Sales Return Under GST: Credit Note & Filing

- 4 Nov 25

- 9 mins

Sales Return Under GST: Credit Note & Filing

Key Takeaways

- Sales return under GST requires issuing a credit note as per Section 34 of the CGST Act.

- Report sales returns in GSTR-1 Table 8 to stay compliant with GST filing norms.

- Use credit and debit notes to adjust errors, discounts, or additional charges in GST invoices.

- Accurate sales return documentation ensures smooth GST reconciliation and recordkeeping.

- Stay updated with GST rules on sales returns to avoid penalties and maintain tax compliance.

Does the concept of sales returns under GST feel like a puzzle for you to navigate, as business owners? Post-implementation of the GST Act 2017, sales returns have emerged as critical aspects of tax compliance. By the end of 2024, India had over 14 million registered GST taxpayers.

This makes it all the more crucial for enterprises to minutely understand the nuances of sales returns.

Even though the GST regime in India has revolutionised the taxation system, the complexity of GST laws is still a tough pill to swallow. Accurate return filing is crucial for businesses so as to comprehend the treatment of sales returns under GST and avoid resulting penalties.

Let’s further dive into the details surrounding sales returns under GST.

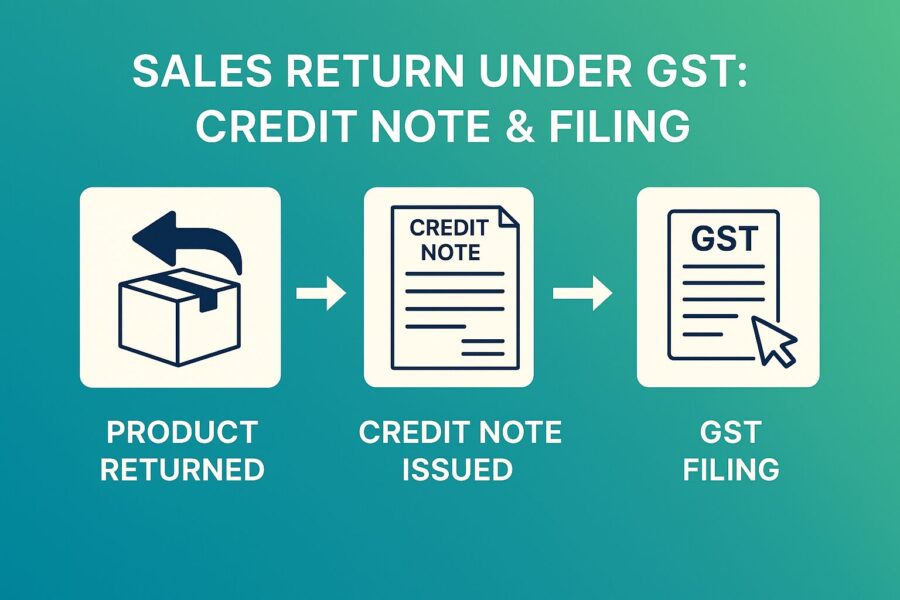

What is Sales Return in GST?

When the goods are returned by the recipient, they will be considered as sales returns on the suppliers' end. In such a case, in which the goods provided by a supplier are returned by the entity that receives them, the supplier shall have to issue a "credit note" as per the CGST Act, Section 34.

The supplier will have to declare the information featured on such credit notes in the monthly return. This must be done as per the time frame extended during which such a credit note was issued. An adjustment in the tax liability shall be considered in the return, which is subject to the conditions of Section 34.

However, note that the CBIC vide Circular No. 137/07/2020-GST (dated 13th April, 2020) specified that:

● If there is no output tax liability against which the credit note can be adjusted, the registered individual shall have to proceed to file a claim under the head, “Excess Payment of Tax, if any” via Form GST-RFD 01.

How to Show Sales Return in GST Filing?

If the recipient of goods returns the said goods or if there is a reduction in sale value, one can:

1. Issue a Credit Note in order to record the sales return (applicable for both local and interstate sales)

2. The credit note will be reported in Table 8 (Credit/Debit Notes) of the GSTR-1 return.

In case there is an increase in sale value, one can use a Debit Note (voucher mode) to account for the escalation.

One can show sales returns in GST filing using a credit note, in the following manner:

Step 1: Navigate to the Gateway of Tally, go to Accounting Vouchers and then Ctrl+F8.

Step 2: In 'Original invoice no.', put in the invoice number associated with the original sales transaction. It should be the one against which you are issuing the current sales return.

Step 3: Under ‘Party’s A/c Name’, choose the party from whom the sales were made originally.

Step 4: Choose the state tax and central tax ledgers.

Step 5: Put in the relevant GST details. Enable the option if you wish to enter any additional details about the goods return.

● 01-Sales Return: If the return of goods/services is to happen after the sales are made

● 02-Post sale discount: If there is an applicable discount on goods/services after the sales are made

● 03-Deficiency in service: If there has been a deficiency in services after sales. This may be in the form of service quality issues.

● 04-Correction in invoice: If there has been a change in the invoice raised, which leads to an alteration in the tax amount

● 05-Change in POS: If there is an alteration in the place of supply, which leads to a change in the final tax amount

● 06-Finalisation of Provisional Assessment: If there has been a change in rate after the department has issued a notification about the finalised price of the concerned goods/services.

● 07-Others: This is for any other nature of return.

When it comes to recording sales returns for interstate sales, it is pretty much the same procedure. All you have to do is choose the relevant party, integrated tax ledger and sales ledger, and you are good to go! GST rules do not particularly mention supplementary invoices, but you may easily make adjustments to sales using credit/debit notes.

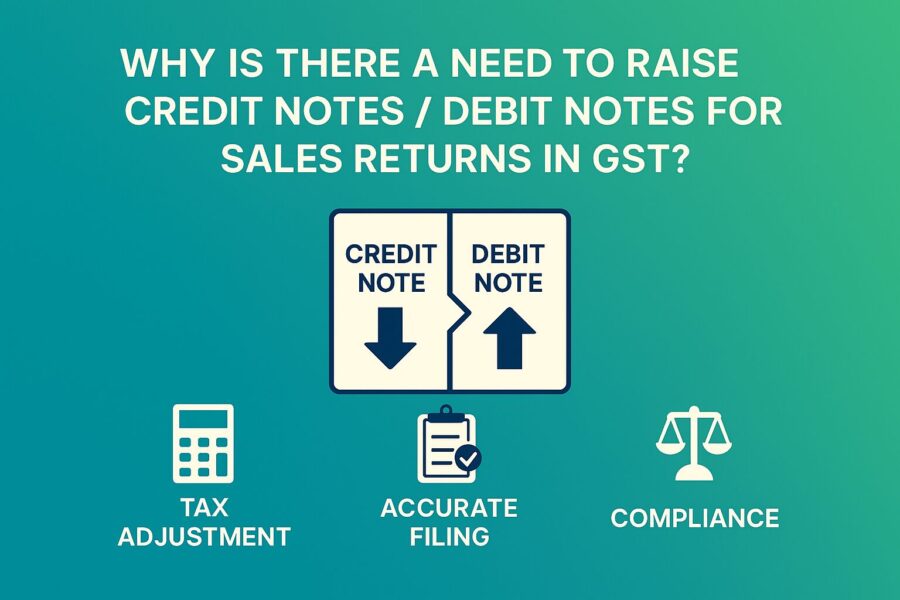

Why Is There a Need to Raise Credit Notes/Debit Notes for Sales Returns in GST?

Here are the reasons why it is considered necessary to raise credit notes for sales returns in GST:

● Correction of Errors: If so happens that the seller overcharges the purchaser, a credit note is raised to request the proper payment of the adjusted amount. The credit note helps reduce the buyer's liability, helping them claim a refund/adjust future payment requirements.

● Record for Additional Charges: If expenses arise unexpectedly after the issuance of the original invoice (like through the accumulation of extra costs for shipping), the seller shall have to raise a debit note to the purchaser for the extra amounts.

● Additional Discounts: In case the seller grants a discount post-issuance of the invoice, a credit note shall be used to document this difference.

How to Prepare Sales Returns Documents?

Here are the steps you can follow to prepare the sales return documents:

Step 1: Gather the Original Sales Information

● Keep the transaction details of the original sales handy. This will include the sale amount, date, and the payment method.

● Have other relevant documents like invoices and receipts.

Step 2: Calculate the Total Return Amount

● Arrive at the total amount which is to be refunded/credited to the customer.

● Take into account any deductions/allowances which may apply to the return.

Step 3: Create the Sales Return Document

You can use the sales return invoice template for documenting the return:

● Seller Information: Full legal name and logo (if applicable)

● Return Details: Description of the returned goods, the amount as well as the reason for the return

● Comments: Additional information/special instructions

Step 4: Record Sales Return in the Accounting System

● Make a sales return journal entry. This will help accurately reflect the return in your records for finances.

● Credit the customer's account and debit the sales return account.

Step 5: File the Sales Return with GST, if applicable

● If you are registered under GST, you will have to report the sales returns in your GSTR-1 return (particularly in Table 8)

● Make sure to prioritise accurate documentation. Also, aim for filing on time to avoid any penalties.

Quick Tips:

● Resort to cloud accounting software in order to streamline the sales return documentation process and GST compliance.

● Upload the sales return data through Excel sheets, if it is supported by the accounting software.

Conclusion

It is crucial to understand the concept of sales returns under GST for businesses to maintain clear financial records and ensure tax compliance, all while avoiding penalties.

By issuing credit/debit notes, reporting the sales returns in GSTR-1 and abiding by proper documentation procedures, businesses shall be able to efficiently manage their sales returns and streamline the GST filing process.

Such effective management of sales returns shall also help maintain customer relationships and ensure transparency through financial transactions. So, stay informed about the latest GST regulations and the best practices.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

What is a Sales Return under GST?

How should a Sales Return be reported in GST returns?

What is the purpose of issuing a Credit Note or Debit Note for Sales Return?

Can sales returns be adjusted if there is no tax liability?

What documents are required to process a Sales Return under GST

The original tax invoice and credit/debit notes issued.

Proof of return or delivery challan for returned goods.

Records of adjustments made in books of accounts.

Proper entries in accounting software for GST filing.

Maintaining these documents ensures smooth audits and accurate tax reporting.

By

By