All about HSN Codes & Biscuit GST Rate in India

- 19 Aug 24

- 11 mins

All about HSN Codes & Biscuit GST Rate in India

- HSN Code and GST Rates for Biscuits

- Applicability of GST Registration for Bakery Products

- GST Rates on Specific Bakery Products

- Rate of GST on Bakery Products

- Input Tax GST Credit on Bakery Products Supplier

- Compliance for Bakery Product Suppliers

- GST Payment Due Date

- HSN Code for Bakery Products

- Conclusion

Key Takeaways

- Most bakery products, including cakes and sweet biscuits, are subject to an 18% GST rate, while basic bread may be exempt.

- Proper classification under the correct HSN code is essential for applying the appropriate GST rates and ensuring compliance.

- Exported bakery products are zero-rated under GST, allowing businesses to claim input tax credit while paying 0% tax on exports.

- Small bakery shops must register for GST if their turnover exceeds the threshold, with compliance including regular GST filings and accurate invoicing.

- Input Tax Credit can be claimed on GST paid on business-related inputs, which helps reduce the overall tax burden for bakery businesses.

In the context of the GST (Goods and Services Tax) in India, the biscuit industry and similar food & bakery products are classified primarily under a specific HSN (Harmonized System of Nomenclature) code, with exact GST rates varying based on their ingredients and branding. Here are the details for the biscuit:

HSN Code and GST Rates for Biscuits

- HSN 1905: This code of biscuit encompasses all kinds of biscuits.

- Plain biscuits typically attract a lower GST rate of 5%. These are usually unbranded or unpackaged biscuits without any additional sweetening or flavoring.

- Other biscuits (including those with added sweeteners, chocolate, or other flavors): These are generally taxed at 18% under GST. This category includes most commercial, branded biscuits that you find in stores.

- The distinction in GST rates largely depends on the composition of the biscuits and whether they are branded or not.

- Biscuits considered essential (like basic rusk or certain plain biscuits) might qualify for lower rates or even exemptions in some cases.

- The 5% rate usually applies to those biscuits that are either unbranded or considered essentials; however, most branded and luxury biscuits fall into the 18% tax slab.

Businesses dealing in biscuits must ensure they classify their products accurately under these codes and apply the correct GST rates during billing and in their tax filings. There is no specific HSN code for bakery services.

GST on Bakery Products

- Bakery products cover a wide range of goods, such as bread, cakes, pastries, and biscuits. The GST rates vary:

- Bread (HSN 1905): 0% GST

Applicability of GST Registration for Bakery Products

The applicability of GST registration for bakery products, including specific items like communion wafers, pizza bread, rice paper, and various food preparations, it's important to delve into the nuances of GST compliance for different types of bakery items. Here's a concise overview:

- General Requirement

GST registration is mandatory for businesses if the annual turnover exceeds Rs. 40 lakh for goods (Rs. 20 lakh for special category states) and Rs. 20 lakh for services (Rs. 10 lakh for special category states).

- Specific bakery products

- Communion Wafers: Often used in religious ceremonies, these might be categorized under essential items but still require GST registration if the turnover threshold is exceeded.

- Pizza Bread: As a popular food item, suppliers of pizza bread must register for GST if they meet the turnover criteria.

- Rice Paper: Used both in culinary and non-culinary contexts, businesses dealing with rice paper need to assess their need for GST registration based on turnover and the nature of the product usage.

- Special Considerations

Small Scale Bakeries: Small bakeries that operate below the turnover threshold can opt for voluntary registration to avail of benefits like input tax credit.

Home-based Bakery Businesses: Even small, home-based operations must register if they cross the prescribed turnover limits.

GST Rates on Specific Bakery Products

- Communion Wafers, Pizza Bread, and Rice Paper: These typically fall under the HSN code 1905, with GST rates varying:

- Basic bread (like pizza bread base) might attract a lower rate or be exempt.

- Specialized products (like flavored rice paper) could be higher, generally around 18%.

Rate of GST on Bakery Products

- As mentioned, this varies

- Essential bakery items, like bread, are exempt.

- Non-essential, luxury items such as cakes, pastries, and some types of biscuits attract higher rates (typically 18%).

Input Tax GST Credit on Bakery Products Supplier

To provide a comprehensive overview of the Input Tax Credit (ITC) under GST for bakery products suppliers, it's crucial to consider the various components involved, such as the applicable rates and rules governing specific bakery-related items. Here’s an insight into how the GST system impacts the bakery sector, particularly focusing on the ITC

- Eligibility for ITC

- Bakery Products Suppliers can claim ITC on GST paid on raw materials and inputs like flour, sugar, and other baking ingredients.

- ITC is also applicable on capital goods (ovens, mixers) and input services (rent, electricity) used in the production of bakery goods.

- Conditions for Claiming ITC

- The supplier must be GST registered.

- Goods and services used must be exclusively for business purposes.

- Necessary documents like GST-compliant invoices or debit notes must be maintained.

- Restrictions on ITC

- ITC cannot be claimed for goods or services used for personal use, exempt supplies, or supplies for which composition scheme has been availed.

- Goods destroyed, lost, or given as free samples are also not eligible for ITC.

Specific Bakery Items Under GST

- Communion Wafers, Pizza Bread, and Rice Paper: These are taxed under HSN code 1905, where the ITC rules apply based on the above eligibility and conditions.

- Cereal preparations (like corn flakes and other cereal flakes): Generally fall under HSN 1904, attracting GST at higher rates, thereby making ITC crucial for cost management.

Compliance for Bakery Product Suppliers

- Accurate HSN Coding: Ensuring correct classification of products under appropriate HSN codes to apply the right tax rates and correctly claim ITC.

- Timely Filing of Returns: Regular GST returns must be filed to report ITC and maintain compliance.

- Record Keeping: Maintaining detailed records of purchases and consumption in production to substantiate ITC claims.

Common Challenges in Claiming ITC

Mismatch in Invoices: Discrepancies between the purchase invoices and GST returns can lead to denial of ITC.

Ineligibility of Certain Expenses: Expenses like those incurred on goods/services used for exempt supplies cannot claim ITC.

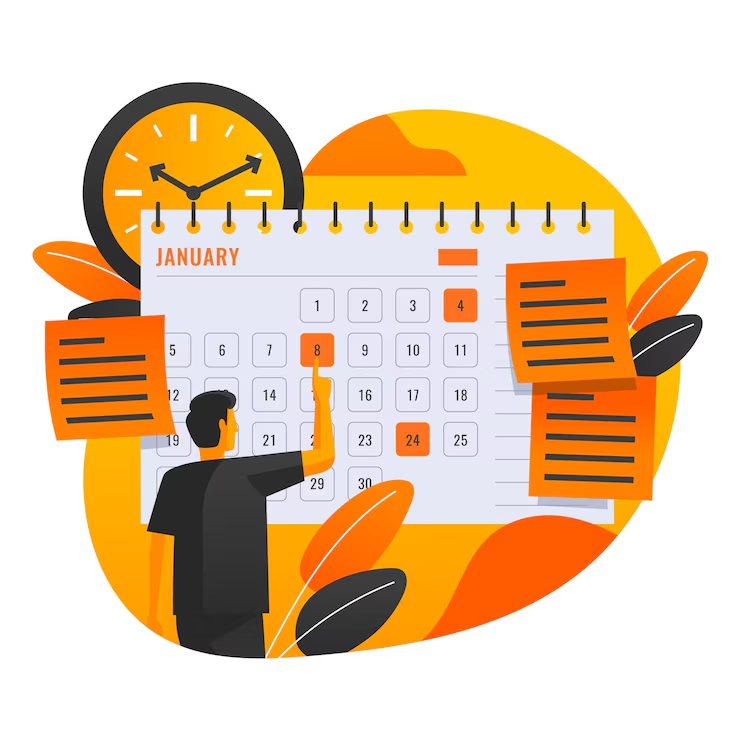

GST Payment Due Date

The GST (Goods and Services Tax) payment due date in India is an important aspect of GST compliance for businesses.

Here's a detailed breakdown of when GST payments need to be made:

Regular Taxpayers

- Monthly Payments: For regular taxpayers who file monthly returns, the GST payment is due on or before the 20th day of the following month. For instance, this means that the January GST payment is due by February 20th.

Quarterly Filers

- Quarterly Return Monthly Payment (QRMP) Scheme: For small taxpayers with a turnover up to Rs. 5 crore, who opt for the QRMP scheme, GST payments are due on the 25th day of the month following the quarter. For instance:

- For the January-March quarter, the payment is due by April 25th.

- For the April-June quarter, the payment is due by July 25th.

- For the July-September quarter, the payment is due by October 25th.

- For the October-December quarter, the payment is due by January 25th.

Composition Scheme

Quarterly Payments: Taxpayers under the GST Composition Scheme need to pay GST quarterly. The due date for these payments is the 18th day of the month following the end of the quarter. Therefore, the payment for the quarter ending in March would be due by April 18th, and similarly for other quarters.

Annual Return

The annual GST return payment, which is a final adjustment payment, is due on or before 31st December, following the end of the financial year. This involves adjusting any discrepancies between the GST paid during the year and the actual GST liability.

Important points to note:

- GST on Advances: For any advance received for services, GST needs to be paid in the month in which the advance is received, regardless of whether the service is provided or not.

- Interest and Penalties: If the taxpayer fails to pay the GST by the deadline, they are responsible for paying interest and penalties. The annual interest rate on the GST payable is 18%.

- Electronic Ledger: GST payments are to be made through the electronic cash ledger, which can be filled through various modes such as net banking, NEFT/RTGS, or through any authorized banks.

HSN Code for Bakery Products

| HSN Code | Product Description | GST Rate |

|---|---|---|

| 2007 | Jams, fruit jellies, marmalades, fruit or nut puree and pastes, obtained by cooking, whether or not containing added sugar or other sweetening matter | 12% |

| 200799 | Other | 12% |

| 20079990 | Other | 12% |

| 1905 | Bread, pastry, cakes, biscuits and other bakers' wares, whether or not containing cocoa; communion wafers, empty cachets of a kind suitable for pharmaceutical use, sealing wafers, rice paper and similar products | 18% for most products, 0% for some bread types |

| 1905310 | Sweet biscuits; waffles and wafers: | 18% |

| 19053100 | Sweet biscuits | 18% |

| 190590 | Other: | 18% |

| 19059090 | Other | 18% |

Additional Notes

- GST for Jams and Similar Products (HSN 2007): Typically, these items carry a GST rate of 12%.

GST for Bakery Products (HSN 1905)

- Most bakery products under this code, especially those containing cocoa or being sweet, such as cakes, pastries, and sweet biscuits, attract an 18% GST rate.

- Basic types of bread can have a 0% GST rate if they are plain and do not contain any other luxurious ingredients.

- GST for Sweet Biscuits (HSN 19053100): As these are typically considered luxury items, they attract an 18% rate.

- The rates mentioned are standard, but it's important for businesses to keep abreast of any changes during the annual GST council meetings or through notifications issued by the finance ministry.

With GST rates on bakery products, it's crucial to understand how different items are classified under the GST framework. For instance, while basic breads such as plain sandwich bread might be exempt from GST, specialty baked goods like garlic bread and sweet biscuits typically attract a higher GST rate of 18%. This classification extends to various bakery and cereal products, each designated under specific HSN codes.

From pizza bases falling under HSN 1905 to cereal flakes or any form of flakes falling under HSN 1904, the correct identification of these codes is essential for accurate GST compliance. Moreover, businesses need to be aware of the input tax credit eligibility of these products to optimize their GST filings. Knowing these aspects is not just about compliance, but also about harnessing efficient tax management strategies that can lead to significant cost savings in the bakery industry.

Conclusion

The GST implications for bakery products require knowledge of specific HSN codes and GST rates. It's important for bakery businesses to stay updated with GST norms and seek professional advice when needed.

💡Facing delays in GST payment? Get started with PICE today and streamline your GST payments. Click here to sign up and take the first step towards hassle-free GST management.

By

By