Response to Show Cause Notice in Form GST REG 24

- 18 Sep 25

- 5 mins

Response to Show Cause Notice in Form GST REG 24

Key Takeaways

- Form GST REG-24 is used by taxpayers to reply to a show-cause notice in Form GST REG-23 regarding revocation of GST registration cancellation.

- It allows businesses to present valid reasons and supporting documents to prevent cancellation of GST registration.

- Taxpayers must file Form REG-24 within 7 days of receiving Form REG-23, as per GST rules.

- The form includes notice details, GSTIN, application reference number, reasons for revocation, and attachments.

- Timely and accurate filing of GST REG-24 ensures compliance, smooth revocation of cancellation, and uninterrupted GST operations.

A proper officer associated with the GST authorities issues a show cause notice to a taxable person if he/ she is dissatisfied with the reasons for revocation of GST registration cancellation. The taxable person needs to respond in Form GST REG-24 to prevent cancellation of GST registration.

As a taxable person, you need to provide valid reasons to revoke the GST registration cancellation. So, read this article to learn in detail about the steps of GST REG-24 issuance to experience a seamless process if you go through such a situation.

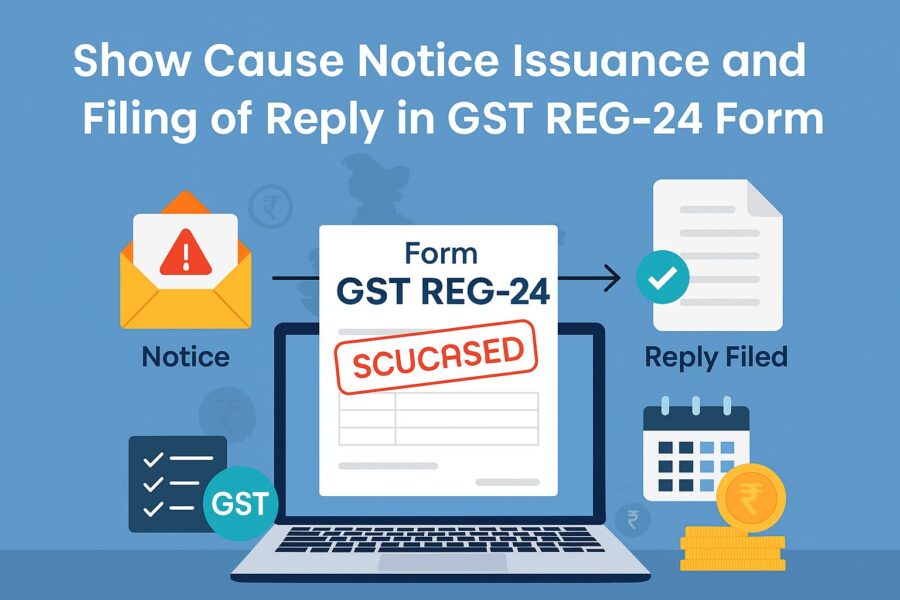

Show Cause Notice Issuance and Filing of Reply in GST REG-24 Form

The following are the steps in which a taxable person will receive notice in Form GST REG-23:

Step 1: The proper officer will cancel GST registration for the concerned taxable person.

Step 2: To prevent GST registration cancellation, the aggrieved taxable person needs to file a revocation application in Form GST REG-21.

Step 3: If the proper officer is not satisfied with the revocation application, he/ she will issue a show cause notice in Form GST REG-23 (notice for rejection of application).

Step 4: The show cause notice (SCN) will include the reasons for rejection of the application.

Step 5: Based on the reasons provided by the proper officer, the aggrieved taxable person can counter-file a response in Form GST REG-24.

Notably, the concerned taxable person needs to file a counter reply in Form GST REG-24 within 7 days from the date of issuance of Form GST REG-23.

Content of GST REG-24 Form

Here are the inclusions in Form GST REG-24:

● Date of notice and reference number

● Application date and reference number

● GSTIN (if applicable)

● Reasons for revocation by the concerned taxable person

● A list of supporting documents attached

Issue Post Furnish of GST REG-24 Form

The taxable person needs to provide valid reasons for the revocation of GST registration cancellation, which the proper officer will verify. If the proper officer is satisfied with the reasons, he/ she will process the revocation of GST registration cancellation.

However, in case the proper officer is dissatisfied with the assessee’s application for revocation, he/ she will cancel the GST registration process. As a result, if you are a taxable person, ensure you provide appropriate details and reasons to prevent GST registration cancellation. It is crucial to provide proper reasons to ensure the GST officer is satisfied with the application for revocation of cancellation of registration.

Conclusion

Form GST REG-24 is a form which taxable persons need to use to respond to a show cause notice issued by a proper officer in Form GST REG-23. As a taxable person, you need to provide valid and relevant reasons to revoke your GST registration cancellation.

Ensure you respond in Form GST REG-24 within 7 days from the date of issuance of Form GST REG-23. Adhering to the stipulated timeline ensures compliance with the Indian finance ecosystem and tax laws. You can further ensure effective vendor management, vendor payment and vendor delight in the process.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By