Related vs Distinct Person under GST in 2025

- 22 Jul 25

- 8 mins

Related vs Distinct Person under GST in 2025

- Meaning of ‘Distinct Person’ Under GST

- Meaning of ‘Related Person’ Under GST

- How the Coverage of Goods/Services/Both Differs between the ‘Related persons’ & ‘Distinct Persons’—Is ’It Classified as ‘Supply’ Under GST?

- How the Supply Valuation Differs When Initiated by a Related Person/Distinct Person

- Conclusion

Key Takeaways

- A ‘distinct person’ refers to different GST registrations of the same legal entity across states or business verticals.

- A ‘related person’ includes entities with shared control, ownership, or family/business connections as defined under Section 15(5).

- Supply between related or distinct persons is considered a ‘supply’ under GST—even if made without consideration.

- Such supplies are taxable and must follow valuation rules under Rule 28 when market value is unavailable.

- Understanding these distinctions helps businesses remain compliant in inter-unit and inter-related party transactions.

In the case of a transaction commencing between ‘related persons’ and ‘distinct persons’, the two shall be treated differently under the GST system. We shall understand what the phrases ‘distinct person’ and ‘related person’ mean and their prevalence under the GST law.

This shall help your grasp of the supply and valuation concepts in regards to ‘distinct persons’ and ‘related persons’.

Before diving into the topic of related vs. distinct person under GST, let us first understand what the terms ‘distinct person’ and ‘related person’ imply in the upcoming sections.

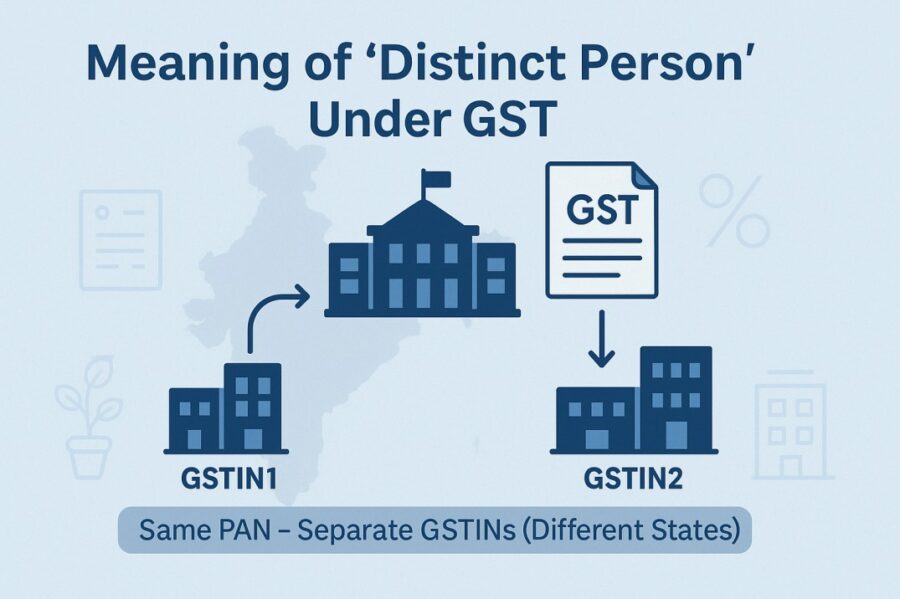

Meaning of ‘Distinct Person’ Under GST

The phrase, ‘Distinct Person’ and the overall concept have been recorded as a new introduction to the GST law scope. We shall simplify the provisions of section 25 (5) and section 25 (4) under the CGST Act which describe the concept of ‘Distinct Person’.

If an individual has obtained or is needed to obtain more than 1 registration, they will be treated as a ‘distinct person’ in the context of said registration. The registration may be in 1 State or a Union Territory or even in more than 1 State or Union Territory.

Further, it is crucial to consider the case of establishments. Say, an individual has obtained or is needed to obtain registration in 1 State or Union Territory in the context of an establishment. If the same individual has an establishment in a different State or Union Territory, the respective establishments will be viewed as establishments of the ‘distinct persons’.

In short, ‘Distinct Persons’ may be:

- An establishment within or outside India;

- An establishment in 1 state/union territory; or in different states/union territories

Any individual in possession of a valid PAN who is required to register must apply for GST registration in each state/union territory. This has to be done within 30 days of becoming liable for said registration.

Note that business verticals in the states may obtain more than 1 GST registration, given that they have various associated risks, functions and returns from the various segments. So, when the same business’s two different units obtain separate registrations, the units shall be considered ‘distinct persons’ or ‘entities’ under the GST framework.

Meaning of ‘Related Person’ Under GST

In the Explanation part under section 15 (5) of the CGST Act, the phrase ‘related person’ has been described. According to the explanation provided, an individual will be deemed as a ‘related person’ in the following cases:

- Such individuals are the directors/officers of each other’s business;

- Such individuals are legal partners in the same business;

- Such individuals share the relationship of an employer and their employee;

- One of the individuals either directly or indirectly oversees the other person;

- Together, the individuals directly or indirectly oversee the third person;

- Both the individuals are directly or indirectly controlled by a third person;

- Either the individual directly or indirectly owns, oversees or holds about 25% (or more) of the outstanding voting stock/shares/both;

- The individuals associated with each other in business, via a sole agent figure/ sole concessionaire/sole distributor or however described.

- Individuals are the members of a family.

Please note that 'Person' refers to the 'taxable person' and the 'legal person'.

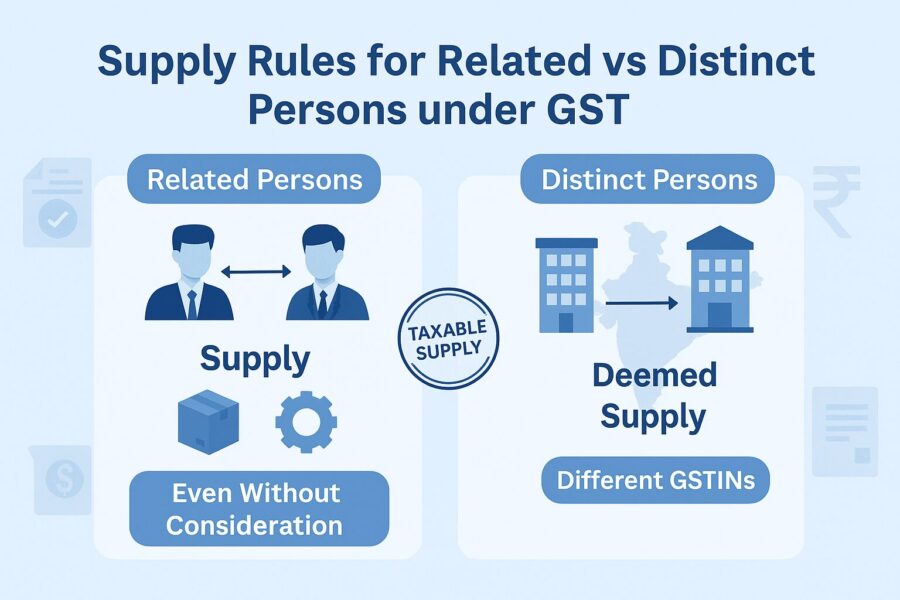

How the Coverage of Goods/Services/Both Differs between the ‘Related persons’ & ‘Distinct Persons’—Is ’It Classified as ‘Supply’ Under GST?

Now that you’ve got an idea about what the phrases ‘distinct person’ and ‘related person’ mean, let’s understand whether or not the supply between persons under the 2 categories is deemed as ‘supply’ in the context of GST law.

Respective provisions in relation to the concept of supply (that have to do with ‘related persons’ and ‘distinct persons’) are specified under the CGST Act’s schedule I. This section details ‘activities’ which are to be treated as ‘supply’ even when made without consideration.

According to the provisions, supply of goods/services/both made with the aim of furtherance of business between related persons or distinct persons will be viewed as ‘supply’ even if it is made without consideration of the same.

So, the transaction commenced between the distinct persons or related persons, regardless of consideration, shall be treated as ‘supply’. Therefore, it shall be taxable under the GST law.

How the Supply Valuation Differs When Initiated by a Related Person/Distinct Person

From the above section, we’ve concluded that the supply transaction initiated between distinct persons/related persons is taxable under GST. Now, let’s get into the nitty-gritty and understand how the valuation of supply rules is established.

The section 15 of the CGST Act, 2017 deals with the concept of value calculation in relation to the taxable supply. But according to the section 15 (4), in case the goods’ or services’ or both values cannot be established (as per section 15 (1)); it shall be determined according to applicable valuation rules.

The valuation rules include Rule 28, which specifically deals with the cost of supply of goods/services/both between distinct persons or related persons. If the sequential order is followed, the goods/services/both supply value would be:

- The respective open market value;

- If the value in the open market is not available for reference, the supply value of quality and like kind;

- If both the channels of valuation are blocked, the supply value of goods/services/both shall be based on the cost (supply cost (cost of production) + markup of 10% = value supply);

- In case the above-mentioned valuations are not possible to deduce, a residual method shall be adopted for the determination of the supply value of goods/services/both. This value will be deduced with the help of reasonable means that remain consistent with the principle norms and generally accepted provisions.

Conclusion

Having an understanding about related vs. distinct person under GST is important for businesses that are based across different areas. This knowledge shall help in the navigation of tax implications, especially in regards to the supplies between distinct persons and related persons.

We hope this blog call helps you gain an upper hand in the navigation of the complex tax landscape.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

What is the meaning of a ‘Distinct Person’ under GST?

Who is considered a ‘Related Person’ under GST law?

Are supplies between related or distinct persons considered taxable under GST?

How is the value of supply determined between related or distinct persons?

Open market value,

Value of like kind and quality,

Cost of production + 10% markup,

Residual valuation method.

This ensures fair value is assigned for tax calculation when parties are related or considered distinct.

By

By