Invoice Registration Portal Under GST: IRP

- 17 Oct 25

- 8 mins

Invoice Registration Portal Under GST: IRP

Key Takeaways

- IRP ensures authenticity — Every GST invoice must be validated and assigned a unique Invoice Reference Number (IRN) through the IRP to be legally valid.

- Seamless integration — The IRP automatically shares validated invoices with the GST and e-way bill systems, reducing manual errors and duplication.

- Compliance made easy — With digital IRN generation and QR codes, businesses can maintain real-time and secure invoicing practices.

- Mandatory for specific taxpayers — Businesses with annual turnover above ₹5 crore must generate e-invoices through IRP for all B2B transactions.

- Promotes transparency — The IRP strengthens compliance, prevents tax evasion, and simplifies GST return filing through digital standardisation.

Ever wondered how businesses ensure their invoices are GST-compliant and secure? If not, here is your chance to learn about the use of the IRP platform.

It serves as the central platform for generating Invoice Reference Numbers (IRNs). The invoice registration portal under GST plays a crucial role in making sure that real-time validation and authentication of invoices are carried out through the e-invoice system.

This article provides an overview of the functioning, benefits, and key processes associated with the IRP under GST. So, keep reading to help your businesses achieve accurate and efficient invoicing practices.

What is an Invoice Registration Portal (IRP)?

The Invoice Registration Portal, or IRP, is a registrar that operates with the help of a website. Its primary function is to assign Invoice Reference Numbers (IRNs) to all of the credit notes, debit notes, and invoices under India's Goods and Services Tax framework.

One can use a prescribed mode to either validate or generate the IRN of any uploaded invoice within a stipulated timeframe after uploading it to the IRP. E-invoice registration with the IRP portal becomes necessary because only CDNs/invoices with an authorised IRN are legally valid.

As of May 1, 2023, businesses that have an annual turnover of more than or equal to Rs. 100 crore are required to report CDNs/ invoices. This report is to be done on IRP in 7 days from the date of invoices/CDNs. For old invoices, this 7-day time limit has been extended to three months.

Why Was IRP Introduced?

Before IRP, the process of filing invoices was manual, resulting in delays and errors. The invoice registration portal under GST was introduced to digitalise the whole process.

Digitalisation solves the issues of delays.

Moreover, this introduction was also intended to prevent invoice duplication and fraud, as well as to improve the accuracy of data fields.

Who Needs to Use IRP?

For the first time, starting from October 1, 2022, all businesses with an annual turnover of over Rs. 10 crore were required to perform their e-invoicing on the IRP. In the most recent amendment, the GST Council has lowered the turnover requirement for businesses from Rs. 10 crore to Rs. 5 crore. This change came into effect on August 1, 2023.

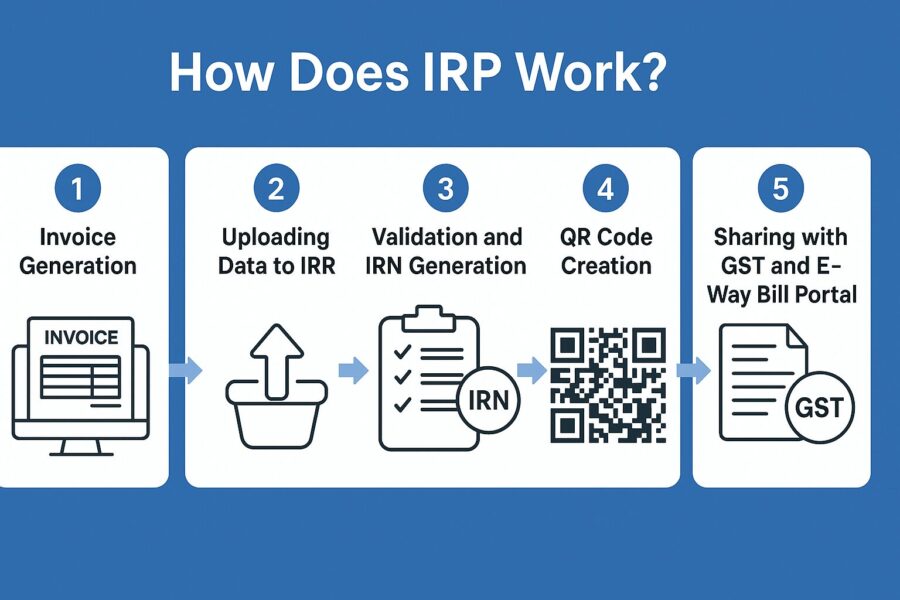

How Does IRP Work?

To understand how IRP works, read the step-by-step process discussed below:

Step 1: Invoice Generation

Businesses utilise invoicing software or accounting software as e-invoice generation systems to create invoices. These businesses need to create invoices in a predefined format.

Step 2: Uploading Data to IRP

After the above step, the businesses upload details of the invoice to the IRP with the use of Application Programming Interface (API) or other offline tools.

Step 3: Validation and IRN Generation

The role of IRP is to prevent duplication of invoices and then verify them. After verification and validation, the IRP system creates a specific Invoice Reference Number (IRN) for a particular business. Lastly, a digital signature is added to the invoice before passing it to the entity.

Step 4: QR Code Creation

A QR then incorporates all invoice details. Any entity wanting to see invoice details can scan the QR. QR codes also prove the authenticity of an invoice.

Step 5: Sharing with GST and E-Way Bill Portal

The GST portal receives the invoice after it has been validated. Autopopulation of GSTR 1 return happens after this, as it gets the information from the GST system.

Key Features of the IRP

The key features of the GST invoice registration portal are as follows:

- With the use of IRP, error detection and duplication of invoices become easier.

- The use of digital signatures is effective in the verification process for invoices.

- QR codes facilitate the quick verification of invoice information.

- Minimisation of manual data entry is a result of automated data sharing of validated invoices with the GST and e-way bill systems.

- Both offline and online accessibility of the system is possible, with additional.

- Value-added services, such as integration with third-party applications, enhance the user experience.

Benefits of Using IRP

Some primary benefits of using an invoice registration portal under GST are as follows:

- With automated systems, compliance becomes easier.

- The IRP validation and generation have also become faster.

- Prevention of invoice duplication reduces fraud due to a unique IRN.

- IRP’s integration with the government GST portal makes tax filing simpler.

- Record keeping for future references becomes effortless.

These advantages are continuously reviewed through IRP Evaluation mechanisms by relevant authorities.

Essential Points About IRP Usage

Below are a few crucial points to remember about the invoice registration portal under GST:

- When the annual turnover of a taxpayer is equal to or over Rs. They need to upload invoices on IRP within 7 days of the invoice date, amounting to ₹ 100 crores.

- There are private IRPs, apart from NIC-managed IRPs, that a business can use.

- The invoice details need to be in a JSON file format for uploading.

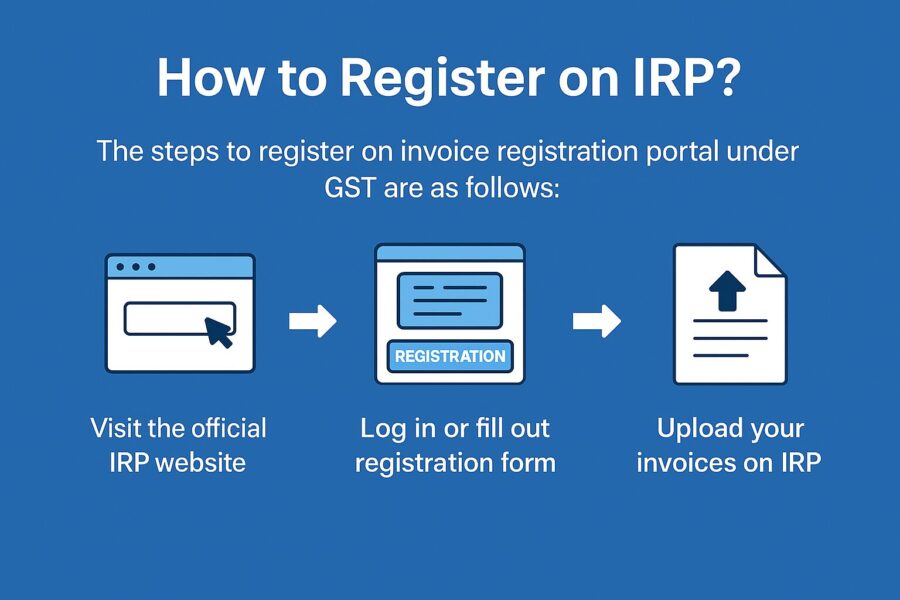

How to Register on IRP?

The steps to register on invoice registration portal under GST are as follows:

- Firstly, you need to visit the official IRP website.

- Then log in to or fill out the registration form to create a new account there.

- After successful registration, you can easily upload your invoices on the IRP.

Common Challenges and Solutions

Below are a few challenges and their resolution for invoice registration portal under GST:

- Technical issues with IRPs can be a common problem. The solution for this is to consult an authorised GST Suvidha Provider (GSP) or a software provider.

- Errors in data entered can cause issues, so remember to double-check the data before submitting it.

- Untimely reporting can lead to penalties, so remember to report timely.

Conclusion

The invoice registration portal under GST has helped the government in India’s evolving tax regime. It has done this by standardising invoice reporting and strengthening compliance. Its integration with the GST system not only promotes accountability but also simplifies the GST return filing process for taxpayers.

Moreover, with further technological advancements and changes to the portal, it will continue to evolve and enhance the effectiveness of the taxation system. Thus, understanding its operations remains essential for businesses to leverage the advantages of digital e-invoice registration fully.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By