Why Businesses Must Not Ignore Accounts Payable Automation Benefits in 2025?

- 14 Nov 25

- 9 mins

Why Businesses Must Not Ignore Accounts Payable Automation Benefits in 2025?

Key Takeaways

- Automation significantly reduces manual errors, with major accounts payable automation benefits such as improved accuracy and faster processing.

- Stronger fraud prevention and compliance are achieved through automated controls and segregation of duties.

- Real-time visibility and transparency across vendors, approvals and payment cycles are key accounts payable automation benefits.

- OCR and RPA technologies boost efficiency, saving time by eliminating repetitive data-entry tasks.

- Seamless integration with financial systems enhances cash flow, reporting, and overall decision-making are some of the core accounts payable automation benefits.

As digital transformation gains momentum, 45% of Indian companies have begun adopting automation. In the financial sector, 65% have implemented it for financial data management and reporting, leading to a 40% drop in reporting errors with AI-driven tools.

One area reaping the rewards is accounts payable. By streamlining tasks and reducing human error, automation delivers measurable value.

In this blog, we will explore the top accounts payable automation benefits that can enhance efficiency, accuracy and control across your financial operations.

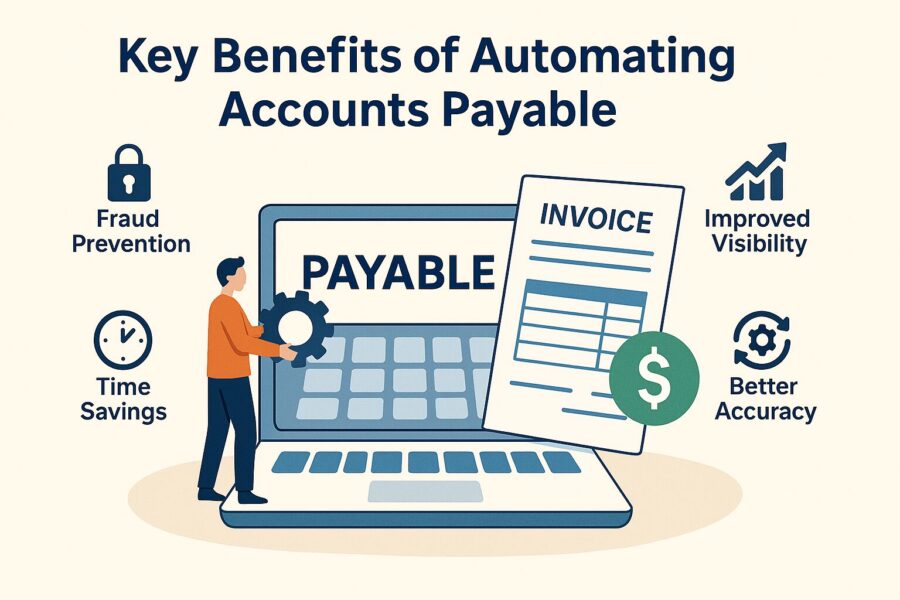

Key Benefits of Automating Accounts Payable

- Prevention of Fraudulent Activities by Segregation of Duties (SoD)

When you get automation software for your AP processes, it generally has an AP control framework that you can personalise as per your requirements.

This allows you to implement SoD among your employees.

- Beneficial Output 1: Doing this removes the responsibility of approving invoice payments from just one employee and divides the task into smaller sections.

Moreover, your AP activity will also be monitored by several entities.

- Beneficial Output 2: The risk of missing a fraudulent activity will be lower. In fact, a report by global analytics software company FICO revealed that 34% of respondents had paid for goods, services or investments that were never delivered, which is a clear indicator of how real the risk is. Thus, by automating, you lower the risk of fraud. Additionally, you also reduce errors and missing information across the process.

- Improved Transparency with Suppliers and Vendors

Your payments to vendors and suppliers play a key role in your company’s success. This is why you need to track each payment carefully. Some businesses fear they might lose control over invoice payments by using automation. In reality, account payable automation benefits include better transparency and control.

The automation software lets you share data with the right people in a customised format. This will allow you to permit only a few AP department members to handle B2B approvals and payments in your company.

- Beneficial Output 1: This ensures only authorised staff can access, edit or approve important payment data, providing security.

With AP automation software, you personally get a clear view of your AP process.

- Beneficial Output 2: You can spot delays and track who handles each approval and so real-time reporting improves oversight. It speeds up the payment processing time and ensures timely invoice payments.

- Save Time by Making the AP Process More Efficient

AP automation software with OCR technology reads printed characters and converts them into digital text. This enables the conversion of scanned documents into editable Word files.

When combined with robotic process automation (RPA), it delivers even greater efficiency. Here are three beneficial outputs it can provide:

- Skip Retyping Tasks: Businesses that deal with suppliers that give out physical invoices can use OCR technology. It will let them scan and upload it without retyping any information. This eliminates the stress of manual processes and the chances of human error.

- Search Documents Quickly: After scanning with OCR technology, you can use keywords or phrases to instantly find a specific invoice.

- Streamline AP Processes: Once scanned, the AP software automatically pulls relevant details from the digital documentation. It applies override changes to future invoices using machine learning. This improves AP performance by taking care of data accuracy.

- Streamlining the AP Processes

The AP process has 7 stages, which are:

- Purchase Orders

- Item Receipt

- Invoice Receipt

- Invoice Processing

- Invoice Approval

- Payment Execution and Reporting

- Transaction Reporting

Carrying out all of these stages manually can increase the risk of human error and be laborious. As per research by the Institute of Finance and Management (IOFL), around 39% of invoices have been found to have errors, leading to an increase in stress on financial departments. All of these stages can be automated to completely make the AP process digital.

2 beneficial outputs that solve the issues brought in by manual labour are as follows:

- Beneficial Output 1: Instant checking on a digital system solved the issue with the payment amount.

- Beneficial Output 2: Large volume search within a short time can be done if any important document is missing.

- Advanced Purchase Order (PO) Matching

AP automation software enables you to perform advanced PO matching through two- and three-way matching. You can customise tolerance ranges.

- Beneficial Output: It will ensure that unmatched invoices are only paid with proper authorisation. This flexibility makes it easy to tailor the software’s matching capabilities to suit your business needs.

- Seamless Integration with Other Financial Systems

You will see the most benefits from AP automation software when you integrate it with your existing financial systems.

- Beneficial Output 1: You will no longer need to switch between platforms or re-enter data.

- Beneficial Output 2: It will help in integration, which will boost your AP team’s efficiency and keep data consistent across systems.

- Beneficial Output 3: By linking the software with enterprise resource planning (ERP) systems, you can also improve visibility across your entire organisation.

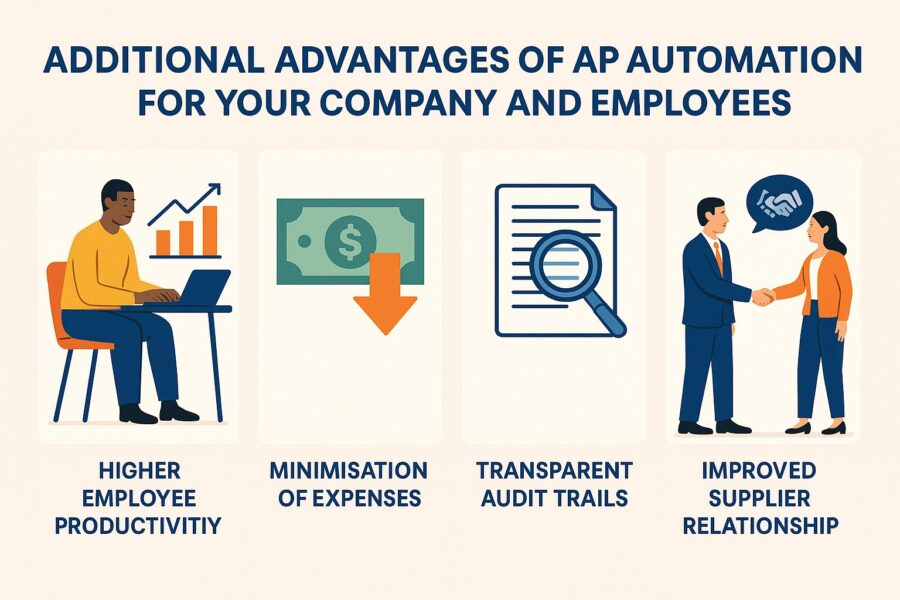

Additional Advantages of AP Automation for Your Company and Employees

Digital transformation has a strong relationship with employee productivity. Around 70% of companies state that digital transformation improved the productivity of their employees.

The same goes for the automation of the AP process. Not only does accounts payable automation benefit the digital workflow of your company, but it also proves fruitful for your employees. Below are the additional advantages that automation for the AP process can provide:

- Higher Employee Productivity by Automating Mundane Tasks

A study shows that around 33% of employees leave their jobs due to boredom, which repetitive tasks can bring.

Automation will free up the time of your employees so they can indulge in other tasks that require human hands, such as problem-solving and innovation. This will result in high employee engagement and reduce boredom in jobs eventually, decreasing employee turnover.

These repetitive tasks related to invoice data entry and more can be easily done with automation.

Below are some examples of the tasks that can be done with automated systems:

- Payment execution and payment scheduling

- Amortisation of schedule creation

- Auto-categorisation of transactions

- Creation of journal entries for any transaction

- Matching invoices and PO creation

- Minimisation of Expenses in the Long Run

AP automation removes manual data entry and simplifies processes. It cuts down operational tasks and shortens the time needed to fix human errors.

- This helps in saving resources and reducing costs over time.

- Automation also helps secure better payment terms and early payment discounts.

- It lowers late payment fees and improves cash flow management.

Despite these benefits, many accounting teams still fall behind in adopting automation. Even when they try to improve, they often fail to fix the full problem. A survey found that nearly 49% of finance departments still rely on manual data entry and have no automation in place.

- Transparent Audit Trails with Limited Human Intervention

As per the Accounts Payable Automation Trends 2025 report, it is found that around less than half (49%) of AP professionals feel that their AP systems meet the standard industry’s audit requirements.

With the help of automation of AP systems, the burden of meeting auditing requirements will ease. This will be done by capturing each step of every transaction in real time and creating a complete digital audit trail.

By following this audit trail, internal auditors and reviewers will be able to quickly check the accuracy and compliance of financial records. Thus, the benefit of adopting automation will impact the company’s productivity positively as the auditors will spend less time and effort on collecting and matching data manually.

- Optimised Cash Flow and Financial Decision-making

If you adopt real-time data analytics and automation in your organisation, it will be possible for you to:

- Detect trends quickly,

- Spot irregularities in your cash flow and

- Identify opportunities to optimise your capital management.

This real-time presentation of revenue streams, expenses and cash flow supports informed decision-making. This helps companies to optimise their financial allocation strategies.

Moreover, an efficient process of a company and its decision-making with real-time data analysis strengthens its agility. They do this by:

- Thoroughly identifying the scope for cost reduction

- Saving by leveraging early payment discounts

- Reallocating resources which result in higher returns

- Improved Collaboration for International Businesses

There are a few businesses which collaborate with international vendors and suppliers. In these cases, sharing data and communicating each change becomes very hectic and confusing at times.

Thus, innovative AP solutions enable employees to work together, even across different countries and time zones. A single user interface for all purchasing helps companies maintain consistency and follow compliance rules.

- Improved Supplier Relationship

Making payments on time and using transparent processes builds vendor trust. Vendors rely on timely payment cycles for a steady and predictable cash flow.

AP automation also increases transparency through a vendor portal. These portals help vendors track their invoice status easily and access accurate information. Eventually, this strengthens supplier relationships and encourages better future collaboration scope for the company.

💡For your bill payments and tracking business transactions, use the PICE App.

Conclusion

As digital transformation becomes the norm, adopting AP automation becomes more of a necessity for staying competitive. Accounts payable automation benefits companies in terms of time savings, enhancing accuracy, strengthening compliance, increasing fraud protection and more. When businesses move away from manual errors and simplify their payment processes, they get a clearer, real-time view of their finances.

By

By