Everything You Need to Know About a Casual Taxable Person Under GST

- 4 Nov 24

- 10 mins

Everything You Need to Know About a Casual Taxable Person Under GST

- Who Qualifies as a Casual Taxable Person?

- Is Registration Required for a Casual Taxable Person?

- Prerequisites for Registering as a Casual Taxable Person

- Steps for Casual GST Registration

- Duration of Casual Taxable Person Registration

- Advantages of Being a Casual Taxable Person

- Limitations and Challenges of Being a Casual Taxable Person

- Are There Registration Threshold Limits for a Casual Taxable Person?

- Can a Casual Taxable Person Opt for the Composition Scheme?

- What Happens After a Casual Taxable Person Makes an Advance Tax Payment?

- Conclusion

Key Takeaways

- A Casual Taxable Person (CTP) is a business that temporarily operates in a location without a fixed establishment there and must register under GST for each temporary operation.

- GST registration is mandatory for CTPs before starting any business activities, even if the business turnover is minimal.

- CTP registration is valid for up to 90 days, with a one-time extension available, allowing temporary business operations like trade fairs or seasonal projects.

- Being a CTP offers benefits like flexibility across states, cost savings through input tax credits, and simplified compliance for short-term business.

- CTPs must make an advance GST tax deposit based on estimated liability, which is adjusted against actual tax, with a refund available if liability is lower than anticipated.

A company that periodically conducts business in a state other than its regular base is referred to as a Casual Taxable Person (CTP). This guide covers the tax laws, registration and ways how to manage Goods and Services Tax as a CTP. It is essential to make businesses aware of what to do while they are temporarily operating at a new location under GST regulations.

Who Qualifies as a Casual Taxable Person?

A business that operates primarily in one place but occasionally undertakes projects or sales in another location without a fixed office for the furtherance of business can be classified as a Casual Taxable Person (CTP). This could be in the capacity of a principal, agent or any other role, where they do not have a permanent office or business establishment in the taxable territory.

💡 If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

Is Registration Required for a Casual Taxable Person?

Registration is mandatory for all casual taxable persons in India, regardless of the value of their taxable supply. This means that even if your occasional business activities are relatively small, you must still obtain a GST registration. The registration must be obtained before commencing any business activity in the new state or union territory. Without this registration, a CTP cannot legally supply goods or services.

Prerequisites for Registering as a Casual Taxable Person

The prerequisites to register as a Casual Taxable Person (CTP) are as follows:

- Obtain a valid Permanent Account Number (PAN) from the Income Tax Department

- Provide a valid mobile number and email address for communication with GST authorities

- Choose the State or Union Territory where you will primarily conduct business

- Ensure all information is accurate and aligns with supporting documents

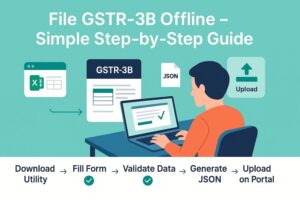

Steps for Casual GST Registration

GST registration of a CTP is to be done five days prior to the commencement of business in the form GST REG-01 from the common portal. The process is as follows:

Step 1: Visit the online GST portal. Initiate a new registration process from the 'Services' tab.

Step 2: Under Part A of GST REG-01, specify personal details such as your name, father’s name, birth date, email address, phone number and PAN number.

Step 3: Under Part B of GST REG-01, provide business details like trade name, address, expected turnover and the desired validity period, which can be a maximum of 90 days.

Step 4: Add any other relevant information in Part C, which has not been mentioned in Part A or Part B of the declaration form GSTR-1 (outward supplies).

Step 5: Upload PAN card, address proof and all relevant documents with the forms which are duly signed or verified with an electronic verification code.

Step 6: For the selected registration term, CTPs are required to pay an advance tax amount equal to their expected tax liability. You can use the GST portal's approved methods to make vendor payments online.

Step 7: Next, the GST authorities will review the information and documentation once you go through the above steps. They may get in touch with you to get any more information if required. Upon successful verification, a brief registration certificate will be issued on the common portal.

Step 8: The temporary registration certificate permits the initiation of company operations. It helps manage the collection and remittance of GST liability. The declaration form has a set expiration date and offers the opportunity to ask for a 90-day extension if necessary.

Duration of Casual Taxable Person Registration

The validity period of a Casual Taxable Person (CTP) registration application is 90 days. You can request an extension using Form GST REG-11 before your current certificate of registration expires, for another 90 days. If you need more time before producing taxable supplies, you will have to sign up again. Apply for the extended period well in advance, if needed.

Advantages of Being a Casual Taxable Person

Being a casual taxpayer under GST helps those running short-term, project-based or seasonal businesses in different states. It is beneficial to operate legally and efficiently across multiple locations for the following reasons:

- Flexibility in Operations: You can do business in different states for short-term projects like trade fairs or exhibitions without needing a permanent GST registration in those states.

- Cost Savings: You can claim input tax credits on goods and services used for your short-term activities, helping to reduce your operating costs.

- Simplified Tax Compliance: You will have fewer tax filings and simpler compliance procedures during your registration period compared to regular taxpayers.

- Legal Compliance: Registering as a CTP ensures you are legally compliant to undertake short-term business activities, avoiding potential legal issues.

- Seasonal Flexibility: Perfect for seasonal businesses, as it allows you to participate in temporary markets or events without extensive paperwork.

Limitations and Challenges of Being a Casual Taxable Person

Here are some of the common challenges you fill face being a casual taxable person:

- Temporary Registration: This is registered for 90 days, extendable only once with a validity of a further 90 days. This time limit restricts the scope of long-term projects that can be undertaken.

- Operational Challenges: Building a sustained customer base, maintaining procurement/distribution channels and setting up operations effectively in new locations become difficult.

- Tax and Compliance Challenges: Managing advance tax payments in locations where you do not have a permanent base can be difficult, this demands careful planning and compliance management to ensure timely filings.

Key Differences Between Casual Taxable Person vs. Regular Taxpayers

| Aspect | Casual Taxable Person | Regular Taxpayer |

| Registration | Needed for specific events or projects in a state where there's no permanent base | Required for ongoing business with a fixed location |

| Tax Payments | Make advance payments based on aggregate turnover | Pays tax based on actual transactions, filed monthly or quarterly |

| Return Filing | Files returns only for the registration period, usually monthly | Files returns regularly, depending on turnover |

| Validity of Registration | Temporary, usually up to 90 days, with an option to extend | Permanent as long as the business operates |

| Input Tax Credit | Can claim credits only for the period of active registration | Can continuously claim credits on business purchases |

| Compliance Requirement | Higher due to the need to estimate taxes quickly | Regular compliance with planned filings and audits |

Are There Registration Threshold Limits for a Casual Taxable Person?

GST registration is required only when a business's annual turnover exceeds a certain threshold. However, for Casual Taxable Persons, this rule does not apply. All CTPs must register under GST regardless of their turnover.

Can a Casual Taxable Person Opt for the Composition Scheme?

The composition scheme under GST is designed to simplify tax payments for small businesses. It allows eligible businesses that have an annual turnover of up to ₹1.5 crore to pay tax at a lower rate and file quarterly returns instead of monthly returns.

However, casual taxpayers are not eligible for this scheme. Since they operate temporarily without a permanent business location, CTPs must register for GST regardless of turnover. In addition, they need to make an advance tax payment based on their estimated GST liability.

What Happens After a Casual Taxable Person Makes an Advance Tax Payment?

A casual taxable person is also required to make an advance tax deposit of GST based on an estimate of their GST liability. This compulsory registration ensures that even short-term or seasonal businesses comply with GST regulations.

In this case, individuals are required to make an advance deposit of tax based on an estimate of their tax liability. After making an advance tax deposit the amount is retained as a credit against their anticipated tax due for the registration period. The CTP can carry on as usual, submitting their GST returns as needed for transitory registration.

If their actual GST liability was less than the advance deposit of tax, the individual is entitled to a reimbursement for the excess amount. This refund process is detailed in Form GSTR-3 Section 14 and is only available after all GST obligations are fulfilled.

Conclusion

Although it gives freedom, becoming a Casual Taxable Person under GST is subject to several regulations. CTPs are required to register, pay advance tax and abide by rules. Businesses can more easily handle their short-term activities under GST if they are aware of these criteria.

By

By