Export-Oriented Unit Scheme: EOU Under GST

- 16 Jan 25

- 8 mins

Export-Oriented Unit Scheme: EOU Under GST

Key Takeaways

- EOUs can be set up anywhere in India, offering greater location flexibility than SEZs.

- Tax exemptions and GST refunds make EOUs cost-efficient and globally competitive.

- EOUs promote exports, create jobs, and contribute to foreign exchange earnings.

- Regulatory waivers simplify operations and boost business efficiency for EOUs.

- EOUs operate across diverse sectors, driving export growth in various industries.

The Indian government introduced the Export-Oriented Unit scheme in 1981 to boost the Indian export industry. This blog will discuss EOU and its objectives, EOU under GST implications, benefits, and more.

Objectives of EOU

The EOU scheme complements schemes such as the Free Trade Zone (FTZ) and Export Processing Zone (EPZ) in India. Export-oriented units are subject to the regulations and procedures in Chapter 6 of the Foreign Trade Policy. EOUs are units that aim to export their entire production of goods and can engage in manufacturing, services, development of software, repair, reconditioning, and re-engineering.

Units dealing in agriculture, aquaculture, animal husbandry, biotechnology, floriculture, geoprocessing, granites, horticulture, pisciculture, poultry, sericulture, and viticulture can obtain the EOU status.

There are some main objectives of the export-oriented units scheme, such as:

- To have an environment suitable for smoother operations and growth opportunities

- To obtain regulatory benefits such as waivers and preferential treatment in compliance and taxation, reducing administrative concerns and increasing business efficiency

- Create job opportunities and address unemployment concerns by promoting export-driven businesses

- Optimising the supply chain from sourcing the raw materials to delivering the finished product and ensuring a smooth export process and trade efficiency

- Promote different kinds of exports, generate foreign exchange income and strengthen the Indian economy, securing a strong position in the global landscape

Benefits of EOU

There are several benefits of EOU. Here are some of them:

1. Export-oriented units get exemptions on duties when they purchase raw materials and capital goods domestically or import them. This helps reduce costs and makes the procurement processes efficient, helping the EOUs become globally competitive.

2. EOUs can reclaim the GST paid by them. This financially assists the EOUs and encourages them to better conduct export activities.

3. EOUs get refunds on duties they pay for purchasing fuel from domestic oil companies.

4. EOUs can move goods across borders quickly as they get expedited clearance processes, and can timely deliver to international markets and achieve better operational efficiency.

5. Export-oriented units have regulatory flexibility as they do not need industrial licenses. This feature helps them simplify their operations and removes bureaucratic hurdles, and the EOUs can focus on expanding their business.

6. EOUs are entitled to tax credits for items and services used in their manufacturing operations fostering investment and innovation by lowering tax burdens and supporting effective resource management.

Difference Between EOU and SEZ

Both Export-Oriented Units (EOUs) and Special Economic Zones (SEZs) promote increasing exports, but there are some key differences between them. EOUs can be established anywhere in the country, provided they meet specific criteria.

On the other hand, SEZs are designated zones treated as foreign territories, operating outside regular Customs jurisdiction. However, SEZs are specially marked territories that can have duty-free import of goods and services for their units and developers.

Special Economic Zones are established by the government to promote exports and bring foreign investment. These areas are exempt from regular Customs jurisdiction, such as a foreign territory. This is why, sales from an SEZ to the Domestic Tariff Area (DTA) are treated as exports, while sales from an EOU to a DTA are seen as deemed exports.

Special Economic Zones often export to domestic tariff areas more than export-oriented units. SEZ-based businesses do not need to pay taxes, but EOUs must pay applicable taxes first and later claim refunds.

Important Facts to Remember While Setting Up an EOU

These are some facts to remember about setting up an EOU:

- Businesses must apply to the Board of Approval to establish an Export Oriented Unit (EOU). When these EOUs are approved, they receive a Letter of Permission, which allows them two years to establish the plant and install machinery. There is a possibility of a one-year extension of this time limit. EOUs have to bring in positive foreign exchange income within 5 years after starting operations.

- Businesses also must invest at least ₹1 crore in plant and machinery. This criterion does not apply to agriculture, animal husbandry, brass hardware services, biotechnology parks, electronics hardware technology parks, handicrafts, handmade jewellery, information technology, or software technology parks.

- An EOU must be set up at least 25 km from urban area limits unless it is in an industrial area or industries dealing with non-polluting products or services.

- Export-oriented units were primarily focused on industries such as textiles, electronics, food processing, chemicals, plastics, and minerals. However, these EOUs now include agriculture, engineering, manufacturing, precious metals, services, software, and trading.

- EOUs must acquire a special license from the Development Commissioner to set up in sectors such as weapons, defence equipment, atomic energy, narcotics, psychotropic substances, and some alcoholic and tobacco products.

- Export-oriented units are licensed to manufacture goods for export within a bonded period of five years and can be extended for another five years by the Development Commissioner. Additionally, this time limit can be extended an additional five years upon request to the Commissioner or Chief Commissioner of Customs.

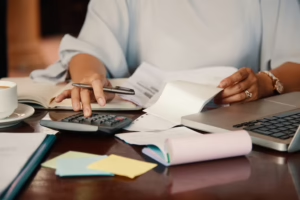

GST Implications for Export-Oriented Units (EOU)

Export-oriented units operate under specific regulations. These are:

- Suppliers to EOUs are required to charge GST on the goods supplied. They can either claim an input tax credit for GST paid on supplies made to the Domestic Tariff Area (DTA) or apply for a refund of the GST amount.

- EOUs must pay GST on eligible sales made to the Domestic Tariff Area (DTA) unless the transaction qualifies as a zero-rated supply exempt from GST.

3. GST applies to transactions between EOUs and are treated similarly to regular sales under GST regulations.

4. Export-oriented units get an exemption from basic customs duty on imports. This promotes suitable conditions for their operational and trading activities. EOUs allow exporters to set up export businesses in locations they choose, and they can also get various industrial sectors they can choose from.

Customs Rules for Export-Oriented Units

100% EOUs are free from paying Basic Customs Duty under the First Schedule of the Customs Tariff Act, 1975, and Additional Customs Duty under Section 3 of Notification No. 52/2003-Customs, dated 31.03.2003. However, on June 30, 2017, Notification No. 59/2017-Customs replaced this notification.

According to this notification, inputs used to produce completed goods sold to DTA by payment of GST would not be exempt from Basic Customs Duty. The exemption, however, will still be in effect for any additional duties that are due under Section 3 of the Customs Tariff Act.

Conclusion

The Export Oriented Unit scheme plays an important role in the promotion of exports. Unlike Free Trade Zones and Export Processing Zones, which required businesses to operate within designated locations, EOUs offered exporters the flexibility to set up their export business at locations of their choice.

Since EOUs can claim the GST refund, it helps them financially and enables them to expand their operations. EOU under GST has some tax implications, and some EOUs require a license to set up operations such as weapons, defence equipment, atomic energy, and certain other sectors.

💡If you want to streamline your payment and make GST payments, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By