How to File Nil Annual GST Return Online 2025

- 4 Nov 25

- 7 mins

How to File Nil Annual GST Return Online 2025

Key Takeaways

- File your NIL Annual GST Return (GSTR-9) before 31st December 2025 to maintain GST compliance for FY 2024-25.

- Avoid penalties under GST law by filing NIL GSTR-9 on time, even if you had no business activity.

- Learn how to file NIL GSTR-9 online through the GSTN portal easily in just a few steps.

- Understand the difference between GSTR-9, GSTR-9A, and GSTR-9C to ensure correct GST return filing.

- Stay compliant with annual GST return filing to keep your business records clean and error-free under GST regulations.

Did you know that you need to file your nil annual GST return by 31st December 2025 for FY 2024-25? Missing this date can lead to legal consequences against the businesses. Yes, even when you have had no sales or purchases!

Filing GSTR 9 for NIL GST return can easily be done through the online GSTN portal. So, keep reading to get informative content about how to file NIL GST return and other details regarding GSTR 9.

Differentiating GSTR-9, GSTR-9A, and GSTR-9C

The key difference between GSTR-9, GSTR-9A, and GSTR-9C, based on their filing conditions under the Goods and Services Tax regime, is as follows:

| GSTR-9 | GSTR-9A | GSTR-9C |

| Filed by taxpayers registered as normal taxpayers, including SEZ developers and SEZ units. | Filed by taxpayers under composition scheme. | Filed by every registered individual who has an aggregate turnover of more than a certain threshold during a financial year.The Government of India notifies regarding this threshold from time to time on the GST portal though notifications. |

What is Nil Annual GST Return?

NIL GST return is an annual GSTR filed through Form GSTR-9, which is one of the GST return types under the GST system. As per the set guidelines of the GST council, one only needs to file this return once in each tax period of the financial year.

CGST rules state that the individuals who need to file GSTR-9 include taxpayers registered as normal taxpayers (including SEZ developers and SEZ units). These normal taxpayers are the ones who have withdrawn from the composition scheme under the GST laws.

In Form GSTR-9, these taxpayers need to fill in the details regarding sales, purchases, demand created/refund claimed/input tax credit (ITC), and more, ensuring accurate filing as per GST regulations.

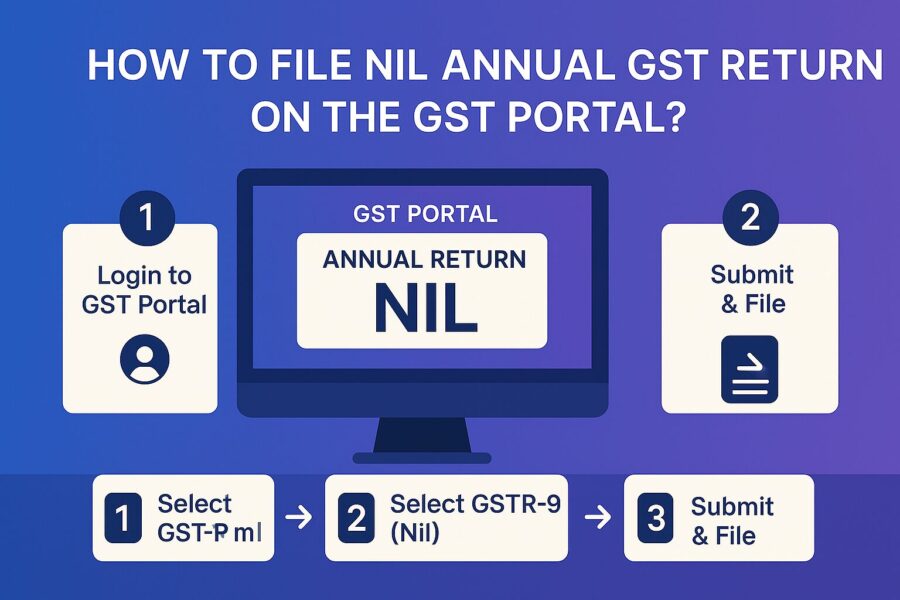

How to File Nil Annual GST Return on the GST Portal?

Below is the step guide that explains how to file a nil annual GST return on the GSTN portal through GSTR-9:

- Go to the official GSTN Network website of India. Click on the link to display the GST Home page.

- Log in to your GST account by putting in your valid credentials.

- The page that appears has a user-friendly interface, just go to ‘Services’ and click on the Returns dashboard.

- Select the ‘Annual Return’ command from the options presented.

- You can also directly click on the ‘Annual Return’ link present on your dashboard after logging in.

- Then select the ‘Financial Year’ from the dropdown list for which you need to file the annual return on the ‘File Annual Returns’ page.

- Click on ‘Search’.

- After this, you will see the ‘File Returns’ page on your screen.

- Remember to read all of the important information given in the message box to adhere to timely compliance and not miss any important notifications, such as the due date of filing the annual return.

- In the ‘GSTR-9’ tile, select ‘Prepare Online’.

- After this, you will need to answer whether you are filing for a NIL GST return. Select ‘Yes’ here.

- Click on ‘Next’ and file Form GSTR-9 with Electronic Verification Code (EVC) or Digital Signature Certificate (DSC).

What are the Due Dates for Filing Nil Annual GSTR-9?

For a particular tax period, the due date to file a NIL GST return is 31st December of the following year. For instance, December 31 2025, is the due date for filing GSTR-9 for FY 2024-25.

These compliance deadlines can also be changed by the government through notifications from time to time by the tax authorities. So, always be updated regarding these GST regulations and keep a good compliance record.

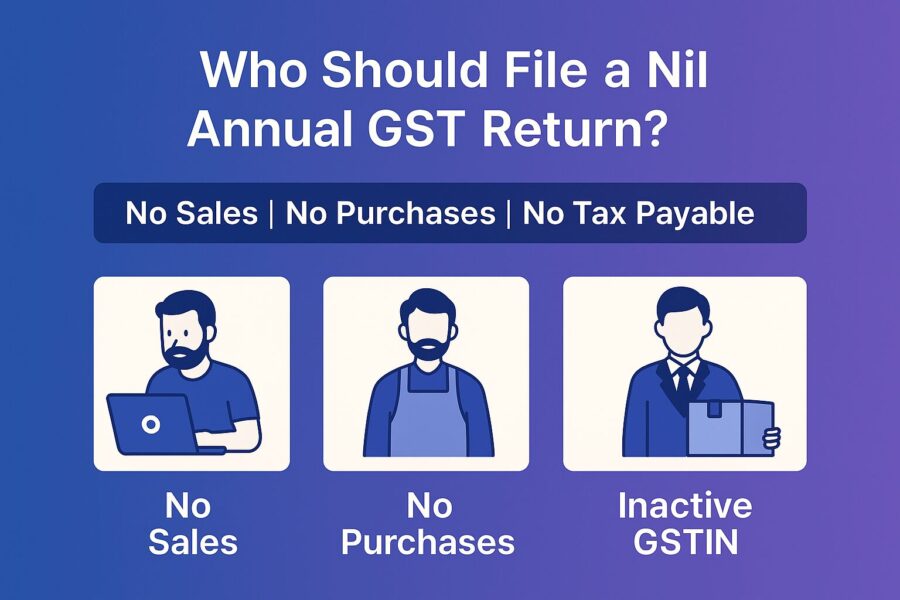

Who Should File an Annual GST Nil Return?

Under the GST regime, the individuals who should file an annual GST NIL return through GSTR 9 need to fulfil certain conditions. These conditions are as follows:

- Not received any goods/services, which means no purchase has been made.

- Not made any outward supply, which means not had any sales.

- Has no other liability to report.

- Not claimed any refund.

- Not claimed any credit.

- There is no late fee to be paid.

- Not received any orders creating demand.

These criteria ensure smooth direct tax compliance under the connected finance ecosystem of the Income Tax Act and Goods and Services Tax regime.

Conclusion

Filing a NIL GST return is crucial for maintaining a clean compliance record, even when there's no business activity. Use the GSTN portal for accurate filing before 31st December to avoid penalties. Ensure GST Registration is in place, as it remains mandatory under Goods and Services Tax norms.

Seek financial advice for handling returns, vendor payments, and Tax deduction at source in line with GST regulations and the Income Tax Act.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By