How to Reverse ITC in GST Portal?

- 26 Aug 24

- 11 mins

How to Reverse ITC in GST Portal?

Key Takeaways

- Timely Vendor Payments: Ensure payments to suppliers within 180 days to avoid ITC reversal, as stipulated in Rule 37.

- Track Usage: Regularly monitor the use of inputs and capital goods to distinguish between business, personal, and exempt purposes, complying with Rule 42 and Rule 43.

- Accurate Reporting: Report ITC reversals promptly in GSTR-3B and GSTR-9 to align with GST compliance and avoid interest charges.

- Maintain Records: Keep detailed records in the Electronic Credit Ledger for all ITC availed, utilized, and reversed, ensuring transparency and compliance.

- Compliance Tools: Utilize ERP systems and e-filing solutions to manage and optimize ITC, ensuring adherence to GST regulations and efficient financial management.

The reversal of Input Tax Credit (ITC) refers to the process of returning the claimed ITC to the government when certain conditions are not met. This ensures that the credit is only utilized for legitimate business purposes and complies with the GST regulations.

Specific conditions for ITC reversal:

Input Tax Credit (ITC) reversal can occur under several specific conditions. Understanding these conditions is crucial for businesses to ensure business compliance and avoid penalties. Here are the key scenarios where ITC reversal is required:

Rule 37: Reversal of ITC in case of non-payment of consideration

- Condition: If a registered person has not paid the supplier within 180 days from the date of issue of invoice, ITC availed must be reversed.

- Process: The amount of ITC to be reversed should be added to the output tax liability, along with interest.

Rule 37A: Reversal of ITC in case of non-payment of tax by the supplier and re-availment thereof

- Condition: If the supplier does not pay tax on the supply, the recipient must reverse the ITC availed.

- Process: The recipient can re-avail the ITC once the supplier pays the tax.

Rule 38: Claim of credit by a banking company or a financial institution

- Condition: Banking companies or financial institutions, including non-banking financial companies, can claim ITC on inputs/input services only to the extent of the credit attributable to taxable supplies including zero-rated supplies.

- Process: They must follow the provisions laid down under this rule for apportionment and reversal of credit.

Rule 42: Manner of determination of ITC in respect of inputs or input services and reversal thereof

- Condition: ITC on inputs and input services used for both taxable and exempt supplies must be reversed proportionally.

- Process:

- Calculate D1 (ITC attributable to exempt supplies) and D2 (ITC attributable to non-business purposes).

- Common Credit (C3) = Total ITC - D1 - D2.

- D3 = C3 × (Turnover of exempt supplies / Total turnover).

- Eligible ITC = C3 - D3.

Rule 43: Manner of determination of ITC in respect of capital goods and reversal thereof in certain cases

- Condition: ITC on capital goods used for both taxable and exempt supplies must be reversed proportionally over the life of the asset.

- Process:

- ITC on capital goods to be attributed over five years.

- Monthly ITC reversal = Total ITC / 60 months.

- Adjust ITC based on the ratio of exempt to total supplies.

Rule 44: Manner of reversal of credit under special circumstances

- Condition: In case of special circumstances such as cancellation of registration or switching to composition scheme, ITC must be reversed.

- Process:

- Calculate the reversal amount based on the remaining useful life of capital goods.

- Reversal amount = ITC taken × (remaining useful life / 60 months).

TC Reversal Situations

Input Tax Credit (ITC) reversal can occur under several specific conditions. Understanding these conditions is crucial for businesses to ensure direct tax compliance and avoid penalties. Here are the key scenarios where ITC reversal is required:

- Non-Payment to Suppliers:

- If the payment to the supplier is not made within 180 days from the date of the invoice, the ITC availed needs to be reversed. This condition emphasizes the importance of timely vendor payments in maintaining ITC eligibility.

- Non-Business Purposes:

- When goods or services are used for non-business purposes, ITC is not allowed. This includes items used for personal consumption or any activities not related to the taxable supply of goods or services.

- Exempt Supplies:

- Goods or services used to make exempt supplies are not eligible for ITC. Exempt supplies refer to goods or services that are not subject to GST. Businesses must carefully track the use of inputs to ensure correct ITC claims.

- Capital Goods:

- If there is a change in the use of capital goods from taxable to exempt supplies or personal use, ITC reversal is required. Capital goods initially intended for taxable supplies but later diverted to exempt or personal use must be monitored.

- Input Services:

- Similar to capital goods, if input services are initially used for taxable supplies but later diverted for non-business or exempt supplies, the ITC claimed must be reversed. This condition ensures that ITC is only claimed for business-related and taxable activities.

GST ITC Reversal as Per Rule 37

Rules and Provisions

As per Rule 37 of the CGST Rules, 2017, Input Tax Credit (ITC) availed must be reversed if the recipient of goods or services fails to make the payment to the supplier within 180 days from the date of the invoice. The rule ensures that the credit availed is used only for genuine business transactions.

Reporting in GSTR-3B

When the ITC is reversed due to non-payment within 180 days, the amount of ITC to be reversed should be added to the output tax liability in the GSTR-3B for the relevant tax period. This ensures that the reversed ITC is appropriately accounted for in the monthly return, adjusting the taxpayer’s liability accordingly.

Reporting in GSTR-9

In the annual return form GSTR-9, there is a requirement for the annual reconciliation and reporting of ITC, including any ITC reversed during the year due to non-payment within 180 days. The details of such reversals should be reported to ensure that the ITC claimed throughout the year matches the actual eligible credit after accounting for reversals.

So, the taxpayers can no longer claim 5% provisional ITC under the CGST Rule 36(4) and ensure every ITC value claimed was reflected in GSTR-2B

Rules and provisions related to the reversal of Input Tax tax of GST

ITC Reversal Requirements:

- Rule 42 and Rule 43 of the CGST Rules, 2017, outline the circumstances under which ITC must be reversed. Rule 42 deals with the reversal of ITC on inputs and input services used for both taxable and exempt supplies or for business and non-business purposes. Rule 43 deals with ITC on capital goods used for both taxable and exempt supplies.

- Rule 37 requires the reversal of ITC if the recipient fails to pay the supplier within 180 days from the invoice date. This must be reported in Table 4B of GSTR-3B.

- Rule 44 mandates ITC reversal for non-taxable supplies, where ITC availed on inputs, input services, and capital goods used for non-taxable supplies must be reversed.

2. Reporting of ITC Reversal in GSTR-3B:

- ITC reversals are reported in Table 4(B) of the GSTR-3B form. This includes reversals due to ineligible ITC under various rules like Rule 42, Rule 43, and Rule 37.

- The reversed ITC amount is added to the output tax liability for the month in which the reversal occurs, and interest at 18% per annum is payable from the date of ITC availing until the date of reversal.

3. Reporting of ITC Reversal in GSTR-9:

- Annual return GSTR-9 requires details of ITC reversals in Table 7. This includes various types of reversals under different rules and provisions throughout the financial year.

4. FORM GSTR-2:

- GSTR-2 is a return form for inward supplies received during the month. It includes the details of ITC availed and the amount of ITC that needs to be reversed due to non-compliance with provisions like Rule 37 and Rule 42.

5. Debit and Credit Notes:

- Debit Notes: Issued by the supplier to the recipient if the taxable value or tax charged in the original invoice is less than the actual amount. The recipient must reverse ITC claimed based on the original invoice and adjust it as per the debit note.

- Credit Notes: Issued by the supplier to the recipient if the taxable value or tax charged in the original invoice exceeds the actual amount. The recipient must adjust the ITC claimed based on the original invoice accordingly.

6. Electronic Credit Ledger:

- The Electronic Credit Ledger is used to maintain records of ITC availed, utilized, and reversed. Accurate entries in this ledger are crucial for compliance and avoiding penalties.

7. Common Credit and Pro-Rata Basis:

- Common Credit (C2) is the ITC on inputs and input services used for both taxable and exempt supplies. Rule 42 provides a formula to calculate the portion of ITC attributable to exempt supplies that must be reversed.

- ITC reversal is calculated on a pro-rata basis, taking into account the turnover of exempt and taxable supplies.

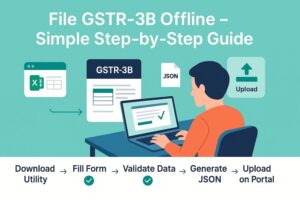

Process to Reverse ITC Under GST

Reversing Input Tax Credit (ITC) in the GST portal involves meticulous attention to various sources and types of inputs, supplies, and compliance requirements.

- The process begins with identifying the Credit on Inputs, including capital goods and services that contribute to the Common Credit C2.

- Tax professionals must carefully apportion the Tax Credit Attributable to Personal Purposes or Exempt Or Non-Business Supply, ensuring accurate reporting in the GSTR-3B and GSTR-2 forms.

- To achieve a Complete Supply Chain Solution, businesses must manage Outward Supplies and account for the Type Of Output Supplies—taxable, exempt, or nil-rated.

- To optimize ITC, compliance with Secretarial Compliance and proper reporting of ITC reversal for inputs utilized for Personal Purposes or Exempted / Non-Business Purpose is crucial. This process is interconnected with the Connected Finance Ecosystem and involves tools like the Electronic Ledger and ERP E-TDS Return Filing Solution to maintain accurate records.

- For instance, under Rule 37(1), the reversal is necessary if the supplier fails to make payment within the stipulated 180-Day Period.

In cases where ITC is claimed but not eligible, the Credit Reversal Failure needs to be addressed immediately. This requires understanding Taxable Person obligations and adhering to provisions for Return In Form GSTR-3B.

The entire ecosystem, including E-Way Bill management and compliance with Major Provisions and Terms Of Rule, supports a seamless process for ITC reversal and effective Apportionment Of Credit.

Tax Professionals and businesses aiming for a Complete Table of compliant transactions must also focus on Provisions Of Clause and Non-Obstante Clause within the GST framework, ensuring Returns In Relation are filed accurately and timely.

Thus, maintaining compliance across various Return Periods, Tax Period Notes, and ensuring all Relevant Details are communicated efficiently. This detailed approach ensures businesses can maintain a robust and compliant Indian Finance Ecosystem while leveraging Optimised ITC for their operational and financial efficiency.

Conclusion

Adhering to reversal of ITC ensures compliance with GST laws, preventing misuse of tax credits. Businesses must maintain accurate records and timely report ITC reversals to avoid penalties and interest charges.

💡 If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for paying all your business expenses.

By

By