How to File GSTR 11 Return Using Offline Utility?

- 29 Jul 25

- 11 mins

How to File GSTR 11 Return Using Offline Utility?

- Who Is Eligible to Use the Offline Tool for GSTR-11?

- Technical Requirements to Use The Offline Filing Tool for GSTR-11

- Steps to Download and Install the Offline Tool for GSTR-11

- How to Prepare Your GSTR-11 Return?

- Steps to Generate the JSON File

- Steps to Upload the Generated JSON File

- How to Open the Downloaded File of GSTR-11?

- How to Fix Errors Using the Offline Tool for GSTR-11?

- Steps to Open the Downloaded JSON Error File

- How to Submit and File GSTR-11?

- Conclusion

Key Takeaways

- Exclusive to UIN Holders: GSTR-11 is specifically for individuals or entities registered with a Unique Identity Number (UIN) to claim refunds on inward supplies.

- Offline Utility Simplifies Filing: The Excel-based offline tool helps UIN holders fill in invoice and debit/credit note details conveniently and generate a JSON file for uploading on the GST portal.

- Mandatory Before Refund Claim: Filing GSTR-11 is a prerequisite to submitting Form GST RFD-10, which is used to claim the actual refund.

- Validation is Crucial: The tool allows users to validate entries, correct errors using error reports, and only proceed when all sheets are error-free.

- JSON File Upload Finalizes Process: After successful validation, the user generates and uploads a JSON file to the GST portal, followed by submission and filing of the return online.

GSTR-11 is a specific GST return that must be filed exclusively by individuals or entities registered with a Unique Identity Number (UIN). It is used by these UIN holders to claim refunds on the taxes paid for inward supplies acquired within India. Filing Form GSTR-11 is a mandatory step before applying for such a refund.

To simplify and speed up the process, an easy-to-use Excel-based offline tool is available in the download section of the GST portal. Users can fill in all the necessary details offline and then upload the completed file to the GST portal to submit their GSTR-11 return.

Who Is Eligible to Use the Offline Tool for GSTR-11?

The GSTR-11 offline utility is designed to help registered individuals or entities with a Unique Identity Number prepare and file Form GSTR-11. This form must be submitted prior to filing Form GST RFD-10 in order to claim a refund for taxes paid on inward supplies.

Technical Requirements to Use The Offline Filing Tool for GSTR-11

There are some technical requirements that must be met by the devices used to file the GSTR-11 form. Here are those requirements:

- Windows 7 or higher versions

- MS Excel 2007 or higher versions

Steps to Download and Install the Offline Tool for GSTR-11

To file a GSTR-11 form, first, you have to download and install the offline tool. Downloading this form is a one-time activity since occasional updates may be required if changes are made to the GST portal. So it is advisable to regularly check for any new updates and ensure the tool is up to date before starting your next filing.

Here is a step-by-step process for you to download and install the GSTR-11 offline tool:

- Visit the official GST portal.

- As you click on it, the GST home page comes up.

- Click on 'Downloads', then click on 'Offline Tools' and then 'GSTR-11 Offline Tool'.

- Your GSTR-11 offline tool usually takes 2-3 minutes to download, depending on your internet speed.

- Choose the location where you want to save the downloaded offline GST tool.

Now that you have downloaded the GSTR-11 folder, it's time for installation. Here are the steps to install it.

- Unzip the downloaded files and extract them from the zip folder.

- The zip folder contains your GSTR_11_Offline_Utility_xlsx Excel file.

- Double-click on that Excel file.

- Check if the Excel tool has 4 worksheets tabs as follows:

- Read Me: This part contains instructions to fill out the form.

- Home: The home part comprises various functionalities, such as opening a downloaded GSTR-11 JSON file, generating a JSON file to upload it, opening a downloaded JSON file and getting your summary.

- 3A: This is to update the invoice details that you received.

- 3B: This is to update the debit/credit note details that you received.

How to Prepare Your GSTR-11 Return?

Before entering any information in the GSTR-11 offline utility, it is important to ensure that the latest version has been downloaded from the GST portal. To update the details in the GSTR-11 offline tool, follow the steps outlined below:

- Open your GSTR-11 offline tool and go to the 'Home' tab.

- Enter your UIN in the UIN section.

- Once you have done this, select your financial year and tax period from the drop-down list.

- Navigate to the Tab 3A.

- A list of details will be required. Manually enter them or modify the auto-populated details. Here is a list of the mandatory ones:

- Supplier’s GSTIN

- Invoice Value

- Invoice Date

- Invoice Number

- Rate

- Origin of Supply

- Taxable Value

- Type of GST return, ie, CGST, SGST and IGST.

- Once you enter these details, click on the 'Validate Sheet' button.

- If you have a successful validation, then it does not show any errors.

- However, in case of an unsuccessful validation, the cells with errors will pop up in red. Click 'OK' to continue.

- Resolve the errors and click on 'Validate' again.

- If there are no errors in the workbook, the 'Sheet Validation Error' column will remain empty. To proceed, navigate to the '3B' tab and input the details of debit and credit notes. Then, follow the same validation process used in the '3A' tab to check for and correct any errors.

Steps to Generate the JSON File

Here is a step-by-step guide for you to generate your JSON file.

- Visit the 'Home' tab and click on the button that says, 'Get Summary'. You will get a summary of all your details.

- You will see a POS-wise summary at the bottom.

- Click on 'Generate JSON File to Upload'.

- A notification will come up stating that the processing might take some time. Click on 'OK'.

- You will get a confirmation that the export of your JSON file is completed. Click on 'OK'.

- Browse and select the folder where you want to save your JSON file, enter the file name and then click on 'Save'.

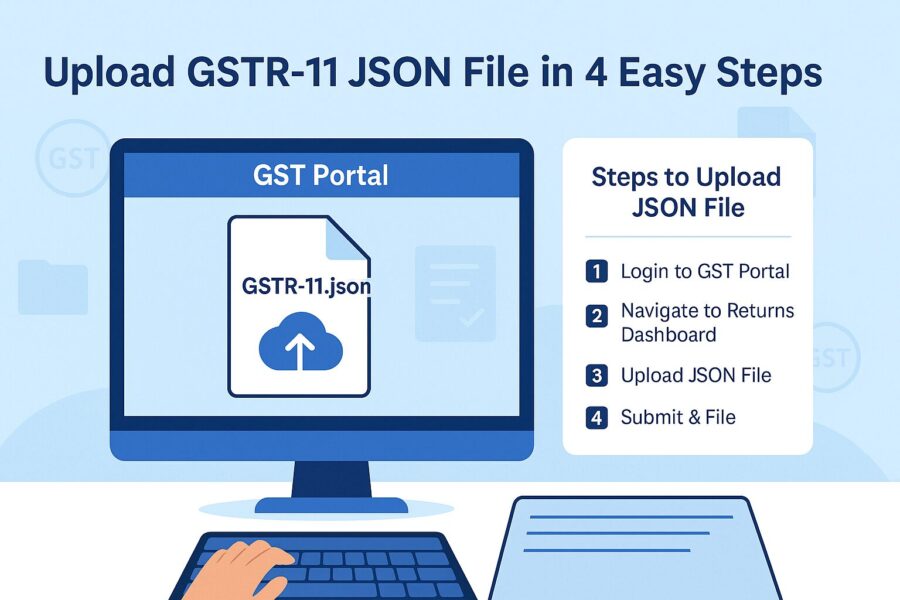

Steps to Upload the Generated JSON File

Here is a step-by-step process to upload your generated JSON file.

- Log in to the GST portal.

- Click on these items back to back: Services > Returns > Returns Dashboard.

- In the returns dashboard, select the financial year and return filing period from the drop-down menu, then click on 'Search'.

- On the GSTR-11 tile, click on 'Prepare Offline'.

- Your offline upload and download page for GSTR-11 will show up on your screen. Click on 'Choose File' from the 'Upload' tab.

- Browse and select your generated JSON file to upload it from your computer and click on 'Open'.

- The tool will then validate and process your uploaded file.

- If you have a successful validation, your details will populate as a summary. And in case of a validation failure, your screen will show an error report.

How to Open the Downloaded File of GSTR-11?

Here is a step-by-step process to open your downloaded file of GSTR-11.

- Go to the 'Home' tab of your GSTR-11 offline utility and click on 'Open Downloaded GSTR-11 JSON File'.

- Browse your JSON file and then click on 'OK'.

- A message will pop up stating that your GSTR-11 file has been successfully imported.

- The section where you had your updated details will auto-populate details. Make necessary modifications if required.

- After checking all the details, click on the 'Validate Sheet' button.

- Once you successfully go through the validation process, click on the 'Get Summary' to update the summary on your 'Home' tab.

- Click on 'Generate JSON file to upload'.

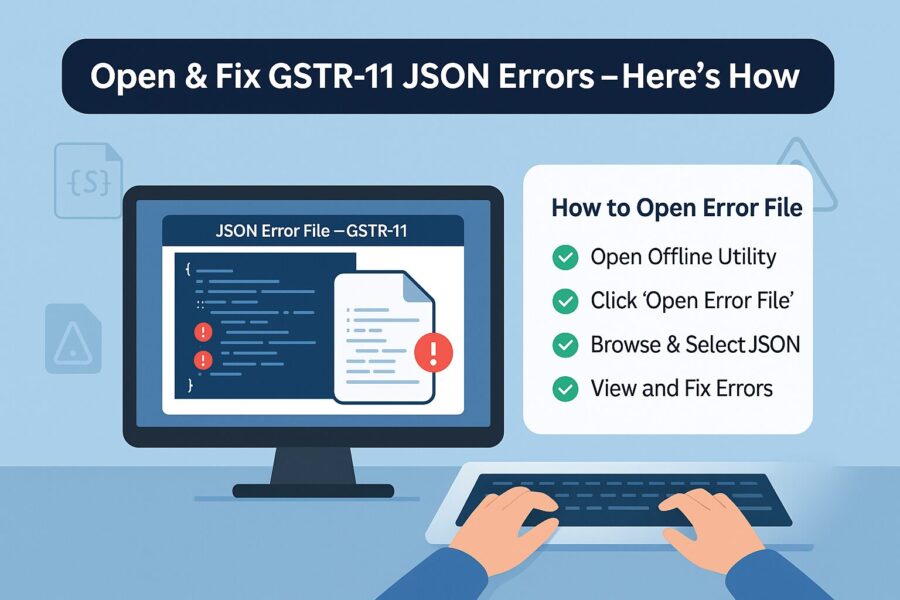

How to Fix Errors Using the Offline Tool for GSTR-11?

Here is a step-by-step process for you to fix any errors using your GSTR-11 offline tool.

- If there are errors in your generated JSON file, you need to resolve them. Once done with that, you will see a message saying 'Processed with Errors', then click on 'Generate Error Report'.

- Once generated, click on 'Download Error Report' and examine the file of your errors.

- Your error report will download in a zip file. Save that report on your computer and unzip the folder that contains your JSON file.

Steps to Open the Downloaded JSON Error File

Follow the outlined steps to open your downloaded JSON file:

- Visit the 'Home' tab and click on 'Open Downloaded Error JSON File'.

- Browse and select your saved error file and click on 'OK'.

- A message will come up saying 'Error Report Successfully Imported' then click on 'OK'.

- Navigate to the tabs, 3A and 3B and correct the errors as it is shown in the 'GST Portal Validation Errors' column.

- Once you have made the corrections, click on 'Validate Sheet'. Next, all you need to do is generate and upload the JSON file.

How to Submit and File GSTR-11?

Here is a step-by-step process that you need to follow with due diligence in order to submit and file your GSTR-11 return:

- Visit the official GST portal.

- Navigate to Services > Returns > Returns Dashboard.

- You will see a 'File Return' page on your screen. Select your financial year from the drop-down menu and click on 'Search'.

- Under GSTR-11, click on the 'Initiate Filing' button.

- To view the summary in a PDF file, click on 'Preview'.

- Make sure to cross-check the PDF summary against both the review provided in the offline tool and your accounting records before submitting Form GSTR-11. Only proceed with submission once you are confident that the summary shown in the ‘Preview’ section is complete and accurate.

- Select the declaration checkbox, click on the 'File Return' button and then click on 'Yes'.

- Select the authorised signatory from the drop-down menu and click on the 'File with DSC' button when you feel convenient.

- Once done with the verification, your ARN will be generated and the status will change to 'Filed'.

- To initiate the refund claim made on a quarterly basis relating to the submitted GSTR-11, click on the ‘Generate RFD-10’ button.

Conclusion

Filing the GSTR-11 form is crucial for GST-registered individuals or entities holding a UIN to claim refunds on inward supplies received in India. Understanding how to use the GSTR-11 offline tool allows you to conveniently file your return and claim refunds.

The process involves various steps, from downloading and installing to final submission. It is important to carefully review and validate all information before submission.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By