How to Export GSTR- 3b in Excel in India?

- 22 Aug 24

- 19 mins

How to Export GSTR- 3b in Excel in India?

Key Takeaways

- Pice and other respective GST software help reduce common errors in GST filings.

- These tools provide an intuitive interface for managing online GST invoices and professional invoices accurately.

- Regular use minimizes human errors and manual errors, enhancing error detection and compliance.

- Pre-designed invoice templates and timely reminders for payment statuses streamline business operations.

- Efficient collaboration with suppliers and compliance support are particularly beneficial for medium-sized businesses.

Filing GSTR 3B is crucial for businesses operating under the GST regime in India. It helps in reporting the summary of outward and inward supplies and the payment of taxes. Exporting this data in Excel format can simplify the process of analysis and record-keeping. This guide will take you through the steps to export your GSTR 3B data in Excel format effectively.

What is GSTR 3B?

GSTR 3B is a self-declaration return form that businesses in India must file monthly under the Goods and Services Tax (GST) regime. It includes a summary of outward supplies, input tax credit (ITC) claimed, tax liability, and taxes paid. Filing GSTR 3B accurately is crucial for compliance and ensures smooth business operations.

Key Components of GSTR 3B

The GSTR 3B form consists of several sections, each requiring specific details about sales, purchases, and tax payments. Understanding these sections is essential for accurate filing:

Outward Supplies and Inward Supplies Liable to Reverse Charge

- Outward Supplies: This refers to the goods and services sold by your business. In this section, you need to report the total value of sales, excluding taxes. Proper reporting of outward supplies is crucial for determining tax liability accurately.

- Inward Supplies Liable to Reverse Charge: This includes goods and services purchased where the buyer is responsible for paying the GST instead of the supplier. Accurate reporting in this section is essential for calculating the correct input tax credit and tax liability.

Interstate Sales

- Interstate Sales: Transactions where goods or services are sold from one state to another. This section requires you to report the total value of interstate sales and the Integrated GST (IGST) paid on these transactions. Accurate reporting of interstate sales ensures compliance with GST regulations and correct calculation of IGST.

Eligible Input Tax Credit (ITC)

- ITC on Inward Supplies: The input tax credit allows businesses to reduce the tax paid on inputs from the tax payable on outputs. This section requires details of the ITC available on purchases made for business purposes. Ensuring accurate reporting helps optimize tax credits and reduce overall tax liability.

- Reversed ITC: Any ITC that needs to be reversed due to ineligibility must be reported here. This helps in maintaining accurate records and avoiding discrepancies in tax calculations.

Values of Exempt, Nil-rated, and Non-GST Inward Supplies

- Exempt Supplies: Goods and services that are exempt from GST, such as certain agricultural products and healthcare services. Accurate reporting in this section helps in determining the correct tax liability.

- Nil-rated Supplies: Taxable supplies that attract 0% GST. Proper documentation and reporting of nil-rated supplies ensure compliance with GST norms.

- Non-GST Supplies: Goods and services outside the scope of GST, like petroleum products and alcohol for human consumption. Reporting these supplies accurately helps in maintaining compliance and avoiding legal issues.

Payment of Tax

- Tax Paid Through Cash: The amount paid using the electronic cash ledger. Accurate reporting ensures that the tax payments are correctly reconciled with the GST portal.

- Tax Paid Through ITC: The amount paid using the available input tax credit. Proper utilization and reporting of ITC help in optimizing the tax liability.

- Interest and Late Fees: Details of interest and late fees, if any, due to delayed filing or payment. Reporting these accurately helps in avoiding further penalties and maintaining compliance.

Details of Outward Supplies and Inward Supplies Liable to Reverse Charge

Definition of Outward Supplies

Outward supplies refer to the goods and services sold by a business. This section of GSTR 3B requires you to report the total value of sales, excluding taxes.

Inward Supplies Liable to Reverse Charge

Inward supplies liable to reverse charge include goods and services purchased for which the buyer is responsible for paying the tax, instead of the supplier. This is crucial for businesses to track and report accurately.

Details of Interstate Sales (Extra Information)

nterstate sales involve transactions where goods or services are sold from one state to another within India. In such cases, the supplier and the recipient are located in different states, making the transaction subject to Integrated GST (IGST). IGST is applied to ensure a seamless flow of tax credits across state borders, preventing double taxation and promoting trade consistency within the country.

Importance of Reporting Interstate Sales

Accurate reporting of interstate sales is crucial for several reasons, particularly for tax calculation and compliance. Here’s why:

1. Correct Calculation of IGST

When goods or services are sold across state lines, IGST is levied. Accurate reporting ensures that the correct amount of IGST is calculated and collected. This is important because:

- Tax Liability: It determines the accurate tax liability for the seller.

- ITC Claims: Buyers can claim input tax credit (ITC) based on the IGST paid, which reduces their overall tax burden.

2. Compliance with GST Regulations

The Goods and Services Tax (GST) regime requires strict adherence to its rules and regulations. Accurate reporting of interstate sales ensures that businesses remain compliant with these regulations:

- Avoid Penalties: Non-compliance can result in hefty fines and penalties.

- Smooth Operations: Compliance with GST rules ensures smooth business operations without interruptions from legal or tax authorities.

3. Transparency and Accountability

Proper documentation and reporting of interstate sales promote transparency and accountability in business transactions. This includes:

- Detailed Invoices: Issuing detailed sales invoices that clearly mention the place of supply and applicable IGST.

- Record Keeping: Maintaining accurate records helps in audits and assessments by tax authorities.

4. Efficient Business Management

Accurate reporting facilitates better business management by providing clear insights into sales and tax obligations. This helps in:

- Financial Planning: Understanding tax liabilities aids in better financial planning and cash flow management.

- Audit Preparedness: Well-documented interstate sales records make it easier to handle audits and inquiries from tax authorities.

5. Facilitates Seamless Trade

Interstate trade is vital for economic growth. Accurate reporting and compliance with IGST provisions ensure that businesses can operate seamlessly across state borders without facing tax-related hurdles.

How to Ensure Accurate Reporting of Interstate Sales

ERP E-TDS Return Filing Solution

- Using ERP systems that integrate E-TDS return filing solutions can automate the process of capturing and reporting interstate sales data, ensuring accuracy and compliance.

File Return

- Filing GST returns such as GSTR-3B and GSTR-1 accurately and on time is crucial. These returns must include detailed information about interstate sales to ensure the correct calculation of IGST.

Sales Invoices

- Issuing and maintaining detailed sales invoices that clearly mention the buyer’s location and the applicable IGST helps in accurate reporting. These invoices should comply with GST invoice rules.

E-Way Bill

- For the movement of goods across state lines, generating an e-way bill is mandatory. This bill ensures that the interstate transport of goods is monitored and that the correct IGST is applied.

Accounting Software

- Using GST-compliant accounting software helps in maintaining accurate records of interstate sales, automating tax calculations, and generating required reports for GST returns.

Details of Eligible ITC

What is Input Tax Credit (ITC)?

Input Tax Credit (ITC) allows businesses to reduce the tax paid on inputs from the tax payable on outputs. This mechanism helps in lowering the overall tax liability and promotes the seamless flow of credit. By claiming ITC, businesses can ensure that the tax burden does not cascade and ultimately benefits the end consumer.

Criteria for Eligible ITC

To claim ITC, businesses must meet the following criteria:

- Business Purpose: The goods and services purchased must be used for business purposes.

- Supplier Compliance: The supplier must have paid the applicable GST to the government.

- Possession of Documents: Businesses must have a valid tax invoice or debit note issued by the supplier.

- Receipt of Goods/Services: The business must have received the goods or services.

- Filing Returns: The business must have filed the required GST returns, such as GSTR-3B.

- Aggregate Turnover: The aggregate turnover must be within the prescribed limits under the GST regime.

Values of Exempt, Nil-rated, and Non-GST Inward Supplies

Definition and Examples of Exempt Supplies

Exempt supplies refer to goods and services that are not subject to GST. While they are included under the GST regime, they are specifically exempt from tax. These exemptions are provided to support certain sectors and ensure that essential goods and services remain affordable. Examples of exempt supplies include:

- Agricultural Products: Basic agricultural products like fresh fruits, vegetables, grains, and milk are exempt from GST to support the agricultural sector.

- Healthcare Services: In order to make healthcare more accessible, hospitals, clinics, and other healthcare facilities as well as medical procedures and medications are exempt from GST.

- Educational Services: Educational services provided by recognized institutions are exempt from GST to promote education and reduce the financial burden on students.

Understanding Nil-rated and Non-GST Supplies

Nil-rated and non-GST supplies, while often confused with exempt supplies, have distinct characteristics under the GST regime.

Nil-rated Supplies

Nil-rated supplies are taxable goods and services that attract a GST rate of 0%. This means that while they fall under the GST ambit, the tax rate applied to them is zero. Key points include:

- GST Compliance: Nil-rated supplies are part of the GST structure, and businesses dealing in such supplies must comply with GST filing requirements.

- Examples: Common examples include certain food grains, bread, salt, and books. These items are essential commodities and are thus charged a 0% GST rate to keep them affordable.

- Input Tax Credit (ITC): Businesses dealing in nil-rated supplies can claim input tax credit on their inputs, but since the output tax rate is 0%, they might not have a significant tax liability to offset.

Non-GST Supplies

Non-GST supplies refer to goods and services that are entirely outside the scope of GST. These items are not taxed under the GST regime, are governed by other tax laws, or are tax-exempt for various reasons. Key points include:

- Outside GST Ambit: Non-GST supplies do not fall under the GST framework, meaning GST does not apply to their sale or purchase.

- Examples: Notable examples include petroleum products (like petrol and diesel), alcohol for human consumption, and electricity. These items are typically taxed under state VAT or other specific tax regimes.

- No ITC: Since these supplies are outside the scope of GST, businesses cannot claim input tax credit on inputs used for these supplies.

Importance of Accurate Reporting

Accurate reporting of exempt, nil-rated, and non-GST inward supplies in GST returns is crucial for several reasons:

- Compliance: Ensures that the business remains compliant with GST regulations and avoids penalties or legal issues.

- Tax Liability: Helps in accurately determining the business’s tax liability and ensuring proper calculation of input tax credit.

- Transparency: This promotes transparency in financial reporting and helps in maintaining clear and accurate financial records.

- Audit Preparedness: Proper classification and reporting make it easier to handle audits and inquiries from tax authorities.

Payment of Tax

Methods of Tax Payment

Businesses can pay their GST liability using two primary methods: the electronic cash ledger and the electronic credit ledger. It is essential to maintain accurate records of all payments to ensure compliance and facilitate smooth reconciliation.

- Electronic Cash Ledger: This ledger is used to pay taxes, interest, penalties, fees, or any other amount payable under GST. It contains information about the amount that the taxpayer deposited.

- Electronic Credit Ledger: This ledger reflects the ITC available to the taxpayer. It is used to pay the output tax liability. The credit can be applied to the tax paid on purchases and other inputs.

Recording Payment Details in GSTR 3B

Accurate recording of payment details in the GSTR 3B return ensures that there are no discrepancies in the filed return, which helps in smooth reconciliation. Here’s how you can ensure accurate recording:

- GSTR-3B Return: While filing the GSTR-3B return, ensure that the details of tax paid through the electronic cash ledger and electronic credit ledger are accurately recorded.

- Online Payments: Ensure that all online payments made towards GST are recorded promptly and correctly in your accounting software. This includes payments made through various payment gateways.

- Vendor Payments: Record all vendor payments accurately to ensure that the input tax credit claimed is based on actual payments made. This helps in avoiding mismatched invoices and discrepancies.

- Advance Payments: Any advance payments made towards future supplies should be recorded accurately. This is crucial for proper ITC claims and tax calculations.

- Export Invoices: For export transactions, ensure that IGST payments are recorded accurately. This is important for claiming refunds and ensuring compliance with GST regulations.

- Notes Against Purchase Invoices: Maintain detailed records of any credit notes or debit notes issued against purchase invoices. This helps in adjusting the ITC accurately.

- Relevant Details: Include all relevant details, such as tax amounts, invoice numbers, and payment dates, in your records to facilitate easy verification and reconciliation.

- Business Compliances: Adhering to business compliances and maintaining accurate records ensures that your business remains compliant with GST regulations and avoids penalties.

- Tax Amounts: Clearly record the tax amounts paid under CGST, SGST, and IGST to avoid any confusion and ensure correct tax liability calculations.

- Bulk Invoicing: For businesses dealing with bulk invoicing, ensure that all invoices are recorded accurately and in a timely manner. This helps in maintaining clear records and avoiding discrepancies.

- Consumer Products and Product Suites: For businesses dealing with consumer products and various product suites, ensure that the GST paid on each product is recorded accurately. This helps in maintaining compliance and accurate tax calculations.

- E-Way Bill: Maintain records of all e-way bills generated for the movement of goods. This is crucial for compliance and accurate tax reporting.

- Optimize ITC: Regularly optimize the input tax credit by ensuring that all eligible ITCs are claimed and accurately recorded.

- Vendor Delight: Maintain good relationships with vendors by ensuring timely payments and accurate recording of transactions.

- Sample Values and Sales Documents: Use sample values to verify the accuracy of recorded transactions and maintain all sales documents for verification.

- Direct Tax Compliance and Secretarial Compliance: Ensure compliance with direct tax regulations and maintain accurate records to avoid discrepancies.

- Effortless Collaboration: Collaborate with your accounting and finance teams to ensure that all tax payments are recorded accurately and promptly.

- Return Period and Capital Between Return Cycles: Manage your capital efficiently between return cycles to ensure that there are no delays in tax payments.

- Monthly Summary Return and Portal For Filing Returns: Ensure that all monthly transactions are summarized accurately in the GSTR-3B return and use the official GST portal for filing returns.

- Rejections During Return Filing and Simple Return: Address any rejections promptly and ensure that the GSTR-3B return is filed as a simple return without errors.

When to File GSTR-3B?

GSTR-3B is a monthly self-declaration return form that businesses must file under the Goods and Services Tax (GST) regime in India. The standard deadline for filing GSTR-3B is by the 20th of the month following the reporting month.

For instance, the deadline to submit the January return is February 20. Adhering to this deadline is crucial to avoid penalties and ensure compliance with GST regulations.

In certain circumstances, the government may extend this deadline. Extensions typically occur during significant system upgrades, changes in GST laws, or during extraordinary events such as natural disasters or the COVID-19 pandemic.

It is essential for businesses to stay updated with notifications from the GST Council or the Central Board of Indirect Taxes and Customs (CBIC) regarding any changes in filing deadlines.

Penalties for Late Filing

Failing to file GSTR-3B on time can result in several penalties and additional costs. The penalties for late filing are structured to encourage timely compliance and are as follows:

- Penalty Amount:

- Normal Taxpayers: A penalty of ₹50 per day (₹25 each for CGST and SGST) is levied for each day of delay.

- Nil Filers: A penalty of ₹20 per day (₹10 each for CGST and SGST) is charged for those with no taxable sales during the month (nil returns).

- Interest on Tax Due:

- In addition to the daily penalties, interest is charged on the outstanding tax amount. The interest rate is 18% per year and is calculated from the day following the due date until the actual payment date.

- Impact on Input Tax Credit (ITC):

- Late filing can also impact the availability of ITC. If the GSTR-3B is not filed within the prescribed time, the input tax credit claimed by the recipient might be affected, leading to cash flow issues and increased tax liability.

- Restriction on Filing Other Returns:

- If GSTR-3B is not filed, the taxpayer cannot file other subsequent returns, such as GSTR-1. This could lead to a cascading effect on compliance and business operations.

- Increased Scrutiny:

- Consistent delays in filing returns can attract scrutiny from tax authorities, potentially leading to audits and investigations.

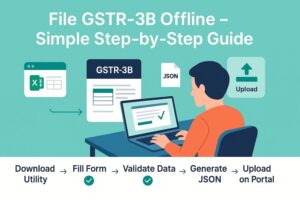

Steps to Use GSTR 3B Excel Template Sheets

Downloading the GSTR 3B Template

The GST portal provides an Excel template for GSTR 3B, which simplifies the process of preparing and filing returns. Follow these steps to download the template:

Step 1: Visit the Official GST Website: Go to the GST portal at gst.gov.in.

Step 2: Navigate to the Downloads Section: Look for the 'Downloads' tab on the homepage and click on it.

Step 3: Select Offline Tools: Under the 'Downloads' tab, choose 'Offline Tools'.

Step 4: Download GSTR 3B Template: Find the GSTR 3B template in the list of available offline tools and click on the download link. Save the template to your computer.

Entering Data into the Template

Once you have downloaded the GSTR 3B template, you need to enter the required details. Here’s how to do it:

- Open the Template: Open the Excel template you downloaded.

- Enter Company Information: Fill in your business name, GSTIN, and other relevant company details.

- Input Data in the respective sections: Enter data in the appropriate sections of the template. These sections include:

- Outward Supplies: Details of sales and supplies.

- Inward Supplies Liable to Reverse Charge: Details of purchases subject to reverse charge.

- Eligible Input Tax Credit (ITC): Information about input tax credits.

- Tax Payment: Details of tax paid through electronic cash ledger and electronic credit ledger.

- Ensure Accuracy: Verify that all values are accurate and match your records to avoid discrepancies. This includes checking against bank account details, complete document details, GST details, and reconciliation details.

- Save the Filled Template: Once all the data is entered, save the template file on your computer.

Follow the Below Procedure for Exporting GSTR 3B into Excel Format

To export your GSTR 3B data into Excel format from the GST portal, follow these steps:

Step 1: Log in to the GST Portal:

- Visit the GST portal and log in using your credentials (username and password).

Step 2: Navigate to the Returns Section:

- After logging in, go to the 'Services' menu.

- Click on 'Returns' and then select 'Returns Dashboard'.

Step 3: Select GSTR 3B:

- In the Returns Dashboard, choose the financial year and the return filing period for which you want to export data.

- Click on the 'Search' button.

- From the list of available returns, select 'GSTR 3B'.

Step 4: Download the Data:

- Click on the 'Download' button.

- Select 'Excel' as the format for downloading the data.

- The system will generate an Excel file with your GSTR 3B data.

- Save this file to your desired location on your computer.

Conclusion

Accurate filing and exporting of GSTR 3B data in Excel format can greatly simplify your tax reporting process. It ensures that your business remains compliant with GST regulations and helps in efficient record-keeping.

Using Pice business payment app or other relevant GST software can significantly reduce the chances of errors and common errors in your GST filings.

These tools provide an intuitive interface and ensure that online GST invoices and professional invoices are accurate. Regular use of these platforms helps avoid human errors and manual errors, improving the likelihood of errors detection.

For businesses, especially medium businesses, these software solutions offer features like pre-designed invoice templates, timely reminders for payment statuses, and efficient collaboration with suppliers, ensuring compliance and streamlined operations.

By

By