Rent Agreement Format for GST Registration

- 15 Apr 25

- 9 mins

Rent Agreement Format for GST Registration

- GST Registration & the Need for a Rent Agreement

- Role of Rent Agreement for GST Registration

- Why Is a Commercial Rent Agreement Required for GST Registration?

- When Do You Need a Rent Agreement for GST Registration?

- Key Elements of a Rent Agreement for GST Registration

- GST Clause in Rent Agreement – Why Is It Important?

- Sample Rent Agreement Format for GST Registration

- DOWNLOAD RENT AGREEMENT FORMAT FOR GST REGISTRATION

- Common Mistakes in Rent Agreements Leading to GST Registration Rejection

- Stamp Duty for Rent Agreement for GST Registration

- How to Ensure Your Rent Agreement is GST-Compliant?

- Conclusion

Key Takeaways

- Rent agreements are essential for GST registration from rented premises.

- Clearly mention address, lease terms, rent, and business usage.

- A GST clause simplifies and accelerates approval.

- Errors like incorrect addresses or signatures can cause rejection.

Goods and Services Tax (GST) registration is mandatory and hassle-free registration process for businesses exceeding the prescribed turnover limit or engaging in specific transactions. One of the key inclusion in the format for GST registration is a valid address proof for the principal place of business. In case of rental property, a rent agreement serves as crucial documentary evidence.

A legally valid rent agreement simplifies the GST registration process by proving the right to use the premises. However, it must fulfill certain conditions, such as being on stamp paper, duly signed, and accompanied by utility bills or an NOC from the owner.

Thus, in this article, we will explore all the particulars of a rent agreement for GST registration if you operate from a rented premise.

GST Registration & the Need for a Rent Agreement

If the aggregate annual turnover of a business exceeds the threshold limit of ₹10 lakh, ₹20 lakh, or ₹40 lakh (as applicable), it must register under GST (Goods and Services Tax). GST registration is crucial for businesses to collect tax (GST) from customers, claim and optimise ITC (input tax credit) on inward suppliers, and manage their tax liability.

While registering under GST, a business has to submit multiple documents, including an address proof. Suppose you plan to operate your business on a rented premise. In that case, you need to provide the tenancy agreement as proof of address of the concerned premises to complete the formalities of registration.

Role of Rent Agreement for GST Registration

A rent agreement plays a vital role in GST registration. For instance, a business might operate from owned or rented spaces. In such a scenario, a rent agreement acts as address proof for the rented space, ascertaining that the place of business is used for commercial purposes and not as a residential property. In other words, it confirms using the premises for business purposes.

Why Is a Commercial Rent Agreement Required for GST Registration?

The GST authorities ask for proof of address for documentation. A rental contract helps businesses present it as address proof and valid document submission helps complete the GST registration process faster. In other words, it is a necessary document for GST registration.

Moreover, without a valid rent agreement or other documents, the GST registration authorities reserve the right to reject your application. Thus, if you operate a business from a rented property, you must submit the rent agreement for documentation and smooth the GST registration process.

When Do You Need a Rent Agreement for GST Registration?

Here are the instances when you need a rent agreement to register under GST:

- If you operate your business from a rented property.

- In case the property of business operation is leased or shared.

Ensure your GST rental agreement format is drafted appropriately for seamless registration.

Key Elements of a Rent Agreement for GST Registration

A GST rent agreement needs to entail the following mandatory information as the key elements:

Mandatory Information in a Rent Agreement for GST Registration

Ensure you include the following mandatory details in your rent agreement for hassle-free GST registration:

- Name of the landlord and tenant

- Address of the tenant and the landlord

- Complete the address of the property along with the PIN code

- Lease terms such as the start and end date

- Monthly rent amount and the mode of payment followed by the terms

- Ensure mention of the usage clause, such as commercial or business use

- GST clause in the rent agreement

- Signatures of landlord, tenant and witnesses

- The amount of security deposits and the bank details where it is kept

GST Clause in Rent Agreement – Why Is It Important?

The GST clause in a rental agreement highlights that the landlord does not object to GST registration and charges GST on rent. It needs to mention:

- The landlord has no objection to the tenant’s GST registration

- Landlord is GST-registered (if applicable)

- The rate of GST (if GST on rent is applicable; the current GST rate on commercial properties and not residential dwellings is 18%)

- Person liable to pay GST (landlord or tenant)

Notably, this clause is not a mandate, but it can effectively improve the GST registration approval process.

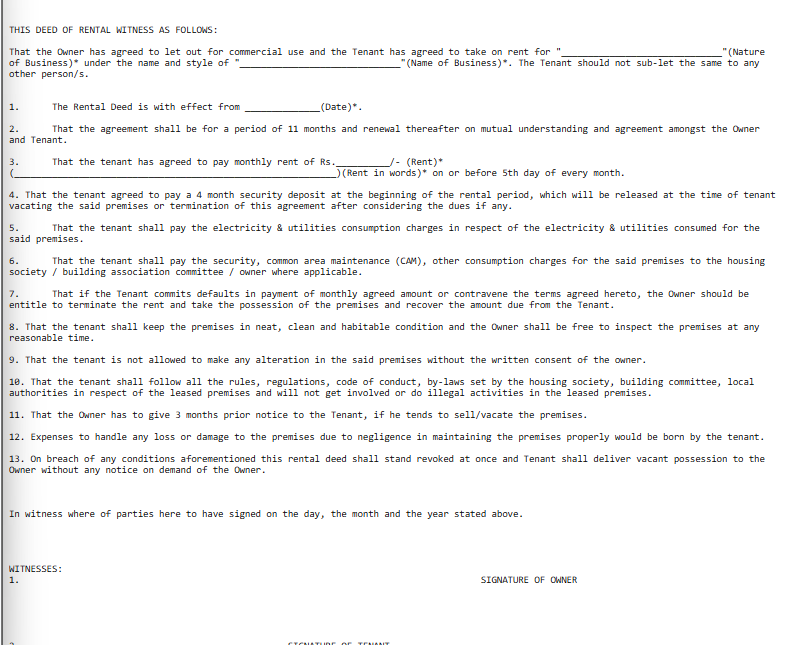

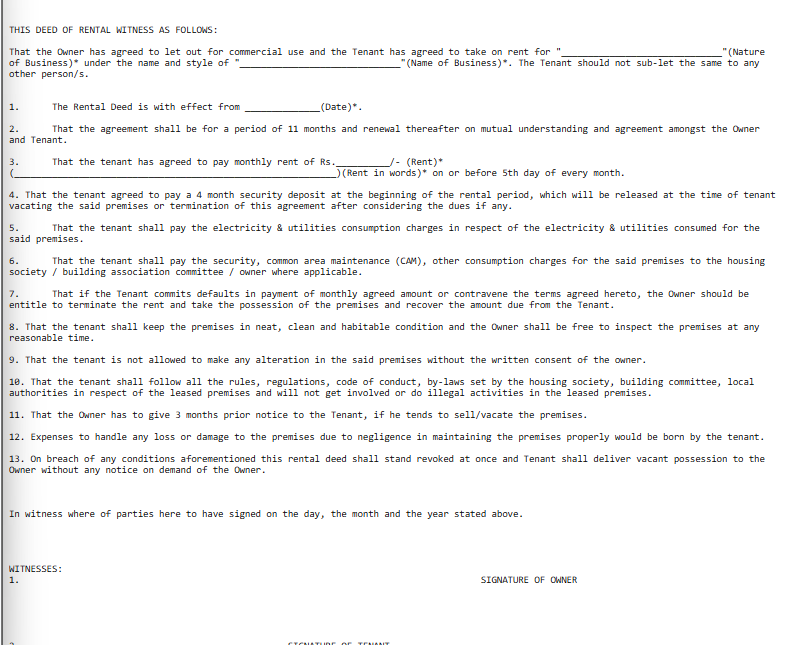

Sample Rent Agreement Format for GST Registration

Here is a sample of a rental agreement:

DOWNLOAD RENT AGREEMENT FORMAT FOR GST REGISTRATION

Common Mistakes in Rent Agreements Leading to GST Registration Rejection

To help you avoid GST registration application rejection due to incorrect GST rental address format, here are some of the common mistakes you need to avoid:

1. Incorrect or Incomplete Address

Missing or a mismatch in office or shop number, building name, floor number, PIN code or landmark can be some of the common mistakes. Ensure you enter all the details and match the information entered for accuracy before you apply for GST registration. Specifically, you need to ensure that you fill in the accurate address as an incorrect address can lead to rejection of GST registration.

2. Inconsistent Information Across Key Documents

Ensure the business name and other supporting documents in the GST rent agreement are the same. Further, landlord and tenant’s PAN and Aadhaar card details must be error-free.

3. Missing Stamp Duty Payment

The stamp duty on rent agreements might vary between Indian states. Ensure you adhere to state laws while using stamp paper. An incorrect stamp paper, for instance, using a ₹100 stamp paper instead of the required value, might lead to the rejection of a GST registration application. You need to pay the correct stamp duty for a seamless experience.

4. Lack of Proper Signatures & Notarisation

Your rent agreement must include the signatures of the landlord (property owner) and tenant, followed by witnesses. Ensure all the required parties appropriately sign the rent agreement. A missing signature or information might result in a rejection of the GST registration application.

Stamp Duty for Rent Agreement for GST Registration

You need to pay a government fee known as stamp duty to validate a legal document. The stamp paper value varies significantly based on the Indian state and the lease agreement duration. Ensure you verify the actual stamp duty with an advocate or notarised person before you prepare a rent agreement. Here are the stamp paper values of some of the states based on prior experience:

Stamp Duty Requirements by State

The stamp duty for different states is as follows:

● Noida, Uttar Pradesh: 2% of the rent amount

● Ghaziabad and Bulandshahr, Uttar Pradesh: 4% of the total rent amount

● Delhi: ₹200 stamp paper

● Haryana: 2% of the amount of total rent

How to Ensure Your Rent Agreement is GST-Compliant?

This is to ensure you have a GST-compliant rent agreement for business compliance. Following the aspects mentioned below can help you in the process:

- Use the Appropriate Format for Rent Agreement: The correct rent agreement format for GST registration needs to be followed, ensuring that the GST clause is included.

- Verify Details Before Submission: Ensure you match your electricity bill with the property details. Note that you checked the stamp duty value to ensure it is accurate as per your state and lease agreement period.

- Attach Supporting Documents: You need to attach the appropriate supporting documents, such as an electric bill that is not more than two months old, the landlord's PAN and Aadhaar card, and copies of the witnesses' Aadhaar (if possible).

Conclusion

Overall, A rent agreement plays a critical role in GST registration for businesses operating from rented premises. This rental agreement format for GST registration is backed by the use of the correct value of stamp paper.

Moreover, as discussed, the stamp duty varies between different states of India. As a result, ensure you verify the stamp paper value from an advocate or notarised person before you design the rent agreement. So, ensure all the necessary details are included in the rent agreement for a seamless GST registration experience.

💡If you want to streamline your payment and make GST payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By