How to File Nil GST Return Online Easily?

- 4 Nov 25

- 8 mins

How to File Nil GST Return Online Easily?

Key Takeaways

- Filing a Nil GST Return is mandatory even when there are no sales, ensuring compliance with GST regulations in India.

- You can file Nil GSTR-3B or GSTR-1 easily through the official GST Portal or via SMS for faster submission.

- Non-filing of a Nil GST Return attracts a late fee of ₹20 per day, so timely filing is crucial for small businesses.

- A taxpayer can file a Nil GST Return online only if there are no outward supplies, ITC claims, or tax liabilities.

- Regular and accurate Nil GST Return filing helps maintain a clean tax record and prevents future GST compliance issues.

Have you ever wondered if you still need to file a GST return when there are no sales transactions in your business? The answer is yes, and this is where a GST Nil Return comes in. Even if your business has not made any taxable activity during a tax period, you are still required to submit a return to stay compliant.

This blog will inform you about what a GST Nil Return is and why it matters. It will also answer any questions you have regarding how to file nil GST return.

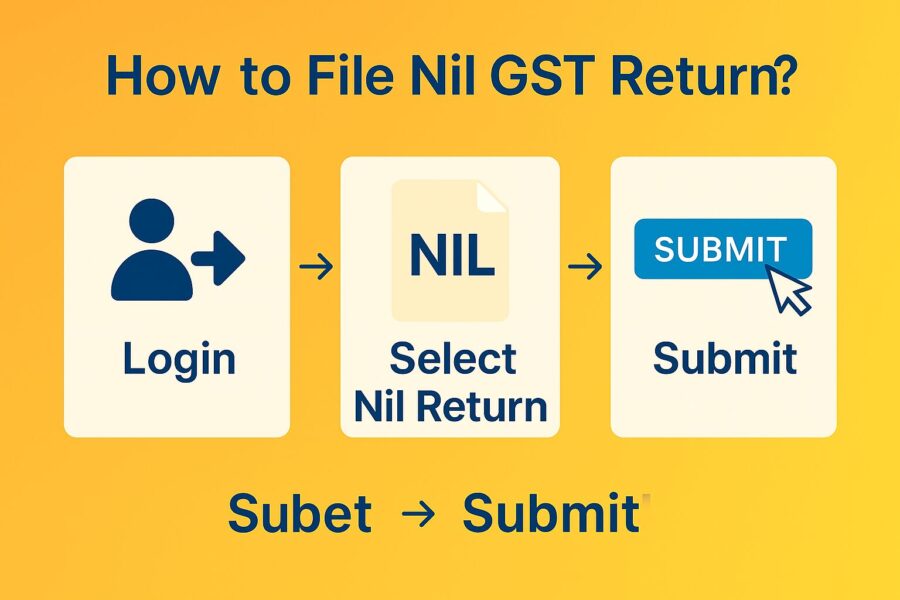

How to File Nil GSTR Return?

Let us get directly into the steps of how to file nil GST return. You can easily carry out this process by following these steps:

Step 1: Visit the official GST Portal and log in to your account using the correct credentials.

Step 2: Then you will have to navigate to the ‘Returns Dashboard’. To do this, sequentially select ‘Services’ > ‘Returns’ > ‘Return Dashboard’.

Step 3: From the dropdown list, you will need to fill in two fields: ‘Financial Year’ and ‘Return Filing Period’.

Step 4: After this, you will have two options: GSTR-3B return and GSTR-1 return. Select GSTR-1 or GSTR-3B and then select the ‘Prepare Online’ option.

Step 5: There will be a lot of fields to fill in after this. However, since you are filing for a nil GST return, you will have to answer ‘Yes’ to the question of ‘Do you want to file a Nil return?’. This will automatically disable other fields that will be irrelevant to you.

Step 6: Then you have to select ‘Save’ option and ‘Generate Summary’ to compile all of the return data.

Step 7: Further, review all of the details by selecting ‘Preview’. When all information is correctly verified, click on ‘Submit’.

Step 8: Finally, to file the return, you will need to select either of the two options: ‘File with EVC’ for Electronic Verification Code or ‘File with DSC’ for Digital Signature Certificate.

After you have filed the nil goods and services tax return successfully, an ARN (Application Reference Number) will be generated for its acknowledgement. Make sure to remember the ARN as it will be necessary later for tracking your Goods & Services Tax application’s progress.

Why Is It Necessary to File a Nil GST Return?

If a dealer with proper GST registration makes no outward taxable supplies during a month, they still need to file a nil return for that period. In such cases, the taxpayer is not required to fill in all the details usually submitted in GSTR-1 and GSTR-3B, since there are no sales to report.

However, failing to file the GSTR-1 return still attracts a penalty of ₹100 per day. Earlier, the late fees for delay in nil GST return filing was ₹200 per day. Reduction of this amount was done by CBIC later via notification. Now, for both GSTR-1 and GSTR-3B nil returns, the late fee is ₹20 per day.

Who Needs to Submit a Nil GSTR?

Taxpayers must submit the GSTR-1 form even when they record no business activity, monthly or quarterly, during a given period. In these cases of no transactions, they need to file a nil GSTR-1. The taxpayers should make sure that the count of all exempt and taxable items in the outward supplies while submitting the return is zero.

There are four conditions when a taxpayer can file Nil GSTR-3B return. These are as follows:

- The taxpayer does not want to claim Input Tax Credit (ITC).

- They do not have any reverse charge liability.

- The taxpayer has no outward supply.

- They do not have tax liability for that specific tax period or its previous one.

Can One Avoid Filing a Nil ITR?

One does not need to file a Nil ITR if their total income falls below the basic exemption limit. This total income is calculated after claiming all eligible deductions. However, many individuals still choose to file a Nil ITR voluntarily.

Filing a Nil ITR helps maintain an official financial record, which strengthens your case for loans or visa applications. It also enables you to claim refunds on any excess TDS and lets you carry forward specific losses.

Even without any tax liability, submitting a Nil ITR shows financial discipline and may ease future compliance or paperwork processes.

Due Dates to Follow for GST Return in India

The due dates for filing a few GST return forms from the GSTN portal are as follows:

| Form Number | Due Date | |

| GSTR-1 (Monthly return for outward supplies) | For taxpayers with turnover above ₹5 crore | 11th of the next month. |

| Quarterly for small taxpayers under the QRMP scheme | 13th of the month after the quarter. | |

| GSTR-3B (Monthly summary return for tax payment) | Staggered deadlines based on the state | 20th of the coming month. |

| Quarterly for QRMP taxpayers | 22nd or 24th of the coming month after the quarter. | |

| GSTR-9 (Annual return summarising yearly transactions) | 31st December of the coming financial year. | |

| GSTR-4 (Annual return for composition scheme taxpayers) | 30th April of the coming financial year. | |

Common Errors When Filing Nil GSTR via SMS

Errors are common while GST filing of Nil Return. A few of these errors that you can look out for are as follows:

- You have used the wrong syntax during the composition of the SMS. This can be anything from incorrect keywords and missing spaces to the wrong format of the return period.

- Entering the wrong GSTIN or incorrect return period format.

- Use of an unregistered mobile number (on the GST portal, which is linked to the authorised signatory) to send the message.

- Not being eligible for filing a nil-GST return. This can happen even if one transaction, such as debit/credit notes, outward supplies, or amendments, for the period, exists.

Conclusion

Understanding how to file nil GST return may appear redundant when there are no outward or inward transactions, but it remains a vital compliance requirement under the GST regulations. Failure to file, even during inactive periods, can lead to penalties, late fees, and issues with future filings.

The good news is that the process is straightforward once you are familiar with the steps. Whether you are a freelancer, small business owner, or seasonal trader, timely nil return filing helps you maintain a clean GST regime and avoid unnecessary legal implications.

By staying proactive and filing consistently, regardless of your transaction volume, you demonstrate financial discipline and ensure smooth operations. Now that you know how to file a Nil GST return, you are better equipped to meet your tax responsibilities with confidence.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By