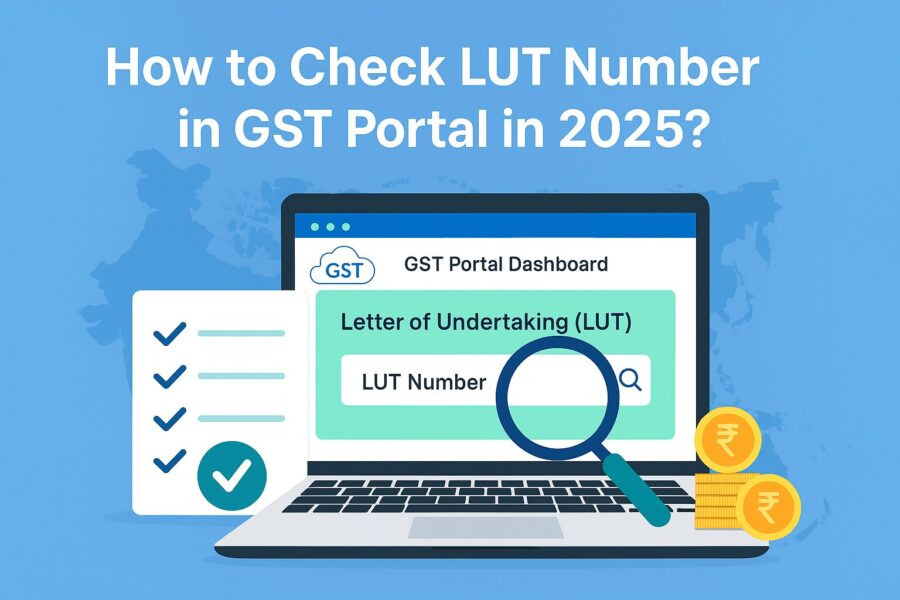

How to Check LUT Number in GST Portal in 2025?

- 13 Oct 25

- 5 mins

How to Check LUT Number in GST Portal in 2025?

Key Takeaways

- A Letter of Undertaking (LUT) under GST allows exporters to make zero-rated exports without paying IGST upfront.

- You can check your LUT number in the GST portal under ‘Services > User Services > View My Submitted LUTs’.

- LUT in GST helps exporters avoid cash blockage, reduce refund delays, and improve cash flow efficiency.

- To file or check LUT, exporters need documents like PAN, GST RFD-11 form, IEC certificate, and KYC of the authorised signatory.

- Regularly tracking your LUT number on the GST portal ensures compliance, prevents delays, and maximises export tax benefits.

Are you an exporter looking to save taxes and streamline your international trade operations in 2025? What if you could legally avoid paying IGST on exports and reinvest those funds to grow your business? That is exactly what a Letter of Undertaking (LUT) allows you to do.

In fact, over 85% of registered exporters in India now file LUTs to enjoy zero-rated exports under GST. But here is the catch, many still do not know where to find their LUT number on the GST portal. In this guide, we will discuss how to check LUT number in GST portal and ensure uninterrupted compliance while maximising tax benefits.

What Is LUT Under GST?

LUT is Letter of Undertaking under GST. Exporters use this document to export services or goods without tax payment. They need to pay IGST (Integrated Goods and Services Tax), which they can reclaim as a refund. Using LUT helps exporters avoid paying taxes and requesting refunds, thereby eliminating the cash freezing due to payment of taxes.

Eligibility of LUT Under GST

If you are an exporter of goods and services registered under GST, you need to submit a GST LUT. However, if any exporter is accused of tax evasion of an amount exceeding ₹250 lakhs in violation of the CGST Act and IGST Act, 2017, then he/ she does not have to submit a LUT under GST RFD 11. Rather, the accused exporter has to submit an export bond.

Thus, you need to submit the LUT under the following conditions:

● If you want to provide goods or services to India or other countries or Special Economic Zones (SEZs) with GST registration.

● In case you want to avoid paying IGST on the sale of goods.

How to Check the LUT Number in the GST Portal in India?

Here are the simple steps to view the LUT number:

1. Visit the official unified GST portal.

2. On the ‘Home’ page, log in to the portal using user credentials.

3. Navigate to ‘Services’, ‘User Services’ and then ‘View My Submitted LUTs’.

4. Choose the date range for the ‘Submission Period’ by filling in the from and to calendars.

5. Click on the ‘Search’ option to view the respective LUTs. If you wish to download LUT, click on the Download button.

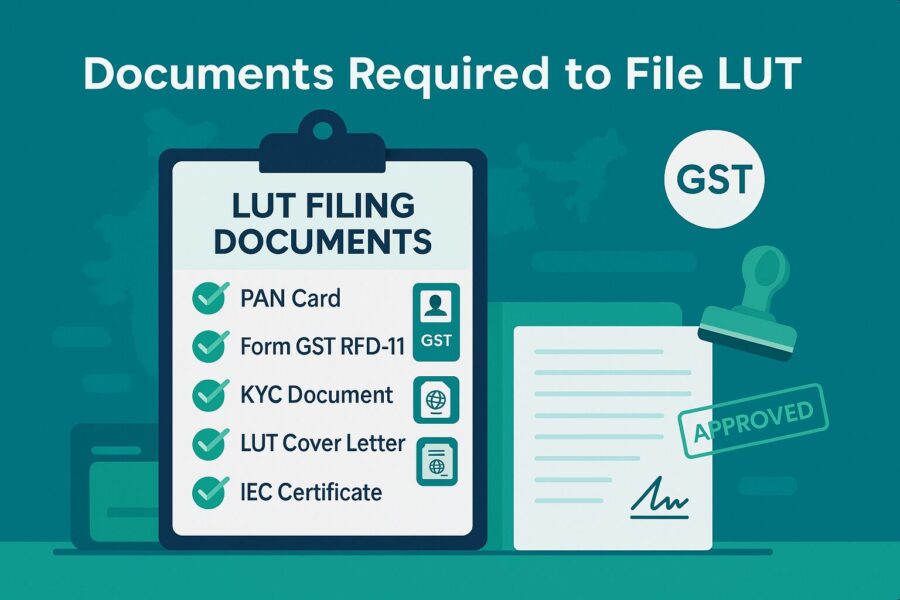

Documents Required to File LUT

Here are the documents required to file LUT under GST:

● The company’s PAN card

● Form GST RFD 11

● KYC of the authorised person

● LUT cover letter with official signature

● Certificate of IEC Code (Import Export Code)

● Cancelled cheque

Conclusion

To answer how to check the LUT number in the GST portal, it is important to follow the step-by-step process outlined above for a smooth and error-free experience. Knowing where to locate your LUT ensures timely compliance, prevents export delays, and helps you make the most of zero-rated tax benefits.

Always ensure you have all the necessary documents ready when filing or checking your LUT number under GST. Staying updated and organised on the GST portal can significantly ease your export procedures and safeguard your business from unnecessary tax burdens.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

What is an LUT number under GST?

Why is it important to check your LUT number in GST?

How can I check my LUT number in the GST portal?

Services > User Services > View My Submitted LUTs.

Select the date range for the submission period and click ‘Search’. You can view all furnished LUTs and download them if required. This process helps you track validity and stay compliant.

What documents are required to file LUT under GST?

PAN card of the business

Form GST RFD-11

KYC documents of the authorised signatory

LUT cover letter with official signature

Import Export Code (IEC) certificate

Cancelled cheque

These documents validate your business and ensure smooth filing on the GST portal.

By

By