How to File GSTR-3B for Amazon sellers?

- 21 Aug 24

- 14 mins

How to File GSTR-3B for Amazon sellers?

- Importance of GST in E-commerce

- How does this apply to Amazon sellers?

- How can Amazon sellers utilize ITC?

- GST Returns: Fulfilling Compliance Obligations

- Types of GST Returns Applicable to Amazon Sellers

- Step-by-Step Guide to Filing GST Returns for Amazon Sellers

- Benefits of GST Return Filing for Amazon Sellers

- Conclusion

- FAQs

Key Takeaways

- Simplified GST Compliance: E-commerce platforms like Amazon make GST return filing straightforward, helping sellers stay compliant effortlessly.

- Automated Solutions: Implementing ERP E-TDS solutions automates GST reconciliation and filing, ensuring timely and accurate submissions.

- Maximized ITC Benefits: Proper GST return filing processes allow sellers to claim the maximum input tax credit, improving financial health.

- Detailed Transaction Records: Filing returns like GSTR-1 on an invoice-wise basis ensures precise record-keeping, essential for audits and compliance.

- Building Trust and Credibility: Consistent GST compliance through regular filing enhances trust with customers and suppliers, giving sellers a competitive advantage.

GST, or Goods and Services Tax, is a comprehensive indirect tax levied on the supply of goods and services across India. It has replaced various other indirect taxes like VAT, service tax, and excise duty, streamlining the tax system.

For Amazon sellers, using an e-commerce platform offers numerous advantages, particularly in managing GST compliance. E-commerce operators like Amazon facilitate the GST tax return filing process by deducting and remitting GST on behalf of sellers, which simplifies compliance and reduces the administrative burden.

Importance of GST in E-commerce

For e-commerce sellers, GST is crucial as it ensures a uniform tax structure, eliminating the complexities of dealing with multiple state taxes. This is particularly important for Amazon sellers who operate across different states in India.

Types of GST and Their Application

CGST, SGST, IGST, and UTGST

- CGST (Central Goods and Services Tax): Collected by the Central Government on intra-state sales.

- SGST (State Goods and Services Tax): Collected by the State Government on intra-state sales.

- IGST (Integrated Goods and Services Tax): Collected by the Central Government for inter-state sales.

- UTGST (Union Territory Goods and Services Tax): Collected by the Union Territory Government for sales within union territories.

How does this apply to Amazon sellers?

Amazon sellers need to understand which type of GST applies to their transactions. For instance, if you're selling products within the same state, both CGST and SGST will apply. For inter-state sales, IGST is applicable.

Input Tax Credit (ITC): A Valuable Asset

Input Tax Credit (ITC) is a crucial component of the GST system, designed to eliminate the cascading effect of taxes and reduce the overall tax burden on businesses. ITC allows businesses to claim credit for the GST paid on purchases (inputs) and use it to offset the GST liability on sales (outputs).

Importance of ITC for Amazon Sellers

For Amazon sellers, ITC is particularly valuable because it helps reduce tax liability, thereby increasing profitability. Here’s why ITC is essential:

- Cost Reduction: By claiming ITC, Amazon sellers can reduce their overall GST payable, lowering their cost of goods sold.

- Improved Cash Flow: ITC helps maintain a healthy cash flow by reducing the immediate tax outflow.

- Competitive Pricing: With reduced costs, sellers can offer competitive prices to customers, enhancing their market position.

Eligibility Criteria for ITC

To claim ITC, Amazon sellers must meet certain conditions:

- Possession of a Tax Invoice: Sellers must have a valid tax invoice or debit note issued by the supplier.

- Receipt of Goods or Services: The goods or services must have been received.

- GST Payment: The supplier is responsible for paying the government the tax reflected on the invoice.

- Filing of GST Returns: Sellers must file the necessary GST returns to claim ITC.

Utilizing ITC for Amazon Sellers

Here's how Amazon sellers can effectively utilize ITC:

- Accurate Record-Keeping: Maintain detailed records of all purchases and GST paid. Ensure that all invoices are accurately recorded and matched.

- Timely Filing of Returns: File GST returns on time to ensure that ITC claims are processed without delay.

- Regular Reconciliation: Periodically reconcile purchase invoices with the GSTR-2A form to ensure all eligible ITC is claimed.

- Professional Assistance: Consider seeking help from a tax professional to navigate the complexities of ITC and ensure maximum benefits.

Common Challenges and Solutions

While ITC is beneficial, Amazon sellers may face certain challenges:

- Invoice Mismatch: Discrepancies between purchase invoices and GSTR-2A can lead to ITC mismatches.

- Solution: Regularly reconcile invoices and promptly address any discrepancies with suppliers.

- Delayed Supplier Compliance: If suppliers do not file their returns on time, it can affect the buyer’s ITC claim.

- Solution: Partner with reliable suppliers and monitor their compliance regularly.

- Complex Documentation: Managing and maintaining accurate records for ITC claims can be cumbersome.

- Solution: Use accounting software that supports GST compliance and automates documentation.

How can Amazon sellers utilize ITC?

For Amazon sellers, effectively utilizing input tax credit (ITC) is a key strategy for reducing tax liability and enhancing profitability.

Amazon sellers can claim ITC on various purchases like inventory, packaging materials, and other business-related expenses. Proper documentation and timely filing of GST returns are essential to maximizing ITC benefits.

Utilizing the input tax credit facility reduces GST liability, enhancing cash flow and profitability. Regular use of the window for reconciliation provided by the GST portal helps match purchase invoices with ITC claimed, ensuring all eligible ITC is utilized. By maintaining business compliance, Amazon sellers can avoid legal issues, build trust with suppliers and customers, and gain a competitive edge in the marketplace.

Quarterly Returns

Amazon sellers can file their GST returns quarterly under the Quarterly Return Monthly Payment (QRMP) scheme if their aggregate turnover is up to ₹5 crore. This scheme allows for easier compliance and reduces the frequency of filing returns, making it simpler for sellers to manage their tax obligations.

Monthly Returns

For sellers with an aggregate turnover exceeding ₹5 crore, monthly returns are mandatory. Filing monthly returns ensures that sellers remain compliant with GST regulations and can promptly claim ITC on their purchases, thus maintaining a steady cash flow.

GST Returns: Fulfilling Compliance Obligations

GST returns are essential documents that every registered business must file with the tax authorities. These returns provide detailed information about the income, sales, purchases, and tax paid and collected by the business during a specific period. For Amazon sellers, filing GST returns accurately and on time is crucial for staying compliant with tax regulations and avoiding penalties.

Leveraging an ERP E-TDS return filing solution can further streamline this process by automating the timely and accurate reconciliation, calculation, and filing of returns. This ensures accurate and timely submissions, allowing sellers to focus on their core business activities.

The return filing process involves several steps, including entering sales details, reconciling input tax credits (ITC), and submitting the return, which helps maintain compliance with GST laws.

Amazon Business offers an additional 28% discount on GST invoices during bulk purchases, encouraging and insisting on the importance of GST invoices and tax credits.

Types of GST Returns Applicable to Amazon Sellers

There are several types of GST returns that Amazon sellers need to be aware of:

- GSTR-1 (Outward Supplies): This return captures the basic details of all outward supplies of goods and services made during the month. Amazon sellers must file GSTR-1 returns monthly if their turnover exceeds ₹1.5 crore, or quarterly if it is below ₹1.5 crore.

- GSTR-3B (Monthly Summary): GSTR-3B is a simplified monthly summary return that provides a consolidated overview of sales and ITC claimed. It is mandatory for all registered taxpayers.

- GSTR-9 (Annual Return): This is an annual return that consolidates all the monthly and quarterly returns filed during the year. It provides a comprehensive summary of the financial year’s transactions.

Importance of Filing GST Returns

Proper and timely filing of returns, such as Form GSTR-1 for outward supplies, on an invoice-wise basis ensures detailed and accurate records of transactions. Adhering to the correct period of return (monthly or quarterly) based on the seller's aggregate turnover ensures compliance and maximizes ITC claims.

Filing GST returns is not just a regulatory requirement but also offers several benefits:

- Claiming Input Tax Credit (ITC): Regular filing ensures that Amazon sellers can claim ITC on their purchases, which helps in reducing their overall tax liability.

- Maintaining Compliance: Timely filing of GST returns helps in maintaining compliance with GST laws and avoiding penalties or legal actions.

- Building Trust: Consistent compliance builds trust with suppliers and customers, enhancing the seller’s reputation.

- Access to Loans and Financial Services: Accurate and regular filing of returns provides a clear financial picture, making it easier to secure loans and financial services.

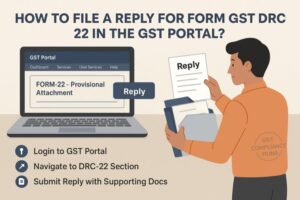

Step-by-Step Guide to Filing GST Returns for Amazon Sellers

Choose the Relevant Form: Identify the correct GST return form (GSTR-1, GSTR-3B, GSTR-9) based on your turnover and transaction type.

- Enter Sales Details: Accurately enter the details of all sales made during the return filing period. This includes B2B, B2C, and export sales.

- Reconcile Input Tax Credit (ITC): Match the ITC claimed with the purchase invoices. Ensure all invoices are uploaded and correctly matched.

- Verify and Submit: Carefully review all the entered details before submission to avoid any errors.

- Generate Challan for Tax Payment: If there is any tax liability after ITC adjustment, generate a challan and make the payment.

- Acknowledgment: Once the return is filed, an acknowledgment receipt will be generated. Keep this for your records.

Filing Frequency and Due Dates

For Amazon sellers, adhering to the filing frequency and due dates for GST returns is crucial to ensuring compliance with tax regulations and avoiding penalties. Understanding the schedule and requirements for filing returns helps in maintaining smooth operations and taking advantage of the input tax credit (ITC).

Monthly Filing

Businesses with an aggregated turnover above ₹5 crore are required to file their GST returns monthly. This includes the following returns:

- GSTR-1: You must submit this return by the 11th of the following month. It contains details of all outward supplies (sales) made during the month.

- GSTR-3B: By the 20th of the following month, you must file this summary return. It provides a summary of the sales, ITC claimed, and tax payable.

Quarterly Filing

Small businesses with an annual turnover of up to ₹5 crore have the option to file their GST returns quarterly under the Quarterly Return Monthly Payment (QRMP) scheme. The quarterly returns include:

- GSTR-1: Filed quarterly by the 13th of the month following the quarter. It details all outward supplies made during the quarter.

- GSTR-3B: While GSTR-3B is a monthly return for large businesses, under the QRMP scheme, it can be filed quarterly. However, tax payments need to be made monthly through a challan.

Annual Filing

All registered taxpayers must file an annual return consolidating the information provided in the monthly or quarterly returns. This is done through:

- GSTR-9: The annual return is due by December 31st, following the end of the financial year. It summarizes all transactions made during the year, including sales, purchases, and ITC claims.

Benefits of Timely Filing

Adhering to the filing frequency and due dates provides several benefits for Amazon sellers:

- Avoidance of Penalties: Late filing of GST returns attracts penalties and interest, which can be financially burdensome.

- Smooth ITC Claims: Timely filing ensures that ITC claims are processed without delays, helping maintain a healthy cash flow.

- Compliance Advantage: Regular filing keeps your business compliant with GST laws, avoiding legal complications and maintaining a good reputation.

- Improved Business Operations: Accurate and timely annual GST return filing helps in maintaining clear financial records, aiding in better business decisions.

Benefits of GST Return Filing for Amazon Sellers

Filing GST returns is a critical compliance obligation for Amazon sellers. Understanding and adhering to these requirements not only helps in staying compliant but also offers several significant benefits. Here’s a detailed look at the advantages of timely and accurate GST return filing for Amazon sellers.

- Financial Savings

One of the most immediate benefits of filing GST returns is the financial savings through Input Tax Credit (ITC). Amazon sellers can claim ITC for the GST paid on their purchases, which can be offset against their GST liability on sales. This reduces the overall tax burden and enhances profitability.

- Smooth Business Operations

Regular filing of GST returns ensures that business operations run smoothly without interruptions due to compliance issues. Maintaining accurate and up-to-date records of transactions helps in seamless business management and operational efficiency.

- Compliance Advantage

Adhering to GST return filing requirements provides a compliance advantage. Timely and accurate filing helps avoid penalties, interest, and legal complications. Staying compliant with GST laws builds trust with tax authorities and ensures uninterrupted business activities.

- Maximize Input Tax Credit (ITC)

Filing GST returns on time ensures that Amazon sellers can maximize their ITC claims. This means more savings on the taxes paid for inputs, such as inventory, packaging materials, and other business expenses. Proper utilization of ITC can significantly enhance cash flow and reduce tax liabilities.

- Legal Security

Timely and accurate filing of GST returns provides legal security. It helps in avoiding disputes with tax authorities and ensures that the business remains compliant with the law. Legal security is crucial for the long-term sustainability of the business.

- Strategic Decision-Making

Accurate financial records maintained through regular GST return filing aid in strategic decision-making. Detailed records of sales, purchases, and tax liabilities help Amazon sellers analyze their business performance and make informed decisions for future growth.

- Supplier and Customer Trust

Regular and accurate filing of GST returns builds trust with both suppliers and customers. Suppliers are assured of the seller’s compliance with tax regulations, which fosters better business relationships. Customers are also more likely to trust a seller who is transparent and compliant with tax laws.

- Competitive Edge

Staying compliant with GST regulations provides a competitive edge in the marketplace. Customers and suppliers are more likely to favor compliant sellers, which can result in increased growth and business opportunities. This compliance also differentiates the seller from non-compliant competitors.

Conclusion

Filing GST returns may seem complex, but it is a crucial part of running a successful Amazon business. By understanding the basics, staying organized, and seeking professional help when needed, Amazon sellers can navigate GST return filing with ease and benefit from the various advantages it offers.

💡Learn more about how our Pice can help you make all your important business payments, like supplier and vendor payments, rent, GST, & utility, from one single dashboard with your credit card. Request a demo now.

By

By