How to file GSTR 11 Return on GST Portal?

- 29 Jul 25

- 12 mins

How to file GSTR 11 Return on GST Portal?

Key Takeaways

- GSTR-11 is a return form exclusively for UIN holders like embassies and UN bodies to claim GST refunds on inward supplies.

- Filing GSTR-11 is necessary only when taxable inward supplies are received and refund is sought via Form RFD-10.

- The form auto-populates supplier data from GSTR-1 and requires verification using Aadhaar-based e-sign or DSC.

- Accurate GSTINs, invoice details, and review of pre-filled data are crucial to avoid delays or rejections in refund processing.

- There’s no penalty for late filing, but delays can adversely impact timely GST refund claims for UIN holders.

The GST (Goods and Services Tax) regime in our country has revolutionised the tax collection system. At the same time, it has introduced different types of forms and procedures for various classes of taxpayers. Form GSTR-11 is one such crucial form, designed for a certain category of taxable persons. This category of taxpayers includes all those who possess a Unique Identity Number (UIN).

Refer to this blog to discover the scope of the GSTR-11. Learn about its format, the eligibility criteria, associated rules and a step-by-step guide on how to file a GSTR 11 return on the GST portal.

What is GSTR-11?

The Form GSTR-11 is essentially a return form which comes under India’s GST Act. It is specifically formulated for all such individuals/organisations who are issued a Unique Identity Number (UIN). This shall include embassies and foreign diplomatic missions.

Such categories of UIN holders may be exempt from paying GST taxes in our country. However, they may still incur GST liabilities on specific purchases made within the borders.

The form GSTR-11 lets one file a quarterly statement of ‘inward supplies’. This enables them to claim the refund of taxes on the GST amount already paid. The form makes sure that the UIN holders are able to rightfully reclaim GST charges as they simultaneously retain their tax-exempt status (recognised by Indian laws as well as agreements of international nature).

Eligibility for GSTR-11

A special category status is allotted to the UIN holders under the GST Act. To get their UIN, eligible organisations will be required to apply for it using Form GST REG-13.

This UIN is issued to specific individuals/organisations who are relieved of GST charges. Here are the entities/bodies eligible to hold onto a UIN and, therefore, are required to file Form GSTR-11:

- Specialised Agencies of the UN Organisation: The international bodies of authority wield access to certain privileges as well as immunities under the internationally binding law.

- Multilateral Financial Institutions & Organisations: Such entities are notified under the UN (Privileges and Immunities) Act, 1947. It operates within our country with a tax-exempt status.

- Consulates/Embassies of Foreign Countries: Such institutions are representative of their respective governments within India. They are usually exempt from the otherwise-applicable local taxes, owing to internationally binding agreements.

- Other Persons/Classes of Persons: The GST Commissioner has notified that this category may include other special entities which are granted the same privileges.

Purpose of GSTR-11

The aim of the GSTR-11 return form is to allow UIN holders to claim refunds for GST payments made on their ‘inward supplies’. Such ‘inward supplies’ may include goods/services bought for official reasons within the country.

Note that the filing of Form GSTR-11 is not necessarily a regular (say, quarterly) process that must be conducted regardless. Instead, it is done if and when the entities make certain purchases on which GST applies.

Due Date for Filing GSTR-11

Form GSTR-11 must be filed on a quarterly basis. However, if a UIN holder has not received any inward supplies during a specific quarter, filing the form for that period is not mandatory. That said, if the UIN holder intends to claim a refund using Form GST RFD-10, it becomes essential to file Form GSTR-11 for the relevant quarter.

There is no fixed due date for submitting Form GSTR-11 and it can be filed at any time after the end of the respective quarter.

Details Required in GSTR-11

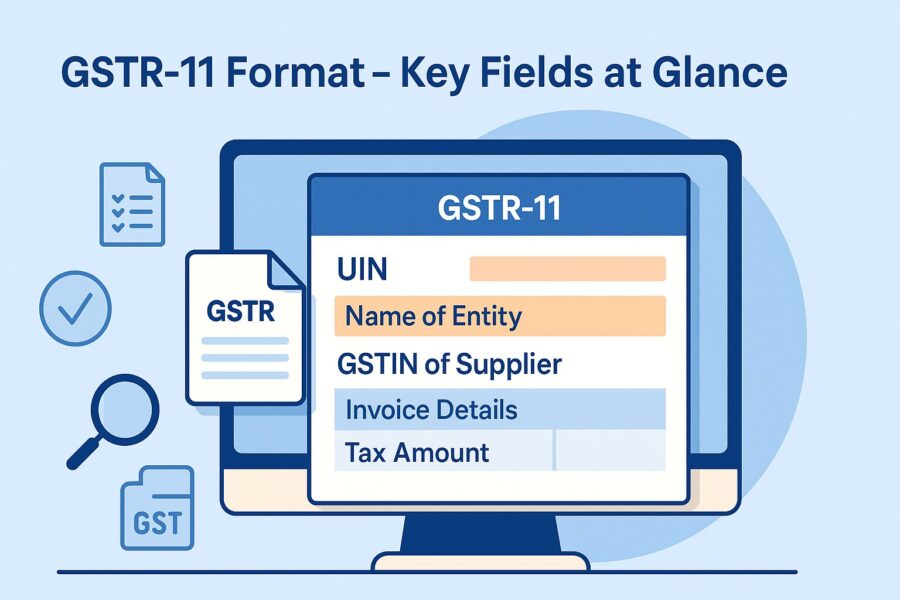

The Form GSTR-11 essentially has four primary sections, including:

- UIN or Unique Identity Number: This section consists of the unique identification number that is specially assigned to the concerned organisation by the GST administrative body.

- UIN Holder Name: This prompt auto-populates and shows the name of the organisation/person holding onto the unique identification number.

- Information Regarding the Inward Supplies Received: The 3rd section requires information about the Goods and Services Tax Identification Number (GSTIN) associated with the suppliers. The inward supplies details automatically populate drawing input from the GSTR-1 returns as filed by the respective suppliers.

- Refund Amount: The refund amount is automatically calculated based on the input provided in the previous sections of the form GSTR-11. A UIN holder is required to extend significant details about their bank to bag the discount.

Once you are done with the filling details, you, as a UIN holder, shall be required to authenticate the return with the help of an Aadhaar-based signature verification/Digital Signature Certificate (DSC).

Recent Updates Related to GSTR-11

The Central Board of Indirect Taxes and Customs (CBIC) and the GST Council are responsible for regularly updating the rules associated with GST returns filing, which includes the GSTR-11.

The information about amendments is important for UIN holders as it shall affect the entire process of filing and even the eligibility for refund claims.

Here is a list of the latest amendments made to ensure seamless compliance and enhanced transparency:

- Amendment of Rule 21: The GSTIN may be cancelled in case discrepancies are detected between the records of ‘outward supplies’ as reported in GSTR-3B and GSTR-1.

- Insertion of Rule 21A (2A): A suspension of the GSTIN may result if several differences are detected between the records of outward/inward supplies, between the GSTR-1, GSTR-3B and GSTR-2B.

- Insertion of Rule 59(5): In case the GSTR-3B form is not filed for the preceding 2 months by monthly filers; or during the preceding tax period by quarterly filers - the facility of filing Form GSTR-1 in the current period will not be extended.

- Amendment of Rule 138E: E-way bills shall not be generated in case the GST registration is suspended, owing to discrepancies being detected in the returns.

GSTR-11 Format Overview

The Form GSTR-11 is formulated to be simple and the least complex, in comparison to other GST forms and procedures.

Get an overall idea about the GSTR-11 format below:

1. The UIN

- About: Here goes the UIN assigned to the organisation/individual.

- Auto-Population: The name of the organisation/person holding the UIN shall auto-populate.

2. Name of Organisation/Individual Possessing the UIN

- About: After the UIN is typed in, this prompt will auto-populate. Note that this field cannot be edited/added manually.

3. Information About Inward Supplies Acquired

- About: Type in the suppliers’ GSTINs from whom the inward supplies have been acquired.

- Auto-Population: The supplier information from the filed GSTR-1 return form shall automatically populate based on the GSTINs provided. Note that the UIN holder shall not be able to edit/add details manually into these fields.

4. Refund Amount Due

- About: The refund amount is calculated in this section automatically. This is the amount that is due from the preceding month’s GST payments.

· Information about the Bank Account: Accurately put in your bank details to allow for the crediting of refunds.

5. Authorisation and Signature

- About: Once you, as a UIN holder, successfully provide the necessary information, digitally sign the GSTR-11 form.

- Options for Signing: An Aadhaar-based signature verification or a DSC (Digital Signature Certificate) can be used to sign the form.

- Confirmation of Submission: Once the digital signature is complete, the UIN holder simultaneously confirms their return submission.

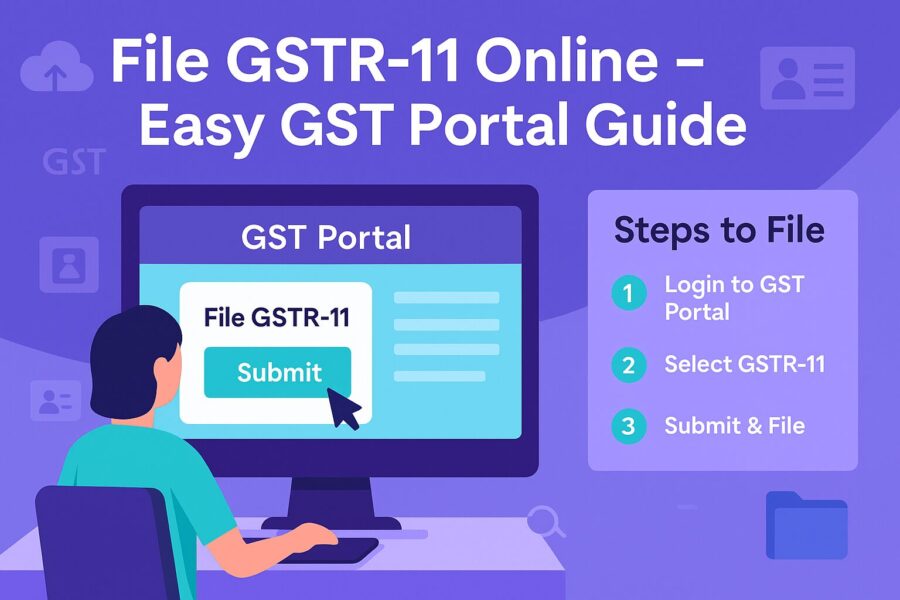

Step-by-Step Guide to Filing GSTR-11 on the GST Portal

Here are the steps you can follow to file the GSTR-11 on the GST Portal:

Step 1: Log in using your GST credentials.

Step 2: Navigate to the Returns Dashboard by clicking on the ‘menu’. Go to the ‘Services’ section, followed by the ‘Returns’ section and finally, to the ‘Returns Dashboard’. You may also access the ‘Returns Dashboard’ from your homepage.

Step 3: Choose the Financial Year and Period from the drop-down list and click on ‘SEARCH’.

Step 4: Locate the GSTR11 tile. Click the ‘PREPARE ONLINE’ button to initiate preparing the return online.

Step 5: Go to the section, ‘DOWNLOAD AUTO DRAFTED DETAILS FOR GSTR-11’ (EXCEL). This will initiate the download of pre-entered information on the basis of Form GSTR-1/5, as filed by the respective suppliers.

Step 6: Review the Auto-Drafted Excel by opening the downloaded Excel file. Information shall be organised across different worksheets; including the 3A-B2B (inward supplies which are taxable, from registered persons), 3A-B2BA (changes to previously filed invoice details), 3B-CDNR (details of Credit & Debit Notes) and the 3B-CDNRA (changes to already-filed credit or debit notes).

Step 7: Initiate the pre-filling process by clicking on the ‘INITIATE PRE-FILL OF GSTR-11’. This will auto-populate Form GSTR-11, drawing details from the suppliers’ Form GSTR-1/5.

Step 8: Upon receiving confirmation, review the auto-populated data.

Step 9: You can then check the status in your downloaded Excel to verify and address any errors.

Step 10: Click on ‘3A’ for the details of the Invoice received tile. Next, go to 'ADD DETAILS’ if you wish to input new invoice details. Specify your GSTIN (only the GSTIN of a regular taxpayer or a non-resident taxpayer is accepted), the invoice number, value and date. You shall also have to specify the nature of transactions (intra-state or inter-state transactions).

Step 11: Click on '3B' for the 'information of Credit/Debit Notes received tile’. Further, navigate to ‘ADD DETAILS’ if you want to add debit/credit note-related information. Specify your GSTIN, the invoice number, value and date. You shall also have to specify the nature of transactions (intra-state or inter-state).

Step 12: Choose ‘PREVIEW DRAFT GSTR-11 (PDF)’ in order to download as well as review Form GSTR-11’s draft summary. Review all the details to make sure they are accurate before moving on.

Step 13: Select the 'FILE RETURN' option and check off the Declaration checkbox.

Step 14: Pick your preferred filing method between ‘FILE WITH DSC’ (go to ‘Proceed’; choose your certificate; click on ‘SIGN’) and ‘FILE WITH EVC’ (type in the OTP you received on the authorised signatory’s email/phone number; click ‘VERIFY’).

Step 15: A success message shall pop up. An ARN or Acknowledgement Reference Number will also be generated and the status shall be updated to ‘Filed’.

Step 16: Finally, click on the ‘Create RFD-10’ tab to generate Form GST RFD-10 in order to claim the refund.

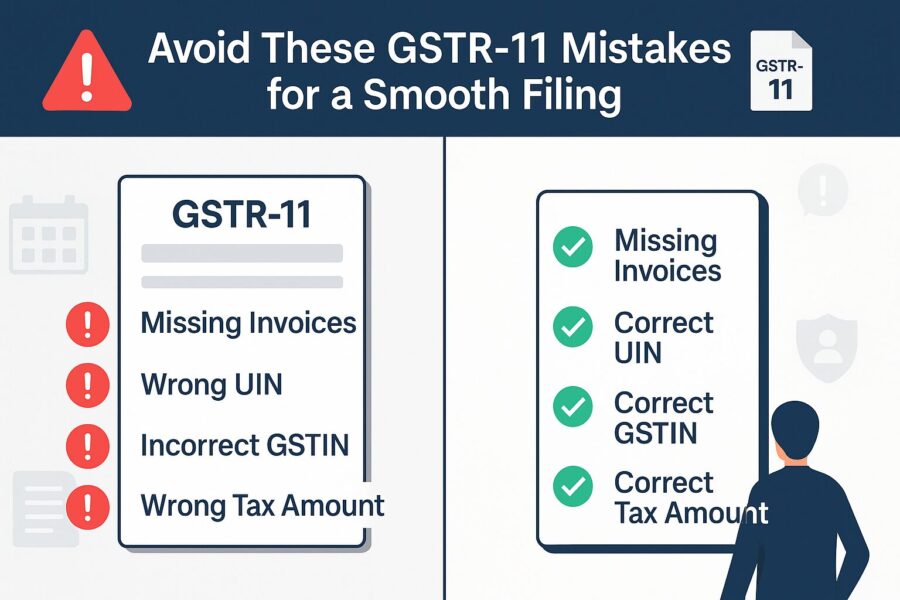

Avoid These Common Mistakes When Filing GSTR-11 for Accurate and Smooth Submission

It is of utmost importance that you avoid making these common mistakes while filing Form GSTR-11, to ensure GST compliance:

- Entering incorrect invoice information

- GSTINs that do not match

- Miscalculations of tax returns

In order to avoid such issues, you must review your entries to verify all the information. All of it should ideally align with your records as well as your suppliers.

Penalties for Late Filing of GSTR-11

There is no specific penalty for late filing of GSTR-11. However, any delay may affect GST refund processing.

Conclusion

The form GSTR-11 is an important return form in the case of UIN holders under the GST Act. It facilitates the claiming of refunds on the paid GST on inward supplies. In the process, this ensures that the tax-exempt entities are not indirect-tax-burdened.

Follow the comprehensive guide on how to file GSTR 11 returns on the GST portal provided above to effectively file your returns on time. Plus, stay updated with the amendments/rules, the knowledge of which is crucial for seamless compliance and avoiding legal consequences.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By