How to File GSTR 10 Return Using Offline Utility?

- 29 Jul 25

- 8 mins

How to File GSTR 10 Return Using Offline Utility?

Key Takeaways

- GSTR-10 is the final return that must be filed within 3 months after GST registration cancellation.

- The offline tool is mandatory for taxpayers with over 500 records in their GSTR-10 return.

- Users must fill table-wise ITC reversal details across specific Excel tabs like Invoice_Available and Inv_Not_Avail.

- After validation, a JSON file must be generated and uploaded on the GST portal for final submission.

- Errors can be reviewed and fixed using the Error JSON file before regenerating and uploading the corrected file.

GSTR-10 is a final return that must be filed by taxpayers whose GST registration has been cancelled. It is mandatory to submit this return within three months of the cancellation date. While the return is filed online, the GST portal also offers an offline utility to enter details. If you need to input over 500 records, using the offline tool becomes mandatory.

Continue reading this blog to learn about how to file GSTR 10 returns using the offline utility. This blog will take you through each step of the process from downloading offline utility tools to uploading information to the GST portal. Let’s go through this guide one step at a time and file your final return without any stress.

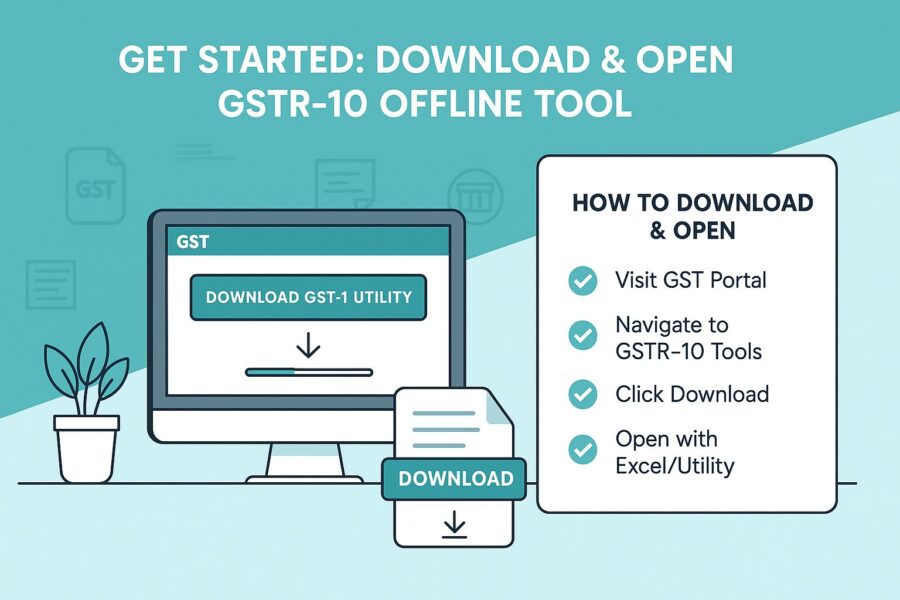

Steps to Download and Open the Offline Tool for GSTR-10

The offline tool application for GSTR-10 offers a simple way to prepare your return without needing continuous internet access. Follow these steps to download and open the GSTR-10 offline tool:

1. Go to the official GST portal.

2. Navigate to Downloads>Offline Tools>GSTR-10 Offline Tool.

3. Choose ‘Download’ and then click on the ‘Proceed’ button.

4. Extract contents as provided in the downloaded zip file. Visit the convenient location of the extracted file and then open the Excel file.

5. Click on the button titled ‘Enable Editing’ followed by the button of ‘Enable Content’ to make sure that the macros are being enabled.

How to Add Table-Wise Details in the Worksheet?

Here is a detailed step-by-step guide to follow for adding table-wise details in the respective worksheet:

Step 1: Go to the 'Home' worksheet tab and then proceed to fill out with personal details that include:

1. GSTIN

2. Date of cancellation of registration form

3. Reference number of order subject to cancellation

4. Date of cancellation order following tax period. Make sure to enter the dates in DD-MM-YYYY format

Step 2: This step entails details for the table as required by the workbook which is summarized as follows:

‘Invoice_Available' worksheet tab :

In Form GSTR-10, respective tables 8A, 8B and 8C need to be filled out. Detailed overview of ITC reversal where there is availability of respective suppliers should be reported for the following:

1. Semi-finished or finished goods held in stock

2. Inputs held in stock

3. Finished goods kept in stock

4. Machinery and details of capital goods or plant

‘Inv_Not_Avail (with ’ worksheet-tab’:

Detailed information of Table 8D as mentioned in Form GSTR-10 should be mentioned in a table. Similar to details as prescribed for ITC reversal where there is non-availability of issue of invoice but GSTIN of suppliers are kept on record.

‘Inv_Not_Avail (without ’ worksheet-tab’:

This tab comprises fields for Table 8D as mentioned in Form GSTR-10 for ITC reversal. However, no bulk invoices are available for respective suppliers of CX/GSTIN/VAT.

How to Generate a JSON File for Upload?

Following the steps below will enable you to generate a JSON file for uploading:

1. Visit the ‘Home’ sheet which you can navigate from the ‘Go Home’ button.

2. Scroll down further and then click on the ‘Get Summary’ button. This will display a detailed summary based on data provided in separate sheets.

3. Again, scroll up to the top of the page and click the ‘Generate JSON File to Upload’ button. When the ‘Save As’ window appears, choose your desired location and click ‘Save’.

A pop-up message will appear confirming that the file has been saved and is ready for upload on the common portal. Click ‘OK’ to continue.

How to Upload the Generated JSON File of GSTR-10?

Once you complete filling out GSTR-10 details, the next step is to continue uploading the generated JSON file on the GST portal. Here are the quick steps to follow to experience a smooth uploading process:

1. Navigate to the official GST portal.

2. Go to Services>Return>Final Return.

3. Locate the GSTR-10 title and further tap on the ‘Prepare Offline’ button.

4. Within the ‘Upload’ section, click the ‘Choose File’ button, locate your saved JSON file on your device and then select ‘Open’ to proceed.

5. You will see a green message appear on the top with confirmation of uploading successfully. The user, however, might need to wait for 15 minutes while the file is being processed and verified further by the portal.

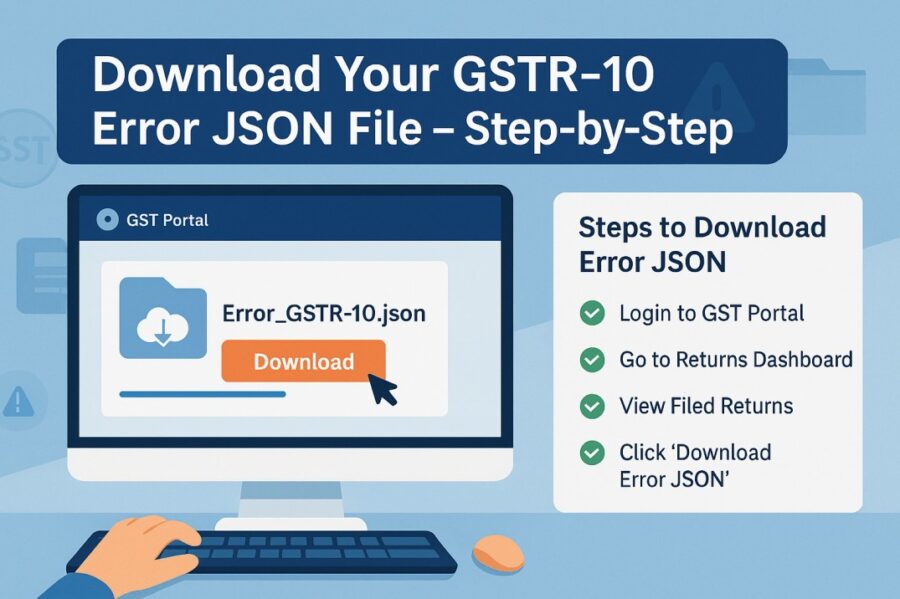

How to Download the Error JSON File?

Downloading the error JSON file is quick and hassle-free. Follow these easy steps to get the file:

1. Once you complete the validation process, you will receive a link to download the error report. To download this report, click on the link titled 'Generate Error Report'. A confirmation message will appear, and the error report column will indicate that the error generation report has been successfully requested.

2. The error generation report may take some time to be generated. Once it is ready, a link will appear in the error report column labelled ‘Download Error Report.’ Click on this link to proceed.

Following these steps, the error GSTR-10 JSON file will be easy to download on your device.

How to Fix Errors Using Offline Tool for GSTR-10?

As mentioned previously, after extracting the error GSTR-10 JSON file to any suitable location in your computer, follow the instructions below:

1. Open the GSTR-10 offline utility and visit the ‘Home’ tab.

2. Visit the 'Error Handling Section' and then further click on the 'Open Downloaded Error JSON file'. Further, go to the desired location where you store the error JSON file and then click on 'OK'.

3. Visit each sheet and then go through the column mentioning 'GST Portal Validation Errors'. A text will appear in this column letting know the user about the nature of the chances of error. Make the necessary corrections and then choose the 'Validate Sheet' button located on each sheet.

4. Navigate to the ‘Home’ tab and select the ‘Generate JSON File to Upload’ option.

5. A pop-up window appears and you need to select the location where you want your JSON file to save. Further, click on the ‘Save’ button.

Soon the screen will display a message requesting the user to upload the required file on the official GST portal.

Conclusion

By now, you know how to file GSTR-10 returns with offline utility. This will help you file your final GST return with greater confidence. Using the offline tool enables you to work without the need for a continuous internet connection, giving you the flexibility to take your time, review your manual data entry and minimise filing errors.

Once you complete filling out and validating the GST form, submitting the return is as easy as uploading the JSON file format on the GST portal.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

Who needs to file GSTR-10 and when?

Why should I use the GSTR-10 offline utility tool?

What are the key worksheet tabs in the GSTR-10 offline tool?

‘Home’ tab: For entering GSTIN and cancellation details.

‘Invoice_Available’ tab: For Table 8A–8C (ITC reversal with invoice).

‘Inv_Not_Avail (with)’ tab: For Table 8D (no invoice but supplier GSTIN available).

‘Inv_Not_Avail (without)’ tab: For Table 8D (no invoice and no supplier GSTIN).

Each tab corresponds to a specific ITC category in the GSTR-10 return.

By

By