Purchase Journal Entry with GST and TDS

- 12 Nov 25

- 11 mins

Purchase Journal Entry with GST and TDS

- Steps to Pass A Purchase Journal Entry with GST

- Types of Accounting Ledgers Under GST

- Types of Accounting Ledgers Before GST (Excise and VAT)

- Example of Passing a Purchase Journal Entry with GST

- Passing Purchase Journal Entries with GST for Interstate Transactions

- Components of GST Accounting Entries

- GST Return Filings Based on Accounting Journal Entries Under GST

- Impact of GST Accounting on P/L Account and Balance Sheet

- Conclusion

Key Takeaways

- Accurate purchase journal entries under GST ensure error-free tax filing and smooth reconciliation of GSTR-1, GSTR-2B, and GSTR-3B.

- Always debit expenses/assets and input GST accounts, and credit the supplier or cash account when recording purchases.

- Maintain distinct ledgers for Input and Output CGST, SGST, and IGST to simplify tax tracking and ITC claims.

- For interstate purchases, record IGST instead of CGST and SGST to comply with the Dual GST Model.

- Proper GST accounting impacts both the P&L and balance sheet, ensuring accurate reporting of ITC and tax liabilities.

Did you know that over 1.4 crore taxpayers are registered under the Goods and Services Tax regime in India as per the latest report? With such a vast network, even a small accounting error can lead to major compliance issues. That is why learning how to pass a purchase journal entry with GST is crucial for every GST-registered business.

Whether you are a business owner, accountant, or student, understanding the right way to record purchases under GST returns can help you avoid mismatches in GSTR-1, GSTR-2B, or GSTR-3B. In this blog, we will break down the process step-by-step to make GST accounting easy, accurate, and stress-free for you.

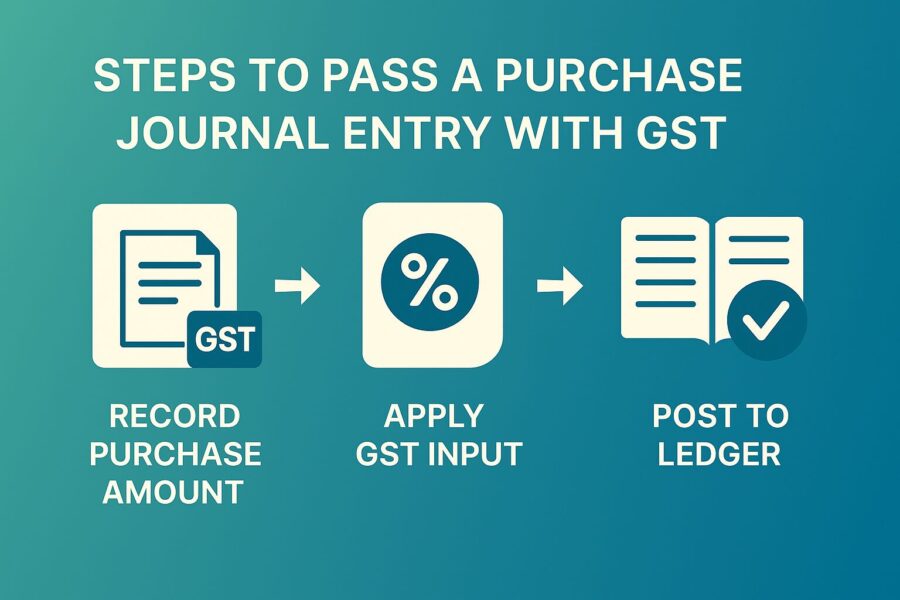

Steps to Pass A Purchase Journal Entry with GST

The basic steps you need to follow for passing the Purchase journal entry with GST are as follows:

Step 1: Separate the different types of transactions from your records, and then debit your expenses or asset account. This will help to make your entire sum less GST.

Step 2: Now, debit the GST input tax account. This is only relevant to the GST total.

Step 3: Finally, Credit your Cash A/C or Accounts Payable A/C. These entries must include GST and the overall cost.

Types of Accounting Ledgers Under GST

Now that you are familiar with the basics of GST accounting, it is important to understand the various ledger accounts involved. When passing a purchase journal entry with GST, you’ll need to create and maintain specific accounts related to purchases, sales, and inventory under your business or GSTIN. These ledgers ensure accurate tax tracking and smooth filing of returns.

Here is a list of the key accounting ledgers you will typically work with:

- Input CGST Account

- Output CGST Account

- Input SGST Account

- Output SGST Account

- Input IGST Account

- Output IGST Account

- Input Cess Account

- Output Cess Account

- Electronic Cash Ledger Account

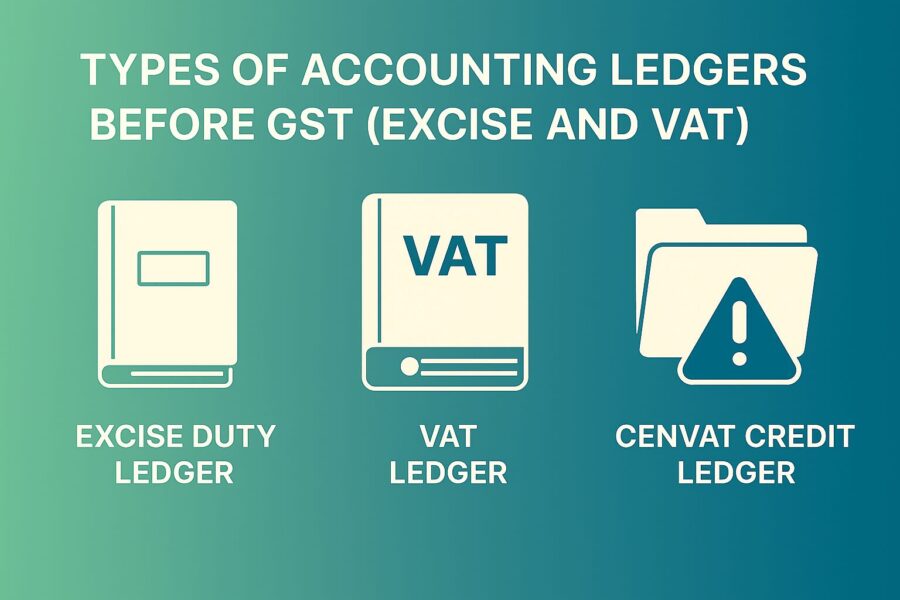

Types of Accounting Ledgers Before GST (Excise and VAT)

Besides knowing about the types of accounting journals under GST, it is also important for business owners to know about the types of accounting ledgers they need to keep a record for when accounting under Excise and VAT. Here is a list of them.

- Input VAT a/c

- Output VAT a/c

- Input Service tax a/c

- Output Service tax a/c

- Excise Payable a/c (Manufacturers)

- CENVAT credit a/c (Manufacturers)

- CST a/c (for interstate sales and purchases)

- Service tax a/c

Example of Passing a Purchase Journal Entry with GST

Now that we know about the various types of ledger accounts, you need to create them while accounting under GST. Here is an example representing the accounting of a purchase journal entry with GST.

Suppose Mr X spends ₹2 lakhs to purchase cricket bats from a GST-registered supplier in the state. The GST levied on this transaction is 18% (9% CGST and 9% SGST). Hence, he pays ₹18000 CGST and ₹18000 SGST. Now, he also pays ₹1000 to his CA and has bought furniture worth ₹20,000. He sells all his bats at ₹4 lakhs in the same state itself. Pass journal entries.

Here are the accounting journal entries for this purchase:

| Date | Particulars | Debit (Dr. ₹) | Credit (Cr. ₹) |

| 09/06/2025 | Purchases a/c (dr)CGST Input a/c (dr)SGST Input a/c (dr) To: Creditors a/c (cr) | 2000001800018000 | 236000 |

| 09/07/2025 | Debtor's a/c (dr) To: Sales a/c To: Output CGST a/c (4 lakhs * 9%) To: Output SGST a/c (4 lakhs * 9%) | 472000 | 400000 36000 36000 |

| 9/07/2025 | Consultation charges a/c (dr)Input CGST a/c (dr)Input SGST a/c (dr) To: Bank account a/c (cr) | 10009090 | 1180 |

| 9/07/2025 | Furniture a/c (dr)Output CGST a/c (dr)Output SGST a/c (dr) To: The furniture a/c (CR) | 2000018001800 | 23600 |

Passing these journal entries for purchases, sales, and two other transactions, we get the following results.

- Total Output: CGST = ₹36000

- Total Output: SGST = ₹36000

- Total Input CGST = ₹18000 + ₹90 + ₹1800 = ₹19890

- Total Input SGST = ₹18000 + ₹90 + ₹1800 = 19890

Hence, Net CGS that Mr. X has to pay = ₹16110 (36000 - 19890)

Passing Purchase Journal Entries with GST for Interstate Transactions

Passing journal entries for interstate purchases and intrastate purchases is different. This is because interstate purchases attract IGST, which is not there in intrastate transactions. Well, here is an example for you to pass a purchase journal entry with GST for interstate transactions.

Now, suppose Mr. X purchases balls from a registered dealer from a different state for ₹100000. He pays 18% IGST, that is ₹18000. Now, he decides to sell a part of his stock at ₹40000 within his state at 18% GST (9% SGST and 9% CGST). He sells his remaining stock at ₹80000, outside his state and pays 18% IGST on it, which comes to ₹14400. Mr X also pays ₹2000 as consultation fees with 18% GST coming to ₹180 for CGST and SGST both. Pass the journal entries.

Here are the accounting journal entries for this purchase:

| Date | Particulars | Debit (Dr) | Credit (Cr) |

| 09/06/2025 | Purchase a/c (dr)Input IGST a/c (dr)Input SGST a/c (dr) To: Creditors a/c (cr) | 10000018000180 | 118180 |

| 09/07/2025 | Debtor's account (dr) To: Sales a/c (cr) To: Output CGST a/c (cr) To: Output SGST a/c (dr) | 11200 | 40000 3600 3600 |

| 09/07/2025 | Consultation charges a/c (dr)Input CGST (dr)Input SGST (dr) To: Bank a/c (cr) | 2000180180 | 2360 |

| 09/07/2025 | Debtor's a/c (dr) To: Sales account a/c (cr) To: Output IGST a/c (cr) | 94400 | 80000 14400 |

Hence, here is what we conclude on Me X’s tax liability.

- Total Input SGST= ₹180

- Total Input CGST= ₹180

- Total Input IGST= ₹18000

- Total Output CGST= ₹3600

- Total Output SGST= ₹3600

- Total Output IGST= ₹14400

Now, net GST payable = (Output GST - Input GST), hence,

- Net CGST payable = ₹3420 (3600 – 180)

- Net SGST payable = ₹3420 (3600 - 180)

- Net IGST payable = ₹3600 (Credit) (14400 - 18000)

*The credit amount in IGST will be adjusted with the CGST liability, which is (3420 - 3600)= ₹180 (Credit). Later, the remaining amount will be adjusted for the liability of SGST. Hence, SGST liability will be (3420 - 180)= ₹3240

Hence, the total tax payable by Mr. X = ₹3240

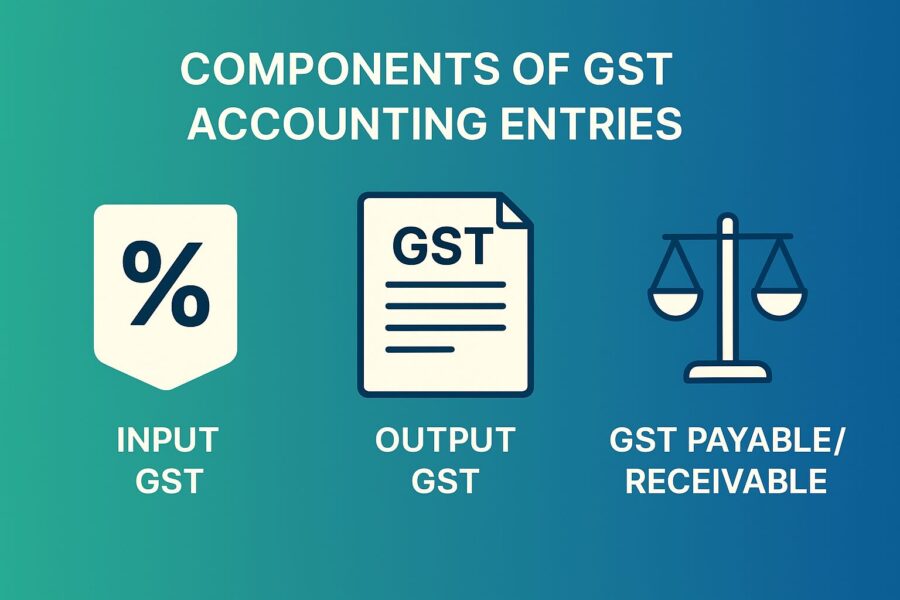

Components of GST Accounting Entries

You need to have a combined knowledge of accounting and GST rules and rates to successfully develop purchase journal entries with GST. Here is a list of the components of GST accounting that you should know.

- GST Rates: The rate of GST is different for various types of goods and services. The government levies GST in the form of tax slabs. 0%, 5%, 12%, 18% and 28% tax slabs cover most goods and services in India.

- Dual GST Model: The Dual GST Model suggests that the accounting entries are done for IGST for both interstate and foreign transactions.

- Return Filing and Invoices: The most important reason why accounting is important for GST-registered people is filing GST returns correctly. GSTR-1, GSTR-2B and GSTR-3B return filings are done from these accounting data.

- ITC: Having correct information about business purchases and the availability of invoices can facilitate people to collect Input Tax Credits or ITC. This can help in reducing their financial liabilities.

GST Return Filings Based on Accounting Journal Entries Under GST

Three GST returns are filed using the significant purchase journal entries and paperwork. Here is a list of these GST return filings with details.

- GSTR-1: It is a return filing that all GST-registered individuals have to file every month or quarter. All information about a business’s out-of-country purchases for the entire month is available in the GSTR-1 return category.

- GSTR-3B: This return requires a periodic filing every month or quarter. The main function of this report is to summarise your business’s ICT, tax liability, and total taxable turnover. This return can help you track your business’s compliance with the law and payment of taxes.

- GSTR-9: The GSTR-9 is a reconciliation of two returns, GSTR-1 and GSTR-3B. This return filing contains all information relating to sales, purchases, GST charged and paid during a financial year. People need to file it annually before 31st December of the next year.

Impact of GST Accounting on P/L Account and Balance Sheet

You must be wondering why tax accounts do not relate to any direct and indirect expenses, so why would the P/L account be affected? Well, when you pay GST on any business purchases and the government does not allow ITC on these purchases, then you have to record the unclaimed ITC as expenses.

For example:

Suppose you purchase office furniture worth ₹50,000 with 18% GST (₹9,000).

- If ITC is allowed, only ₹50,000 is recorded as a fixed asset, and ₹9,000 goes under Input GST in the Balance Sheet (as an asset).

- If ITC is not allowed (say, furniture is for personal use or used in a non-eligible business), the entire ₹59,000 becomes an expense or asset cost, increasing your expenses in the P&L account.

The impact of ITC under GST on the Balance sheet is that the balance sheet should show positive ITC or tax liability as a liability or an asset. Fixed assets that are eligible and have taken advantage of ITC must report them as cost less GST.

Conclusion

A GST-registered person should be able to maintain complete books of accounts. Not only the journal entries, but also the ledger, Profit and Loss a/c, and balance sheet. A purchase journal entry with GST and its invoices, along with other accounting books, is very important for a business to claim Input tax Credits on its business purchases.

Moreover, the GST Act mandates all registered individuals to maintain their books of accounts and also retain them for a certain period of time. You will also have to retain them if you surrender your GSTIN Number. This brings transparency and makes it easy for people to comply with their liabilities.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

What is a purchase journal entry under GST?

How is TDS recorded along with GST in a purchase entry?

What are the main accounts involved in GST purchase entries?

Purchase or Expense Account (for the transaction value)

Input CGST, SGST, or IGST Accounts (for the tax portion)

Supplier/Accounts Payable (for the total payable amount)

These accounts help segregate tax components, making reconciliation and filing of returns easier while maintaining accurate Input Tax Credit (ITC) records.

By

By