Format and Components of Form GST REG 27

- 18 Sep 25

- 5 mins

Format and Components of Form GST REG 27

Key Takeaways

- Form GST REG-27 is a show-cause notice issued for cancellation of provisional GST registration.

- It highlights discrepancies or eligibility doubts in the GST registration application.

- Taxpayers must respond promptly with clarifications or amendments through the GST portal.

- Failure to reply may result in permanent cancellation of provisional GST registration.

- Awareness of REG-27 format and components ensures timely compliance and smooth business operations

Ever asked yourself what would happen if your provisional GST registration is put under scrutiny prior to finalisation? Suppose you get a notice raising doubts over your eligibility, what do you do? That is where Form GST REG 27 is needed.

This form is a show-cause notice for cancelling provisional GST registration and calls for prompt action. Familiarity with its structure and essential elements is not only useful. It is also necessary to defend your business registration.

So, let us understand how this form operates and why knowledge of it will enable you to respond promptly and confidently through the GST portal.

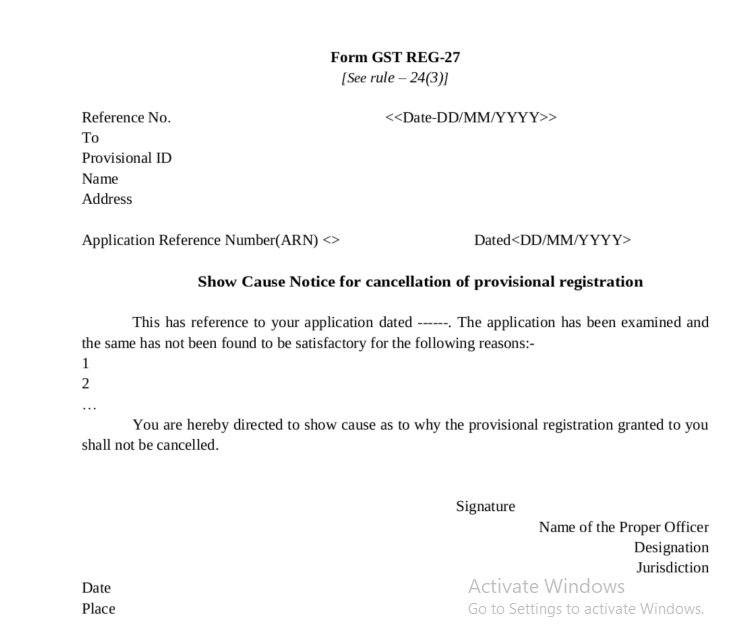

Format of Form GST REG-27

Form GST REG-27 follows a structured layout intended to inform taxpayers about proposed cancellations and to provide them with an opportunity to clarify their position. The format is standardised and used across jurisdictions by tax authorities under applicable GST notifications.

Components of Form GST REG-27

The following are the crucial components of Form GST REG-27:

1. Reference Number is a distinct number given to every notice for reference and tracking purposes by both the authorities and the taxpayer.

2. The date on which the show cause notice was issued.

3. Provisional ID identifies the provisional GST registration of the taxpayer and is used for initial compliance tracking.

4. The legal name of the taxpayer to whom the notice is issued.

5. The full address according to the Principal place of business, which assists in jurisdictional classification.

6. Application Reference Number is a distinctive number for the Registration Application, utilised for correspondence and future reference.

7. Show Cause Notice Text is an extensive note on why the tax authorities are suggesting the cancellation of the provisional registration. It tends to point out inadequacies in the documents or inconsistencies in the information presented.

8. Authentication by the proper officer issuing the notice and their name and signature.

9. Specification of the designation of officers and the jurisdiction assigned to them, serving to identify the authority under whose jurisdiction the assessment is to be conducted.

10. Specification about date and place, where and when the form was issued.

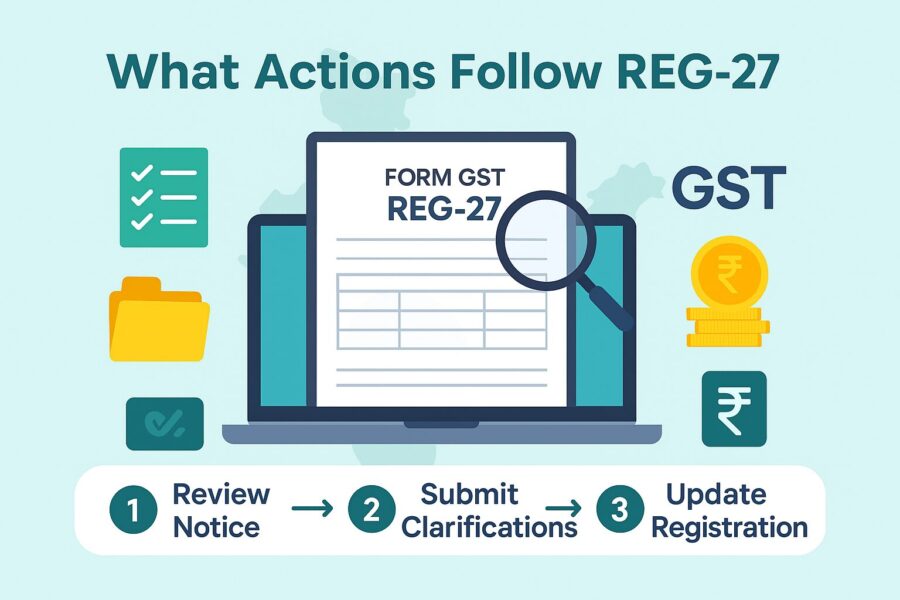

What Actions Follow REG-27?

After a taxpayer is issued Form GST REG-27, they need to reply within the notice time frame. It may be a clarification, supporting documents, or submission of an Application for Amendment in case the mistake is in the submitted information. Taxpayers have to be accurate in Core as well as Non-Core fields while making corrections.

If the taxpayer does not respond or the officer is not satisfied with the response, then provisional registration can be cancelled permanently. In this case, the taxpayer shall need to file a new Registration Application through the GST portal to again start business activities.

Conclusion

Form GST REG-27 is crucial for warranting compliance of only such firms to keep their GST registration. The companies can ensure uninterrupted compliance and avert revocation of provisional registration by having an awareness of its elements and consequences.

Moreover, ex-ante management of registration information, on-time communication through Amendment of Registration, and regular tracking of GST notifications will help companies comply with regulations and ensure uninterrupted relations with suppliers and tax officers.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By