Credit Note Against Invoice: Everything You Need to Know

- 19 Nov 25

- 7 mins

Credit Note Against Invoice: Everything You Need to Know

Key Takeaways

- A credit note against invoice is issued to correct an already-issued invoice due to errors, returns, or refunds.

- It helps reverse or adjust part or full value of the original invoice without cancelling existing accounting entries.

- Businesses must maintain accurate audit trails, and a credit note against invoice ensures proper double-entry bookkeeping.

- Multiple credit notes can be issued for one invoice, but their total must not exceed the original invoice value.

- Using invoicing software like Pice simplifies creating and applying a credit note against invoice seamlessly.

Did you know that from 1st April, 2025, businesses having an AATO of over ₹10 crore are required to upload e-invoices to the Invoice Registration Portal (IRP) within 30 days? However, you may be wondering what happens when a supplier has to make changes to an invoice that has already been issued.

Do they have to cancel the issued invoice, or is there an efficient way of adjusting the amount? A credit note against an invoice is the answer to such a dilemma.

Further, explore how credit notes work, helping you streamline the invoicing process and maintain healthy business accounts.

Credit Note or Credit Memo Meaning in Accounting

A credit note is also known as a credit memo or a credit memorandum. It is essentially a formal record that is required to be formulated after an invoice has been issued. It shall indicate that the issued invoice is no longer accurate. This may be a result of:

- An invoicing error

- A refund

- A chargeback or some other alternative.

Common billing errors, such as overcharges or incorrect item details, are typically corrected using credit notes.

The amount as per the credit note can be a portion of the invoice amount or even the entirety of the invoice amount. One may issue more than one credit note upon a single invoice, if need be. But the sum of the credit notes should not exceed the amount featured on the respective invoice.

A business shall have to issue a credit note to consumers in order to ensure that there is an accurate audit trail of paper to account for. After that, the credit note has to be entered into the business’s accounting system as ‘debit under revenues’ and as ‘credit under accounts receivable’. This is to be done for double-entry bookkeeping and for updating accounts payable records accurately.

When is it Necessary to issue a Credit Note against a Paid Invoice?

1. Credit Notes for Sales Return/Refund

A return or refund is one of the most commonly faced scenarios, which requires the raising of a credit note. Consider the following example for better understanding.

Say, an e-commerce platform sells a piece of clothing to the customer for Rs. 1000. However, the customer has to return the clothing piece due to the wrong size. The e-commerce platform then has to issue a credit note against the paid invoice for Rs. 1000 in order to nullify the sale originally made, to further process the refund.

The original invoice number must also be referenced in the credit note to ensure accurate recordkeeping.

2. Credit Notes for Cases of Overpayments

Another type of scenario that may need businesses to raise credit notes is a case of overpayment/overcharge. This case involves a customer who has paid more than the amount mentioned in the invoice.

For example, you may invoice your customer Rs. 2000 for website designing services. However, the customer ends up accidentally paying you Rs. 2500. You will then have to issue a credit note for the overpayment of Rs. 500. This amount shall be refunded/applied to invoices in future, depending on the agreed payment terms.

3. Credit Notes for Invoice Cancellation

A credit note is required to be raised when an issued invoice has to be cancelled owing to inaccuracies/changes. For instance, a consumer may have paid you Rs. 35,000 for a quoted invoice issued for the purchase of a mobile device.

However, it so happens that the invoice was supposed to be issued for a laptop instead of a mobile device. You can then issue a credit note against the paid invoice for Rs. 35,000 in order to cancel the previous invoice.

You may then refund the Rs. 35,000 or apply it to another fresh invoice for the laptop. This is often accompanied by generating a new commercial invoice with the correct details and taxable value.

The Difference Between Credit Notes & Debit Notes

| Credit note | Debit note | |

| Issuer | The seller issues the credit note. | The buyer issues the debit note. |

| Purpose | It is aimed towards rectifying invoice errors/changes like in returns, refunds, overcharges or cancellations. | The debit note requests an undercharge, return, or adjustment. |

| Impact on Finances | The credit note increases the amounts owed by the buyer. | The debit decreases the amounts owed to the seller. |

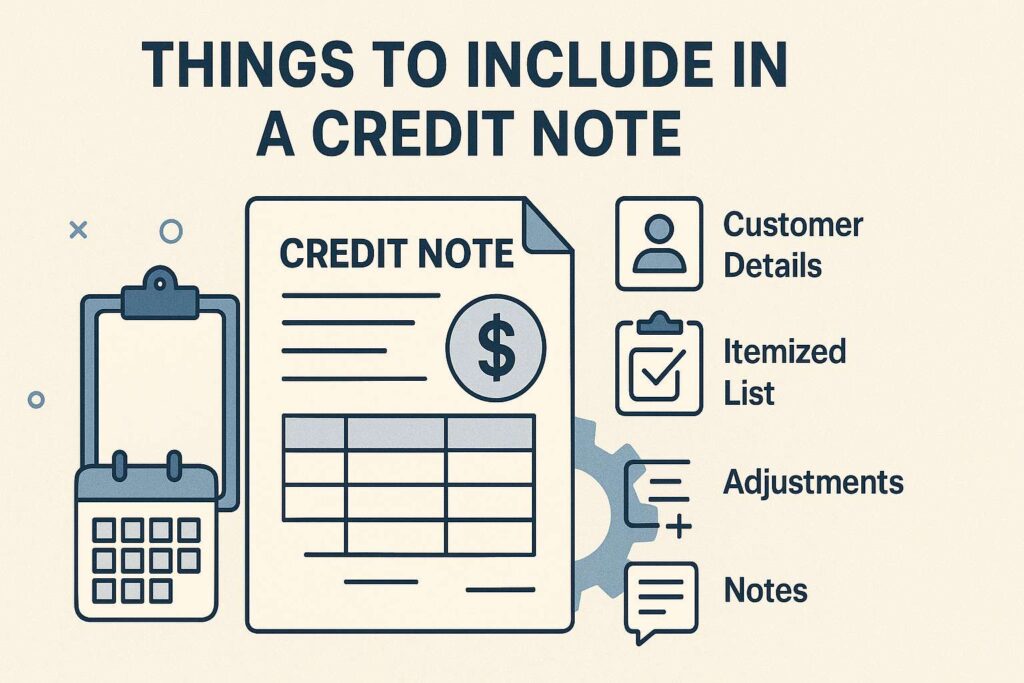

Things to Include in a Credit Note

- A credit note must ideally consist of the key details about the:

- Buyer

- Seller

- Details of the credit

- Reference to the original invoice number

However, the credit note structure is left up to the business. If one is using invoicing software, they are likely to see which fields are mandatory to fill out when they are needed to create a credit note. Most invoice templates available in such software include these essential details.

The following information is included in a credit note:

- Title: The document must clearly state the identity itself, as a credit note.

- Customer/Order Reference Number: If necessary, the customer’s and/or order’s unique identifier number should be mentioned.

- Date: The date on which the credit note was issued.

- Credit Note Number: This detail uniquely identifies the credit note. It corresponds with the respective original invoice number.

- Contact Information: Name, address and contact information for both the buyer and the seller.

- Information about Goods/Services: Description of the concerned item. This section must include the quantity, tax rate, unit rate, and the total amount that is to be credited.

- Reason for Credit: An explanation as to why the credit note is being issued must be provided.

- Terms of Payment: Information like whether the credit shall be refunded/applied to future invoices, needs to be specified. This ensures alignment with the business's standard payment terms.

Steps to Add a Credit Note in Pice

In case you are a business that uses Pice, streamline the process of setting up and issuing a credit note by following the steps mentioned below:

Step 1: Create a credit note from an invoice directly by going to ‘Business’.

Step 2: Then, to ‘Invoices’, followed by ‘Awaiting payment’.

Step 3: Proceed to select the menu icon.

Step 4: Go to ‘Create and apply credit’.

Step 5: Fill out the necessary information and click on ‘Approve’.

Proceed to fill out the prompted details and click on ‘Approve’. You shall then get the option to allocate the credit.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

Conclusion

Issuance of a credit note against invoice is a straightforward process if you get a grasp on the basics. Credit notes are essential tools to help businesses keep the necessary records accurate. They also ensure that businesses stay compliant with the tax regulations and that business accounts are reconciled properly.

The use of invoicing software can simplify the process, allowing one to keep all their financial records, including credit notes, invoice templates, and commercial invoices, in a single place.

By

By