Guide to Cross Utilization of ITC under GST in India

- 22 Jul 25

- 9 mins

Guide to Cross Utilization of ITC under GST in India

Key Takeaways

- Rule 88A optimises IGST credit utilisation, ensuring minimal credit balances and smoother inter-governmental tax settlement.

- Cross-utilisation of ITC allows taxpayers to set off tax liabilities across CGST, SGST/UTGST, and IGST, subject to a defined hierarchy.

- Incorrect application of set-off order can increase working capital burden and result in cash flow challenges for businesses.

- Input Tax Credit (ITC) can only be claimed under stringent conditions, including proper documentation and timely vendor compliance.

- Regular ITC reconciliation is vital to avoid GST registration suspension and ensure accurate, eligible credit claims.

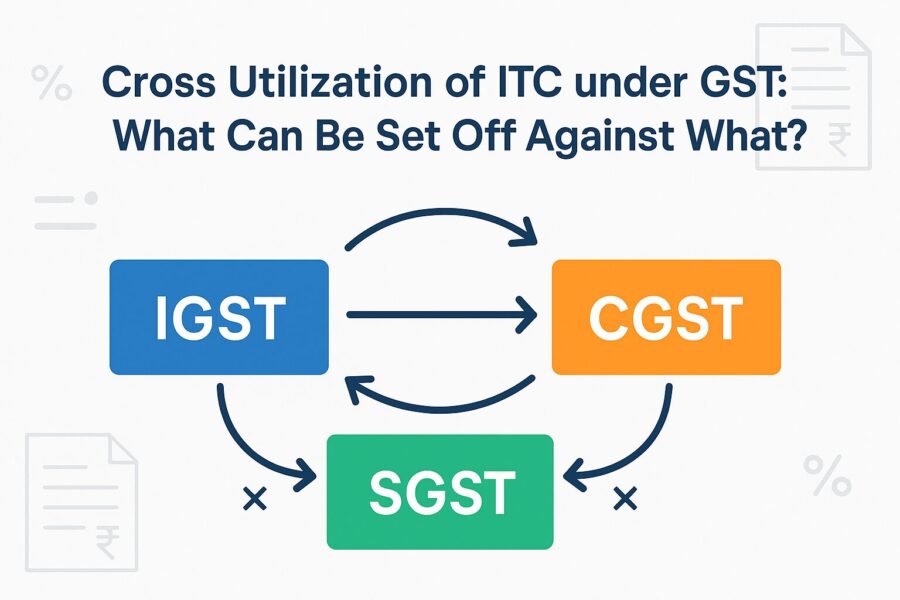

The Indian government has altered the process for the order of its set-off, as per GST Rule 88A, in effect ever since the 29th of March, 2019. The latest rules were introduced with an aim to minimise the credit balance under IGST. This newly inserted rule 88A, in turn, helped optimise distribution between the state and the centre.

If the established mechanism is not comprehended well enough or the offset is not optimised, businesses will have boosted working capital needs on their hand. Thus, it is crucial to have an understanding of the order of utilization of input tax credit, ways to optimise it, and its impact on businesses. The cross - utilization of ITC under the GST concept shall be discussed in detail below.

What is Cross-utilization of Credits?

The availing and consequent utilization of credit represent separate processes within the GST ecosystem. Availing credit pertains to the claiming of an input tax credit. On the other hand, credit utilisation requires one to apply for credit against tax liabilities. Such processes are usually governed by different sections/rules under GST legislation and help minimise tax burden. They also help streamline tax payments.

Section 17 of the CGST Act particularly addresses rules regarding the availing of credit. This further ensures compliance with GST laws as well as authenticity in claiming the input tax credit (ITC). Sections 49(4) & (5) of the CGST Act provide a framework of the provisions relating to utilization of input tax.

The CBIC has established that the IGST credit may be used for the payment of all categories of tax liabilities. But CGST credit shall solely be used for paying off CGST or IGST. Further, SGST credit shall only be used to pay for IGST or SGST liabilities. This type of tax credit utilization shall be permitted in the following situations:

● ITC of CGST for the payment of CGST and IGST in the mentioned order;

● ITC of SGST for the payment of SGST and IGST in the mentioned order;

● ITC of UTGST for the payment of UTGST and IGST in the mentioned order;

● ITC of IGST for the payment of IGST, CGST and SGST or UTGST in the mentioned order.

What is the Input Tax Credit in GST?

‘ITC’ standing for ‘Input Tax Credit’ refers to the Goods and Services Tax liabilities as paid by a registered taxpayer. This amount is paid on the purchase of any goods and/or services which are used/shall be used for the furtherance of a efficiency for business.

The Input credit of ITC can be lessened, subtracted from the GST liability on sales made by the taxable person. However, this applies only after the claimer of ITC has fulfilled certain necessary conditions. While the conditions under the GST law are similar to the ones established in the pre-GST regime, a couple of additional conditions have been added, like the GSTR-2 B. Such rules are direct and shall be stringent.

Here are some of the conditions under which ITC can be claimed:

● If the goods/services purchased are used for business purposes and not for personal use

● If buyers hold a relevant tax invoice/document/debit/credit note as evidence of payment for the purchase

● If the tax type invoice/debit note is issued by the supplier in Form GSTR-1, it must show up in the buyer's Form GSTR-2B)

● If the buyer has received the concerned goods/services.

● If the buyer furnishes the GST returns via Form GSTR-3B

● In case the products are received in instalments, ITC shall be claimed when the final lot is received

● If the buyer pays for the supply of goods/services within 180 days, starting from the invoice date.

● If the tax invoice/debit note of a particular financial year is claimed within the time frame extended by the GST provisions

● If the common credit on inputs of ITC is identified and divided (given that it is used for selling both exempt as well as taxable supplies; activity related to business/non-business).

● Note that there are certain goods which are not eligible for ITC claims under Section 17(5) of the CGST Act. These are termed as 'blocked credits' under Section 17(5) of the CGST Act.

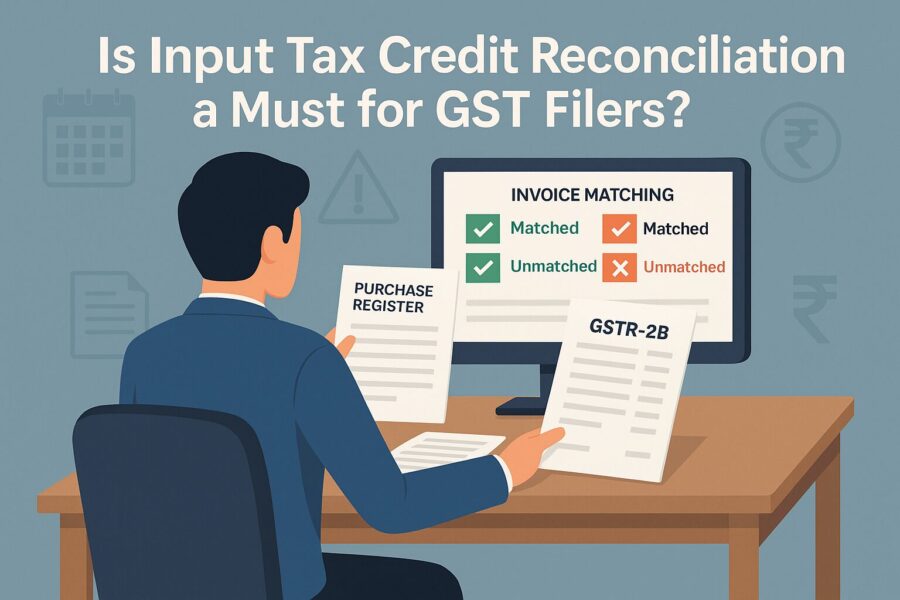

Is Input Tax Credit Reconciliation a Necessary Step for GST filers?

Input Tax Credit (ITC) reconciliation plays a crucial role for GST filers. This process has gained more importance in the GST regime as the input tax credit, as utilised by various business compliances, is regularly and minutely monitored by the GST authorities. It is done with the help of the taxation system online.

At the same time, taxpayers are required to regularly reconcile their data each month with the data established by the respective vendors. This step is especially necessary in order to claim the accurate Input Tax Credit (ITC). It shall also help avoid the individual’s GST registration from being suspended owing to any major mismatches detected between returns.

Note that the return filing and processing methods are automated, and the GST returns are all essentially interlinked.

Here are a few specific reasons why ITC reconciliation is needed by business types registered under GST:

● Taxpayers are able to claim ITC if the invoice is a part of their GSTR-2 B. Thus, taxpayers are now required to do a reconciliation when the ITC corresponding to their purchase register and the data on GSTR-2B do not match.

● To ensure the accuracy of the declaration made while avoiding cases of duplication, registered taxpayers are required to reconcile their data. After that, they can consolidate the respective values and establish the declaration.

● If the tax official in charge finds any discrepancies in the values, he may suspend the GST registration of the concerned taxpayer. He will send forth a show cause notice for the cancellation of registration as per form REG-31 if in these scenarios:

a) If there are mismatches in comparing information of outward supplies as provided in GSTR-1 and GSTR-3 B

b) If there are errors found in the details of inward supplies as provided in the GSTR-2B and GSTR-3B

● Specific deadlines apply as per the GST laws, for amending any information provided in reference to GST returns data/to claim ITC. According to the CGST Act, here are the actions that must be taken prior to 30th November, or the relevant annual return information must be provided, including:

a) Claiming eligible ITC against the invoices issued in a Financial Year

b) Apportionment of ITC of a Financial Year, as eligible/ineligible not done before, should be brought into effect before the deadline hits

c) Declaration of CDNs raised against Invoices in a Financial Year

d) Filing of Amendments to lay down information provided in the GST Returns (as filed in a Financial Year)

Conclusion

To conclude, the cross-utilisation of ITC under GST allows business owner to effectively manage their tax obligations by offsetting the credits across various tax heads. However, this is subject to certain rules as discussed above. The efficient utilisation of ITC shall result in the enhancement of cash flow, minimise GST compliance burdens, and even prompt business growth overall.

With a better understanding of the provisions, business priorities can smartly be leveraged and optimised with the tax management process and even improve operations within the GST system.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By