Letter of Undertaking Under GST Explained

- 13 Oct 25

- 10 mins

Letter of Undertaking Under GST Explained

Key Takeaways

- A Letter of Undertaking (LUT) under GST allows exporters to ship goods and services without paying IGST upfront, easing compliance.

- Filing an LUT under GST improves cash flow, reduces administrative burden, and eliminates the need for frequent tax refunds.

- The LUT facility is available to all GST-registered exporters, except those prosecuted for tax evasion of ₹250 lakh or more.

- Exporters can file LUT online via the GST portal using Form GST RFD-11, authorised signatory details, and required documents.

- LUT in GST is valid for one financial year and must be renewed annually to continue exporting goods and services without IGST.

Usually, exporters are required to pay IGST (Integrated Goods and Services Tax) on the shipment of goods and services and can later claim the input tax credit for the tax paid. However, this process involves significant effort and adherence to various formalities and compliances. Here, a Letter of Undertaking offers much-needed relief.

It is a formal agreement between exporters and the tax authorities that allows exporters to make exports without paying tax upfront, thereby eliminating the hassle of later claiming ITC.

In this article, we will explore the concept of a Letter of Undertaking under GST, its benefits, key components, eligibility criteria, and the application process.

What is the Full Form of LUT in India?

The full form of LUT in India is a Letter of Undertaking. According to the Central Goods and Services Tax (CGST) Act 2017, an LUT is considered an export document facilitating exporters to deliver goods or provide services without paying Integrated Goods and Services Tax (IGST).

Exporters can issue a Letter of Undertaking (LUT) or provide an export bond to confirm their compliance with GST regulations during the period of exports. This crucial instrument helps them prevent capital blockage by avoiding upfront tax payments and allowing access to the tax refund process as per the GST law.

According to Rule 96A of the CGST Rules, 2017, the LUT facility is available to all registered taxpayers, except those who have been prosecuted for tax avoidance up to an amount ₹250 lakh and over.

Why is LUT or Letter of Undertaking Used?

An LUT in GST is usually used for the following reasons:

- Postponed Tax Payment:

By furnishing a Letter of Undertaking (LUT), exporters can operate their business without immediately paying Integrated GST (IGST).

- Reduced Administrative Burden:

As exporters can avoid upfront IGST payments, they can reduce the burden of administrative tasks associated with IGST payments, including requesting a refund and other related tasks. It ultimately saves precious time and resources for a business.

- Avoidance of Bank Guarantees:

Businesses that furnish an LUT on the GST portal do not need to give bank guarantees to the importers, thereby saving potential administrative costs.

- Reduced Risk:

Registered taxpayers lower their financial risks with LUT as it defines contractual responsibilities accurately, eliminating misunderstandings and disagreements.

Eligibility Criteria for Exporters under LUT in GST

Have a look at the eligibility criteria for the Letter of Undertaking under GST:

| Eligibility Criteria | Details |

| Exports of supplies (goods and services) | A Letter of Undertaking will be furnished for shipping both products and services. |

| Prior defaults | Exporters with no outstanding GST or prior defaults are eligible. |

| Gross revenue | To file an LUT, the law has no minimum turnover threshold limit. |

| Financial situation | Exporters who sound financially strong means who can fulfil their export requirements. |

| Supplies on an LUT basis | All types of supplies can be shipped by filling an LUT |

| No prosecution | The GST authorities should not have prosecuted the exporter due to any offence under the GST regime. |

Step-by-step Process to file online LUT under GST

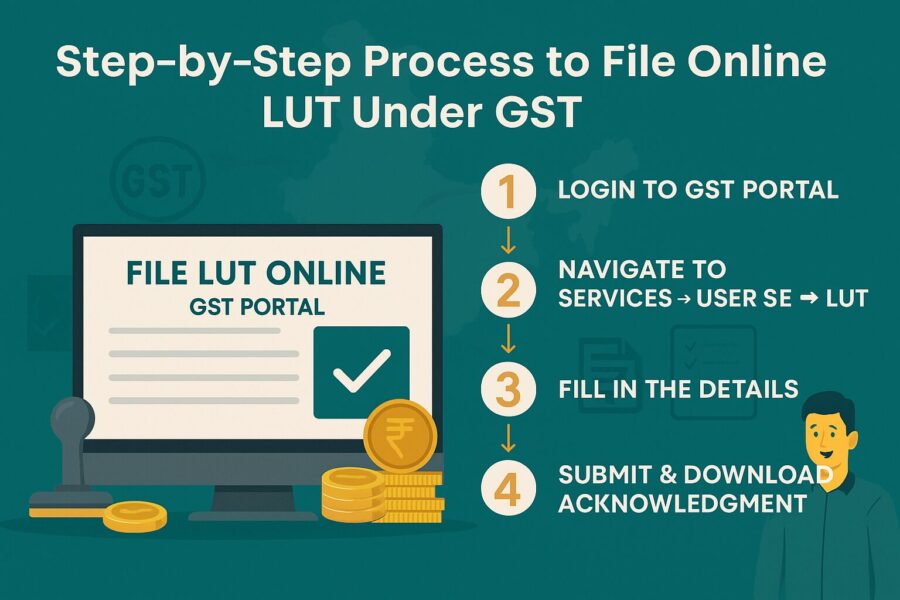

Here are the steps one must follow to furnish an LUT on the GST portal:

Step 1: Visit the official GST Portal and log in using a verified Email ID.

Step 2: Find the "SERVICES" tab. Then choose "User Services" option and go on to select "Furnish Letter of Undertaking(LUT)" option.

Step 3: Choose the financial year for which you will furnish the Letter of Undertaking under GST from the "LUT Applied for Financial Year"drop-down list.

Note: If an LUT has already been furnished in previous months, you only need to upload the same by selecting the "Choose File" tab on the same window. But check the following before uploading this crucial document:

- The LUT must be in PDF or JPEG formats (only.

- The maximum file size should be 2 MB.

Step 4: Enter all the significant details on the Form/ GST RFD-11 that appears on the screen. Then, proceed to the self-declaration step. Mark tick against each of the boxes. By doing this, you declare that you will comply with all the export rules and regulations while undertaking exports.

After that, provide independent witnesses details such as the name, occupation and address of two witnesses in the respective boxes.

Step 5: Fill in the "Place of Filing LUT" box, then click on the "SAVE" button. Choose the "PREVIEW" option given there to check the details of the form. It is crucial before hitting the "SUBMIT" button as the revision of a submitted form is not acceptable.

Step 6: At the last, sign and file the Letter of Undertaking under GST. Note that only the authorised individuals can sign the LUT. An authorised signatory can be the Managing Director, the Company Secretary, the partners in a firm, or the proprietor.

There are two ways to submit the form:

- Submit with DSC: Sign the LUT using the Digital Signature Certificate of the chosen authorised signatory. For this, choose the "SIGN AND FILE WITH DS" option. Then, click "PROCEED" and receive a unique ARN (Application Reference Number).

- Submit with EVC: For this, choose "SIGN AND FILE WITH EVC" and receive an OTP to the linked phone number and e-mail ID of the authorised individuals. Enter that OTP and click 'PROCEED' to assist in generating a unique ARN.

To download the recently furnished LUT, hit the “DOWNLOAD” button. To view the previously furnished LUTs on the GST portal, follow the steps mentioned here:

Home page > "SERVICES" > " User Services" > "View my Submitted LUTs" > Select period > carefully look at the list of LUTs furnished during the chosen period > Select the option "VIEW" against your chosen Letter of Undertaking to view the details.

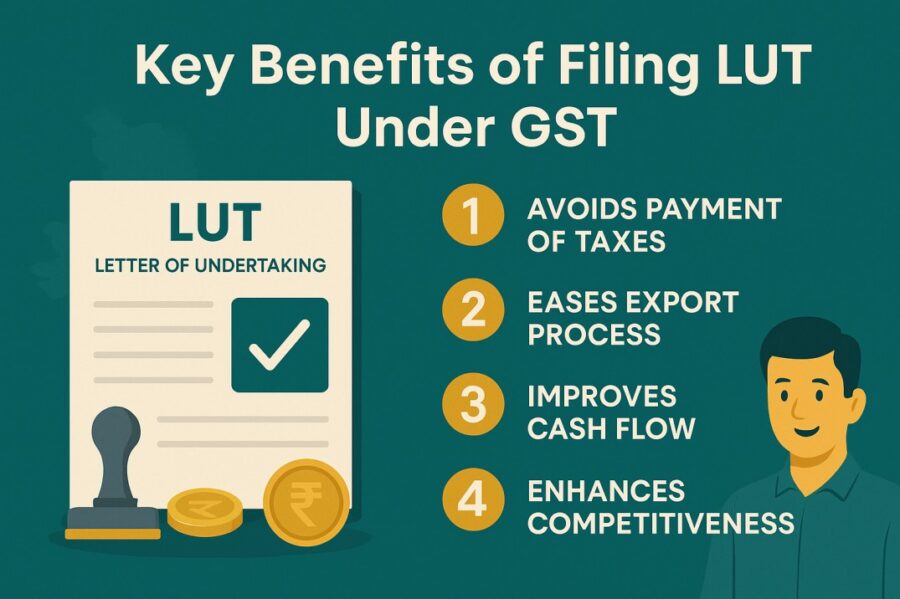

Key Benefits of Filing LUT Under GST

Here are some advantages of filling a Letter of Undertaking under GST:

- Tax Exemption: By filing an LUT, exporters can ship products and services without paying taxes, thereby no need to manage tax refunds.

- Cash Flow Improvement: Filing LUT helps businesses maintain liquidity as they can free up funds by not having to indulge in tax payments.

- Process Simplification: The online method of furnishing LUT on the GST portal simplifies the steps of complying with GST regulations for exporters.

- Global Competitiveness: As exporters are not required to pay upfront taxes, they can offer competitive prices in international markets.

- Time-saving: This facility eliminates the need to take Input Tax Credits, which cost a considerable amount of time and administrative effort.

Who can Use an LUT in GST?

Exporters that are liable for tax can use a Letter of Undertaking (LUT). However, experts who have been prosecuted for tax avoidance of rs. 250 lakh or more can not use this crucial instrument for their business.

Note that an LUT is valid for one year after it gets furnished. The authorised signatory needs to renew it every financial year. If the exporters fail to meet the conditions within the specified timeframe, the facility may be withdrawn. Then, they will need to submit the export bonds instead.

Letter of Undertakings Are Applicable for:

- Export of supplies without IGST

- Zero-rated products or services to SEZ without IGST

What to Consider Before Filing a Letter of Undertaking Under GST?

Here are some significant factors one needs to remember before furnishing LUT under GST regulations:

- Validity Period:

An LUT remains valid for up to 12 months from the date you file it.

- Required Documents:

Exporters need to submit an Aadhar card, PAN card, IEC certificate, GST registration certificate, witness information, cancelled cheque, form GST RFD-11, authorised Person's KYC and an authorised letter.

- Bond Alternative:

Exporters need to file a bond if they become ineligible for an LUT. Along with this, a bank guarantee which is written on non-judicial stamp paper is also required, paying the estimated tax obligation spending on the results of the exporter's evaluations.

- Official Letterhead:

A registered taxpayer should submit LUT applications using the official letterhead.

- Fill out the GST RFD-11 Form:

When applying for an LUT, exporters must submit the GST RFD-11 form. And it should be signed and submitted by the authorised signatory of your business.

Conclusion

The Letter of Undertaking under GST plays a crucial role in simplifying the export process for Indian exporters. It not only eliminates the tax burden and improves cash flow in the business but also ensures growth in the competitive global landscape and promotes reinvestment in the business.

This document contains basic information about the exporter, validity period, export transaction specifications, witness details, a dedicated part for declaration and signature of authorised signatory with date and place. Exporters can avail of the professional services to obtain support on documentation and compliance.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By