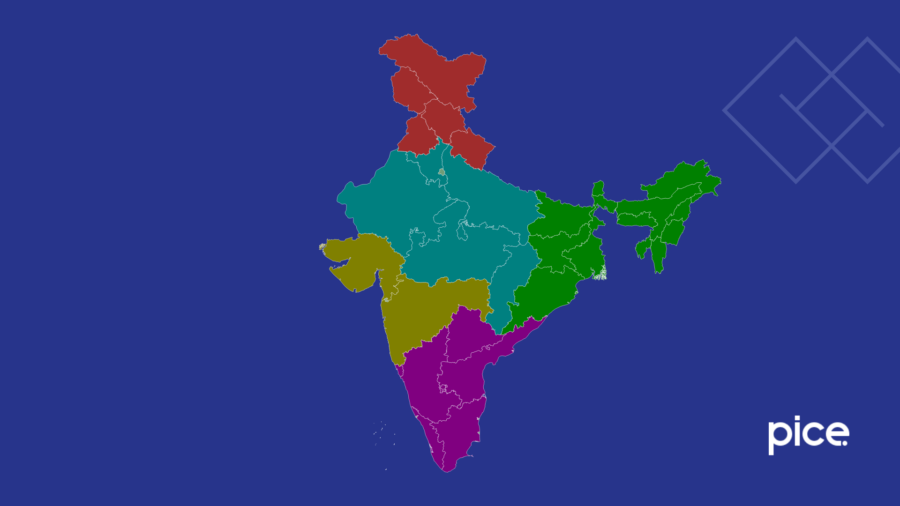

Which States are notified as Special Category States in India?

There are 11 states in India which occupy the special category status under GST, including:

- Assam

- Arunachal Pradesh

- Himachal Pradesh

- Meghalaya

- Manipur

- Mizoram

- Sikkim

- Nagaland

- Tripura

- Telangana

- Uttarakhand

What is the Threshold Limit for Special Categories States?

The table below lists the old and new threshold limits applicable for the special category states:

| Earlier/Newer | Registration Required or Not | Aggregate Turnover | Applicability |

| Earlier | Registration for special category states required | Exceeds Rs.10 lakh | Up till 31st March 2019 |

| Newer | Registration for special category states required | Exceeds Rs.20 lakh | 1st April 2019 onwards |

What Benefits Does the Central Government Give to Special States Categories?

Here are the benefits granted by the Central Government to Special Category states:

- 30 % of the plan expenditure is allotted to the special category states.

- Authorities do not allow the funds that are not used up, to lapse; instead, they are carried forward.

- The external aid special categories states and the Centrally Sponsored Scheme (CSS) get allotted a 90%; and 10% as a loan option.

- Tax benefits of various kinds are provided to the newly set-up businesses across special category status states, which constitute subsidies, comprehensive insurance subsidies, interest subsidies, and even transport subsidies.

How to Compute the Threshold Limit for GST Registration When a Person is Operating in Both Special Category State and Regular States?

According to the GST law, the aggregate value is referred to by the phrase, “aggregate turnover” in the case of these supplies:

- Exports;

- All taxable supplies (does not include the value of inward supplies on which the tax amount is payable on the reverse charge basis);

- Exempt supplies;

- Inter-state supplies;

The authorities in charge will be computing the aggregate turnover on the basis of the Permanent Account Number, on a PAN-India basis. The central tax, union territory tax, state tax, integrated tax or cess should not be considered when one is computing the aggregate turnover.

In case an individual is operating in both, a regular state as well as a Special category state, here is how the requirement to obtain a GST registration can be understood:

| Taxable Supplies within a Regular state | Taxable Supplies within a Special Category state(Uttarakhand) | Aggregate Turnover to establish the GST registration requirement | Requirement for GST registration |

| 5 Lakh | 5 Lakh | 10 Lakh | The aggregate turnover remains below the threshold limit for both of the states. Therefore, no GST registration is necessary in both the states |

| 20 Lakh | 10 Lakh | 30 Lakh | There is no requirement for GST registration as the aggregate turnover remains below the threshold limit in Punjab.GST registration is required in Uttarakhand. |

| 30 Lakh | 20 Lakh | 50 Lakh | GST registration is necessary in both the states. |

What is the Process of the GST Registration for Special Category States?

Here is the GST registration process for Special Category States:

Step 1: As a taxable person, create a profile on the GST portal. The registered person can proceed with the step.

Step 2: Provide the following information required in Part-A of GST REG-01:

- Select the type of GST registration from the displayed dropdown list.

- State

- Legal Name (as mentioned in the PAN).

- Permanent Account Number (PAN)

- Email Address

- Mobile Number

The GST portal will then display a list of GST registrations that have already been completed, are pending processing, or are rejected under the PAN, across all the states in India.

Step 3: Verify your mobile number as well as email ID with the relevant OTPs, as prompted by the GST Portal.

Step 4: A Temporary Reference Number (TRN) will be generated. It will be used up until the application for GST registration is completed. This TRN will be communicated to you via your e-mail address/mobile number.

Step 5: Part B of GST REG-01 shall then be filled using the TRN. The following details/documents need to be provided:

- Partners’/promoters details

- Business Details

- Authorised Signatory

- Principal Place of Business

- Authorized Representative

- Additional Place of Business

- Aadhar authentication

- State-Specific Information

- Goods and Services

- Verification

This will conclude the process of GST registration for special category states. The documents which are needed to be uploaded are the same as for regular GST registration.

How GST Affects Special Category States

This section shall specify how the special category states are affected by the implementation of GST.

Positive Impacts

Here are some positive impacts of GST in Special Category States

The Centre Provides Funds and Concessions

90% of the required funds in a centrally-supported scheme are paid by the Centre to the special category states. The percentage stands at 60% or 75% in the other states. The state governments pay off the remaining necessary funds. Hefty concessions are extended to the special status states in excise/customs duties, corporate tax as well as income tax. Note that 30% of the Centre’s Gross Budget is reserved for Special Category status-bearing states.

Promotion of Industrialisation and Tax Concessions

The Centre encourages the growth of industrialization efforts in the special category states. They provide this push by allowing for lowered GST rates and incentives for investment. This results in the increase of job opportunities and overall economic growth, especially within areas which are occupied by tribes and are characterised by poorly-cultivated industries.

Development of Infrastructure

The central and regional governments actively fund infrastructural development within the special category status states. This includes investments which go into bridges, roads, etc., in order to enhance transportation and connectivity in general.

This initiative is especially necessary as such states have hilly and uneven terrains which pose several complexities. The concessions help in generating more money for the overall social development, healthcare and education. Therefore, these states experience a degree of betterment in quality of life, literacy levels and healthcare.

Strengthening of Border Areas

The Centre invests in the security and trade aspects in relation to the special category states, polishing their strategic position next to their neighbour’s borders. This initiative is of great importance as it ensures the stability/development of economies in such regions.

More Funding

There is more flexibility in the aspect of fund allocation in special category status states. This allows the states to customize certain resources that would suit their unique development-related requirements. It will, simultaneously, boost the efficacy of developmental efforts.

Conclusion

To conclude, the Special Category States under GST form a major segment of the country's tax reform story. States like Assam, Arunachal Pradesh, Himachal Pradesh, Meghalaya and Manipur with higher tribal population, face certain, peculiar-to-them challenges which necessitate ‘special treatment’ from the Central government, under the GST regime.

So, the GST Council has settled on provisions for such states which aim to promote overall economic growth and compensate for the predictable losses of revenue. Regional disparities are also addressed actively.

The GST framework is evolving with time, with a view to strike a balance between the requirements of Special Category States and the objectives of the GST model. This shall steadily lead to a future with an equitable tax method for all states.

💡If you want to streamline your payment and make GST payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By