DRC 21 in GST: Everything You Need to Know

- 17 Jul 25

- 6 mins

DRC 21 in GST: Everything You Need to Know

Key Takeaways

- Form GST DRC-21 is an order issued by the Commissioner allowing extension or instalment-based payment of GST dues.

- It is issued after reviewing the taxpayer’s application and financial capacity report from the jurisdictional officer.

- The form enables payment flexibility by allowing up to 24 monthly instalments under Section 80 of the GST Act.

- DRC-21 includes taxpayer details, payment schedule, order specifics, and the reason for granting relief.

- This form helps taxpayers facing financial hardship stay GST compliant without facing immediate penalties.

In the context of Goods and Services Tax (GST) compliance, several types of forms play crucial roles in ensuring seamless tax payments and recoveries. The GST DRC-21 is one such essential form which is used for the intimation of the amount payable, alongside reasons for the demand under the GST Act.

In this blog, we shall explore the meaning of DRC, its format and other key aspects of the Form DRC-21 in GST. This shall allow taxpayers to navigate the GST recovery procedures with more confidence and ease.

What is Demand and Recovery under GST?

A Demand and Recovery Case (DRC), in simple terms, is a legal process in which the tax department issues a notice to a taxpayer. This is done if the said entity is not able to pay the correct amount of GST.

In case a registered taxpayer owes more GST amount compared to what they have paid, the Indian government shall issue a DRC. It will ask for the payment of the unpaid amount alongside the mention of applicable penalties/interest.

The DRC plays a significant role within the GST system, prompting the maintenance of proper tax collection and the prevention of tax evasion cases. It shall ensure that businesses are paying their taxes honestly. This, in turn, also assists the government in tracking and recovering any pending dues.

What is DRC 21 in GST?

The Form GST DRC-21 is an important document issued by the Commissioner under the GST regime. It is relevant in the context of the extension of time for the payment of dues, taxes or other amounts under the GST Act. It also allows for the payment of outstanding amounts in instalments, according to Section 80 of the GST Act.

When a taxable person electronically submits an application requesting an extension of time to pay taxes or any other amount due under the Act, or seeking permission to pay such amount in instalments as per section 80, the Commissioner shall obtain a report from the jurisdictional officer regarding the financial capacity of the applicant to make the payment.

After reviewing the taxable person’s request and the jurisdictional officer’s report, the Commissioner may issue an order in the form GST DRC-21. The Commissioner may alternatively permit the taxpayer to make the full amount in monthly instalments, but not in more than 24 months.

As a result, the order shall provide relief to the taxpayers who are facing genuine difficulties in paying their taxes. It will help them manage and distribute their cash flow more effectively and avoid penalties.

Therefore, the Form GST DRC-21 serves as a tool for taxpayers to gain flexibility in paying their taxes while being able to ensure compliance with GST regulations. By granting such instalment/time extension facilities, the Commissioner allows a more manageable approach to tax payment. This also lets growing businesses maintain their financial stability.

Format of DRC 21

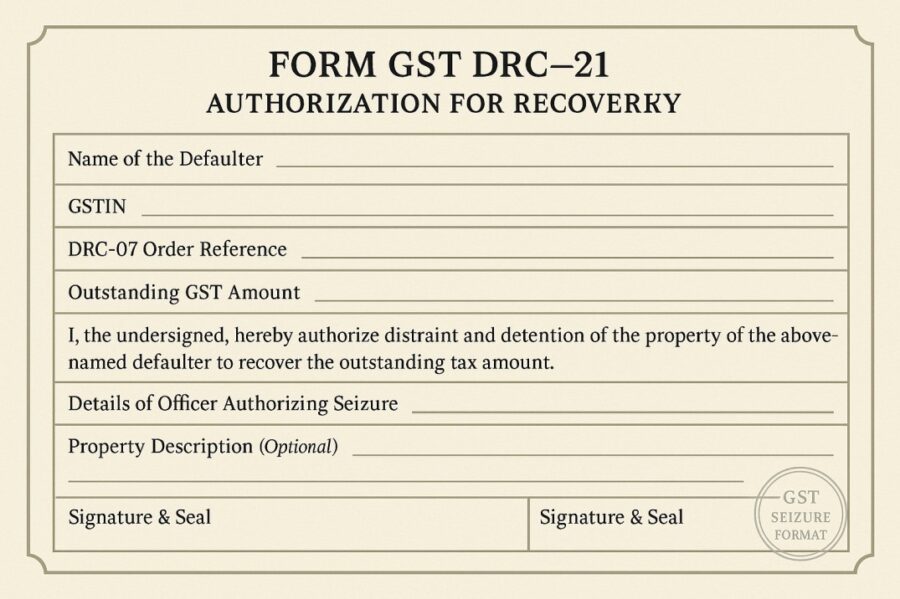

The Form GST DRC-21 includes information such as mentioned below:

● Taxpayer-related Information: This shall include the Name, GSTIN and other basic details.

● Order Specifics: This section includes the order number, time period and date for which the extension/instalment facility is granted.

● Payment Information: This includes the amount due, the payment schedule, as well as the instalment plan.

● Reason for the Extension/Instalment: The reasons for the granting of the extended period/instalment facility shall be mentioned.

Here is the format of the GST DRC-21 for your reference:

Conclusion

To conclude, the Form DRC-21 in GST plays an important role by granting relief to taxpayers who are faced with unforeseen difficulties in meeting tax obligations. Via extension/instalment facilities, the Commissioner allows for a more efficient approach to tax payment.

By understanding its format, taxpayers can navigate GST compliance requirements seamlessly and make informed decisions.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By