Form DRC 12 in GST: Sale Certificate

- 15 Jul 25

- 5 mins

Form DRC 12 in GST: Sale Certificate

Key Takeaways

- DRC-12 is a sale certificate issued by GST officials during the recovery process through auction.

- It documents the legal transfer of ownership of movable or immovable assets sold to recover tax dues.

- The certificate includes details like property description, buyer details, and sale amount.

- GST recovery methods include asset sale, detention, or adjustment against government dues.

- DRC-12 ensures legality and transparency in the GST recovery proceedings.

The Goods and Services Tax (GST) has unified India under one tax regime. Every individual assesses their tax liabilities and pays them promptly. However, many cases arise where people pay insufficient taxes to the government. According to the Central Goods and Services Act (CGST) of 2017, the government can recover this unpaid tax amount through the DRC.

In this blog, we will examine DRC 12 in GST, its purpose and its components.

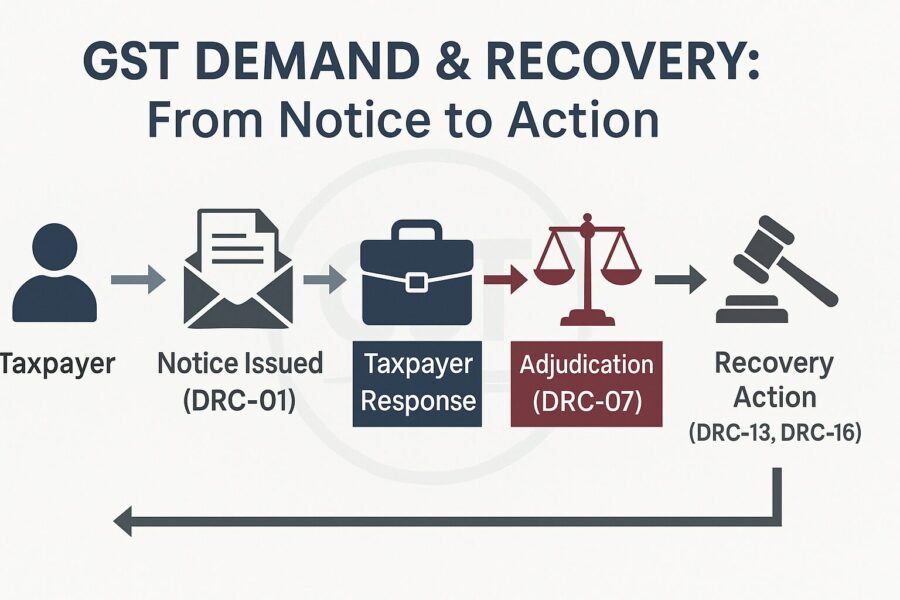

What is Demand and Recovery Under GST?

Let us understand demand and recovery with an example. Suppose Mr A self-assesses his liabilities and pays GST correctly and on time. In this scenario, authorities will not initiate any process.

However, if Mr A fails to pay his taxes or improperly uses input tax credit, officials will start a demand and recovery process. Through this, they will first issue a notice demanding the total payment within a deadline. Officials do not take any steps if Mr A complies and pays the remaining tax.

Conversely, if Mr. A fails to pay the underlying GST and associated interests, then the government will initiate the recovery process.

Types of Recovery Under GST

GST authorities can use a number of methods to recover the GST amount. They are as follows:

● Selling the defaulter’s real estate, whether movable or immovable

● Detaining the defaulter and selling their possessions

● If the GST department owes anything to the defaulter, the officials will deduct the tax amount

● GST officials will carry out a civil court money order

What Is the Purpose of DRC 12 in GST?

DRC 12 in GST helps in the recovery process of underpaid taxes. A proper officer issues this sale certificate, which serves as proof. This certificate can be used when the officials decide to sell the defaulters' property. This is generally done through an auction.

After the buyer pays the outstanding amount, the GST authorities issue this sale certificate. It contains all details such as the transfer date and details of the goods.

Components of the DRC 12 in GST

The DRC 12 in GST form contains several components serving different purposes. Let us discuss them below.

● Movable Goods

This part contains key information about goods, such as the description and quantity. A proper officer will fill in these details and issue it to the buyer.

● Immovable Goods

Property and real estate are considered immovable goods. This form contains information such as the building and flat number, name of the premises, floor number, locality, district, state and PIN code.

● Shares

GST officials can also recover the outstanding amount by selling any shares owned by the defaulter. This form contains information on the company, quantity and value of the shares.

What Is the Format of DRC-12 in GST?

Take a look at the official format of DRC-12 in GST:

Conclusion

A Demand and Recovery Case (DRC) is a legal procedure initiated by the tax authorities when a business fails to pay the correct amount of GST, prompting the issuance of a notice.

A DRC 12 in GST is an important part of the legal procedure. Usually, officials allow a 30-day deadline for the defaulter to pay their taxes.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

What is DRC-12 in GST?

When is DRC-12 issued during the GST recovery process?

What details are included in the DRC-12 form?

Description of the asset sold (movable/immovable/shares)

Buyer's name and payment details

Location and timing of the auction

Legal reference to the GST case

Signature of the GST officer

It serves as proof of lawful transfer under recovery proceedings.

By

By